$HIFS A VERY conservative bank caught in an inverting yield curve supernova

Hingham Institution for Savings is a conservative and high quality bank based in Boston caught in a strong inverting yield curve storm

Disclosure: I first purchased Hingham Institution for Savings HIFS 0.00%↑ in 2010-2011 at a price of 44$. This bank caught my eyes as it was continuously ranked in the top 10 small banks in terms of low efficiency ratio (the lower the better), extremely low NPA (Non Performing Assets) and steady loan growth. I have continued to increase my position as the company continued to deliver steadily over the last 11 years.

Before describing the difficult situation the bank is facing, I will briefly describe how unique this bank is as a compounder and as a company culture. My best investments over the years have often been when investing in a high quality compounder priced at depressed value facing terrible but temporary industry headwind. I think HIFS fits here.

This following is a deep dive article on HIFS. The article constitutes the authors’ personal views and is for entertainment purposes only. Please refer to the disclaimer at the end of this article for more details.

A Compounding Machine

HIFS has grown steadily over the last 29 years since the current management has taken over the bank.

HIFS stock price has compounded 13% in the last 29 years - from 5.50 in 1993 to now 184$. If you add around 1% in dividends, this is about 14% CAGR. You can appreciate the big drop in share price since the second half of 2022 from a high of 420$ to 184$ today. HIFS is currently trading at tangible book value. This doesn’t happen often.

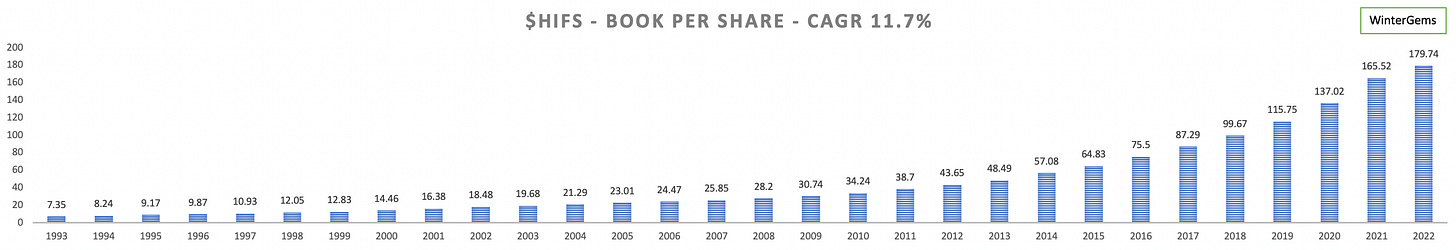

The following shows the progress of this small bank in terms of Book value. Please note that HIFS have made no acquisition over the last 29 years, so this is all organic! The management do not believe in acquiring other banks. Book value is almost identical to the tangible book since HIFS has never done acquisition (so no goodwilll) and does not hold HTM securities (Held-to-Maturities). The infamous HTM that hides the fair value of securities. The book per share has increased at a CAGR of 11.7%, pretty much inline with the stock price.

