Spirits Landslide and Champagne Supernova:

As a Pernod Ricard follow-up, personal notes on Q1 results from Pernod Ricard and LVMH plus other rumblings on the spirits market

In Part II, will cover

Champagne Supernova!

My personal notes on Q1 results for Pernod Ricard

Competitive Landscape: top brands sales from Diageo which are not disclosed by the company

Other Rumblings on Spirits

Champagne Supernova

How many special people change?

How many lives are livin’ strange?

Where were you while we were gettin’ high?

Slowly walkin’ down the hall

Faster than a cannonball

Where were you while we were gettin’ high?

Someday you will find me

Caught beneath the landslide

In a champagne supernova in the sky

Someday you will find me

Caught beneath the landslide

In a champagne supernova

A champagne supernova in the sky

The article constitutes my personal views and is for entertainment purposes only. The main goal of this article is to log my personal views. Nothing in this article or these posts in this blog should constitute an investment advice. The projections and estimates provided here should be considered as purely speculative. Do your own model and projections. Please refer to the disclaimer at the end of this article for more details.

The Spirit business seems like a landslide. Supernova is a little bit too strong but Champagne is rebounding from weak 2024 numbers. LVMH has stated this week that Champagne and Wines (Rosé) have improve significantly in Q3 - up 7% organically. For 9months, it is organically up 3%.

In the call, LVMH is stating that Champagne is seeing a real improvement in USA. This constrasts drastically from the rest of the Spirit industry in USA. I cannot explain this dichotomy except that Moet Chandon and Veuve Cliquot, Dom Perignon are real luxury product and the bullmarket, AI frenzy and the millionaires are not impacted by the middle class loss of discretionary spending in U.S.

Initially I thought this might be related to some market share gains from LVMH or something specific to USA. But Pernod Ricard also has reported that Perrier-Jouet Champagne was one of the bright spot in Europe sales. Champagne is a luxury and is a lot more resilient that I thought.

Maybe time to get a few shares of Laurent Perrier before they announce their 6 month sales - April to September 2025. They should report some upward trends, unless its only the super luxury brands that are getting the bump. Will see.

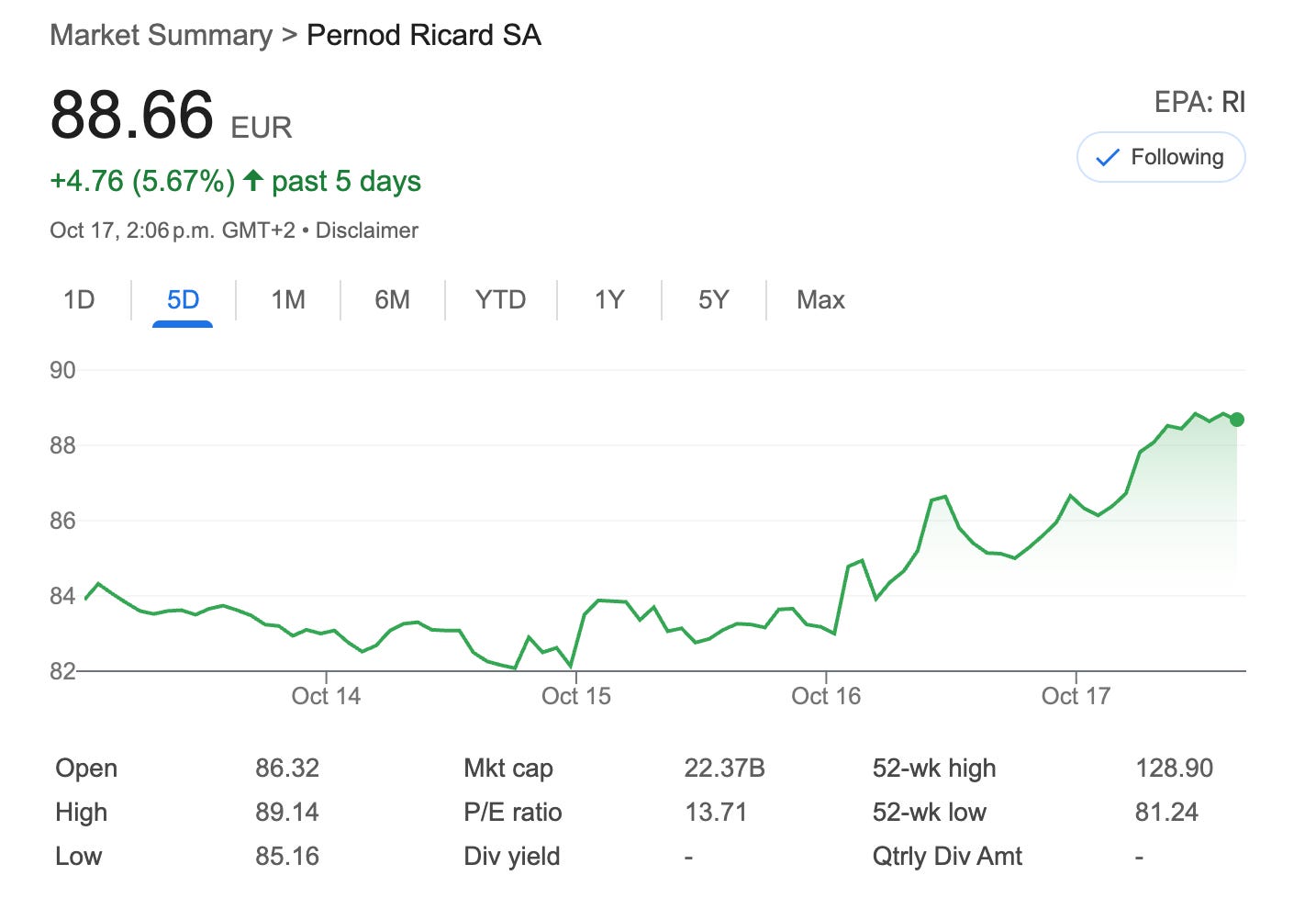

This Champagne Supernova seems to have put some life on our holdings $RI and LVMH - will take any 5-10% jump anytime - but again this rerating will unfold on a 3-5 years timeframe:

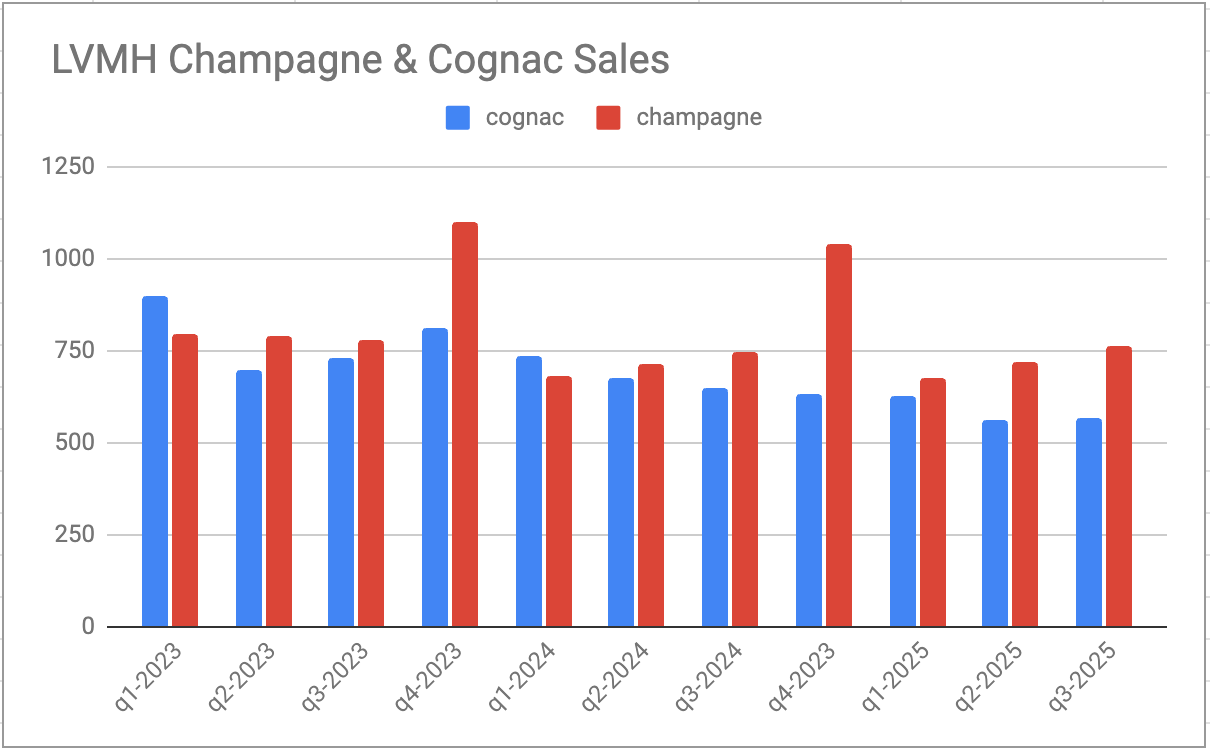

Cognac Landslide

In contrast, the cognac spirits segment - Hennessy represents the vast majority of LVMH Cognac Spirits segment - saw a decline of 12% organically for the first 9 months and 6% in the latest quarter. Cognac is faced with a sharper decline than the Spirits market overall.

The figure below shows the quarterly sales of these 2 segments for the last 11 quarters.

Looking at the last 11 quarters, we see that cognac has gone through a landslide:

Q3 historically is better than Q2 historically (see 2023) so I am not sure that we have hit the bottom yet on cognac. For Champagne, we see that the last 2 quarters have seen an increase in sales.

Personal notes on Q1 Pernod Ricard

I will go through market by market starting from the largest.

