Industry research on video games in Japan

Industry Research on Japanese Videogames Companies : Part 1 Capcom and Nintendo

Intro: Part 1 of video games Made in Japan will provide some KPIs for 5 companies in the video game industry, my perspective on the console wars, an analysis on Capcom and a review of Nintendo recent earnings. Subsequent post will cover a bit more Nintendo, plus Sony, Bandai Namco and Square Enix. The Japan video game industry is a fertile ground and have solid compounders currently trading at historical lows so it is a good spot to do some hunting right now.

Legal Disclaimer: All content published on Wintergems is intended for informational and entertainment purposes only. It is not intended to serve as a recommendation to buy or sell any security. The views expressed are my own and are subject to change without notice. The information provied here is proprietary. I make no representations or warranties as to the accuracy or completeness of the information provided and will not be liable for any losses, injuries, or damages from the display or use of this information. Readers are solely responsible for their own investment decisions.

Wintergems Mutations

Starting now, Wintergems is becoming an independent investment blog focused on industry-level deep dives. The current post will cover the video game sector made in Japan. This will be a multi-part industry deep dive.

Moving to industry-wide research in fertile ground allows to understand the battlefield before picking one or more soldiers. This approach enables broader commentaries on sectors and countries, while granting me the freedom to highlight specific, high-conviction data points without the fluff of a general company overview. This is also aligned with my industry centric investment philosophy. I invest in a handful of industries and pick the best companies if trading at an attractive price.

Consequently, I am moving away from the traditional single-stock pitch. It is a crowded space which often leads to unidimensional views. In my experience, the standard investment thesis pitch often reduces complex analysis to a binary ‘buy or sell’ decision, stifling the deeper discussion and reflection that actually drives long-term returns.

I am also discontinuing public portfolio updates and performance rankings. Portfolio construction is deeply personal and implies a specific risk tolerance that may not match yours. I want to avoid encouraging a ‘copycat’ mentality, which I believe is one of the most dangerous traps for an individual investor.

Going forward, all posts will remain public for a two-month window before moving to the archive. This provides ample time for our community to read and discuss the analysis while the thesis is fresh.

However, my research is proprietary. By limiting long-term public access, I am taking necessary steps to protect the content. I write for individual investors—not to provide free data for search engine scrapers, AI training models, or institutional funds.

🇯🇵 Japan 🇯🇵

A classic live album in the seventies is Deep Purple Made in Japan which was recorded in 1972 in Osaka. This is the inspiration of doing a special Video games Made in Japan! Hoping to clear somewhat the smoke over the video game industry in a foreign country…

Japan has been a major fishing pond for me for years. Its not easy, small cap often only publishes result in Japanese and the culture is so different. Its been 12 years since I purchased my first shares of Shimano and Fanuq and some net net. I am starting to get some good traction. It takes some time, patience and curiosity.