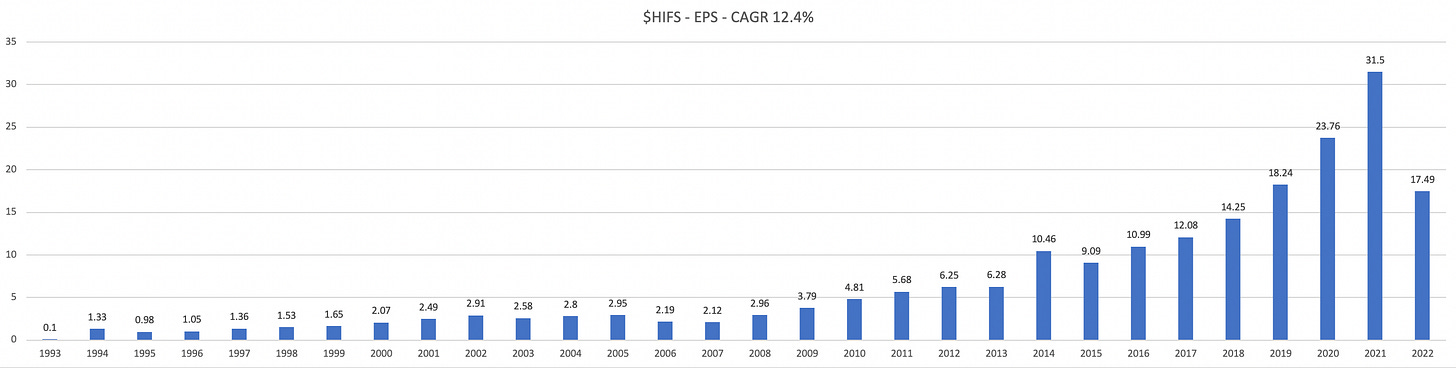

The Earnings per Share has increased at a similar rate with a CAGR of 12.4%. To calculate the CAGR, I removed the 1993 year which had a very low EPS and also removed the depressed 2022 EPS. EPS has increased steadily, but one can note that 1995, 2003, 2006, 2007, 2013, 2015 and finally 2022 have seen a drop in earnings versus precious year. So it is not always smooth, but the general trend is always up. 2023 will certainly not be an exception and will also trend down from previous year!

The period of 2006-2007 was a period of inverting yield curve, and its impact was felt considerably, as earnings went down from 2.95$ in 2005 to 2.12$ in 2007. Now, the inverting yield curve event in 2006-2007 was not as sharped as it is today. So we expect even stronger head winds on earnings for the period of 2022, 2023.

The good news however and that once we enter in a recession as it is likely to happen in late 2023, like during the Great Financial Crisis of 2008-2009, the EPS actually resumes on the positive side. During a recession, the central bank lowers the short term interest rate to mitigate the economic downturn which stops the inverting yield curve. This is also a testament of the high quality loan book of HIFS with almost no NPAs or charge-off even during an economic downturn. In 2009, HIFS had achieved a EPS of 3.76$, much higher that in 2005. Not many banks have seen an increase in earnings during the financial crisis.

The Loan book has increased at an even higher rate of 14.2%. You can observe that the loan has increased steadily, always increasing each year without any exception.

A Unique Culture and Management

30 years ago, Robert Gaughen - the current CEO, took over the Hingham Institution for Savings which had lost $8 million in the past 3 years (1989, 1990, 1991). Since then, the new CEO had change the culture of lending and clean up the loan book.

Now, HIFS has one of the best record in terms net charge-offs in the industry as shown below. Even in the Great Financial Crisis, net charge-off was less than 0.1% compared to industry average hovering over 2%. A 0.1% charge-off is insignificant to the bottom line.

In the last 3 years, the net charge-off is unbelievably good.

2020: $260 thousands

2021: $1 thousand

2022: $50 thousand of recoveries!

One of the main reasons, is that all loans over a certain amount are actually reviewed by the boards and discussed thoroughly. The majority of the loans are concentrated in Boston and management have a deep knowledge of the city. The other reason is the type of loans they offer is very narrow and low risk. For loans outside of Boston, namely Washington, and San Francisco, a delegation including Patrick Gaughen, the COO and son of Robert Gaughen, do a site visit prior to approve any loans. Patrick Gaughen is an exceptionally sharp banker.

Here is the list of loans they do:

80% of their loan book is Commercial Real Estate and of this, the vast majority of the CRE loan book is in the multi-family market, ie loans to business owner of multi-family homes. Multi-family loans have been targeted by HIFS, as this type of real estate is always in great demand in coastal cities like Boston, Washington and San Francisco due to structural issues. Building new appartement buildings in these coastal cities is very difficult due tight regulations (it takes 684 days in average to get a construction permit), and a lack of available lands.

You can see below the components of the CRE loan book:

If you include mixed use which typically include residential units, 67% of the loan book addresses the residential/multifamily market. Office space represents 18% or $553 million. Because of the high vacancies in office building following COVID, Patrick Gaughen has spend considerable time explaining the components of the office loans and I will relay the information here in a subsequent section.

Certain loan types are very sensitive to economic downturn and as such HIFS avoids these types of loan. Here is the list of things HIFS don’t do:

In summary, loans not guaranteed by real estate or with too much leveraged (not enough equity) are not offered by the bank.

