A timely post! Bombardier - Leading Private Jet Vendor in a Duopoly caught in a Tariff Storm

Bombardier ranks #1 or #2 in terms of private jet delivery and sales. This is an attractive duopoly market. The 25% tariff will significantly impact the aerospace industry as a whole and Bombardier.

Warning: 25% Tariff Update

I decided to hold in publishing this post until today - Tuesday morning- to see if Trump would proceed or not on the broad 25% tariff to Canada and Mexico imports. It seems that Trump is going ahead on this at the time of publishing. Before the close yesterday, Bombardier shares crashed at 78 CAD or 54 USD. It reached a similar level early February before the tariff was postpone. The post was written assuming a price of 83 CAD in terms of PE ratio etc..

The article constitutes my personal views and is for entertainment purposes only. The main goal of this article is to log my personal views. Nothing in this article or these posts in this blog should constitute an investment advice. The projections and estimates provided here should be considered as purely speculative. Do your own model and projections. Please refer to the disclaimer at the end of this article for more details.

Canada and USA manufacturing in aerospace and automobile are highly intertwined and I suspect that most USA companies operating in the aerospace industry (GE Aviation, Textron, Boeing, Alcoa*, Gulfstream, Lockheed Martin, Pratt & Whitney) will request that the aerospace industry be exempted from the broad tariff.

The aerospace industry is highly regulated and capacity constraint and as such parts manufacturing cannot be replaced.

* Alcoa makes the latest and greatest in terms of AL-Li alloy used in Boeing 787, Airbus 350, Global 7500, Gulfstream 650). Alcoa has three aluminum smelters in Canada, located in Baie-Comeau, Bécancour, and Deschambault.

Canada and in particular the Province of Quebec makes critical aerospace parts which are sold to USA.

Most of the Aluminium (AL) consumed in USA are made in one of the 8 mega smelter plants in Quebec and one smelter in BC. AL smelter requires a lot of energy. All aircrafts are made of AL alloy. USA relies totally on the AL produced in Quebec. In 2024 alone, U.S. primary aluminum imports from Canada totaled nearly 2.7 million metric tons. This represents over half of the U.S.'s aluminum consumption. USA does not have the energy available to produce AL and smelter would take years to be build and get the proper authorization and there is no energy availability. A smelter cannot rely on solar plant! If a smelter stop due to energy blackout, it looses weeks of production.

GE aviation relies on GE Bromont to produce critical parts of the most popular engine in the world the CF56. The CF56 is used in the narrow body Airbus 320 and Boeing 737, the two most popular plane in the world. The CF56 is already supply constrained.

Pratt & Whitney Quebec produced engine for Textron and Gulfstream. The whole line of G400, G500 and G600 uses engine from P&W. The G650 uses engines from Roll Royce.

A majority of Helicopters are assembled in Quebec for Textron. Both the Cesna and Helicopter business of Textron will be totally disrupted.

Quebec aerospace industry makes a lot of other critical parts like landing gear and so on.

Lockheed Martin sells the F35 to Canada.

Here is what the conference board of Canada has to say about the 25% tariff:

I strongly believe that once cars and planes price increases by 10-20% - rough guess - Trump will pullback after a few months from this broad tariff. This is my investment thesis.

Finally, 66% of Bombardier customers are wealthy individuals or private companies. I do not see any reason for these customers not to take delivery of their private jet in Bermudes or some other tax haven location or even in Canada to avoid the tariff. This previous statement is speculative from my part and will need to be clarified over the next few months if this is the case.

Overview (original post starting here)

The medium and large size private jet market is dominated by Bombardier and Gulfstream (Gulfstream is #1 in sales, Bombardier is #1 in delivery). Falcon maker Dassault is far behind as #3 with only 26 deliveries in 2023 (Bombardier delivered 5.3 times more planes in 2023 with 138 deliveries). So Bombardier and Gulftream are operating in an almost private jet duopoly with Dassault, Textron (Cesna maker) and Embraer far away as #3, #4 and #5 respectively.

Bombardier has a very broad offering in both the large cabin and medium cabin private jet segment with the Global aircraft and the Challenger aircraft. If you include the light cabin Learjet which was discontinued, there are more than 5000 Bombardier private jets in operation today.

Having sold their train business to Alstom in 2021 and the CSERIES to Airbus in 2020, Bombardier was finally able to focus all its creativity and innovation to its most valuable market, the private jet market. Since 2020, the private jet segment has improved significantly and Bombardier was able to significantly improve its financial situation which was in dire condition in 2020.

I took a significant position in this Canadian stock recently, as the stock price has come down due to fear of the Trump tariff on Canadian export. Bombardier is currently trading at a very attractive ratio. It made 5.16 USD of adjusted EPS or 11x earnings. Bombardier currently trades at 83$ CAD, or 57USD. Through a combination of continuous increase of delivery of private jet planes, increase in aftermarket sales, significant repayment of long term debt, increase in sales to defense market, I believe Bombardier can double its EPS over the next 5 years and with a PE upward rerating, which should be able to achieve a very good return over the next 5 years (PE expansion and EPS growth). I will go over these 4 aspects in the next sections:

Historical increase of delivery vs competition

Debt level

Aftermarket sales

Defense spending

Some history mostly on private jet development

I am going by memory here, so some dates might be off and so on but this is a company that I have tracked and owned (on and off) since 1992.

Bombardier was founded by Armand Bombardier in 1930s, who patented the first snowmobile. Bombardier has a very long history of inventions and innovations. The company invented the small size snowmobile in the 1950s (initial snowmobile in the 1930s was a 2-8 passengers car on ski) and also invented the noisy but fun jet ski in the 1980s. They started their foray in the airplane business by buying Learjet and De Haviland in early 1990s. They also got access to the Challenger aircraft program this way.

They invented the Regional Jets in the 1990s, which really transformed the commercial airplane industry. In the 1990s, in parallel to the RJ jet development, they developed from scratch the Global Express which was launched in 1999. The Global Express was the longest range private jet at the time. It was a very ambitious program internally developed on the heel of the Challenger program. It was Bombardier first foray in the large cabin private jet market. The Global Express is the original design of the currently sold Global 5500 and Global 6500. The even longer range Global 5500/6500 are powered by new Rolls-Royce Pearl engines with lower fuel burn and were unveiled in May 2018. Rolls-Royce is another turnaround story that I hold share in. I provided a quick overview on Rolls-Royce here: 7 european

They also developed from a clean sheet of paper the Global 7500. The development started in 2010. The Bombardier Global 7500 and Global 8000 are ultra long-range business jets and remain the largest business jets in the world. The Global 7500, originally named the Global 7000, made its first flight on November 4, 2016 and entered service on 20 December 2018. The Bombardier Global 7500 uses the latest and greatest in terms of alloy with the new Aluminium-Lithium alloy which provides 10% weight reduction compared to composites, leading to up to 20% better fuel efficiency, at a lower cost than titanium or composites. Al–Li alloys is used on aircraft such as the Airbus A380 and A350, Boeing 787 and the C Series. It also is used on the Gulfstream G650.

