Pernod Ricard's visibility into the future

Pernod is trading at its lowest ratio since 2009, the investment thesis is that I believe we have sufficient visibility into the future to project a return of growth at MSD and capture thePE rerating

The Investment Thesis

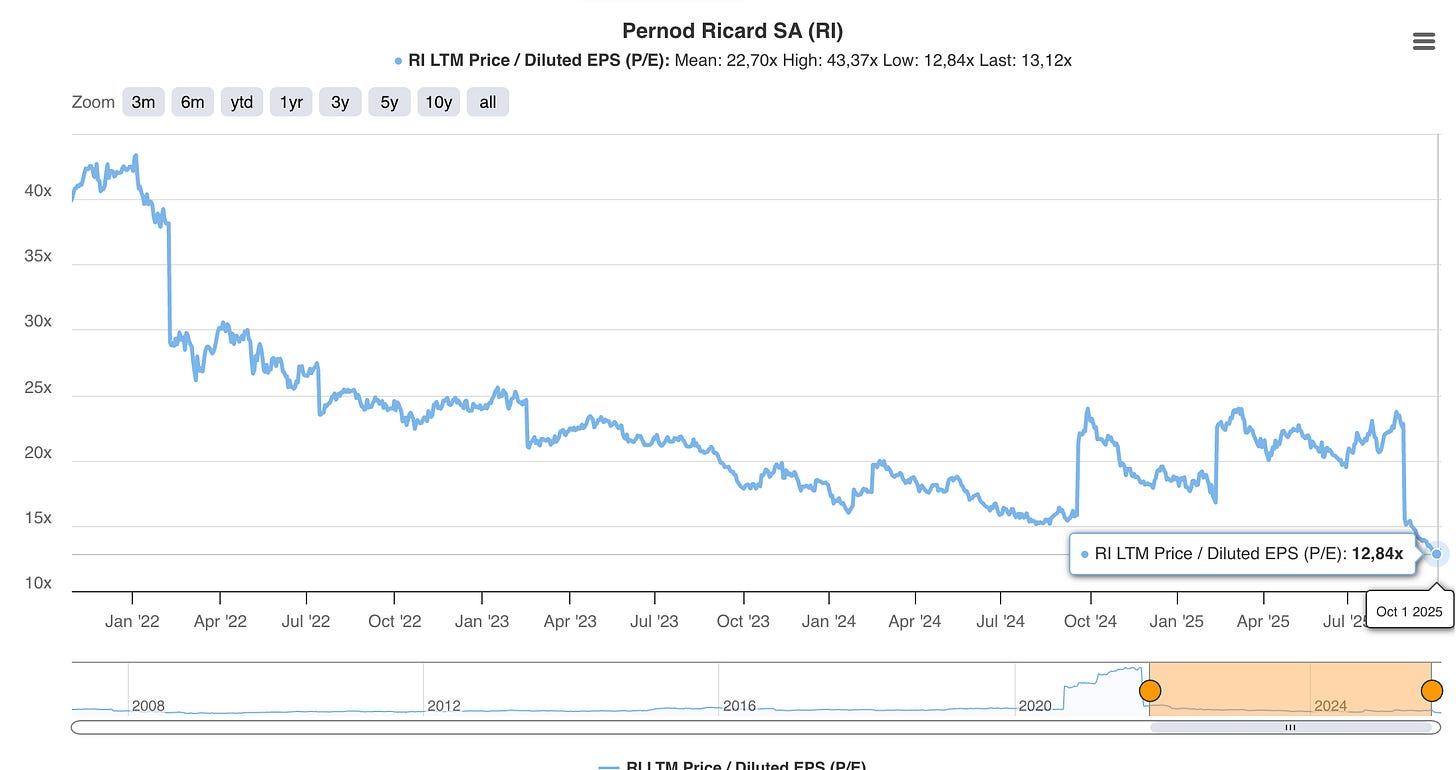

Pernod Ricard is trading at its lowest P/E of 12.83 since 2009, based on a price of 83EUR at the time of writing. In 2009, during the midst of the GFC, the stock was trading at 11 to 12 times PE as shown below:

The article constitutes my personal views and is for entertainment purposes only. The main goal of this article is to log my personal views. Nothing in this article or these posts in this blog should constitute an investment advice. The projections and estimates provided here should be considered as purely speculative. Do your own model and projections. Please refer to the disclaimer at the end of this article for more details.

PE ratio post COVID - Mean 22.70 versus 12.84 now.

PE ratio pre COVID - mean 22.2 - traded at 11.29 times in 2009 in the midst of the GFC.

Even though Pernod Ricard is growing sales at 3-4% per year and operating margin at a slightly higher rate, the stock trades at an average PE of 22-23 times earnings as Premium branded Spirits companies are considered high quality and risk haven with good return of investment and as such are historically priced at a premium to the market.

If someone would have bought Pernod Ricard at 11.3 times earnings in 2009, priced at 41.5EUR, 5 years later, the stock would have rerate and trade back to its mean at 20 times earnings. In mid-2014, the stock was priced at 88EUR for a 125% gain including dividends. In mid 2019, the stock would have quadruple from 2009 not including dividends.

The investment thesis here is that once mid single digit (MSD) growth in revenue and earnings will resume, then we will have a P/E rerating back to the mean at 20 times earnings. It may take one or 2 more years, as we are still facing a few headwinds, but I personally have a good confidence that this will turn positive.

The next section explains the visibility into the future

Pernod Ricard’s 13 strategic international brands

Pernod Ricard’s 13 strategic international brands represent 61% of sales. Now that most of the wine business has been sold in April 2025 or 438m of sales, this segment represents 64% of sales and I suspect an even larger percentage of operating income, likely into the 75% range. This is the core of the business.