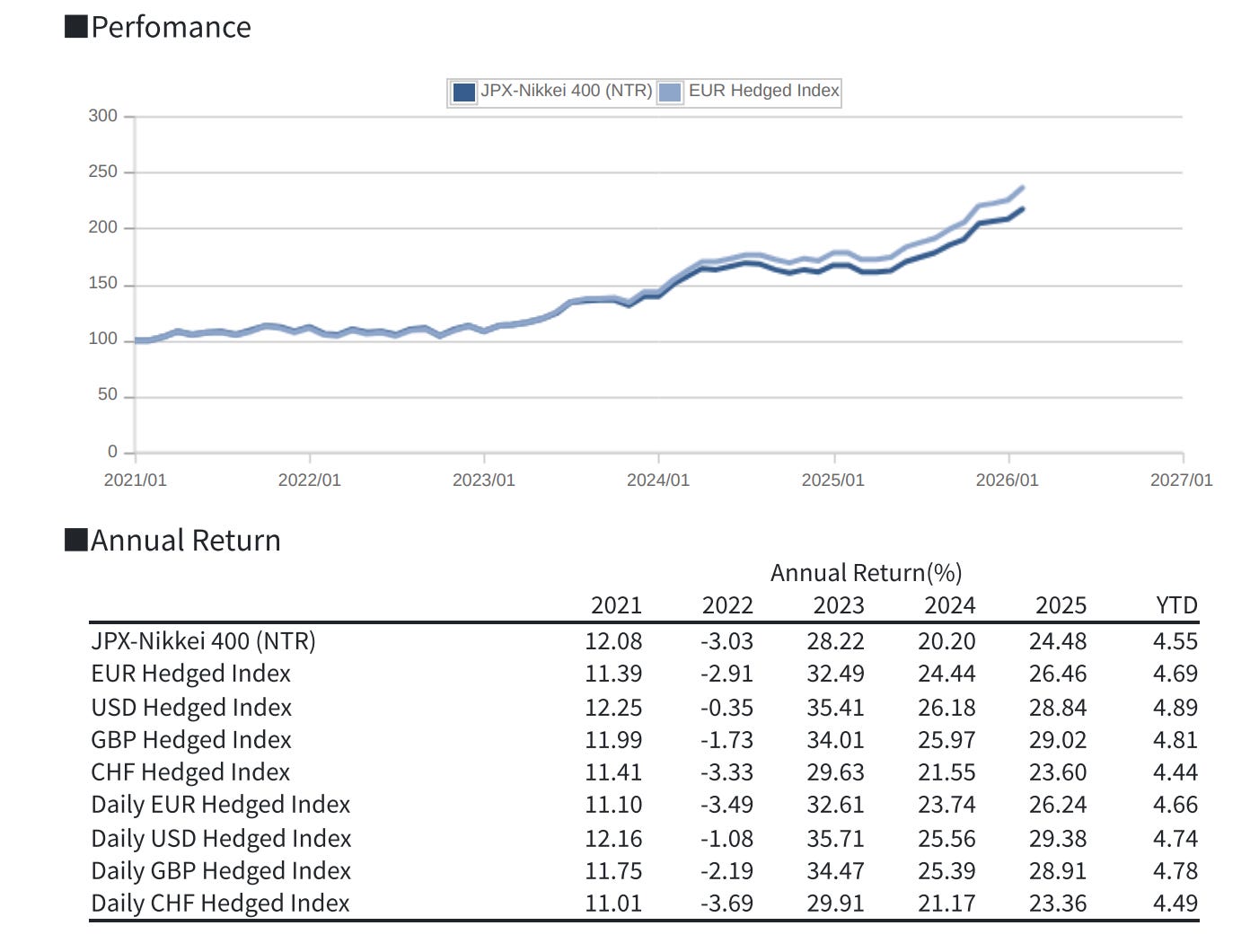

The JPX-Nikkei 400 had a good year in 2025, having return 24.48% which is beater than the S&P500.

Japan Video Game Sector

The Japan video game industry is a fertile ground and have solid compounders currently trading at historical lows so it is a good spot to do some hunting right now. The two most important video game platforms are developed in Japan: Sony and Nintendo.

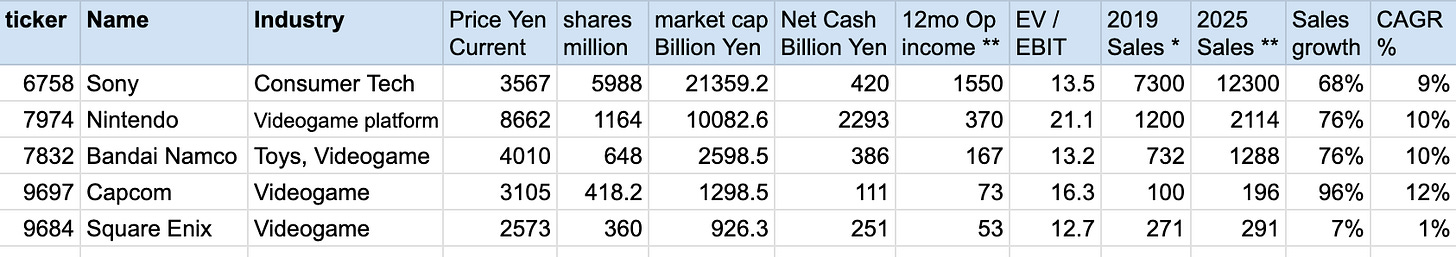

The following table covers solid compounders operating in the video game sector.

The table is is not exhaustive, but has been filtered based on having sales CAGR growth of at least 10% (or close to) since 2019 and sustainable or improving operating margin. If I miss one please provide a comment and I may add it in my analysis

price based on Feb12th 2026

Looking quickly at the table, those companies not only have good growth, but are trading at a reasonable EV/EBIT mostly in the mid teens. They all have a good cushion of cash with no debt.

Square Enix with only 1.2% CAGR growth since 2019 does not satisfy the requirements. However, Square Enix has historically been growing steadily since 2011 - 125m yen sales in 2011 versus 291m yen sales in the latest 12mo. So only recently did sales stalled. Square Enix is going through a major restructuring and so I thought it would be interesting to investigate this one as stock as come down quite a bit. It also owns one of the best video game franchise - Final Fantasy so worth a look. This could be a turnaround story.