So within 2 years (circa 2019) they completely revamped its private jet offering with the Global 5500, the Global 6500 and the ultra long range Global 7500. So no wonder that margin was at its lowest in the year of 2020 as we will see in the next section.

One final thing, Bombardier was split into 2 companies around 2001, Bombardier Recreational Product DOO 0.00%↑ (Snowmobile, jetski), and Bombardier (Aircraft and Trains) $BBD.b . Both are still traded in the Toronto stock exchange but there is no cross-ownership.

Historical increase of delivery

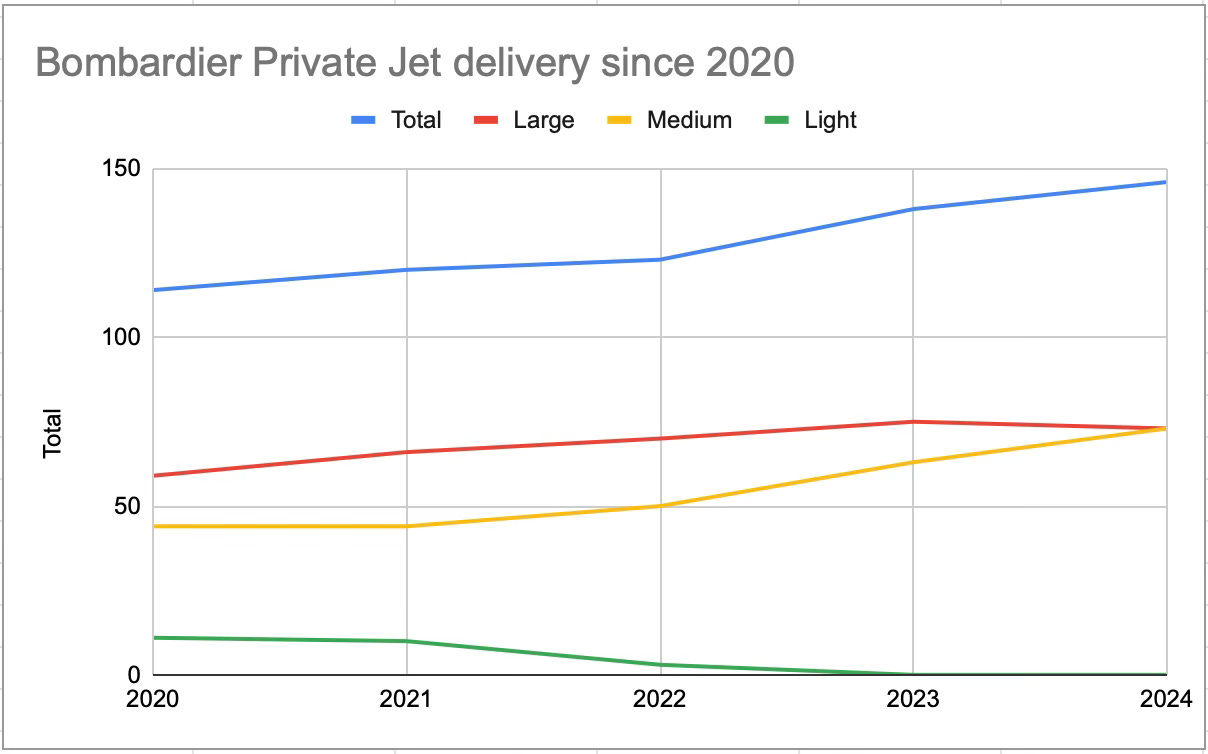

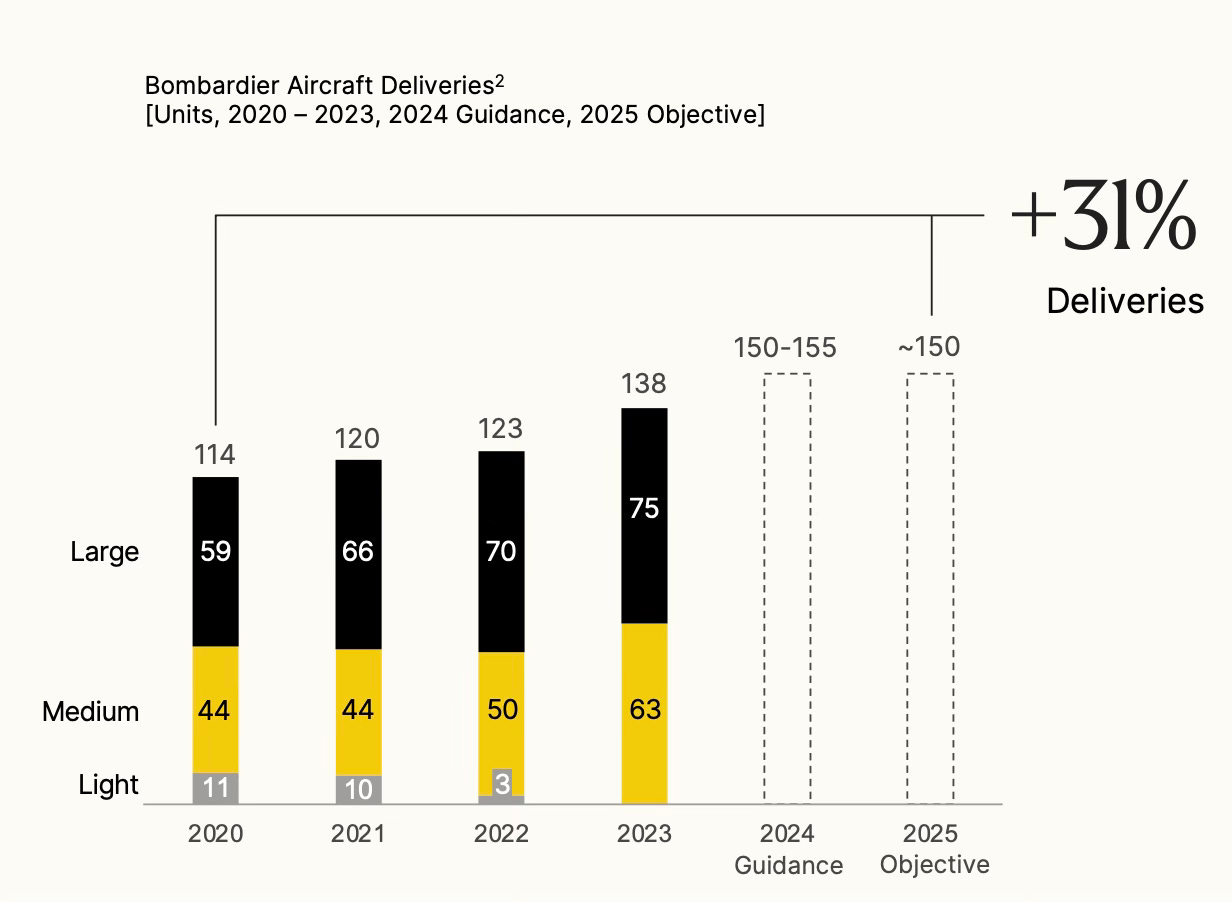

Since 2020, the number of delivery per year has increased steadily going from 114 delivery in 2020 to 146 delivery in 2024. If you look on a segment level, the number of medium cabin private jet has increased steadily going from 44 Challenger deliveries to 73 deliveries in the latest year. The number of Global jets delivered has also increased slowly but steadily from 59 aircraft to 73 aircrafts. Note that Bombardier discontinued the delivery of Learjet aircraft in the light cabin segment.