Visibility Visibility!

One thing that is great about Pernod Ricard, is the level of visibility it provides to the shareholders for these 13 brands. This is no fuzzing around, Pernod Ricard has diligently disclose the volume, the pricing mix of each of its strategic brands in its annual reference report. There is no equivalent with Diageo or Remy Martin - 2 companies that I follow. Remy Martin has actually stop disclosing the volume numbers 4-5 years ago. Diageo bundles sales split per category (Beer, Scotch, etc..) which makes it difficult to understand what is happening under the hood.

As an investor, this level of visibility is critical to understand what is going well what is going wrong, to get a level of confidence and to project into the future. I also think that it forces the management to stay honest, accountable with the investment community but also honest among themselves. The CEO of Absolute for example cannot hide his performance among its peers after a bad year. Its one your face.

The French company Thermador is another example of visibility, where the annual report discloses sales and operating income of each of its twenties something subsidiaries for the past 15 years.

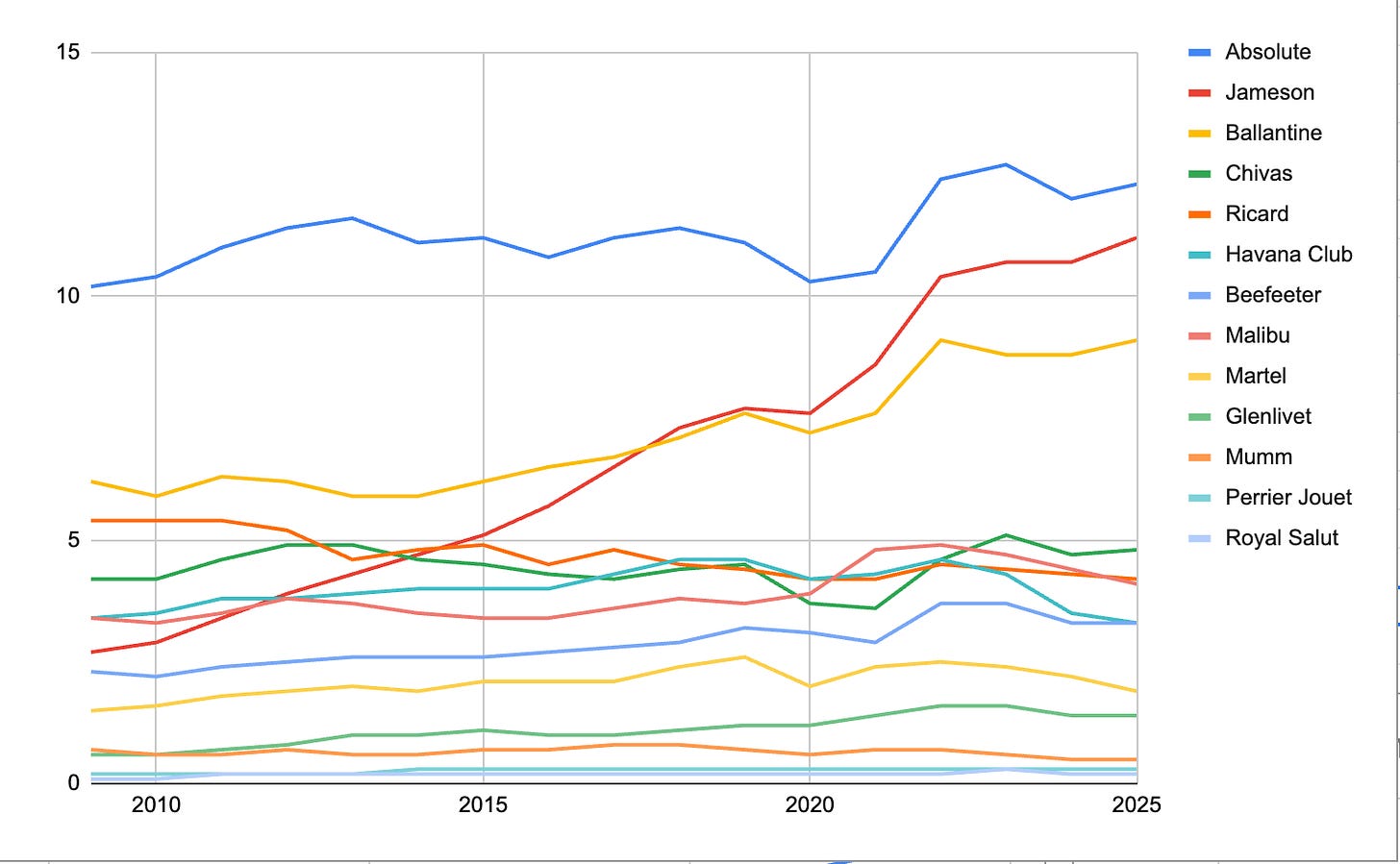

I captured from the past 16 annual reference document the volume in million of cases (9 Liter) for each strategic brands.

If you look at the volume over the last 16 years for each brands, you get a chart like this:

Clearly, Absolute, Jameson and Ballantine has risen to be a super brand.

One of the interesting results out of this is that I charted the increase in volume for the top 8 brands since 2009. As a whole, those 8 brands have grown steadily adding 17m cases of volume.

In the next sections, I will go through the 5 largest contributors to the volume growth namely Jameson, Ballantine Absolut, Beefeater and Glenlivet.

