HIFS REVISITED (Post Q4 earnings)

Last Friday, HIFS has posted some improved core earnings - lets see how it matches our projection based on our model and what to expect for the First Quarter 2025

The article constitutes my personal views and is for entertainment purposes only. The main goal of this article is to log my personal views. Nothing in this article or these posts in this blog should constitute an investment advice. The projections and estimates provided here should be considered as purely speculative. Do your own model and projections. Please refer to the disclaimer at the end of this article for more details.

On January 17th 2025, HIFS has posted some very good numbers for Q4 pretty much inline with Wintergems model on projected Net Interest Margin.

After this experiment, I still need to do some fine tuning to the model to get to even closer projection for the first quarter 2025, but my confidence level has increased for the next quarter.

The recent pullback seems to be a good entry point from a valuation perspective.

The management very well explained the improvement on the net interest margin in the Q4 earnings press release:

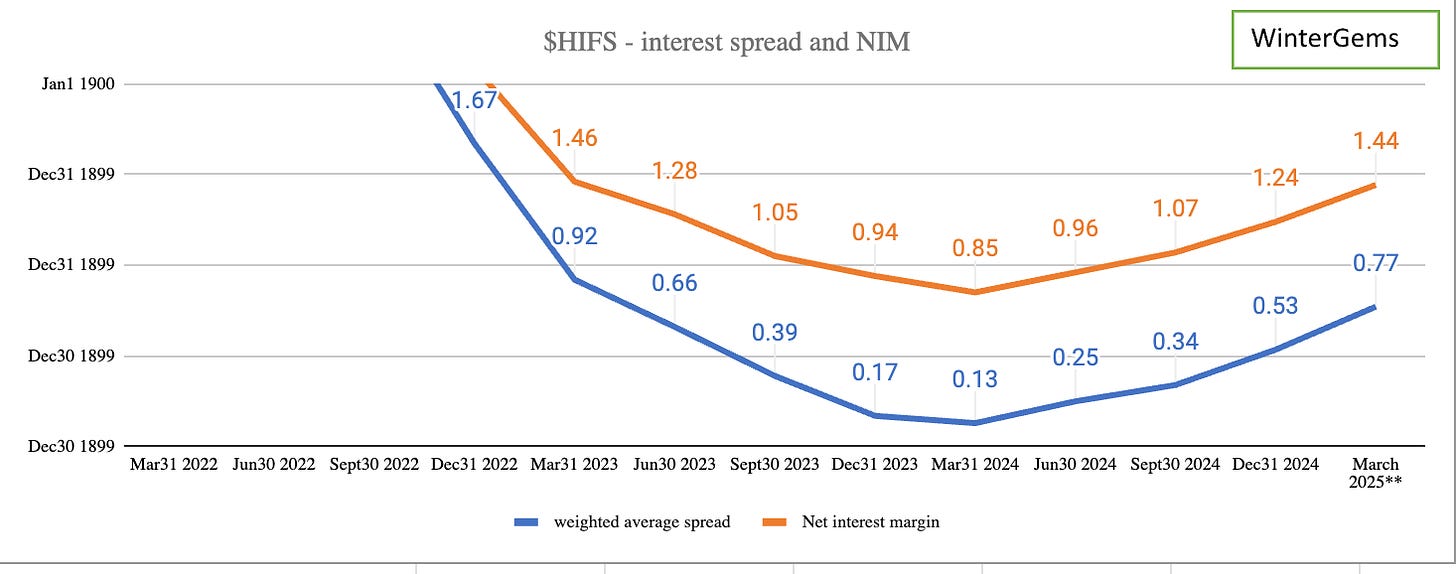

So NIM improved sequentially by 17 basis points to 1.24%. a 16% improvement. The management is also providing greater visibility of what to expect in the first quarter of 2025, by disclosing a NIM for December 2024 of 1.36%. The Federal Reserve made 2 cuts in the fourth quarter, one in October and one December, so in December the Company has benefited fully from the first one and but only partially from the second one. The last cut was done in December 18th, so we should expect a NIM north of 1.36 BP in the first quarter 2025.