Bombardier midterm plan was to get to 150 jets delivery by 2025, so we are close to this objective.

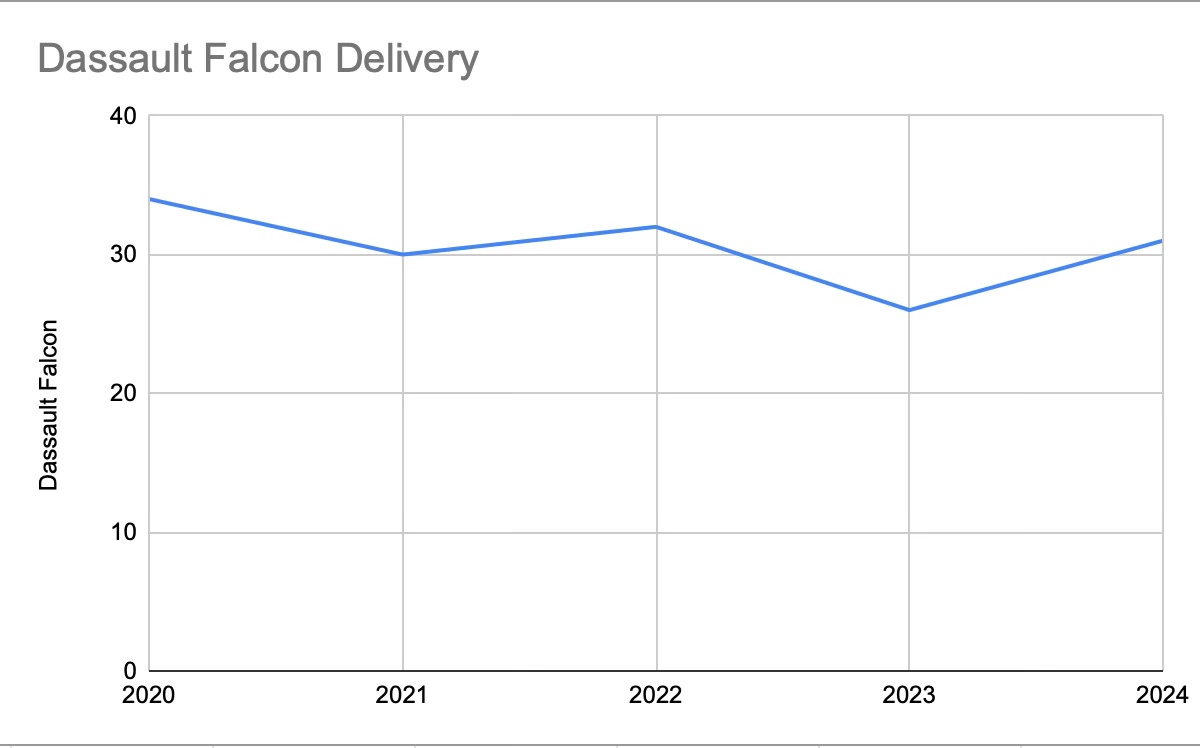

If we look at the delivery numbers of Dassault Falcon and Gulfstream, we do not see the same level of steady increase. Dassault is more or less delivering the same amount of private jets year after year at low 30s (except 2023 which saw a drop to 26 deliveries.

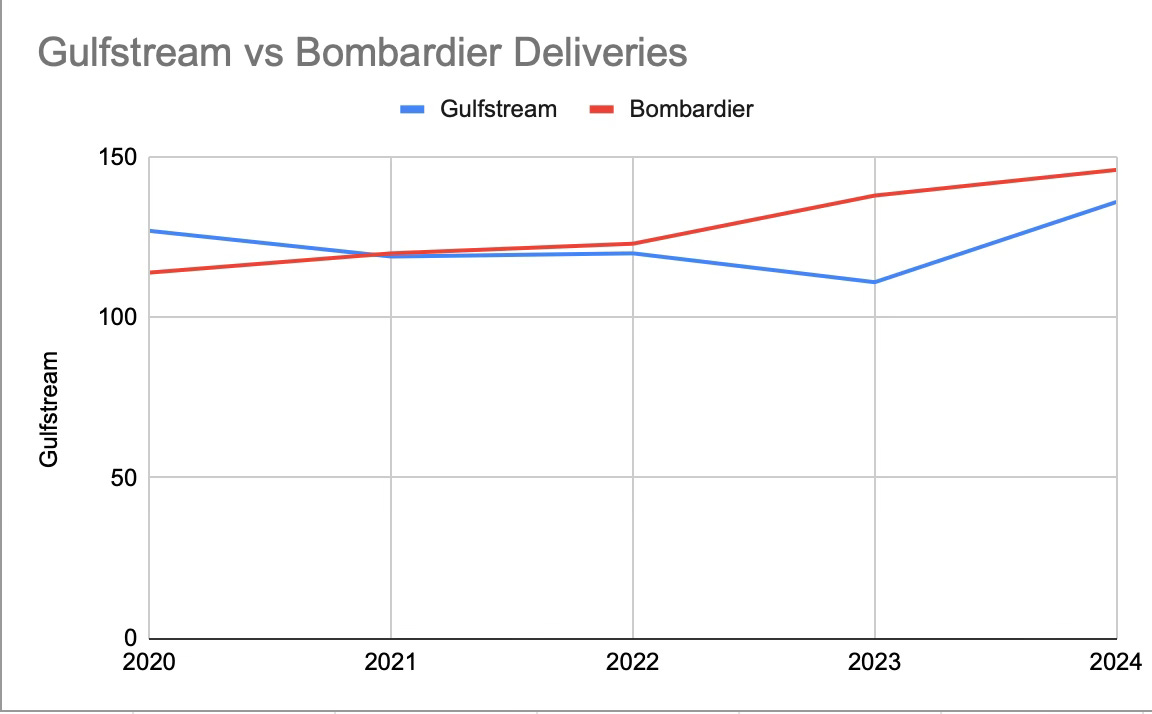

Gulfstream has been stable at around 127 deliveries in 2020, and 132 deliveries in 2024.

If you compare the deliveries of Gulfstream versus Bombardier, you can observe that clearly Bombardier is gaining market share since 2020 versus Gulfstream. Bombardier overtook Gulfstream in terms of delivery in 2022.