Those 5 brands have grown by 15.3m cases since 2009. This represents 97% of the resulting growth for all the 13 brands. The other growing brands more or less compensating the loss of volume from declining brands (Ricard, Mumm). The goal is to take the historical volume growth of these 5 brands and project their volume for 2030. In my experience, linear projection of absolute numbers (NOT percentage) using decades of data is the best way to do projections.

Jameson

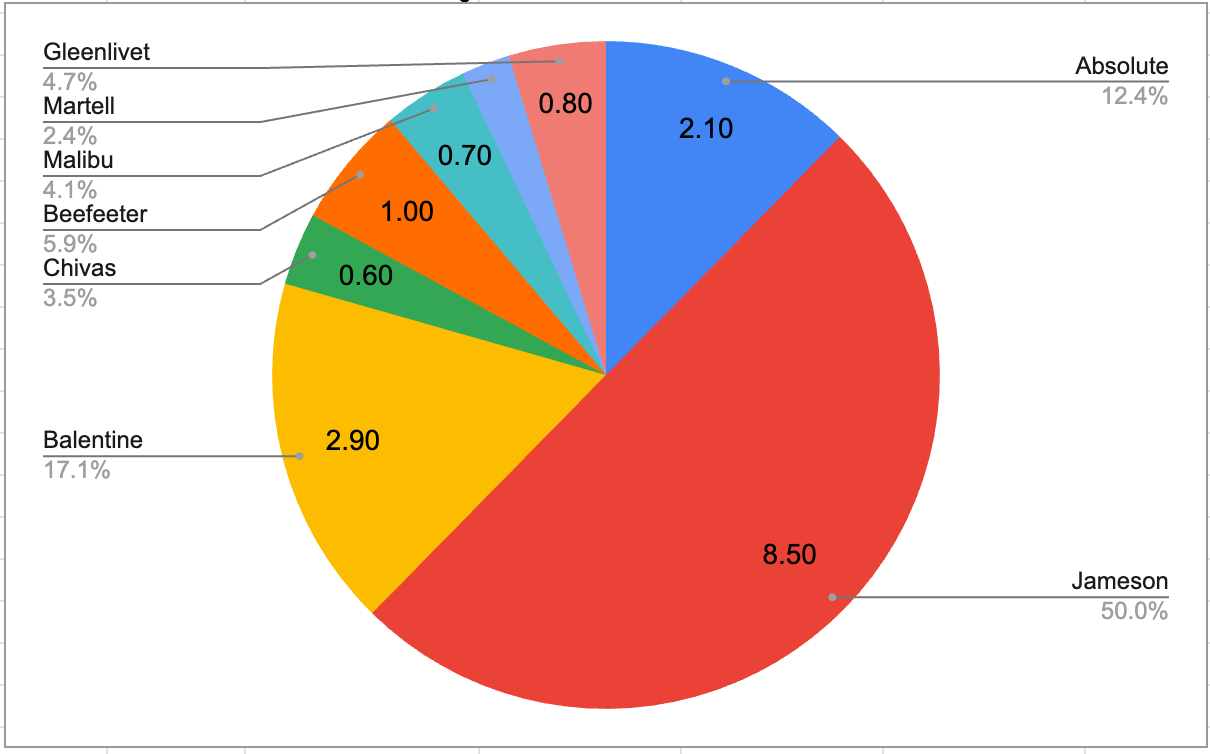

Jameson has to be made in Ireland. Irish whiskey is whiskey made on the island of Ireland. Jameson was purchased by Pernod Ricard in 1988 and have been nurtered to be the second largest brand of the portfolio in terms of volume and the most important brand in my opinion. Half of the overall volume growth of the company is due to Jameson. Jameson is popular across many markets but recently have shipped more and more cases in India, where it is the #1 import spirit brand in India. India is Jameson’s #2 market. Pernod Ricard is very strong in India with its indian whiskey brands.