The Inverting Yield Curve Supernova

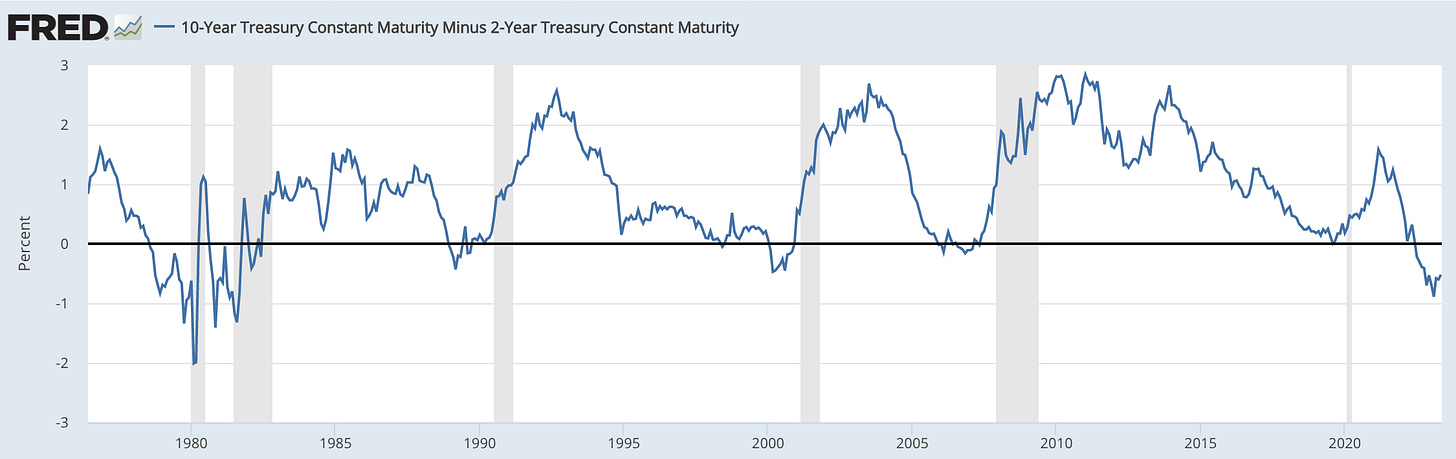

To assess whether the yield curve is inverted, we commonly take the 10 year treasury yield minus the 2 year treasury. As shown below, the phenomena of inverted yield curve occurred 6 times in the last 50 years. It is also a reliable leading indicator of an incoming recession.

1978-1980: which lead to a recession in 1980

1981-1982: which lead to a very deep and long recession in 1982

1989: which lead to the recession of 1990-1991

2000: which lead to the tech bust bubble and the recession of 2001

2006-2007: which lead to the GFC of 2008-2009

2019: which lead to a very short recession in 2020

2022-2023: Recession incoming?

In terms of the depth and duration, there is no equivalent today in terms of inverted yield curve then to the 1981-1982 era which lead to a very deep and long recession.

Now, history does not repeat itself in all respect, but it is fair to say that considering how deep and long is the investing yield curve, a recession is almost a given. Once the recession starts, the inverting yield curve will quickly end. Inverting yield curve is always temporary and does not last more than 2 years.

Last 50 years:

Last 20 years:

We can observe that the inverting yield curve is much deeper that the one that occurred in 2006-2007 or the blip in 2019.

Impact of inverting yield curve on NIM

For a majority of conservative banks which invest mostly in real estate loans, a sharp raise of the short term interest is very negative as loans especially real estate loans are often fixed rate or repriced infrequently while deposits or borrowing from the Feds are short term dated.

Banks that are operating in the riskier side of the loans spectra with riskier loans, such as consumer lending, SBA, ABL etc.. have loans that are repriced much more often. The big 4 banks with a large components of loans for credit card loans, personal loans, etc. have navigated the inverting yield curve quite easily. The same with some regional banks, like MTB bank which is not shy to do personal loans. However, these are riskier loans and once we hit a recession, the NPA loans will raise, net charge-off will raise and so on.

This is a trade-off. Riskier loans often mean repriced more frequently. More conservative loans often mean repriced very infrequently.

HIFS is at one end of the spectrum, the very conservative end with no personal loans and other business loans like SBA, ABL. Actually, 80% of the loans are commercial real estate, and the most common loan they offer is the 5/5 ARM or the 5/1 ARM. These are Adjustable Rate Loans, where the initial interest rate remains the same for 5 years, and that for the rest of the life of the loan, the interest range will be subject to change every x years ( x is the second number) after the first 5 years.

For personal mortgage, HIFS is also currently promoting the 5/5 ARM at 6.286% on its website.