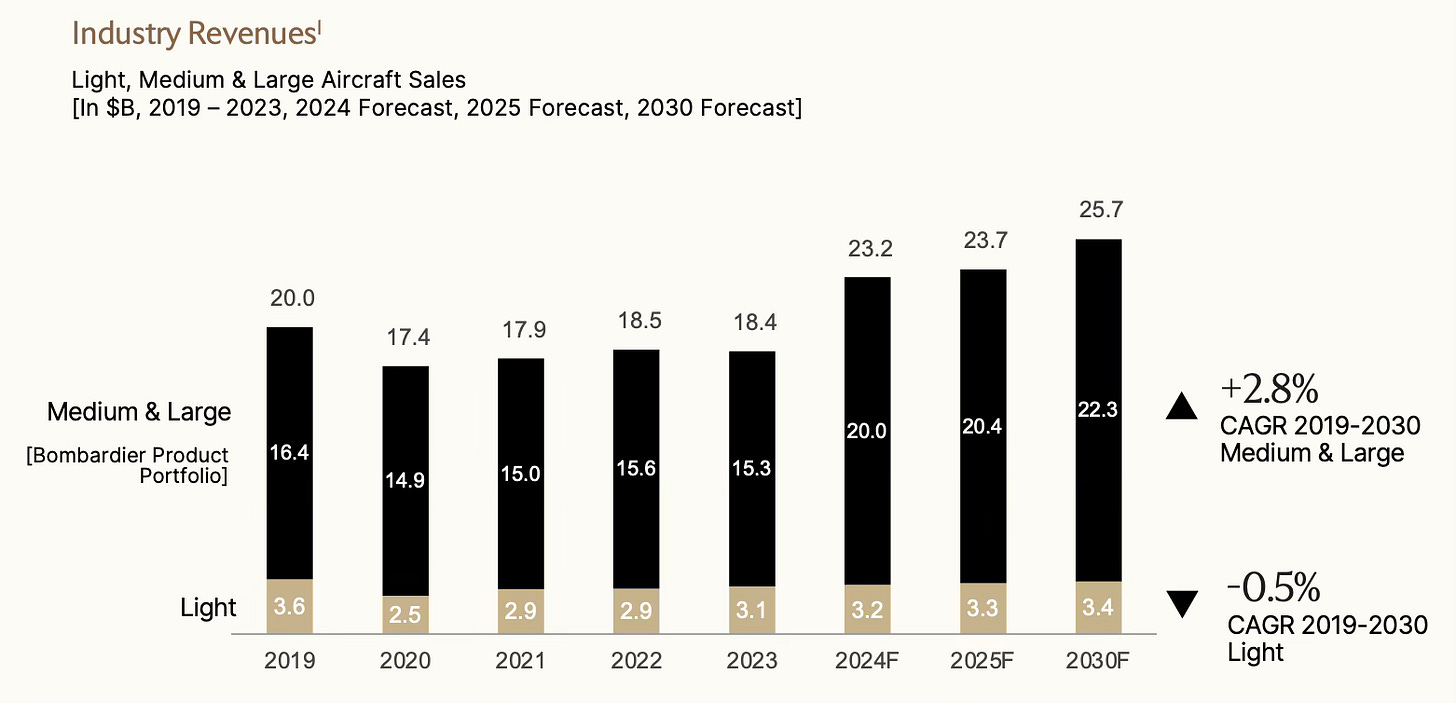

If you look at the different industry segment historical sales, we understand why Bombarder exited from the light segment. The light segment is been flat and represents less than 15% of the total market. In contrast the large and medium segments is expected to grow significantly in 2024 and the following year.

Bombardier large cabin delivery went from 59 to 73 in 4 years, or an increase of more than 5.4% per year. Medium cabin delivery went from 44 to 73, or 13.5%.

The positive trend in delivery should continue over the next 5 years. Will delivery increase by 5% per year or 10% per year, this is hard to say, but we should expect this to continue in my opinion in this range.

A Reduction in interest expenses

Since 2021, Bombardier was able to concentrate on its core business (private jet) and sell its loosing money or breakeven business (Trains, Light cabin jets and CSERIES). As such since then, Bombardier was able to reduce its net debt by 1100M in US Dollar. I selected the end of 2021, as the benefits of selling the other business with its debt was captured in 2020 and 2021. In other words, from the end of 2021, all the debts repayment is related to operational cash flow. We can assume a similar repayment trend for the next 5 years.

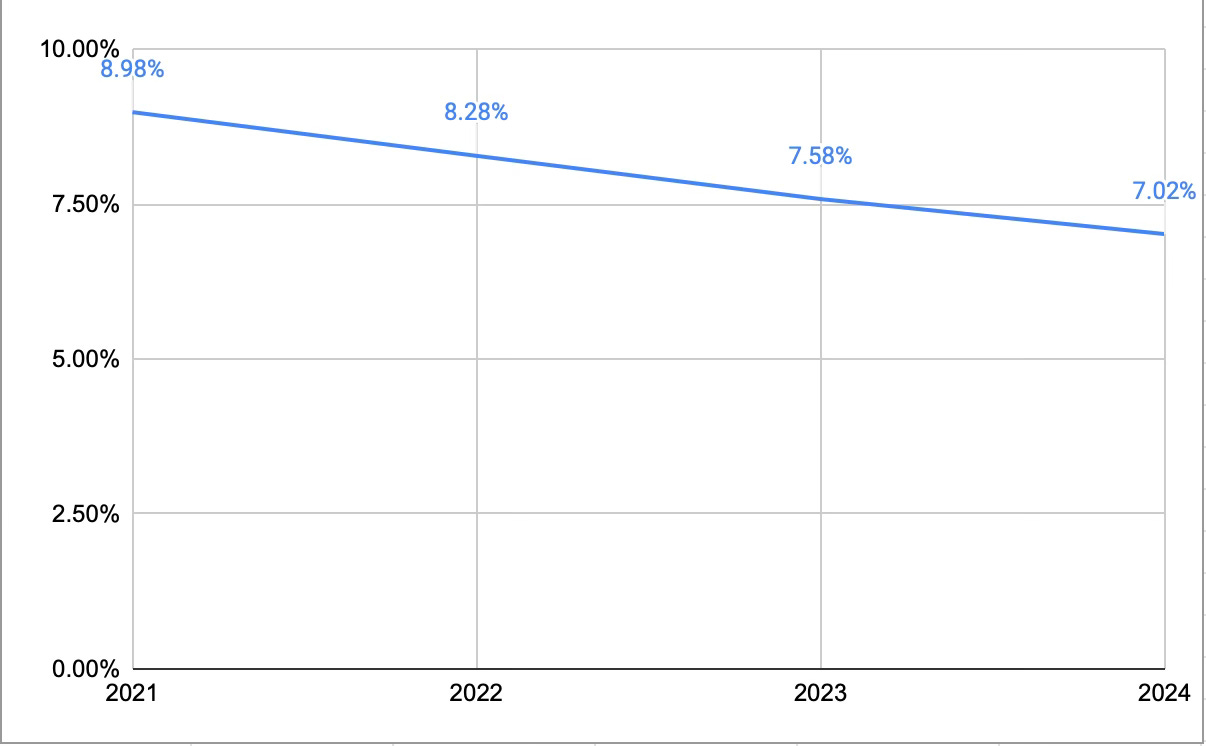

The other benefits of paying down the debt is that the bonds issued by the company are now at lower interest rates. I provided for each year the average interest rate of long term debt. The major credit firms have rerated positively Bombardier credit rating in 2024. Moodys Bombardier's credit rating from B2 to B1 on May 2, 2024 and S&P credit rating from B to B+ on June 4, 2024. Average interest rate went from almost 9% to 7% in 3 years. The trend should continue.