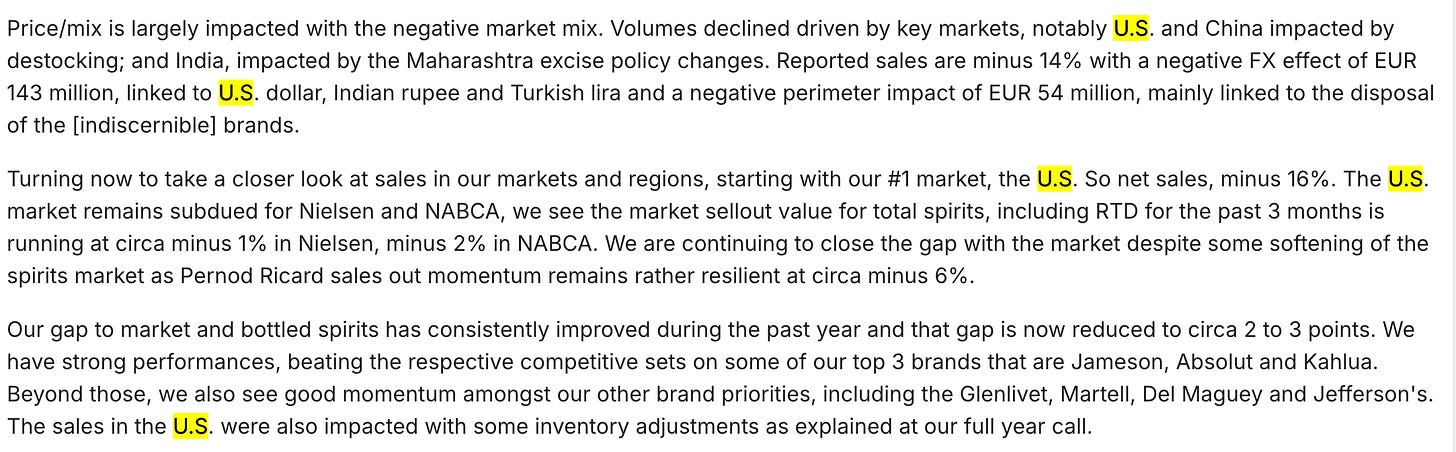

U.S. (19%)

In 2024-25, U.S. represented 19% of sales. In Q1, organic sales was down an depressing 16%. If you consider sales in sales out, we are at 6%. So 10% of the drop is due to inventory adjustment. I suspect that U.S. distributors over ordered in Q4 to avoid the tariff. Europe and UK are subject to a 15% and 10% tariff to U.S. respectively since July 2025.

Jameson, Absolut and Kahlua are the top 3 brands for Pernod Ricard in the U.S. and performed well. Although I suspect strong headwind from inventory adjustment. Note that Kahlua is not longer considered a strategic international brand bucket since mid 2010s. It is part of the strategic local brands. They are pushing Martell into U.S. and Glenlivet is the #1 single malt brand in U.S. so these brands should go well. I suspect weakness for blended scotch brands (Ballantine, Chivas). RTD portfolio is strong.

Big marketing push on the following 4 brands Kahlua, Jameson, Glenlivet and Redbreast. Redbreast is the #5 Irish whiskeys. U.S. consumes almost half the Irish whiskeys, 10x more than in Ireland. Irish whiskeys is the highest growing spirits with Tequila in U.S. in the past 10 years.

India (13% of Sales)

India organic sales is up 3%. Price of alcool increased 35% in the state of Maharashtra due to a 50% increase in excise tax. Mumbai has 20m people.

Again Royal Stag, the #2 indian whiskey, and Jameson were growing.

China (was 9% of sales - likely 7% now)

Okay 27% decline is crazy. Management is explaining that Mid-Autumn festival was moved from mid September to October, but a few weeks shifting should not explain such a decline. I think this cognac market is going dead. The good news is that China is probably less than 7% now.

Remy Martin has not reporting yet their Q1 numbers, but considering the sharp decline in China and that Asia represents 50% of sales of cognac for $RCO I personally decided to sell my small line in Remy until October 28th results.

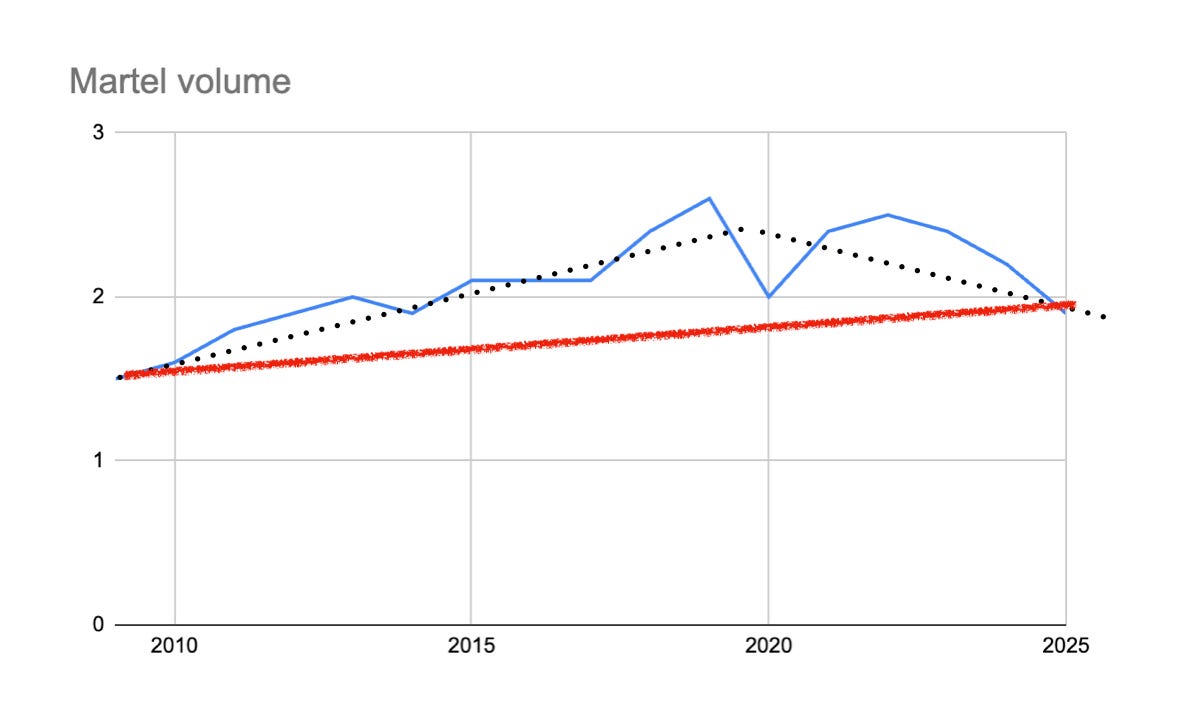

Other Markets

Europe is -4%.