Console Wars

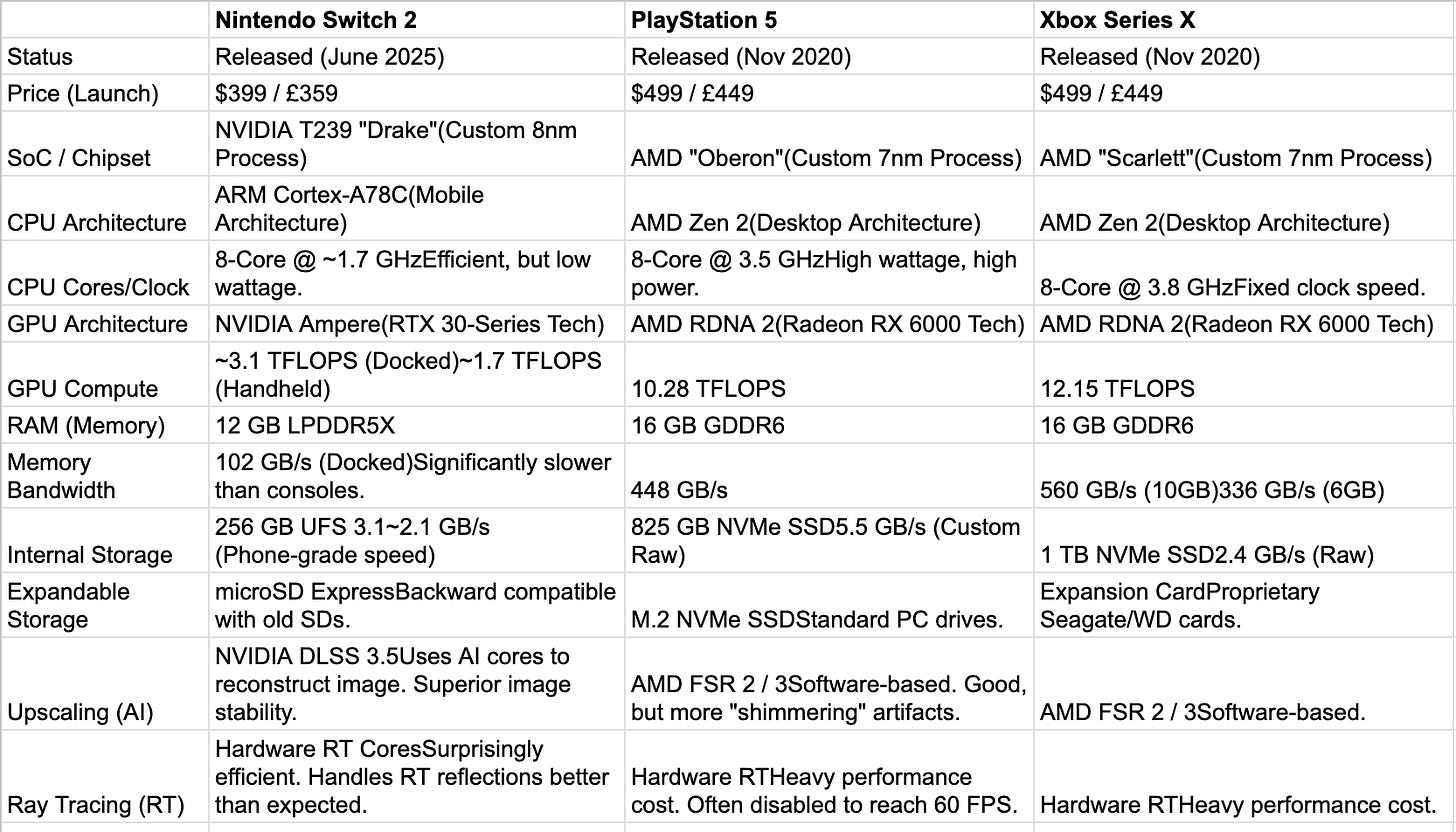

The Switch2 has finally been released in June 2025 so we can compare the technical specs and performance of the 3 major consoles:

In summary, the biggest gap between Switch 2 and PS5/Xbox is the CPU. Thus most "Next-Gen" ports on Switch 2 are locked to 30 FPS, whereas PS5/Xbox versions often offer a 60 FPS performance mode.

Very demanding game like the future GTA6 or Borderland4 may not be released on the Switch2. Cyberpunk 2077, a very demanding game, runs on the Switch2 but was framed down to 30FPS.