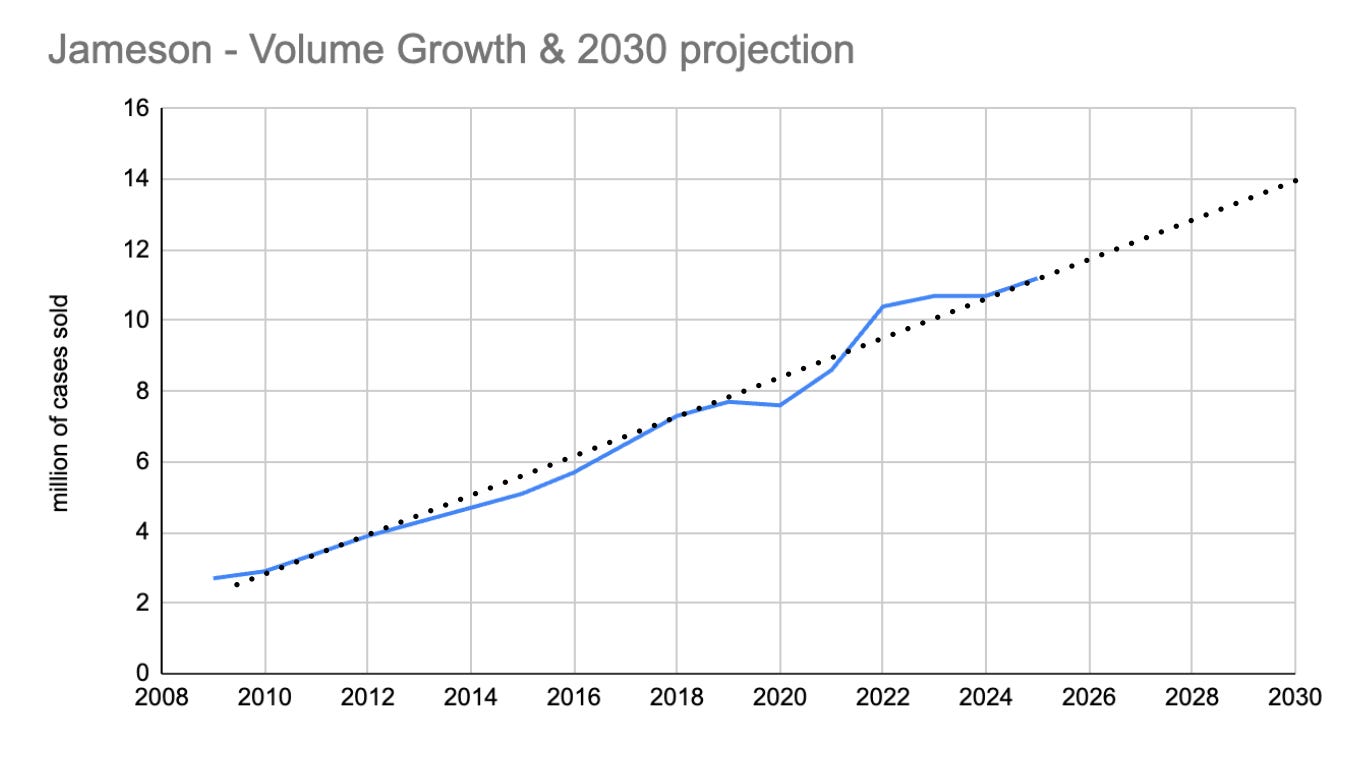

The volume sales of Jameson is quite fascinating, having quadruple, going from a 2.7m cases in 2009 to more than 11.2m in 2025.

The growth of Jameson have been very steady in the past 16 years, with only one down year in 2020. With a very high confidence, our best estimate is that Jameson will reach 14m cases in 2030 - up 2.8m.

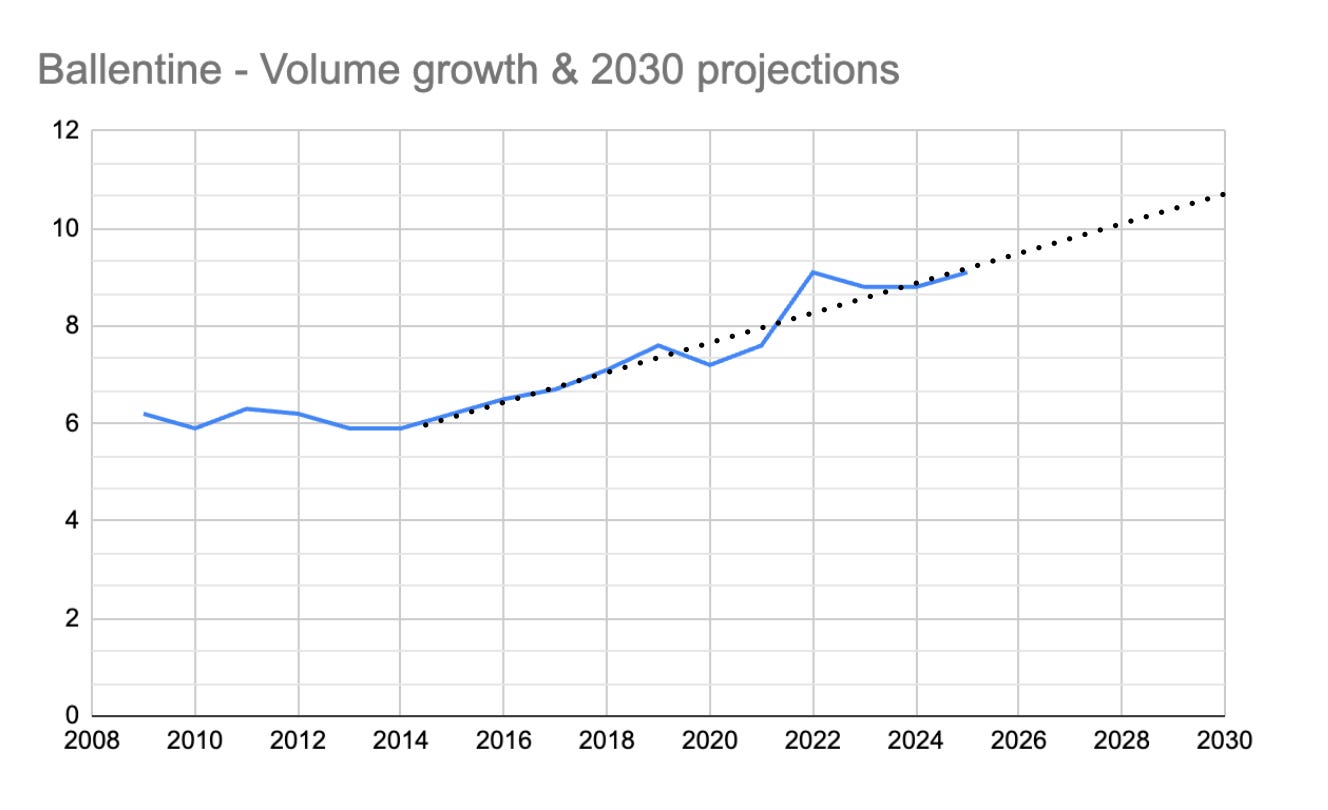

Ballantine

Another strong brand is Ballantine, a scotch which have seen steady growth since 2014 going from 6.0m to 9.1m. Ballantine has been purchased from Allied Domecq in 2005. A very good acquisition in my opinion which is now the #3 brand for Pernod Ricard.