Canada is strong, especially the RTD they bought recently, Jameson and Absolut.

So on a brand basis, it reinforces my belief that both Jameson and Absolut are growing organically across multiple markets (Canada, India, Europe, Turkey, South Africa, probably holding market share in U.S.).

Martel is suffering even more than what I thought in China. They might be loosing market share there versus Remy and Hennessy. This is something to worry and to be monitored.

Pernod Ricard is still guiding for a pickup in second half - January to June 2026.

On the strategic local brands -4%, things are looking better with strength with Olmeca, Kahlúa and Royal Stag in growth.

RTD is up 10% so this might become an important growth driver.

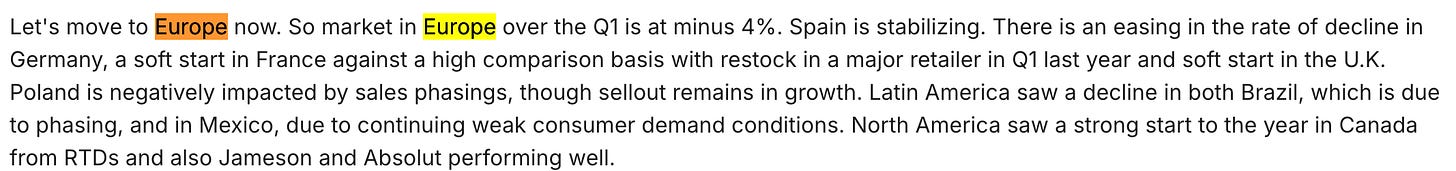

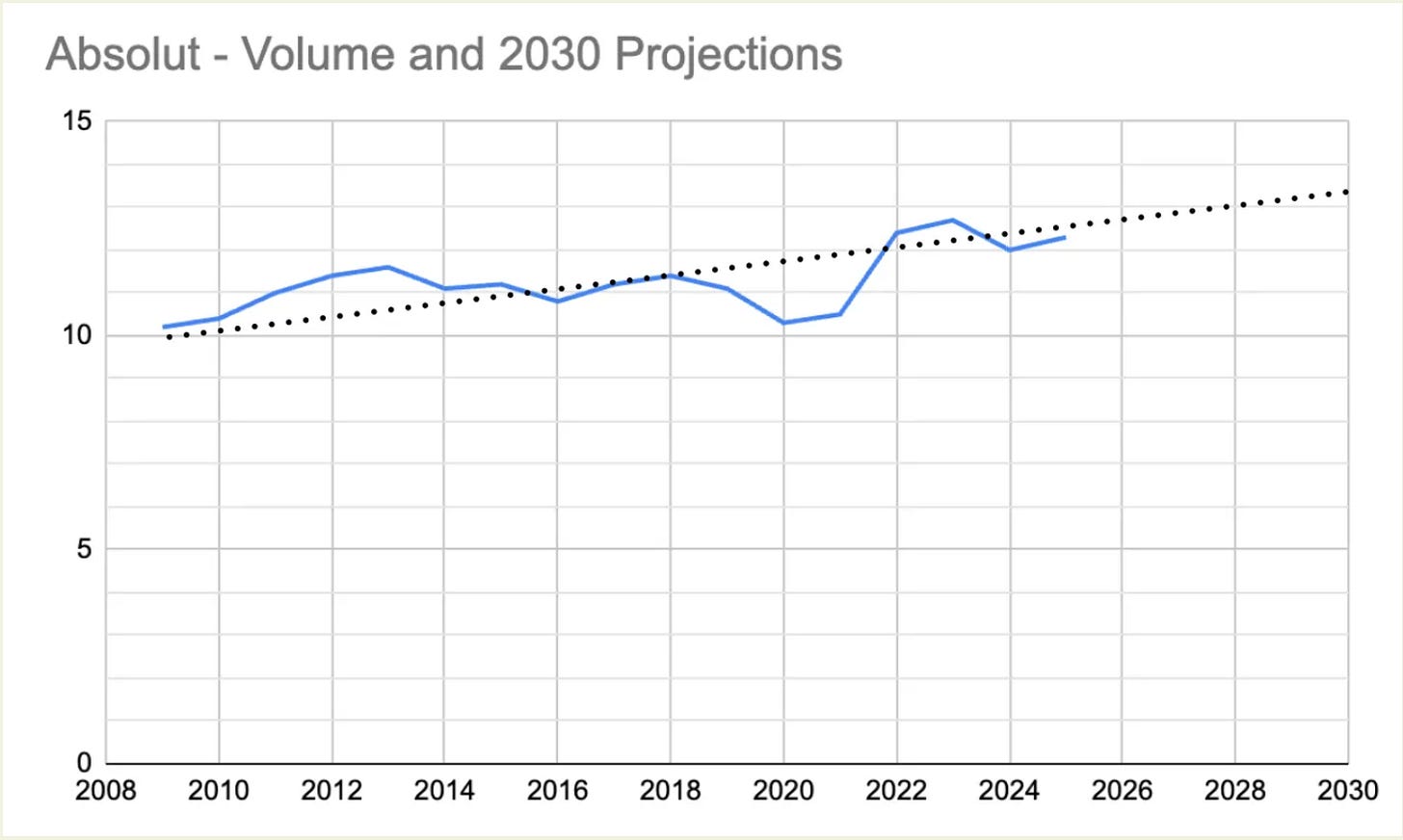

On the limitation of linear interpolation

In my previous post (see below), I used 16 years of data to detect if linear interpolation could be appropriate to project into the future. I understand that brands can be somewhat fashionable and spirits in general are subject to economical cycle. For more linear projection done in previous post click to the link below.