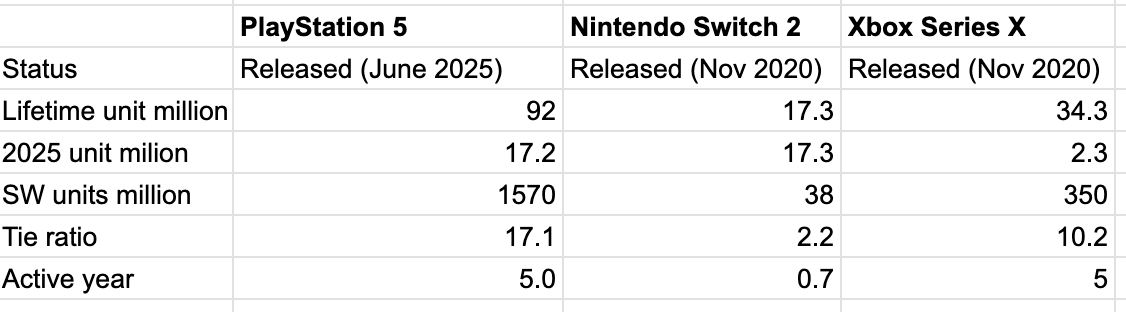

In terms of market share, the following table provides a nice comparison:

Clearly, PS5 has the largest installed based with 92m. The Switch2 had a exceptional start with 17.3m units sold in 7 months. PS5 almost outsold the Switch2 in 2025 although being 5 year old. XBOX unit sold in 2025 was abysmal with 2.3m.

Another important KPI is the tie ratio. PS5 has an excellent tie ratio of 17.1 title sold per PS5 sold. So the 92m user base is very active. Nintendo had an expected tie ratio of 2.2 in less than 7 months. Xbox has a much lower tie ratio of 10.2 but a large portion of users have subscribed to the gamepass giving them access to a large set of games ( a la Netflix) via the gamepass.

In my opinion, The Switch2 being CPU and GPU limited and FPS constrained and more expansive than the 5 year old PS5) will likely not attract active gamers. Sony will continue to extend its lead to what is expected to be a very long console cycle. No new platform is expected to launch before 2029 due to the cost of memory due to AI. There is no competitive pressure from XBOX this time as well, as XBOX as become a marginal player. Only dire hard Nintendo fan - and they are numerous - will decide to purchase the Switch2. The very high cost of a gamer PC due to the memory price, may actually force certain PC games to move to PS5 or PS5 Pro over the next few years.

On top of that, the most popular game franchise in history, GTA6 will come out in the end of 2026, with more than 45m game to be sold in the first year. Expect a big jump for Sony PS5 when the game comes out. That game will not be available on Nintendo due to CPU limitations. Also, since PS5 has outsold Xbox 7.5 time in 2025, most of the GTA6 effect will be felt on the Sony platform. We should expect less sales on the PC due to the prohibitive cost of a PC gamer due to the recent memory price jump.

So clearly Sony has won the console war, this decade. Nintendo, protected by its proprietary IP will be fine. I still think they should have at least match the 5 year old PS5 platform on the CPU performance to attract gamers and 3rd party software. XBox is now a marginal player so Sony will reap the benefit.

Capcom

If you refer back to the table, Capcom has produced the best CAGR 12% sales and has improved steadily the operating margin. If you look back the last 10 years it is also true based on steady revenue and operating income. Capcom is a mid-cap of 8.3B USD.

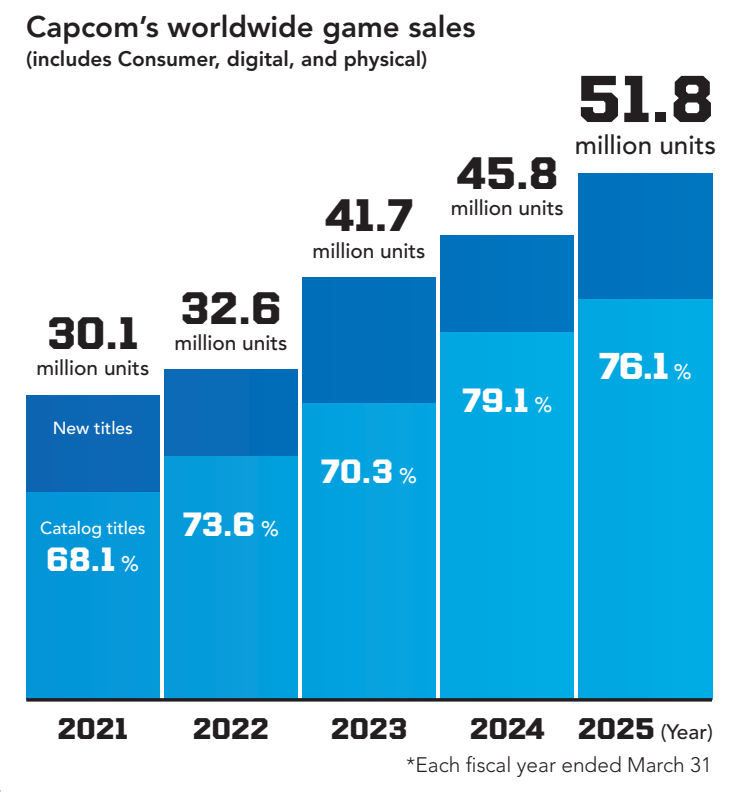

The following chart is an extract of the latest 2025 annual report (ending March 2025).