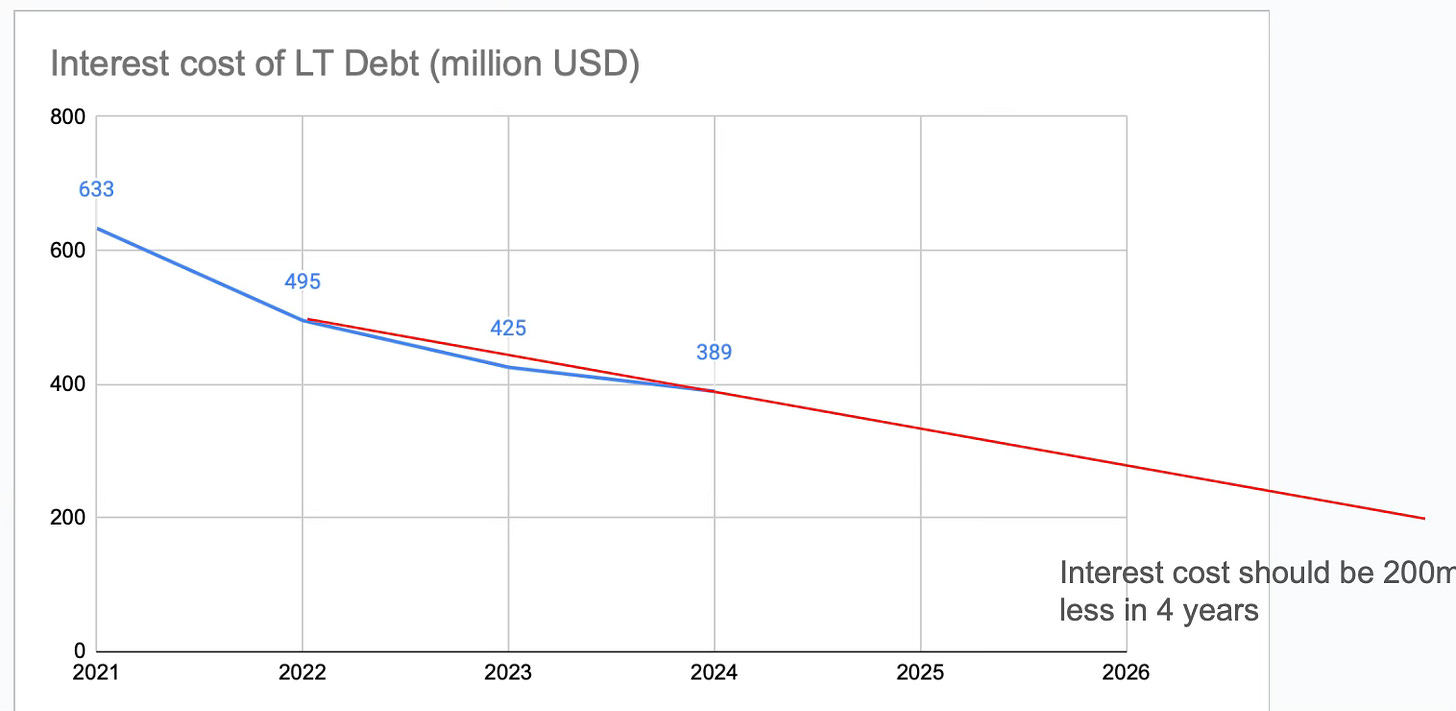

This resulted in the interest cost from LT debt to reduce steadily since 2021 as shown below (from 633M to 389M). I am expecting that interest cost may be around 200M in 4 years if we follow the current trend. 200m translates to a 2$ USD per share of EPS. Analysts are estimating an even more accelerated pace of repayment of the debt. But I prefer to believe in recent trend than management guidance to analysts.

Still we should get a 40% increase in EPS from this level by assuming a conservative repayment of debt and small reduction in interest rate as currently trending.

Please note that operating income translates directly into net income since Bombardier has more than 12B in tax deductible from previous loss.