In my previous post, I took the top 5 brands in terms of growth contributor and for these brands at least, I thought that it was appropriate to use linear interpolation.

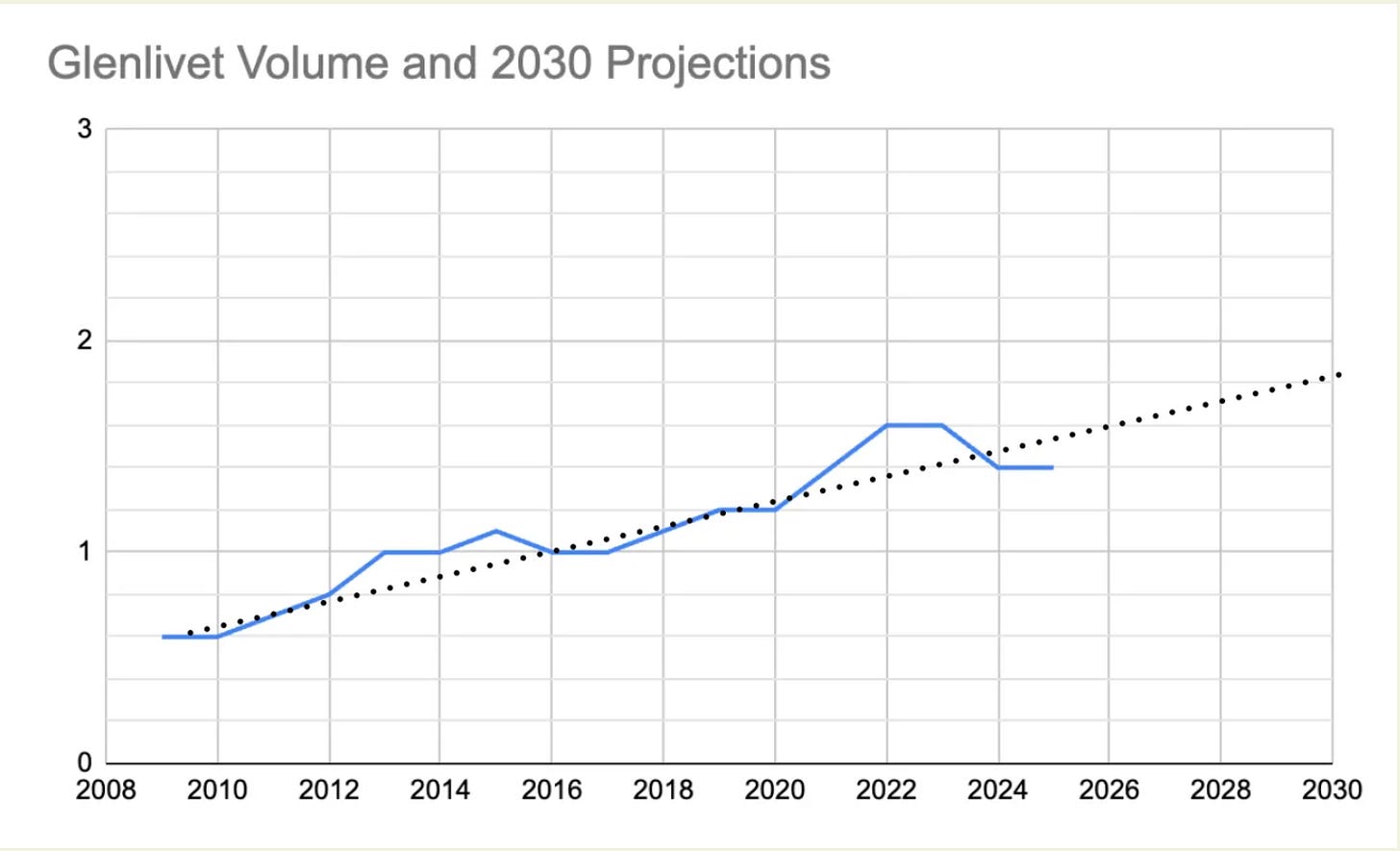

Here are 2 examples:

For Glenlivet, except some acceleration years (2013, 2022) and deceleration years (2016, 2024) the linear trend over 16 years is intact.

For Jameson, besides the economical cycle impact of 2020 (COVID shock) and 2022 (post COVID euphoria), the linear trend is highly predictable.

Now, linear interpolation works until won’t… But the probability of a breakout of a trend is small if a stable trend has been detected for the past 16 years.

The goal of this projection is not be exact about a particular year, but to project out volumes in 5 years, which is my investment time horizon. The result of my analysis is that volumes are pretty predictable in general and follows historical trends for those top 5 brands at least.