Capcom was able to increase operating income every year since 2014, which is unique in this hit driven industry. 2015 was an exception with no new release, but operating income was fine as 2015 only relied on catalog titles. I am particularly impressed by the steady increase in unit sales which has quadrupled since 2015 from 13m units to 54m units projected. From 2015 to projected 2026, sales has tripled, and operating income has multiplied by 7. The digital distribution is key for Capcom operating income as catalog price is in the 20—30 USD range. For fiscal 2026, the average sales per units comes down to 24 USD.

As shown below, the reason for the steady income is the strong share of the catalog titles of the overall sales. A title is considered a catalog title once sales occur after the fiscal year when the title was first release. It can be a bit misleading since if a title is released on February 27th, all sales coming after March 31st are considered catalog sales which happens just 1 month after the release.

Resident Evil

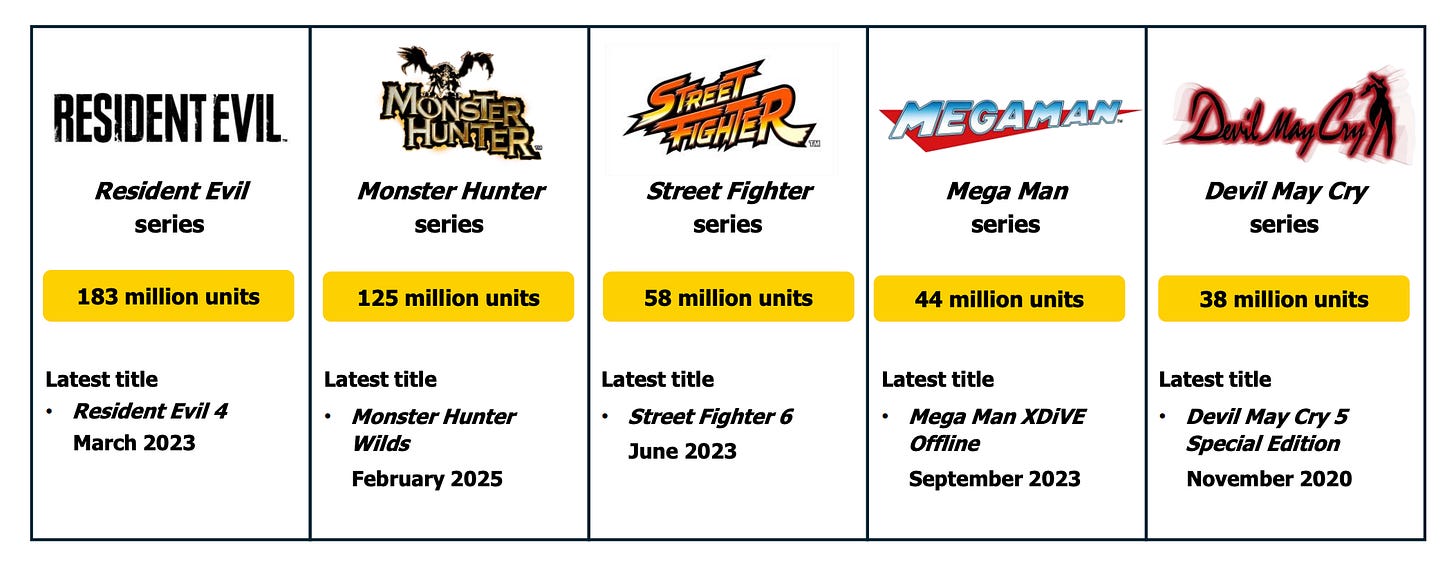

Resident Evil is the oldest franchise and 2nd most important franchise after Monster Hunter franchise. It is fully owned and developed internally by Capcom and has sold more than 183m units. There were 12 different titles, so each title has sold around 15m units each.