Trend on Revenue

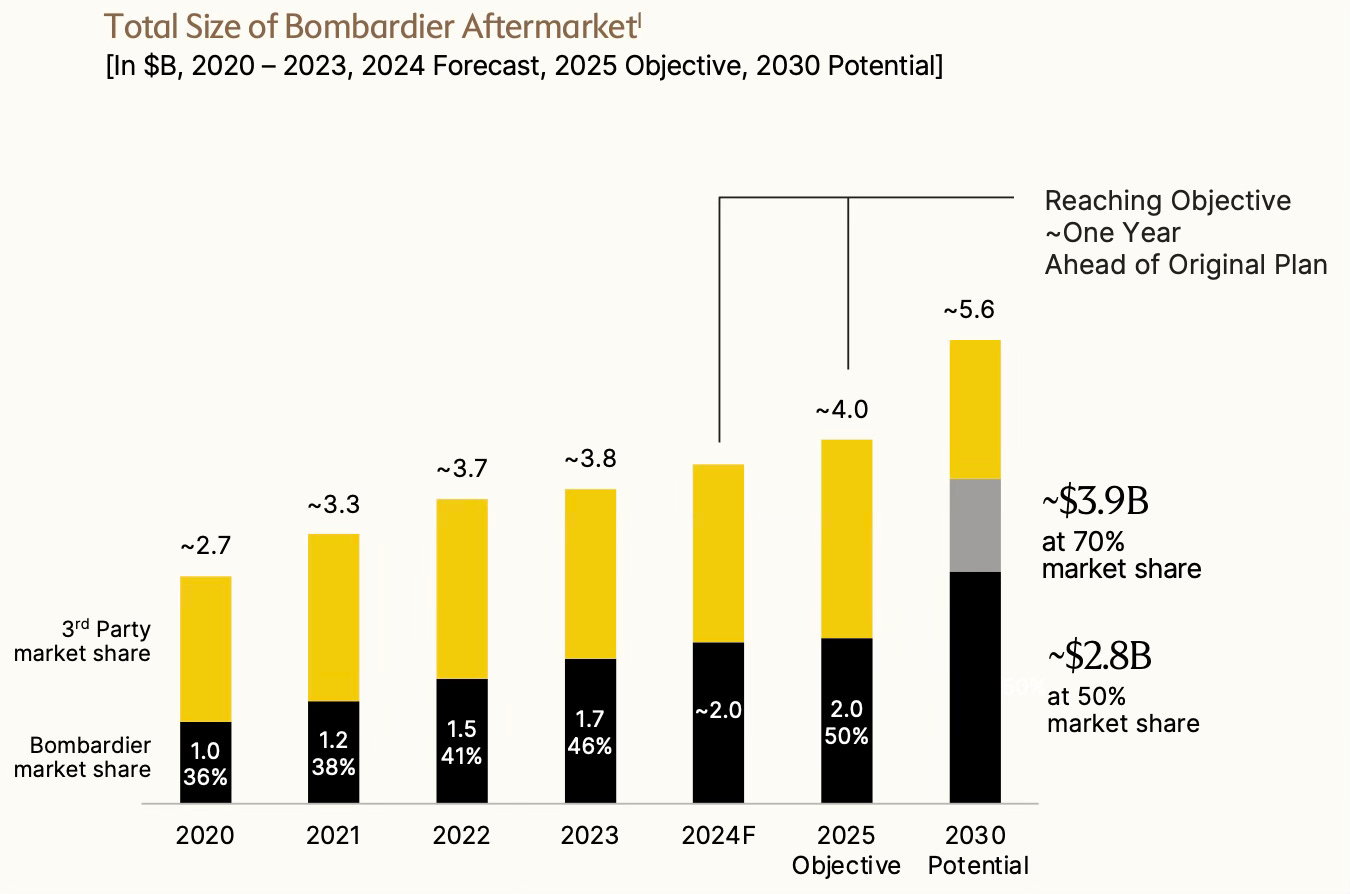

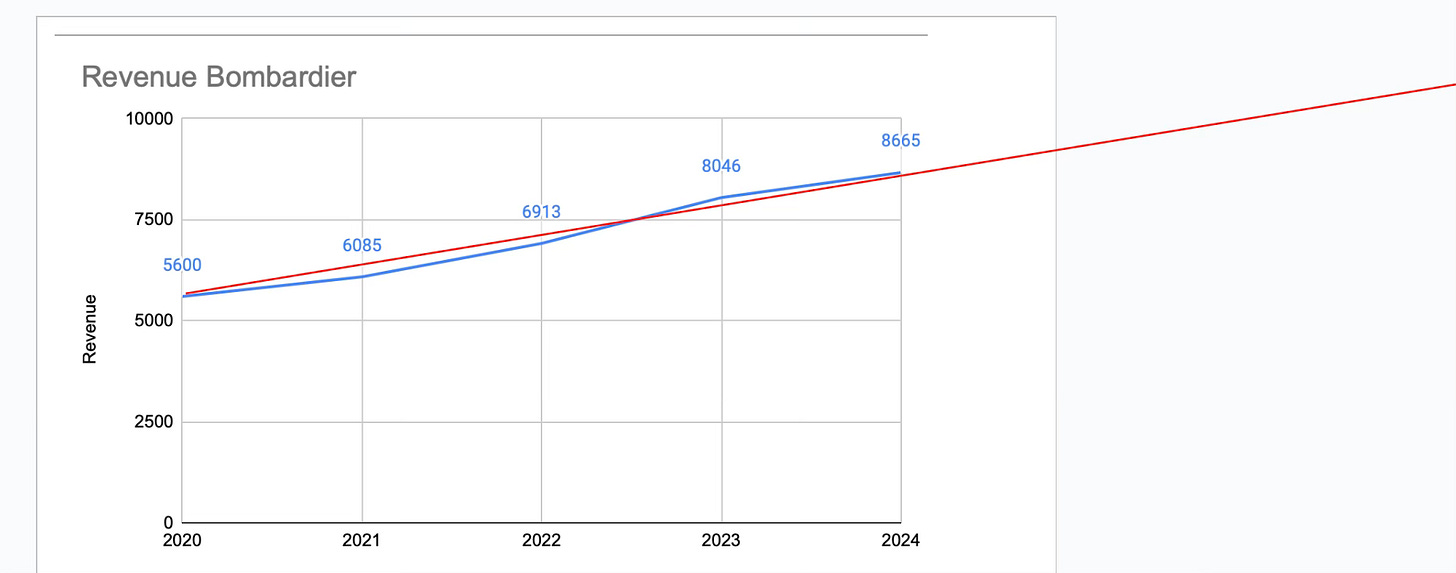

In 2020, the business jet revenue was 5600M (discontinued business in 2020 was removed from this number) and it increased to 8665M in less than 4 years or 11.1% per year. This is a combination of a higher level of delivery (as shown in previous section) plus an higher increase in aftermarket services. Services revenue was 1200m in 2021 or 20% of total revenue and it increased to 2036m in 2024 or 23% of total revenue. So services increased at a faster rate than aircraft sales. Management has been investing in service centers all over the world in recent years, enabling Bombardier to increase its share of the aftermarket and maintenance market.

Based on the information provided by management, if Bombardier maintains its current market share of the aftermarket (50%), the services component should increase by 800M in 2030. If it increase market share to 70%, then the aftermarket sales would increase by 1900M. Market share went from 36% (in 2020) to 50% (in 2024) in less than 4 years. So we should expect some increase in market share. An increase of 3% per year should be achievable based on historical trend. This should get us to 65% market share by 2029 or 3600M in revenue or an increase of 1600M from 2024 level.

Assuming that the Bombardier increase aircraft sales based on industry trend of 3%, aircraft sales should be 16% higher than 2024 level. Aircraft sales was 6650M in 2024. A 16% increase would represent an increase of 1060M. Bombardier has increase market share over the last 4 years, so this is a conservative estimate.

This result in projecting sales in 2029 at 11330M.

Another way to look at this is to simply interpolate current historical sales.

Looking at the current trend, Bombardier sales would reach around 10 Billion USD by 2027 and 11 Billion USD by 2029. So both approaches leads us to a 11300M revenue in 2029.

Operating Margin Trend

I believe operating income less LT debt interest is the best way to track Bombardier profitability since net income is often impacted by currency hedges, price fluctuation between the Canadian dollar and US dollar and LT debt repayment before expiration.