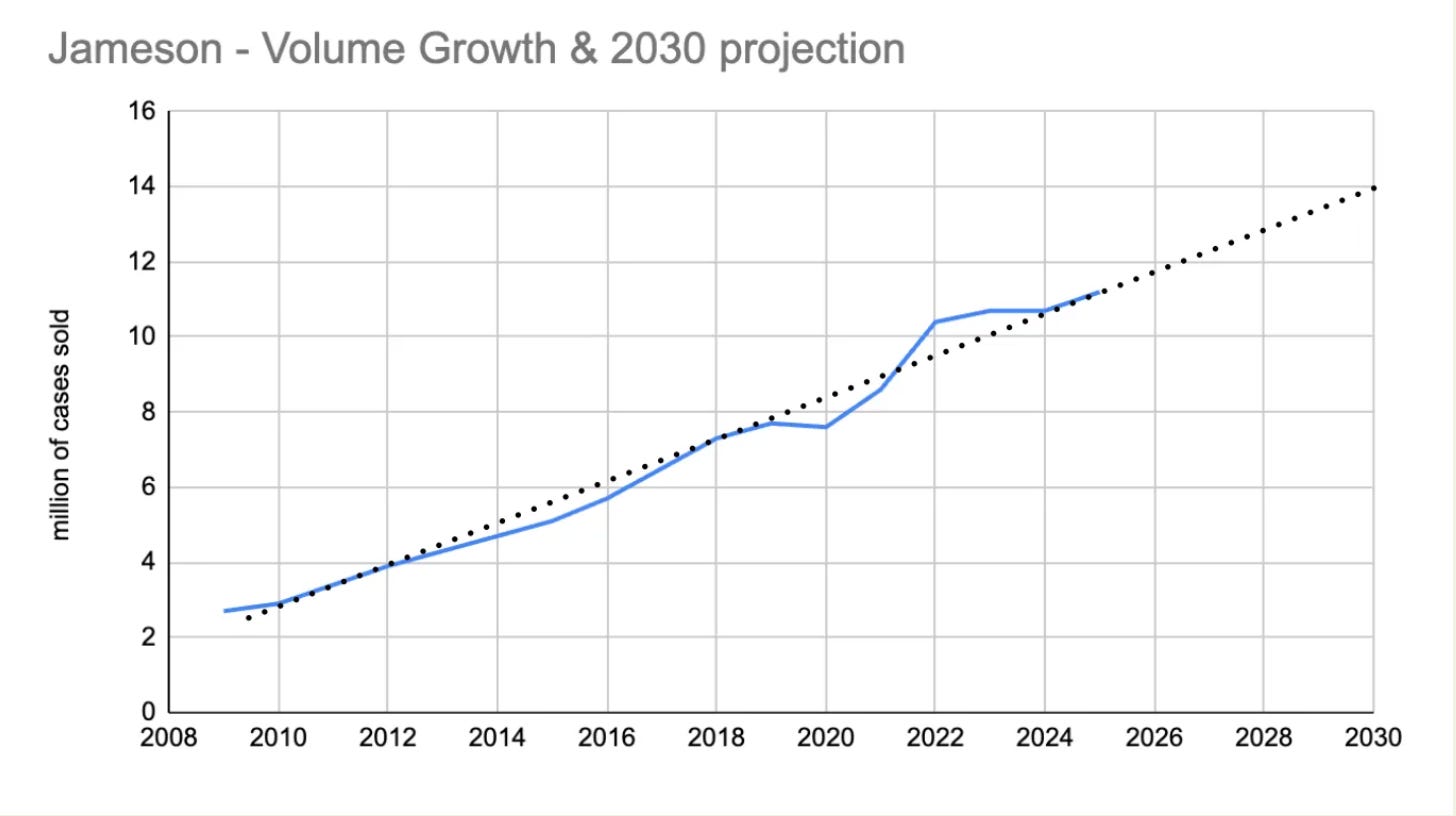

However it cannot be said the same for all brands.

If you take Martell for example, using linear interpolation and 16 years of data, clearly we see a problem:

We have a 9 years uptrend (with up and down) followed by a down trend that has been lasting 3 to 4 years. What will happen it 5 years, I have no clue. Will cognac sales continue to decline for another 5 years, will it stabilize or will it go up and resume the 2009 to 2025 red line - I doubt. So definetely, my confidence level of predicting what volume we will see in 2030 is very small. Probably a range between 1.3m and 2.2m.

Rumblings about Diageo

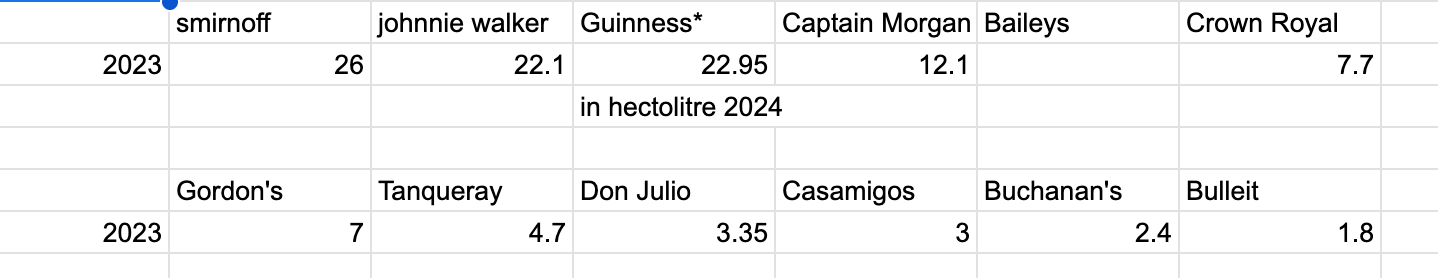

Diageo doesn’t disclose the volume nor sales of their top brands in contrast to Pernod Ricard. However I did look for estimates through independent market research source. Here are some numbers:

The following are the 2023 volumes ranked for the top 13 brands:

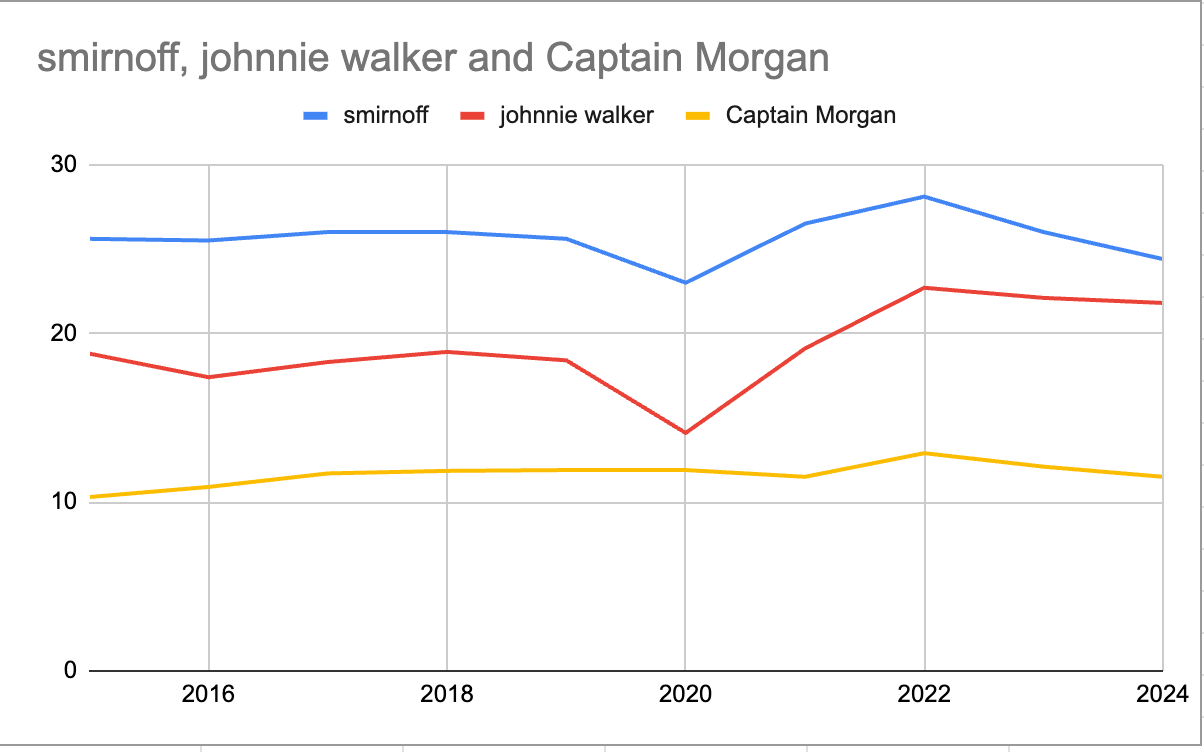

If you exclude Guinness which is a beer, Smirnoff, Johnnie walker and Captain Morgan represents two thirds of the top 13 brands. So I decided to focus on these 3 brands to understand the historical trends.

If you take the largest brand in terms of volume, Smirnoff, the 2015 volume was actually slightly higher than the most recent numbers (2024). It is unlikely that this brand will grow significantly over times. In comparison, Absolut has half the volume but is a more premium vodka brand, often priced almost twice the price of Smirnoff. Absolut’s has risen by 2 million cases since 2010. A bit cyclical but with long term growth.

#1 in Scotch

Johnnie Walker was flat until 2019, then dropped and rise up in 2022 sharply to decline in 2023 and 2024. 2024 is still up versus 2019, so I would think that it will rise up slowly. In contrast to Smirnoff, Johnnie Walker is one of the best blended scotch. The black label is a great balance of dark fruits, vanilla, and smoke and is very high end. Johnnie Walker is worth a lot more than Smirnoff in terms of overall sales. If you look at the top 13 brands, there are 2 major scotch brand: Johnnie Walker, Buchanan for about 25m cases. This represents 22% of sales for Diageo.

In comparison, Pernod Ricard has 15.5m cases spread over 4 brands.

Ballantine 9.1m

Chivas Regal 4.8m

Glenlivet 1.4m

Royal Salut 0.2m

Captain Morgan is slightly up versus 2015, but down versus 2019. So I would suspect flat numbers ahead.

In summary, Johnnie Walker is a strong brand with good prospect of rising slowly over the next 5 years, Captain Morgan and Smirnoff are mainstream brands with less prospect for growth.