The growth of Ballantine have been steady with a drop in 2020, a peak in 2022, but as since resume its historical growth. The raise has started in 2014. I suspect a change in marketing from the company to make this a priority. With a high confidence, our best estimate is that Ballantine will reach 10.7m cases in 2030 - up 1.6m.

Being a Scotch, Ballantine is also protected and has to be produced in Scotland so with limited competition.

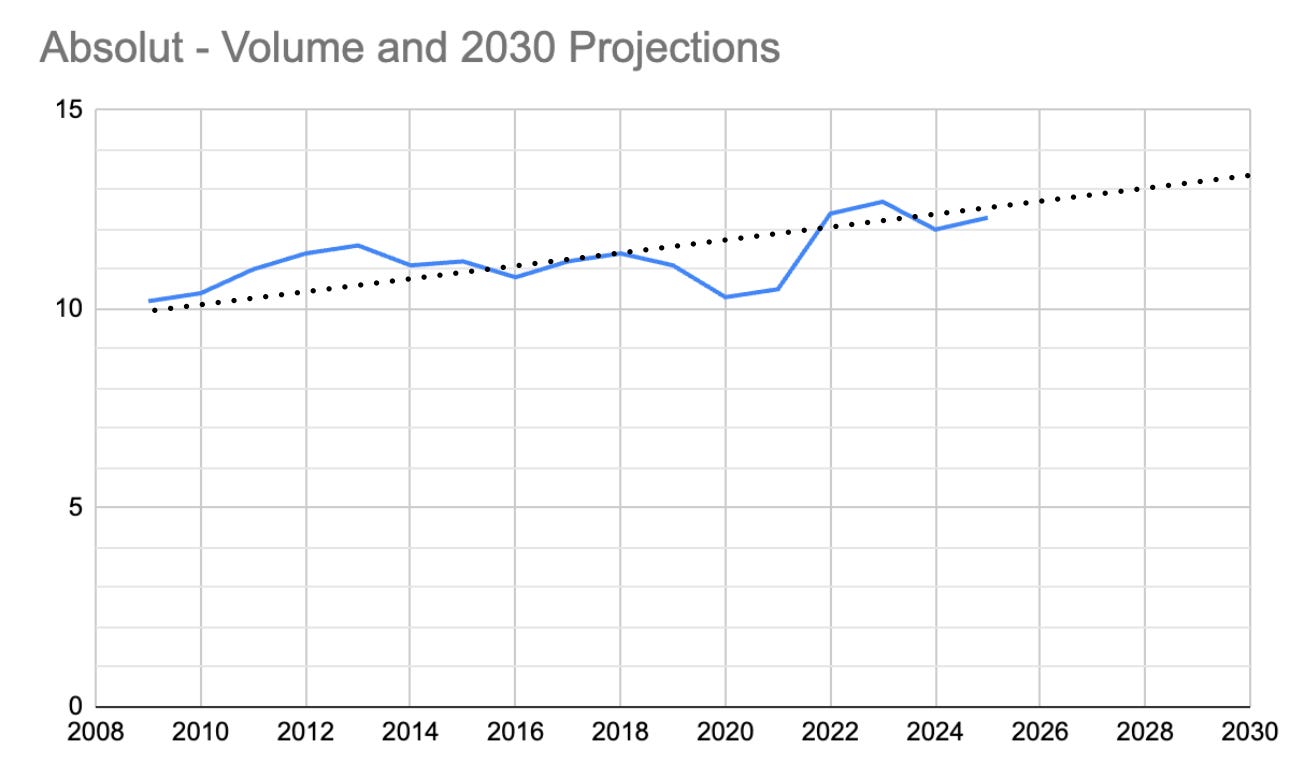

Absolut

Absolut is the second largest vodka brand in the world and was acquired in 2008 for about 5.6B EUR. It is currently the largest brand for Pernod Ricard.

Absolute sales has gone upward with some cyclicality but over a 5 years timeframe, Absolute sales should raise with a good confidence. Absolut sales were 10.2m cases in 2009 to raise to 12.3m cases in 2025. It peaked at 12.7m in 2022.

With a high confidence, our best estimate is that Absolut will reach 13.3m cases in 2030 - up 1.0m.