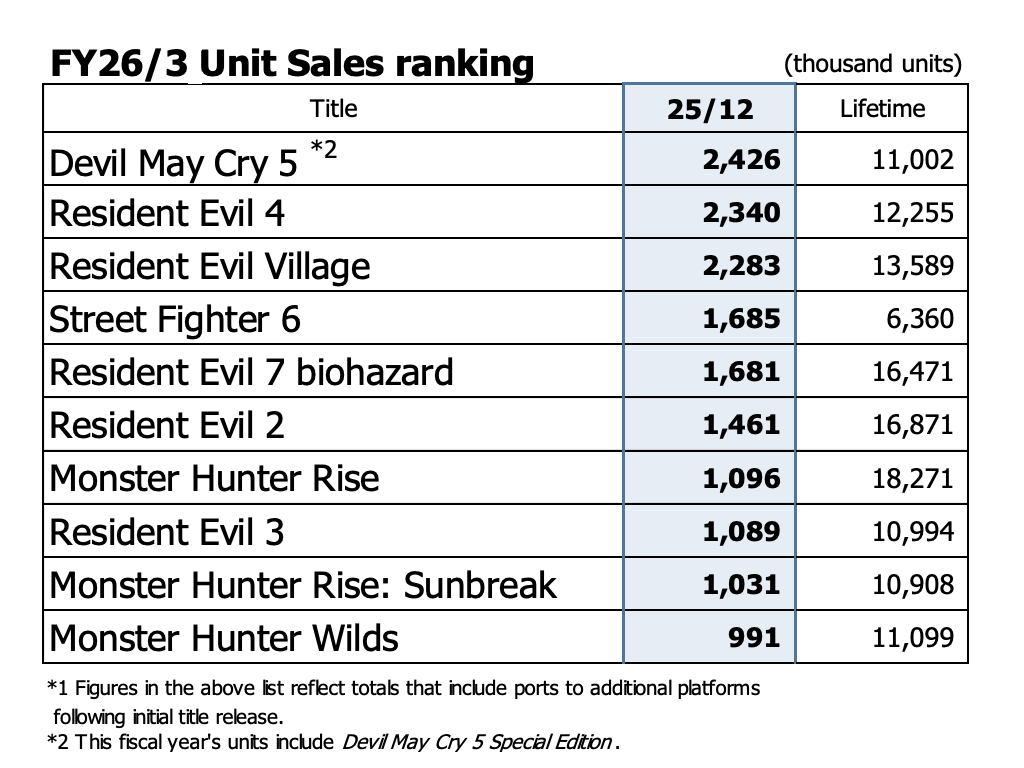

If you look at the latest sales of the past 9 months, I am making the case that the Resident Evil franchise shows up in 5 of the top 10 sales for around 8m units. And no game were released for this franchise in the latest fiscal year. Resident Evil 4 was released in 2023 and Resident Evil Village in 2021.

On February 27th, Requiem, the latest Resident Evil game will be released. So sales should be strong for the last quarter and for the next few quarters.

Monster Hunter Franchise

The most important franchise is the Monster Hunter series. Monster Hunter Rise in particular, released in 2021 has sold for more than 18m units. The Monster Hunter World title released in 2018 has sold even more to 28m units. Those two titles are the company biggest release.

Monster Hunter Wild released in early 2025, has been a instant hit - strong pent up demand - but was running on a new 3D engine - which was too demanding for the regular PC and even for the PS5. As such, similar to Cyberpunk 2077, a lot of players were disappointed by the poor performance of the game. A patch has been released in January 2026 to provide better performance, but it may have been too late. Likely a new scenario or release will be required to get players interested again on the game. Monster Hunter Wild will release on the Switch2 in March 2026.

Valuation

Recent AI fear related to the video game industry and disappointment on the Monster Hunter Wild reception have put the stock in the bargain bin.

In the past 5 years, Capcom has traded at an average of 20 EV/EBIT, versus 16 right now based on forecasted earnings for fiscal 2026 (ending March 2026)..

Latest 9mo results

Last week, Capcom has reported its latest 9mo results and maintains its target of 190B Yen of sales (up 12%) and operating income of 73B (up 11%). Stocks trades at 16x EV/EBIT projected based on their latest forecast.

Although small compared to the main segment (video games), the amusement equipment segment seems to be having a great 9 months with already 10.5B of operating income ahead of the full year forecast.

Ownership

One good thing is that the founder Kenzo Tsujimoto is still heading the company and the Tsujimoto family owns 25% of the company. One of his sons is heading the Monster Hunter division. They don’t have full control but they have significant skin in the game. They have done some buybacks before (not recently) and are returning about 30% of profits in dividends. They are prudently accumulating cash, which is fine for me. Always good to have some buffer in case of a lackluster year.

Strong Internal R&D

All their game franchise are developed internally and in parallel. They have one division focus on movie like realistic game a la Resident Evil, one division for Street Fighter and one division for the Monster Hunter franchise. So they can release these games in parallel.

They also have developed their own 3D engine, the RE engine which is used accross all divisions. They have developed a new engine called REXT to support more open world game like Monster Hunter Wilds. It seems that they are having performance issues on this new Engine. This should get resolved in my opinion over the next few years through more optimization and the hardware (PC and PS5 Pro) catching up.