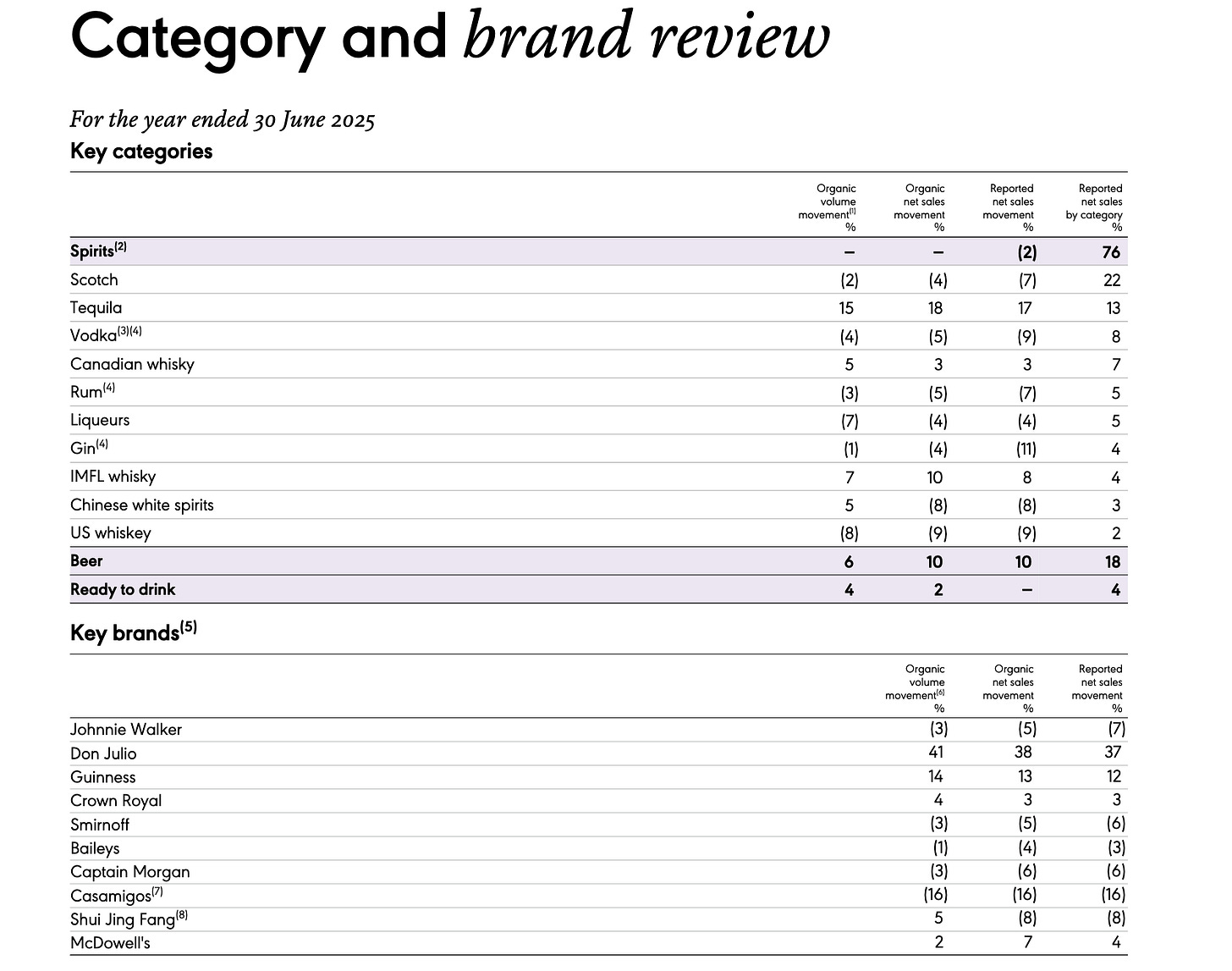

The following is the only information that Diageo disclose in terms of brands.

Scotch represents over 22% of sales. Tequila comes next to 13%, then vodka 8%. If you look at the recent year, we have organic growth in tequila and Canadian whisky, and Indian Whisky. This confirms the data from the independent market research where we see decline in Johnnie Walker & Scotch overall, Smirnoff &Vodka, and Captain Morgan & Rum.

Diageo - one the sideline for now.

In summary, I am still on the sideline for Diageo. I want to see the next shoe that will drop when they report Q1 sales on Nov7th. USA numbers will be ugly in my opinion. There is still some inventory adjustment expected in this summer as some shipment was pull forward to avoid tariff from Europe and UK. This was reported by Pernod Ricard this week.

Deportation

Furthermore, about 2 million immigrants were deported (400k forced) in 2025 in U.S., the majority of Spanish culture, creating a real economic impact on goods consumed especially by Spanish culture (ex. Corona, Modelo, Tequila). Some weakness on tequila should be expected. Cuervo, the leading Tequila company in the August release, reported some weak numbers in USA with some inventory adjustment again, in contrast Mexico numbers were up. Constellation brands also reported some very weak numbers on the Modelo and Corona sales.

The tariff imposed by the Trump administration is creating a supply shock in U.S. that will only be aggravated with time, as suppliers passes more and more the tariff cost to the consumers.

For Diageo, U.S. represents a much larger component (40%) of sales than Pernod Ricard (40% versus 19%).

Cuervo is reporting Q3 numbers this week, so this will be interesting to get an updated view of the immigration deportation impact on the Tequila market. This might influence my decision to initiate a position with Diageo before or after the Nov7 update.

I hope this update was helpful to clarify some aspects to concentrate on Pernod Ricard (and LVMH) and avoid Remy Martin and Diageo for now.

Cheers! let me know what you think!

Disclaimer: The above article constitutes my or the authors’ personal views and is for entertainment purposes only. It is not to be construed as financial advice in any shape or form. Please do your own research and seek your own advice from a qualified financial advisor. I / The authors may from time to time hold positions in the aforementioned stocks consistent with the views and opinions expressed in this article. The information provided in this article is not making promises, or guarantees regarding the accuracy of information supplied, nor that you guarantee for the completeness of the information here. The information in this article is opinion-based and that these opinions do not reflect the ideas, ideologies, or points of view of any organization the authors may be potentially affiliated with. The authors reserve the right to change the content of this blog or the above article. The performance represented is historical” and that “past performance is not a reliable indicator of future results and investors may not recover the full amount invested.

BNP analyst has downgraded Pernod to "reduce", another great sign.