Top5 Valuation check 1H2025 and rumblings

Going through valuation assessment and some qualitative rumblings about my top positions. This is part1 - will go through up to top15 over the next few weeks

Once a while I like to go over my holdings in terms of valuation and qualitative opinion. I can put my thoughts on paper so I can review later on what aspect I was right about or wrong. I can then identify later on mindsets and thoughts patterns that I must strengthen or let go to make me a better investor. This is the main objective of what follows:

The article constitutes my personal views and is for entertainment purposes only. The main goal of this article is to log my personal views. Nothing in this article or these posts in this blog should constitute an investment advice. The projections and estimates provided here should be considered as purely speculative. Do your own model and projections. Please refer to the disclaimer at the end of this article for more details.

Part 1 will cover the top 5 positions: Google, Bombardier, Adyen, Dollarama and Monarch Cement. I try to have around 60% of the total holdings in my highest conviction stocks (top5). Currently it is higher than that as I went All -In on Bombardier and the stock almost double while adding significantly to Google at 154 range. Crazy concentration level which is not recommended. Only for people with strong stomach and actually don’t care about their holdings value based on current price should follow this path.

#1 Google

At 17.74 EV/EBIT, Google trades 25% less than historical average of 22x EBIT/EV. Google is the company that generates the highest profit in USA (110B) but trades less than Microsoft (EV is less by 1.6T) or Apple (500B less) or Nvidia (1.6T less). It makes twice as much money than Nvidia. It is true that OpenAI or Antropic have captured attention away from Google users. The same can be said for Facebook around 2008, TikTok in 2020, Apple’s APP ecosystem in 2010. Google search was, is and will remain the ultimate entry point for the web in my opinion. Google search is THE launchpad. OpenAI wants the user to stay with you and chat with you and capture all your attention. But if you want to go on the web and look at 3rd party info, the best way, the fastest way and the dominant way is to use google search. I personally think the combination of AI overview and ranked best links is the best informational tradeoff for me. On top of that, Google has a much deeper AI knowhow than any other company. OpenAI is centrally focused on LLM. LLM only addresses a subset of the AI capability required for Waymo for example. Refer to the Waymo foundational model blog.

I would also recommend to listen to the 3 hours podcast from the acquired podcast on google to get some perspective on google early days. Cannot wait to listen to the part 2 on this on.

Historical EV/EBIT of Google

#2 Bombardier

At 16.1 EV/EBIT, Bombardier is trading in the historical range of the last 3 years and above mid range of the last year of around 14-15x. Bombardier almost double (91%) since my analysis when it was trading at 78$. For the record, I used a 12mo trailing of 953m EBIT, a market cap of 10.8B and a net debt of 4.6B to derive the EV/EBIT (all numbers in USD). To recap, Bombardier is compliant with the USMCA trade regulation and as such its private planes are not subject to new USA tariff. More interestingly, according to the recent guidance range and my own estimates, the company should be able to generate 800m of free cash flow this year (even after paying debt interest) and as such trades at a market cap to free cash flow 13.5. It has paid 300m of LT debt in January and is planning to repay 600m in LT debt later this year. At this rate, I would not be surprise that most of the LT debt will be repaid over the next 5 years. For more on interest cost savings and projected earnings, refer to this article of March 4th in the middle of Canada-USA tariff shock:

A timely post! Bombardier - Leading Private Jet Vendor in a Duopoly caught in a Tariff Storm

Warning: 25% Tariff Update

Earnings projection 2029 of March 4th 2025 analysis:

#3 Adyen

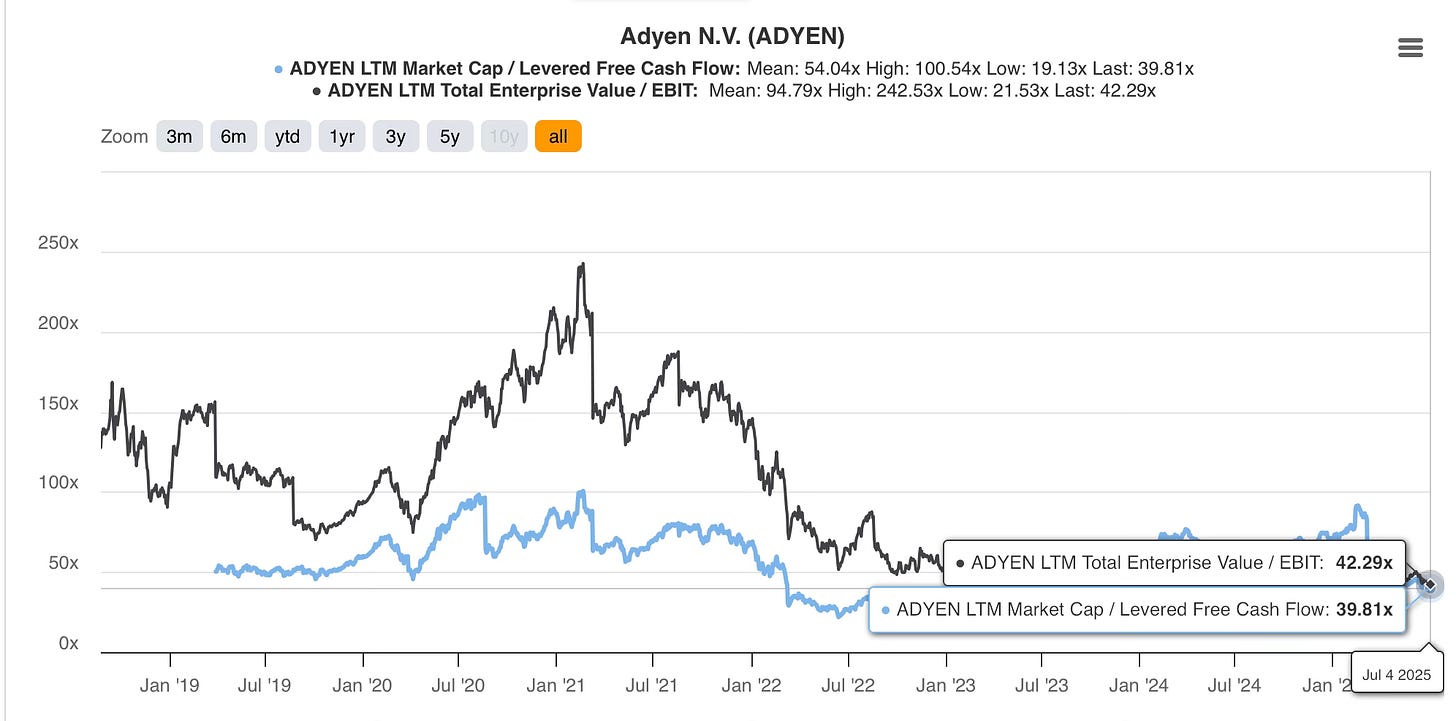

At 42 EV/EBIT, Adyen is trading at below historical average of 94 since IPO.

If you take the last 3 years and exclude the post COVID 2020 and 2021 euphoria, the stock has traded at an average of 50 EV/EBIT, and as such Adyen is trading at a 16% discount to historical average. Fair value is probably more in the range of 1750 in my opinion. If results are good for the half, expect to trade up on news. I added more recently as I am consolidating my holdings to the top15 and removing the number of holdings to about 20 in total.

On a free cash flow basis, the stocks trades at a free cash flow ratio to market cap of 40. Adyen has a bullet proof balance sheet with 10B of cash. At some point, management will use this cash balance to purchase shares if growth slow down. Similar to what Fiserv does. A lot of the cash (about 6B) is coming from the natural float from holding for 48 hours the 1Trillion of merchant processing payment volume per year. This is very stable and part of the business. The cash will only raise as Adyen grows its payment processing volume to 2T as well at its earnings. I do not see any reasons that this high tech buldozer to not grab an ever increasing part of the payment processing land. As a payment processor, it also has a natural hedge to inflation.

#4 Dollarama

At 35 EV/EBIT, Dollarama is at a historical peak in terms of valuation, which average 25 over the last 5 years. Things are going extremely well in terms of organic operational metrics and there are excitement with the new development in Mexico and Australia.

The latest news on the Reject Shop takeover can be found here Latest on Reject takeover. 97% of shareholders have accepted the offer and the takeover just need to be approved by the Second Court Hearing.

I posted on Dollarama last year and recently for more qualitative assessment. I bought Dollarama at the IPO (2009) so I am not selling if the stocks is trading higher than historical valuation.

Dollarama - 1 year later

Before you continue glancing into the latest post, I would strongly encourage you to first review my analysis publish last year in June on this amazing dollar store company based in Canada :

#5 Monarch cement

At 11.32 EV/EBIT, Monarch cement is trading at higher multiple than historical average, however the increase in spending in infrastructure is providing a strong tailwind in the years to come. Whether you build new AI centers, or energy to feed those computing servers, you need a lot of concrete to make this a reality.

Pricing of concrete product have been on the raise in the last 5 years:

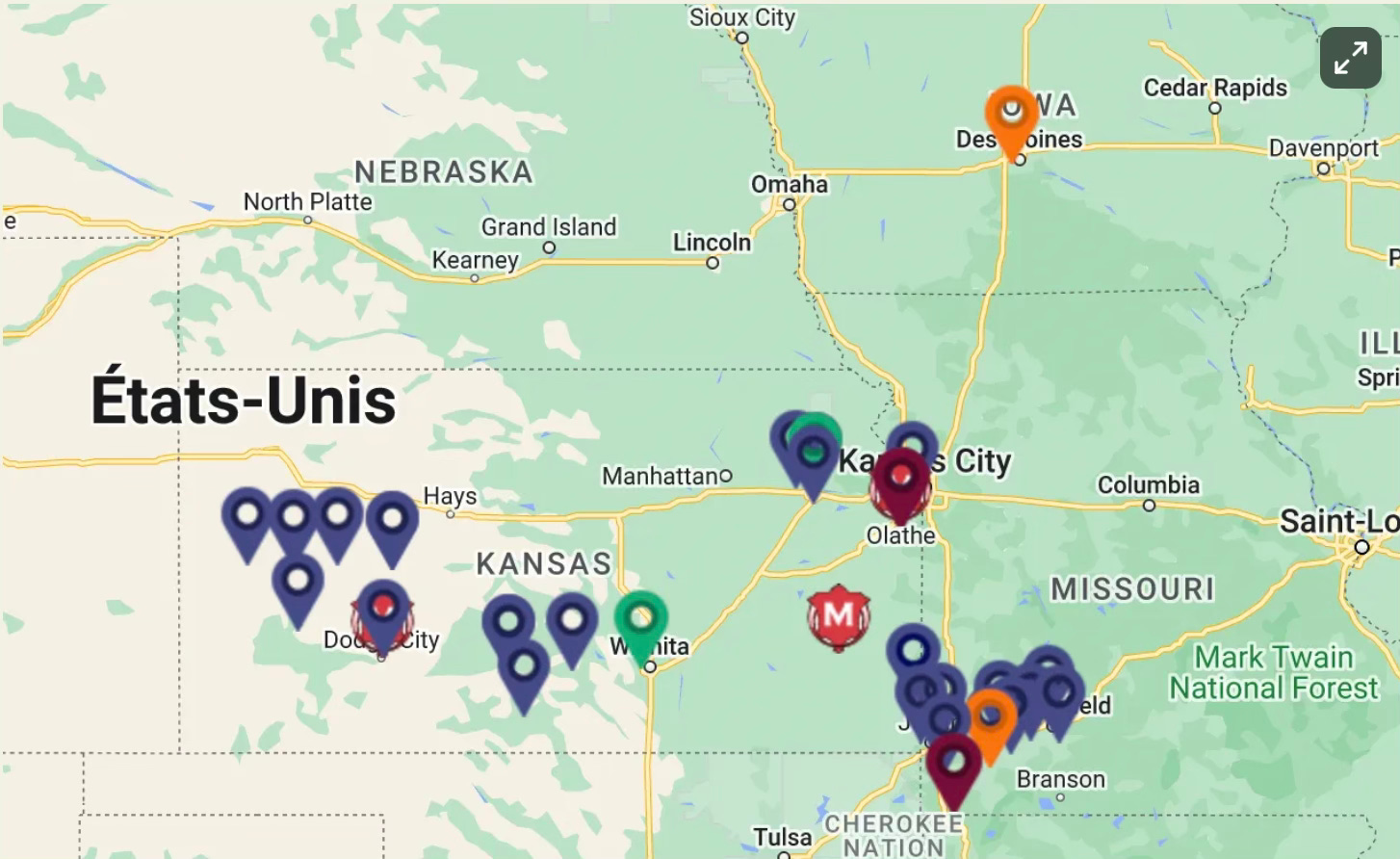

The management have done some changes on the ready mix front. It has merged its SW Missouri ready mix operations with 2 companies. These are now deconsolidated as monarch cement retains 49% of the combined entity. I am fine with that actually, as the goal of ready mix operations in my opinion is to distribute monarch’s cement. The cement business i.e. the Humboldt cement plant, generates more than 80% of the operating income. So by merging with these 2 other companies and retaining a 49% equity, this should strengthen the ties of the merged companies with the main objective of selling the cement produced from Humboldt.

You see below a map of the ready mix locations in the SW of Missouri (close to Springfield). The M is the location of the cement plant Humboldt

I have published a post on Monarch last year. More on the company here:

$MCEM Monarch Cement: A superior cement business

Monarch cement is a $700M market cap pure play cement company which has delisted in 2014 from the public market to reduce overhead cost. It is currently trading on the pink sheet (OTC market) in USA. It is VERY thinly traded. Some day there is no trade (like today May 24th). Be patient if you decide to buy some shares. Monarch cement’ main asset is a single cement plant located at Humboldt, Kansas, approximately 110 miles southwest of Kansas City, Missouri. The Company owns approximately 5,000 acres of land on which the Humboldt plant, offices and all essential raw materials for the cement operations are located. This cement plant has the competitive advantage of having all the essential raw materials to make the cement.

For comparison, CRH, one of the largest pure play in cement in America, trades at 16x EV/EBIT, which is also higher than historical average. On that basis, Monarch trades at close to a 50% discount to CRH.

Amrize, who IPOed last week, is currently at 16x expected EV/EBIT, so also priced much higher than monarch cement. Both CRH and Amrize have a good amount of debt, while monarch cement is debt free and has 60m cash on its balance sheet. I decided to stick and concentrate on Monarch and forget about CRH or Amrize.

Next post will be covering mercadolibre, Netflix, Nintendo, Amazon and LVMH.

Very interesting article. Agree on Google and I'll look more into Bombardier.

Thanks! Thought so. Own this as well.