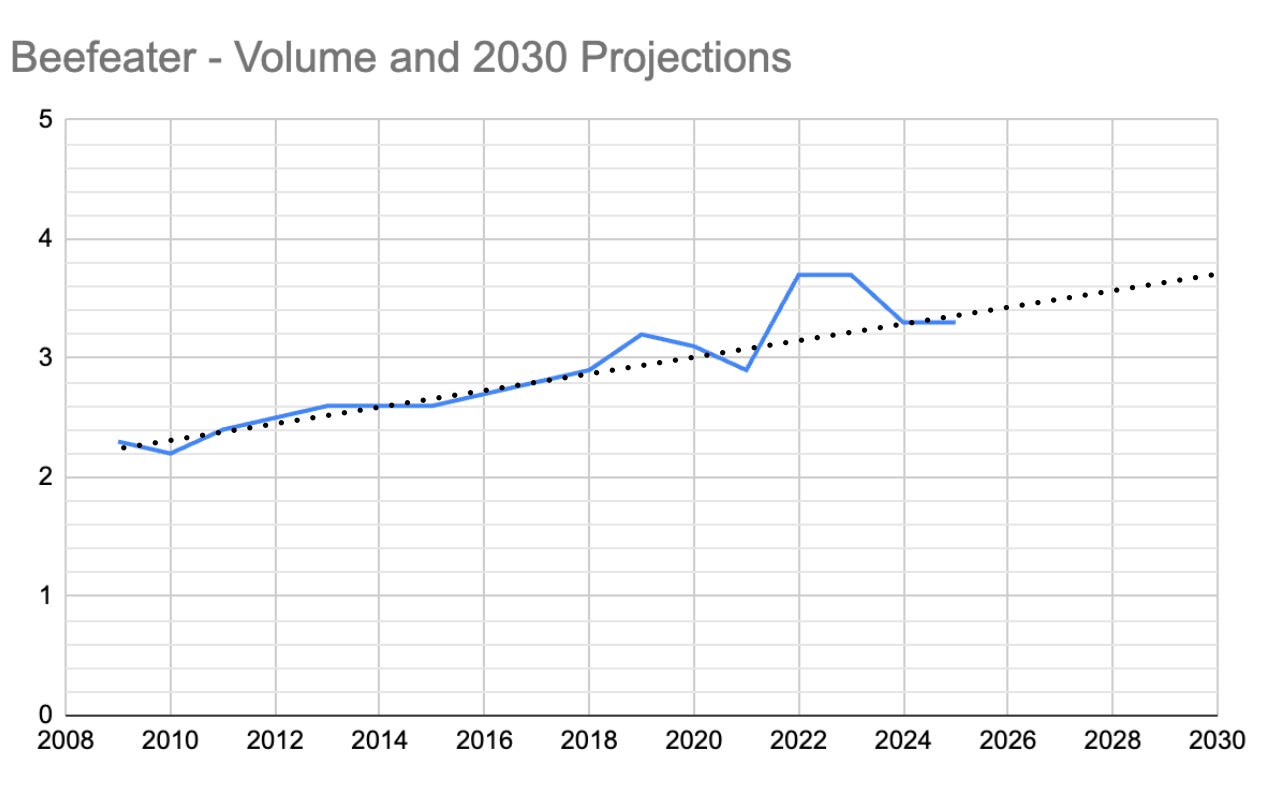

Beefeater

Beefeater is the #4 gin brand in the world. It is in a more precatious spot than the other 3 previous brand. Still, Pernod Ricard was able to grow the brand over the years by reinvesting. in the brand since the acquisition in 2005. In 2009, volume was 2.3m and has risen slowly to 3.3m. Besides the drop in 2020 and the aftermath of the post COVID boom, we believe that slow volume growth will resume.

Gin is not protected, so competition can pop up everywhere in the world so as such my level of confidence is not high. With an average confidence, our best estimate is that Beefeater will reach 3.7m cases in 2030 - up 0.4m.

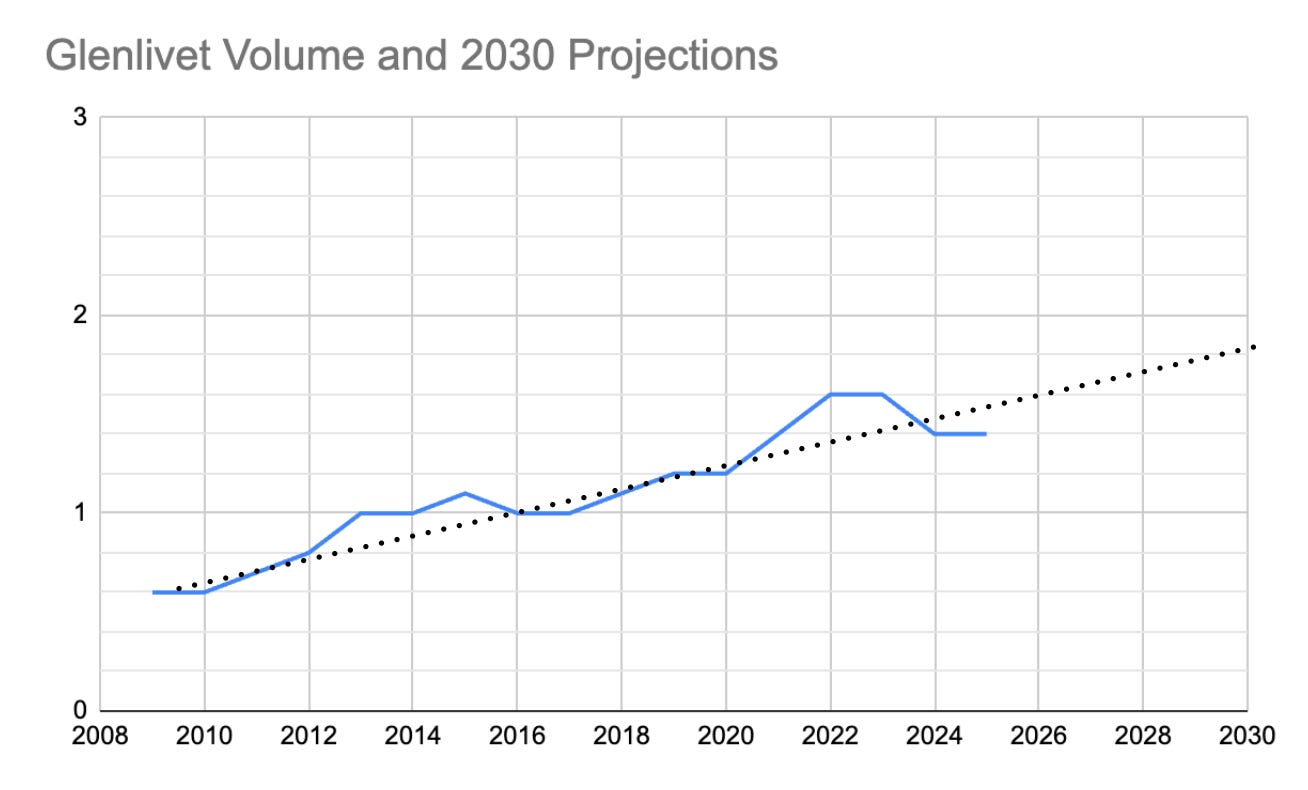

Glenlivet

Glenlivet is the second best selling single malt scotch in the world. It was acquired in 2001 as part of the Seagram split deal. Sales were less than 0.6m in 2009 and has risen to 1.4m in 2025.