Nintendo

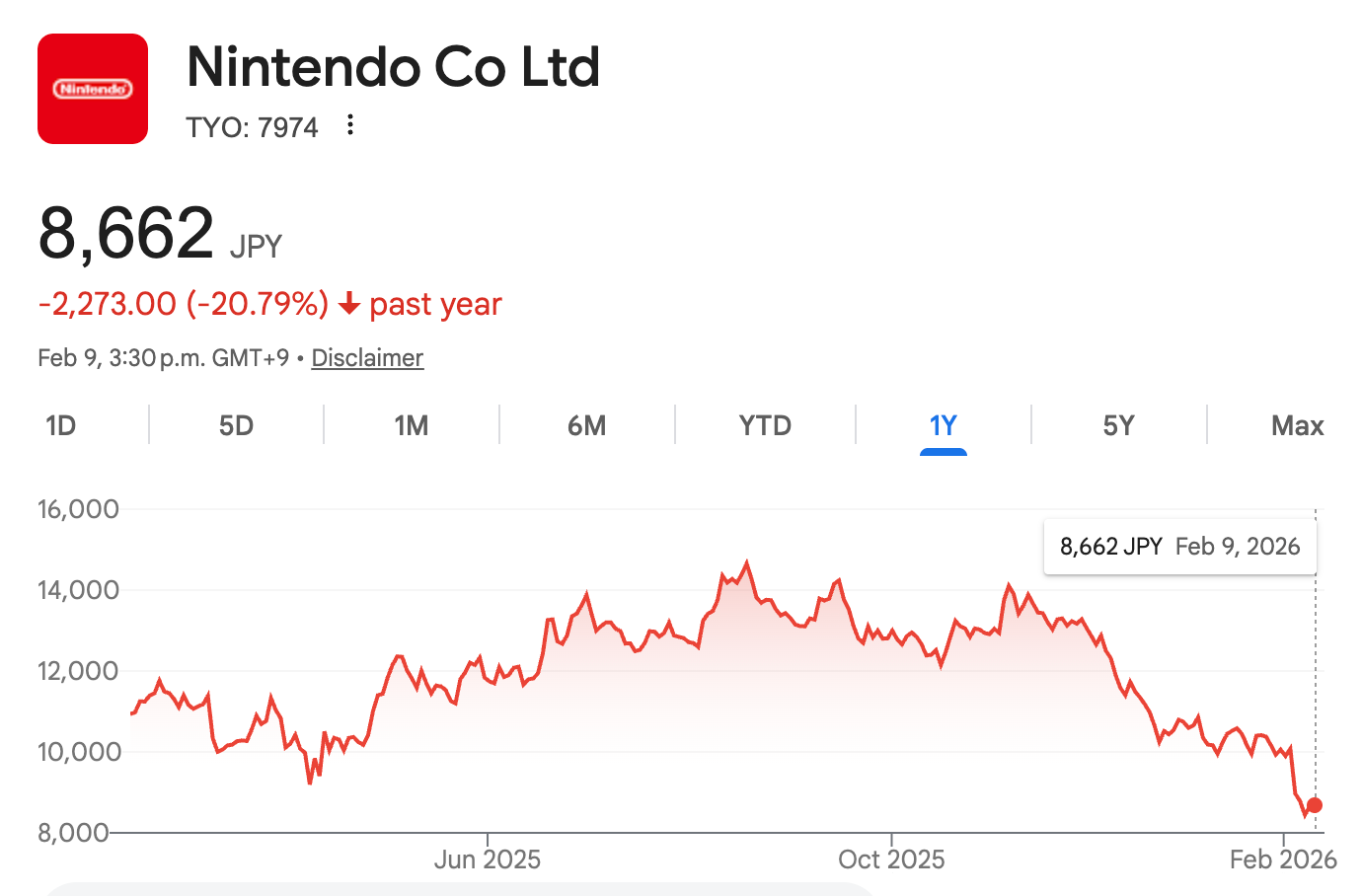

Nintendo is the 2nd largest game platform in terms of sales and operating profit closely behind the Sony Playstation platform. Sony game division operating income is projected to be 500B yen for fiscal 2025 versus Nintendo at 370B yen in the current fiscal year. Nintendo has release this week some excellent results, with the Switch 2 being an instant success with 17m units sold since the May launch- Nintendo is projecting to sell 19m units by the end of fiscal 2026 (ending March 2026). This is better than initially planned of 15m units. The stock has come down significantly in recent months from the 14000+yen high, now trading at a price of 8600 yen..

Latest results

For the first 9 month of fiscal 2026, Nintendo Switch2 sold 17.37 m hardware unit and 37,93 m SW units of Switch2 for an attached rate of 2.2 SW units per hardware platform.