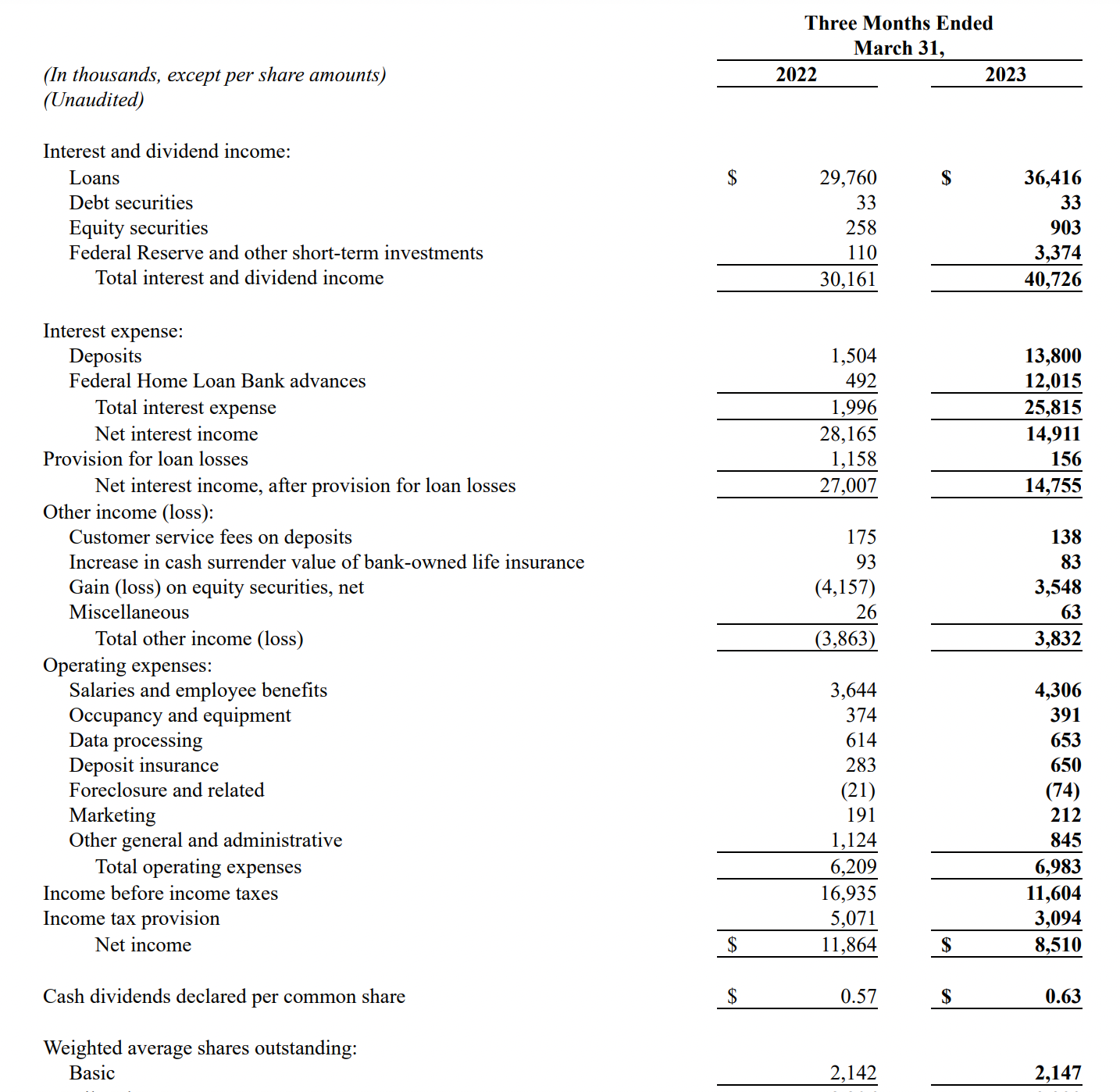

The following table shows the yield rate in function of the assets held for March 31st 2023 and March 31st 2022 for HIFS. Loans constitute the vast majority interest-earning assets with $3.682 billion over $4.046 billion. the yield rate of Loans has barely move up in the last year, from 3.87% to 3.96%.

In contrast, the largest component of the interest-bearing liabilities e.g. the interest-bearing deposits has seen a sharp increase from 0.30% to 2.45%. This results in a NIM (Net interest margin) compression from 3.30% to 1.46%.

The following figure shows the yield rate per asset types for the last 5 quarters. As you can observe, the yield rate achieved from loans, which the majority of the assets held by the bank, moves very slowly upward. The other components, since they are mostly short term, follows the Federal fund rate.

On the liabilities side, the interest rate that must be paid by the bank for deposits has increased very rapidly as shown below:

Thankfully, the bank doesn’t need to pay for interest coming from the demand deposits and its equity! So about $800 million is interest free.