Loans

The Company had an average loan book of 3 882 million in the fourth quarter and 3 873 million at the end of the quarter. Loans follows a small decline since the last few quarters. The Company is probably not chasing loans too aggressively and is renewing loans at a much higher yields. Jumbo loans is currently priced at 6.941%, much higher than current average loan yields of 4.58%.

Loans Yields

Q3 2024 (published): 4.56%

Q4 2024 (WG proj.*): 4.63%

Q4 2024 (published): 4.58%

*Based on WinterGems homemade model published one week before the earnings.

Improvement on yields of 2BP did not match the last 4 quarters improvements which were 10BP, 3PB, 13BP and 7BP for an average of 8BP per quarter. The new 5 quarters rolling average is 7BP. I dont see any fundamental reason to revise downward this trend on a going forward as newly originated loans are priced at a much higher yields than current average loan book.

The charts shows the historical loan yield rate and the new projected yield for the first Quarter 2025.

Interest Bearing Deposits

The Interest Bearing Deposits were 2 136 million in average in the fourth quarter and 2 094 million at the end of the quarter. It follows a slight upward trend in the last 2 quarters. The Company is focusing in attracting deposits more aggressively since the last few quarter in my opinion.

Interest Bearing Deposits Yields:

Q3 2024 (published): 4.09%

Q4 2024 (WG proj.*): 3.81%

Q4 2024 (published): 3.80%

Our projection was on target versus published numbers. The next quarter will be trickier. There is a 10BP reduction due to the money market deposit part. But the other portion of the deposit is more difficult to assess as being composed of a mix of short term certificates and plong term certificates which are not totally correlated with the Fed fund rate.

Net Interest Margin

Based on other considerations not disclosed here, we derived a projected Net Interest Income of 1.31%. We overshoot slightly the NIM as the loan yield did not increase as much as projected (2BP versus 7BP) and the borrowing yield was higher than projected.

Q3 2024 (published): 1.07%

Q4 2024 (WG proj.*): 1.31%

Q4 2024 (published): 1.24%

We are projecting a NIM of 1.44%, with a good level of confidence since the Company said that the NIM was already 1.36% in December alone. We do not expect the Federal Reserve to cut this quarter. Consensus is for a cut in the second quarter.

Net interest Income

In Q3, net interest income was 11.1 million and core operating income per share was 1.45$.

In Q4, net interest income was 13.3 million with a NIM of 1.24% and core operating income per share was 2.18$ per share.

As such, using our expected NIM of 1.44%, Net interest income would raise by 2.3m to 15.6 million which should result in core operating income of 2.95$ per share or 35% increase sequentially from previous quarter.

In summary, HIFS should continue to benefit from the strong momentum in sequential earnings growth. Book value is now 198$ per share so this also provide some downside protection.

I think the path to get back to a more acceptable* NIM of 2% is within reach - it is just a question of time, possibly 3 or 4 quarters. With 2%, this bank could earn close to 5$ per share in core earning per quarter or 25$ per year.

*Please note that HIFS was historically able to achieve 3%+ in terms of NIM However I do not believe they can get to 3% in the short term. HIFS since 2018 have cut in the number of branches (which is good in terms of operating expenses) and is really focus on commercial loan and more specifically multi-family loan (not retail anymore) and does not have a strong deposit franchise anymore in my opinion. Furthermore, they have an unbalanced loan / deposit ratio and as such they rely too much on more expansive FHLB and wholesale deposit. It was fine in 2016-2021 as rate was ultra low, but not anymore. As such it will take some time before HIFS is able to get back to 3%, especially if rates stays around 3-4% and don’t go back to 0%.

For more info on the Company, you read my 2 previous post:

and

you are right historically HIFS was able to achieve 3% + NIM. However I do not believe they can get to 3% in the short term. HIFS since 2018 have cut in the number of branches (which is good in terms of operating expenses) and is really focus on commercial loan multi-family loan (not retail anymore) and does not have a strong deposit franchise anymore in my opinion. Furthermore, they have an unbalanced loan / deposit ratio and they rely too much on more expansive FHLB and wholesale deposit. It was fine in 2016-2021 as rate was ultra low, but not anymore. I should have said expected and not historical. Thanks for the comment