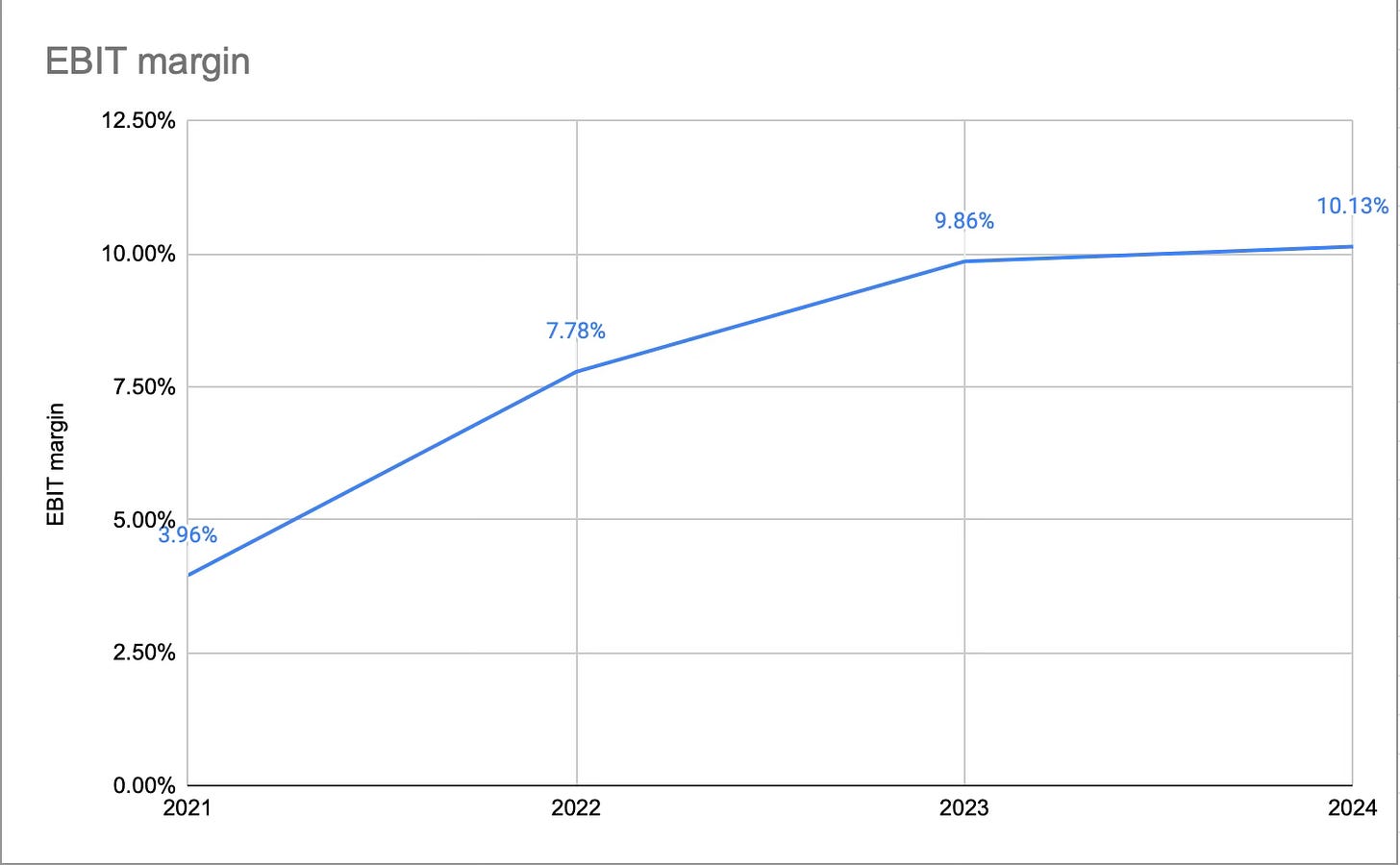

The following is the historical operating income margin over the last 4 years.

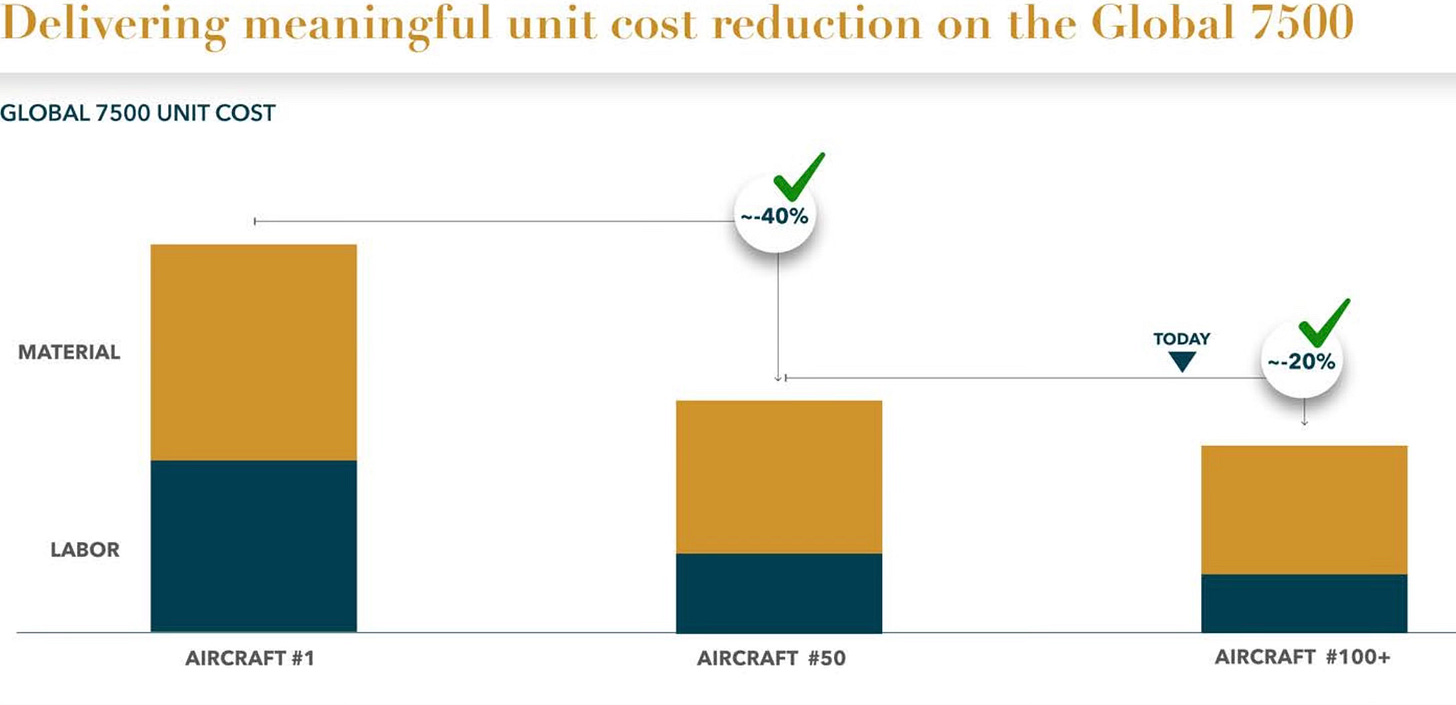

As we can see, the operating income is improving rapidly. This is due to 2 factors: Bombardier launch 3 new aircraft (Global 7500, Challenger 3500, Challenger 650) around 2018-2020. As the program is maturing and more planes are produced, margin improves significantly. 2022 investor day presentation illustrate the cost improvement of the Global 7500 as more plane are produced. There is a 40% reduction from Aircraft #1 to Aircraft #50 and another cost improvement of 20% after the next 50 aircraft. Bombardier has shipped 200 Global 7500 in December 2024. So we should expect a further decrease in cost per plane.