As a single malt scotch, Glenlivet is a leader and very well protected. With a high confidence, our best estimate is that Glenlivet will reach 1.8m cases in 2030 - up 0.4m.

Overall strategic international brand volume

If we take the top 5 brands (in term of growth), the volume increase by 2030 should be 6.2m cases.

If you take the total volume for the 13 strategic international brands and we map it for the last 16 years, we get a steady increase and through linear interpolation, we should get to 64m cases in 2030.

In 2025, the total volume was 56.6m cases, so this represents a 7.4m cases increase or 13%.

6.2m cases or 83% of this increase can be explained with high level of confidence with the top 5 brands discussed earlier in my opinion.

A 7.4m increase would represent a CAGR of 2.5% in volume.

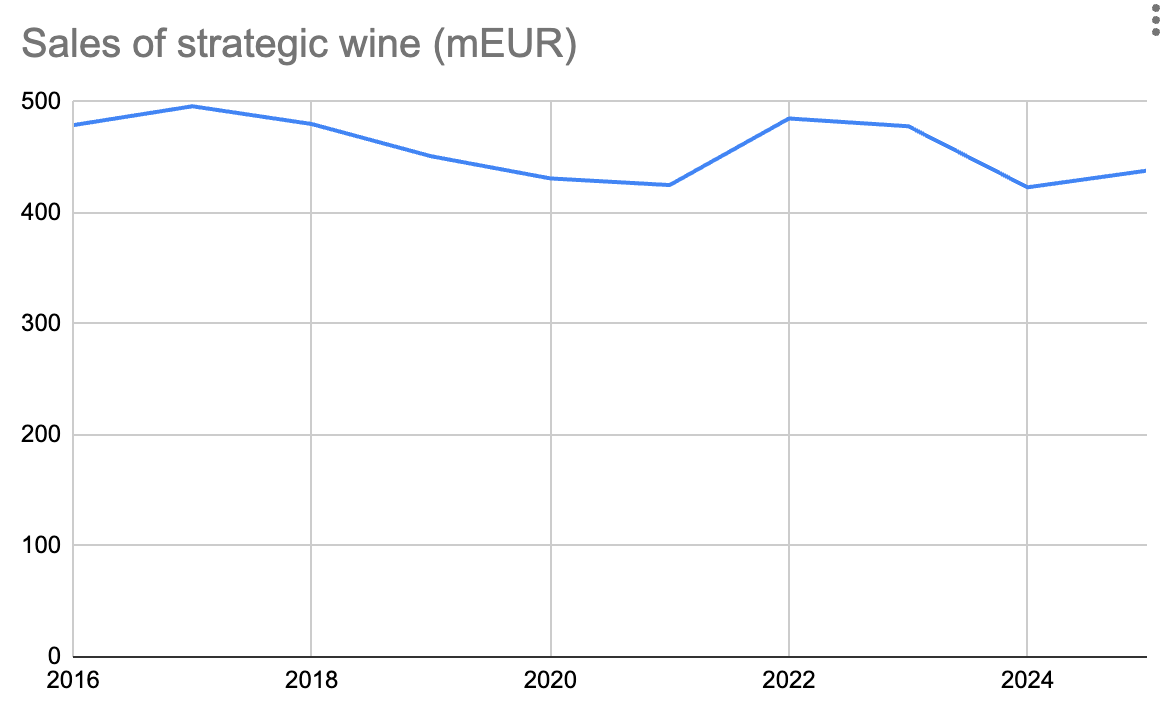

The Wine business

The wine business have been largely sold in April 2025. This business has been underperforming since 2014. Here are the segment sales:

Pernod Ricard has not disclosed the amount for the sale of this business, but when the announce their intention to sell this business, they were hoping to get 250m Euros. So I suspect, this division had a very small operating margin - below 10%.

