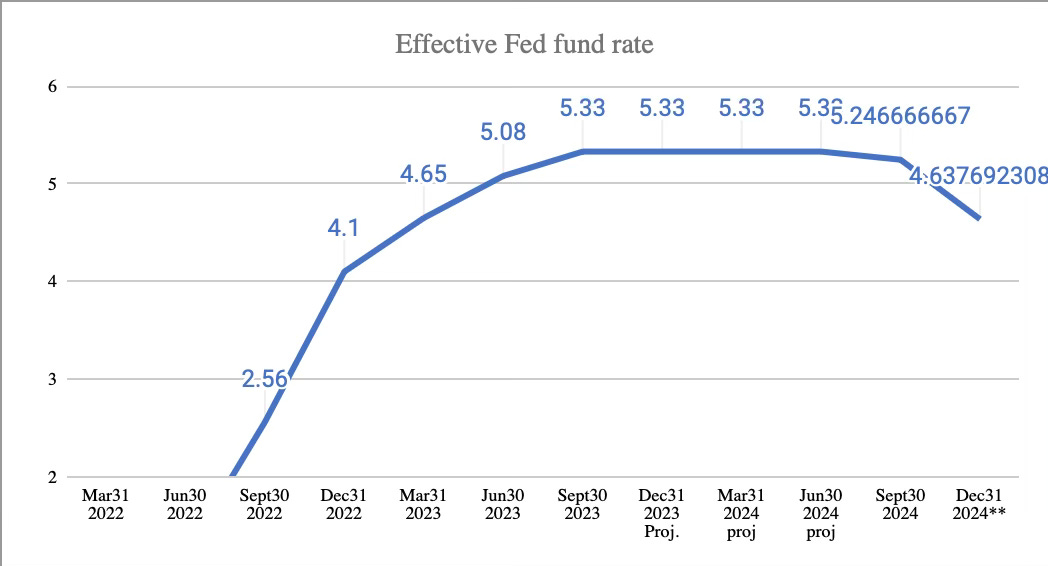

HIFS REVISITED after 3 federal reserve cut

On Dec. 18, the Federal Reserve made its 3rd cut in 2024, and HIFS is expected to publish this coming Friday a first large improvement in NIM while the stock has come down to a reasonable price

On Dec. 18, the Federal Reserve made its third consecutive cut of 2024, reducing the federal funds rate by 0.25 percentage points and 1 percentage points since September. Hingham Institution of Savings HIFS 0.00%↑ will be publishing Q4 results this coming Friday (Jan 17th 2025) or Monday (Jan 20th 2025) and I expect a first impactful improvement in NIM (Net Interest Margin) since the rapid raise of interest rates and inverting yield curve occurring in end of 2022.

The article constitutes my personal views and is for entertainment purposes only. The main goal of this article is to log my personal views. Nothing in this article or these posts in this blog should constitute an investment advice. The projections and estimates provided here should be considered as purely speculative. Do your own model and projections. Please refer to the disclaimer at the end of this article for more details.

At the same time, when the Federal Reserve started to cut rates, the stock has skyrocketed, and almost increased by 50% from 200$ to 300$. Very recently it has come down to 233$ and I started to buy some at this level. I think I have good visibility on future earnings power over the next few years based my proprietary model of the NIM, so I feel confortable to re-initiate a position here.

I discuss in great length about the bank unique culture and so on when I publish a post on HIFS 0.00%↑ which was trading at the time at 184$ in the middle of the interest rate crisis. At 230$, it’s about 25% higher, but with greater visibility for the years ahead, so the expected return might actually be better. HIFS is currently lending at 6.9% and attracting deposit at 4.2% so there is a nice spread here. As the backlog of commercial loans get repriced, the trend over time should be to get back to a 2 to 2.5 percentage point NIM. With close to 4 B in loans this would get us close to 100m in interest income.

You can find my post published on May 2023:

Q4 Preview (speculative)

The following is my projection of the interest rate that HIFS will be able to get (Loans, securities) and pay (Deposits, Borrowing) in Q4. There are a lot of moving parts here, a great deal of loans, deposits and borrowing are following a long duration so it’s not repriced immediately when the Federal Reserve makes a cut. So take this as a grain of salt. I am actually posting this as an experiment so test the model 1 week before the company is publishing to test the model. View this as an experiment to refine the model and not the result. Still I have good confidence that NIM will improve.

Here are the numbers without much comments.

The December 2024** number is the projection of the model

This is the actual Federal Reserve fund rate

This is the average effective fund rate per quarter

The yield rate on Loans. Projected to be raising to 4.64%. The bank is still lending new loans at 6.9% on 5/5 ARM jumbo.

This one is tricky with a lot of moving parts but about 40% is money markets so this should be very responsive to the Fund rate as such we should see a good drop, which will continue in Q1 even if no additional cut as the effective fund rate over Q1 will be lower.

The borrowing part is also tricky as well since a portion (785m) of the borrowing is via HLB-Option Advances with long duration. This portion has already a much lower interest rate than the current fund rate so that part is not expected to change unless we get to much lower interest rate (e.g. 3.5%).

This result is a NIM getting to 1.27%, up 20% from previous quarter. So interest income would raise by about 20% sequentially. Will see if the model holds Friday. Q3 saw an improvement of 10%. Q2 the same. The trend is our friend.

Stay Tune!!

One final thing… I closed my twitter account, as the recent comments of Elon Musk and Trump vis a vis my home country Canada, Greenland and Panama it totally unacceptable and it has a reminiscence of Germany in the 1930s. It started with a friendly country Austria 1938 and Poland in 1939.

Boycotting twitter is my contribution to a peaceful non aggressive world.