Management has targeted an EBITDA margin of 18% for 2025. In 2024, Bombardier has achieved an EBITDA of 15.7%. This should translate to a corresponding EBIT margin of around 12%. Let’s assume a EBIT margin of 2029 for 2029 as well to stay conservative.

2029 Net income Projection

Hera are the baseline assumption for 2029:

Revenue of 11300M

EBIT margin of 12%

Reduction of 200M in LT Debt payment

This result in operating income of 1350M - less 200M in interest income should get us to a net income of 1150M. EPS would be 11.50 USD in 2029 or 2.2 times current adjusted EPS. If Bombardier rerates to 15x earnings, this could be a 4 bagger in 5 years and trade at 240 CAD.

Risks and factors

North America sales (including Canada) represents 55% of aircraft sales for Bombardier. I suspect Canada represents 10% of sales. So 45% of sales targets USA customers. Some of the sales originally targeted to USA customers could be moved to offshore or Canada but this need to be verified. But still a prolonged tariff war will seriously impact sales in USA.

A prolonged tariff war will impact Canadian currency which should help reduce the cost of aircraft labor done in Canada in relative US dollar.

23% of sales are aftermarket so this part will be protected.

Some critical parts for Bombardier aircraft are made in USA. The GE engine in the Global 7500 for example. Canada has not yet imposed broad tariff to USA import. Canada is smart about imposing tariff. It only imposed tariff on parts that Canada also produce or can get elsewhere. Mainly food, wine, alcohol, electrical appliance. Here is the complete list: https://www.canada.ca/en/department-finance/news/2025/02/list-of-products-from-the-united-states-subject-to-25-per-cent-tariffs-effective-february-4-2025.html

As such, Canada will not impose tariff from Bombardier critical parts made in USA. My thesis is that USA will do the same eventually.

I am doing this analysis mainly for me and some friends that also are interested by this stock. Still the main goal is to get comments and different views to strengthen my investment thesis. If you agree or disagree with the thesis please provide your comments. If you enjoy the post let it me know by putting a comment. My dream would be that a strong discussion thread on this company will get started here. Not in X!

As a final note, I feel that the combo Bombardier - Pernod Ricard is the perfect risk combo! You can drink your way out of this world insanity and cheering for that chaotic president to go away for the next 4 years while enjoying a 5% dividend and some amazing Scotch and cognac.

Have a nice day !

Disclaimer: The above article constitutes my or the authors’ personal views and is for entertainment purposes only. It is not to be construed as financial advice in any shape or form. Please do your own research and seek your own advice from a qualified financial advisor. I / The authors may from time to time hold positions in the aforementioned stocks consistent with the views and opinions expressed in this article. The information provided in this article is not making promises, or guarantees regarding the accuracy of information supplied, nor that you guarantee for the completeness of the information here. The information in this article is opinion-based and that these opinions do not reflect the ideas, ideologies, or points of view of any organization the authors may be potentially affiliated with. The authors reserve the right to change the content of this blog or the above article. The performance represented is historical" and that "past performance is not a reliable indicator of future results and investors may not recover the full amount invested.

Thanks for the write-up. A few points on tariffs:

• The taking delivery in other jurisdictions is less certain – there’s bonus depreciation benefits to taking delivery in the US that may counterweigh tariff impact. That said, BBD customers may have flexibility to take delivery in different jurisdictions if they are a fleet operator. At the onset of the Delta tariffs in 2020, they were able to skirt tariffs through classifying planes as “used” (https://www.ajot.com/news/delta-skirts-trump-tariffs-by-sending-airbus-jets-on-world-tour).

- There are other tools that BBD can use – BBD could incur a transfer fee to bring an aircraft into the US through its own facilities, incurring some tax obligations that can be offset with existing NOLs/tax credits

- Customers can also simply wait until a more constructive tariff regime is in place – as it stands a newbuild order will only be delivered in several years given backlogs across the industry

• The current tariff regime in place (till April 2) indicate that products compliant with existing USMCA will be exempt (BBD planes are compliant). Beyond April 2, it still is unclear whether there’ll be issues, since General Note 6 of the Harmonized Tariff Schedule exempts civil aviation as well (https://hts.usitc.gov/reststop/file?release=currentRelease&filename=General%20Note%206). Prior Trump tariffs on civil aviation (C-series 2017 ~200-300% proposed tariffs, and new Airbus deliveries in 2020) were both trade-oriented and therefore allowed for HTSUS exemptions to be superseded. Since this is a broad tariff agenda, our understanding with 3rd party experts is that HTSUS exemptions will be upheld.

• Most importantly amongst all of this though, is that the market seems to think that it’s a blanket 25% tariff, which alongside countervailing tariffs, means it’s closer to a 35% effective tariff

- In reality, from available government docs on the existing tariffs + corroborated by other potentially affected companies (US auto industry, recreational products like BRP, etc.), the tariff will be only on materials and labor not originating the US

- ~40% of aircraft COGS are either made or performed in the US – lowers effective tariff rate to ~15%

- Pilot training, service training and technical publications are typically included in purchase agreements, and the value of these aren’t subject to tariffs, lowers effective tariff rate to ~12%

- Implies that a HSD to lower DD price increase required by BBD to maintain equivalent EBIT $/plane vs. pre-tariff, which is more than palatable for customers to split with OEM, or even for BBD to eat. Especially vs. a 25% tariff.

More than happy to chat about the other elements of the thesis that I don’t think have been covered here. Specifically 1/ the replacement cycle of mid-2000s fleet aircraft that are being upgraded to heavy jets where BBD has a duopoly with Gulfstream, 2/ the potential for defense growth, 3/ ability for BBD to buy back a large chunk of stock after reaching desired leverage targets, and 4/ continued aftermarket growth from growing fleet exposure / usage which is very accretive to group margins.

At end of day, given the continued strong demand (corroborated with the company as recently as last week) and the recent depreciation in the Canadian dollar, we believe they will be able to almost fully offset the tariff with price and currency-based cost reduction. And while BBD has 40%+ market share of heavy jets, Gulfstream has considerable more non-US content in some models, and therefore would face similar tariff percentages as BBD.

We see BBD trading at 6x 2025 FCF and expect FCF to grow double digits through the cycle. This stock should trade at 15x+ cash flow, equating to CAD300/share at least. The market recognition point should more clarity on the tariff situation and BBD coming out with a specific FY25 guide (they said on 4Q24 call that they wanted to raise their 2025 guide if not for lack of clarity on tariff regime).

Great article, Thanks a lot. There is a lot to unpack here but its an intriguing story. I am working on a write-up, too. Now I will have a lot less work because I can make many references to your post ;-)