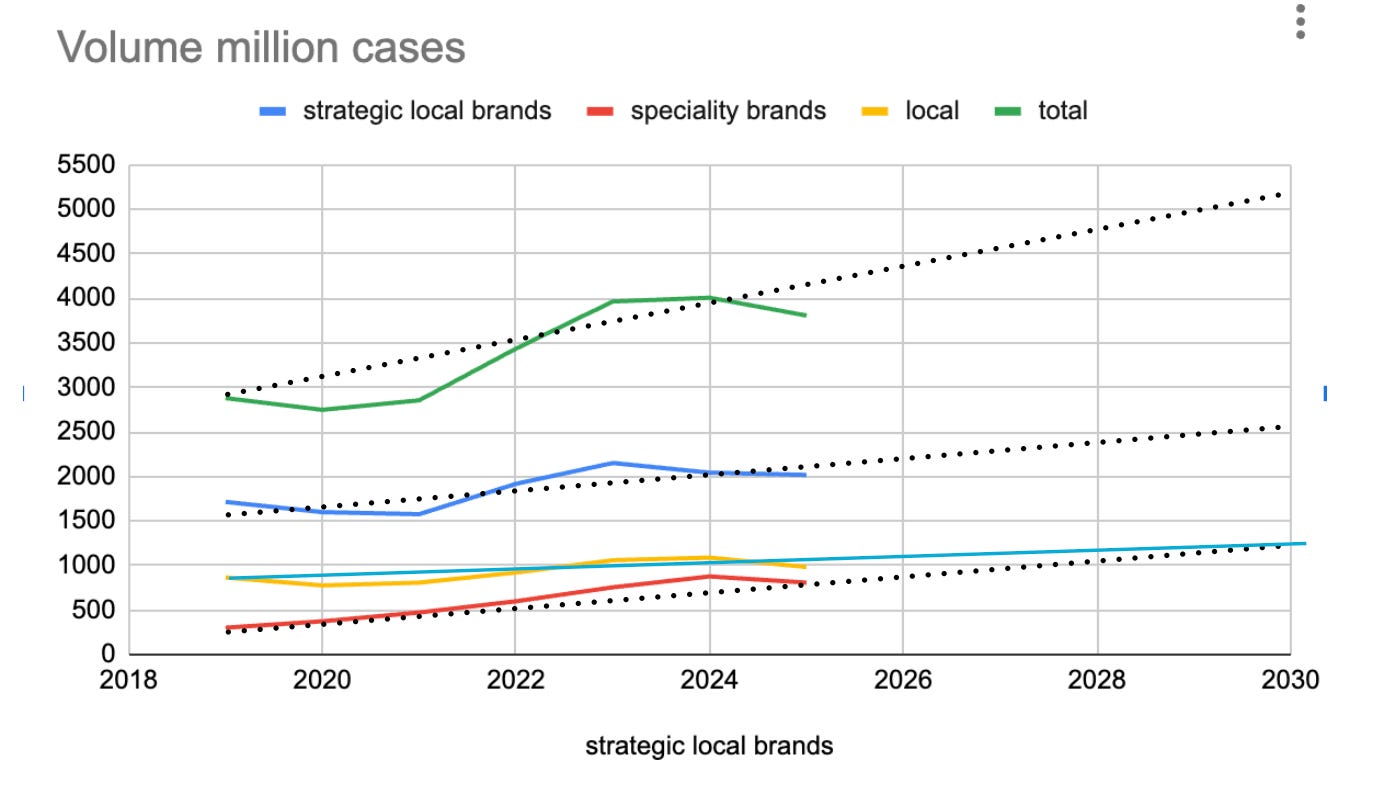

Strategic local brands and specialities

If you carve out the wine business, you get strategic local brands and specialities.

Here is a list of these brands:

This represents 25% of sales.

These segments have been disclosed since 2018. Here is the historical data of the 3 segments (specialty, strategic local and local) and total of these 3 segments.

On 2018, total sales of these 3 segments were 2894m and it went up to 3804m and increase of 31.5%. In contrast, the strategic international brands increased by 26.5% of sales. So, by 2030 these 3 segments could represent 5000m EUR based on the rough projections from the 3 segments; 2500mEUR, 1250mEUR and 1250mEUR for strategic local, specialty and local respectively.

Pricing on Strategic international brands

Since the majority of the top13 brands are produced in Europe: UK (Scotch, Gin), Ireland (Jameson), Sweden(Absolut) and France(Martell, Mumm, Perrier) and the company is reporting in EURO, the recent strenghtening of the Euro versus US Dollar has created a headwind on pricing for the strategic international in recent years. As such, pricing has not been favorable in recent years.

I would think that pricing increase should return over the next 5 years to a 2% CAGR. As such the strategic international brands should get 11% from pricing and 13% from volume for a resulting increase of 25%.

This would get us to 8325m.

2030 projection for overall sales

Strategic International top13: 8421m 6714m in 2025

Strategic Local : 2500m. 2017m in 2025

Specialty : 1250m 807m in 2025

Local : 1250m 983m in 2025

Once we carve out the wine business, the 2025 sales is 10521m

Our projections for 2030 should get us to 13421m or up 27% or close to 5% CAGR so Pernod Ricard should get back to MSD growth.

The investment thesis here is that once mid single digit (MSD) growth in revenue and earnings will resume, then we will have a P/E rerating back to the mean at 20 times earnings.

In Part 2, we will assess what should be the operating margin improvement if any. We will also look at some long term trends of the spirit business. But for now, based on this analysis the main investment thesis is intact and I am confortable to bet that Pernod Ricard’s MSD should continue over the next 5 years. We just have to be patient.

As a disclosure, I have bought Pernod Ricard significantly and made it a top12 position at 83EUR in recent weeks.

Cheers

Disclaimer: The above article constitutes my or the authors’ personal views and is for entertainment purposes only. It is not to be construed as financial advice in any shape or form. Please do your own research and seek your own advice from a qualified financial advisor. I / The authors may from time to time hold positions in the aforementioned stocks consistent with the views and opinions expressed in this article. The information provided in this article is not making promises, or guarantees regarding the accuracy of information supplied, nor that you guarantee for the completeness of the information here. The information in this article is opinion-based and that these opinions do not reflect the ideas, ideologies, or points of view of any organization the authors may be potentially affiliated with. The authors reserve the right to change the content of this blog or the above article. The performance represented is historical” and that “past performance is not a reliable indicator of future results and investors may not recover the full amount invested.

Wine wallet share of alcool has dropped 33% (from 20% share to 15%). Beer has lost 2% of market share. Spirits went from 35% to 40% between 2014 to 2024. Overall consumption of alcool went up. So we are fine. Demographic change happens very very slowly. GenZ are more into spirits than wine and beer for sure. Cocktail generation.

Good writeup. I am long Diego. But coming up to speed on this one. Looks like premium Wine did well in the recent quarter as per LVMH earnings release. The trend changes very slowly but narratives are so strong. Buying at these prices feel safer even if it does not mean revert