Here is the demand deposits and the equity amount over the last 5 quarters.

This result in a Net Interest Margin of 1.46% in the last quarter. It has dropped by 50BP in the last quarter. I would not be surprised if the drop continues by another 50 BP in the next quarter to reach 1% in Q2. Hopefully, in Q3, the rate of increase from the Federal funding rate will have stabilized, and the NIM might stabilize around 1% until the short term interest rate lowers again.

The $550 million office loan book

HIFS has around $550 million of loans in the office real estate. Considering the COVID impact on office vacancies, the investment community is very concerned about the risk associated with loans for office real estate. At the annual assembly of April 27th 2023, Patrick Gaughen explained in great length the composition of the office loan book.

15% of the loan book or about $80 million is composed of 2 large loans to unions with offices in Boston and in Washington. These 2 loans are very low risk, as the Loan to the Value (LTV) is very low. They mentioned that even if the market price of these offices would crumble, the residual LTV would still be very low. This is basically risk free.

10% of the loan book are loans that are in the process of being repurposed to residential units.

The rest of the loan book is composed of mostly small offices with doctors, lawyers, etc. The majority of the office loan book for these are in Boston.

As such, they feel very confident about the office loan book.

The Deposit Angle

Hingham is in unique position in terms of providing safety to depositors. Depositors are insured in full, up to any amount, with a combined FDIC and DIF insurance coverage. The FDIC insures all deposits up to $250,000 per depositor. All deposits above these amounts are insured by the Massachusetts DIF. This deposit insurance covers all customers of the Bank without limit or exception.

As such, we should not expect a bank run similar to what as happen at Silicon Valley Bank or First Republic Bank. This was advertised clearly in their website during the crisis of March 2023.

There is a renewed focus from HIFS to increase deposits. We typically see a drop in deposits in Q1. But this year, by re-energizing deposits, interest-bearing deposits has increased from $2.221 billion to $2.250 billion or 29 million. In contrast, interest-bearing deposits went from $2.087 billion in december 31st 2021, to $2.028 billion March 31st 2022.

According to management, one key thrust to gain more deposits is the Specialized Deposit Group. They were able to increase non-interest bearing balances by 8%. They hired bankers from the defunct Boston Private bank, a subsidiary of SVB. That subsidiary (Boston Private) was the #1 competitor of HIFS in this segment of commercial deposit.

In conclusion, due to deposits being fully insured and the recent closing of a an important competitor: Boston Private, I believe HIFS is in good position to increase their deposits. Interest-bearing deposits are of lower cost than federal borrowing. This should improve the NIM situation.

Increasing the yield rate of loans!

As discussed before, the yield rate of loans has been crawling very slowly upward. So what need to be done, to have those loans being repriced at the right value. Currently, new loans for CRE are priced in a range of 5.75% to 6.75% versus current average of 3.92% based on the latest quarter.

Patrick Gaughen mentioned 3 ways for HIFS to increase yield rate

New Loan origination. HIFS is still active in originating new loans in all 3 markets (Boston, Washington and San Francisco). This is the fasted way to increase the yield rate according to management. New loans should be in the range of 5.75% to 6.75%. Last year, HIFS was able to add $600m of new loans. This does not include repricing or payoff. Assuming, that this new origination is much slower this year, we could cut this in half to $300 million. New loans should improve yield by 15BP. We can assume the same for 2024 to be conservative.

Repricing (loans maturing). In the latest 10K, you can find the repricing or maturing date of the loan book.

As such $531 million will be repriced by the end of 2023. This represents 15% of the loan book. Assuming a rate hike of 200BP, this should get us to 4.3% by the end of 2023.

In 2024, $504 million will be repriced. As such, 29% of loans will be repriced by end of 2024. Assuming the same repricing for 2024 in terms of yield, we get to 4.58%.

Payoff or Paydown: The management discussed that there are other reasons that can trigger a pay off or a paydown of loans. The owner might decide to sell one property or refinance or releverage which will trigger a repricing. This is difficult to assess. Q1 was really slow in terms of activity because of the changing rate environment. But the market will adjust and sales of CRE will resume. That should trigger repricing. Another consideration is paydown or re-leverage. Say you have an owner with multiple properties and loans. One property is due to renew its mortgage. The same owner also have a loan with HIFS with a very low leverage. So the owner might contact HIFS to re-leverage its loan to help paying down some capital on the to-be-renewed loan to reduce interest rate. HIFS would then renegotiate the loan (with low leverage) and increase the rate of the existing loan. This is difficult to quantify, but I think we can estimate that 5% of the properties will be refinanced or terminated due to sales or re-leverage or accelerated pay off. This should add 10BP per year.

In summary, my rough estimate for end of 2023 would lead to loans yielding: 3.96% (current)

+0.3% (maturity repricing)

+0.15%(new origination)

+0.10%(payoff/paydown)=

4.5% and 5.05% by end of 2024.

Scenario 1 : Interest rate stays at a fed fund rate of 5-5.25% for the next 2 years

This is an unlikely scenario, but one can entertain the idea that the latest Fed decision to increase the fund rate in May by 25BP was the last increase or decrease for a long period. Inflation stays at a higher level than desired, something like 4% and the Fed doesn’t want to lower the interest rate. Even if we are in extended inverted yield curve situation, fiscal stimulus from the government prevents the US economy from going into a recession. What would happen to HIFS NIM?

In this case, I would assume that Q2 will be the worst quarter in terms of NIM, as the Fed will stop raising rates (after May) and then through repricing of loans, HIFS will steadily increase its NIM by 10-15BP due to loan repricing, payoff and new origination.

Scenario 2 - US goes into recession in late 2023 and Fed lowers rate by 200BP in Q4 2023, Q1-2024

This is probably the most likely scenario. Each time we have an inverted yield curve phenomena, the US goes into a recession. I suspect history will repeat itself. The economy will worsen in the Fall and the Feds will start lowering rate by 50BP each month to get to the 3% or possibly lower if the recession is steep. If the Feds cut rate in October, we will see the benefit almost instantly in the borrowing from feds line. Long term loan rate will stay firm at 6% as banks will be prudent in originating new loans. The cost interest-bearing liabilities will probably see a benefit of 50BP per quarter for 2-3 quarter. 25BP in Q4, 50BP in Q1-2024 and 25BP in Q2-2024.

What happen to the bottom line if NIM gets to 1%?

If NIM gets to 1%, with assets of $4 billion, net interest income will be $10 million per quarter. HIFS is a very low cost bank, with recurring cost quarterly $7 million per quarter. So, even at a low NIM of 1%, they will still make money. EPS may go down to 1$ per quarter, but I would be surprised that they loose money. I hope this statement will age well…

Summary

The NIM estimates are very rough estimates, lets see if this blog post age well, but it is the best I can do for now. But based on these 2 scenarios, HIFS 0.00%↑ never loose money and the tangible book of 184$ per share will keep increasing over the next 2 years. As such, buying HIFS near the tangible book seems a good entry with limited downside. The likely scenario 2 of a recession starting in Q4 2023, may translate to very good earnings in 2024 and a quick jump in stock price. Scenario 1 will see the stock price hovering over the book value and improve a bit more as the effect of loans repricing and new originations will improve slowly the net interest income.

Feel free to give me some feedback, comments, or if you have any inquiry.

I will probably address those in a part2. Looking forward for comments!

Thanks

JL

Disclaimer: The above article constitutes my or the authors’ personal views and is for entertainment purposes only. It is not to be construed as financial advice in any shape or form. Please do your own research and seek your own advice from a qualified financial advisor. I / The authors may from time to time hold positions in the aforementioned stocks consistent with the views and opinions expressed in this article. The information provided in this article is not making promises, or guarantees regarding the accuracy of information supplied, nor that you guarantee for the completeness of the information here. The information in this article is opinion-based and that these opinions do not reflect the ideas, ideologies, or points of view of any organization the authors may be potentially affiliated with. The authors reserve the right to change the content of this blog or the above article. The performance represented is historical" and that "past performance is not a reliable indicator of future results and investors may not recover the full amount invested

If we enter a recession ...and inverting yield.curve do always (7 out of 7 ) end up in a recession The inflation will come down ... At least a bit so that short term yield will go down a bit ... So that Lt yield will catch up and intersect .. We might get into a stagflation like 78 - 82 ... Here the st yield went down but inflation stayed high ... So we end up with another inverting yield curve ... In 81 ... That is an horrific scenario .. it may repeat again ...but I don't think we are facing the same demographic trends than in 1970s baby boomers all wanted houses kids at the same time

Would you have any thoughts about their reliance on the Federal home Loans? That is huge , expensive and increasing. I was a big fan of this bank before the rate rise, but it now looks much more vulnerable that I thought