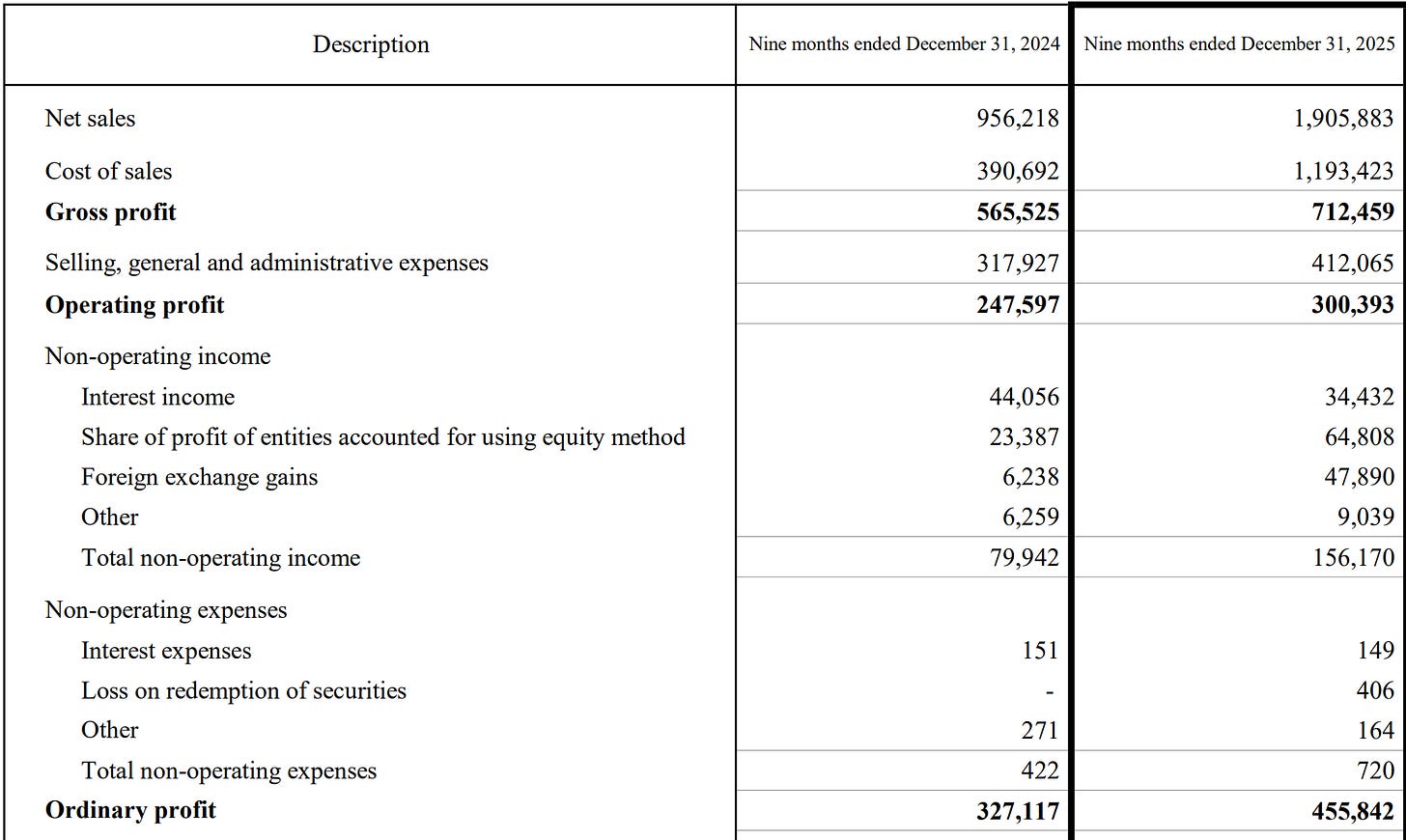

As a result the following table shows 9mo sales for 2025 and 2026 fiscal year

There are 1164 million shares of Nintendo. For operating income, to the 300B, I am adding the share of profit from entities accounted for equity method or 65m. This includes profits from Pokemon for example. The last quarter is expected to bring another 70B of operating income. So we should get 435m of operating income thus it is trading at around 20x operating income. You have about 25% of the market cap in cash, so this ratio goes even lower if cash is removed.

In Part 2, I will revisit Nintendo in terms of 10 years historical trend in terms of results and valuation and will tackle Sony.

Cheers

Legal Disclaimer: All content published on Wintergems is intended for informational and entertainment purposes only. It is not intended to serve as a recommendation to buy or sell any security. The views expressed are my own and are subject to change without notice. The information provied here is proprietary. I make no representations or warranties as to the accuracy or completeness of the information provided and will not be liable for any losses, injuries, or damages from the display or use of this information. Readers are solely responsible for their own investment decisions.

Hard to be bullish here imo. All your numbers are obviously correct, but the future will be a lot tougher than the past. Industry growth ex China is basically nil and China is expanding rapidly globally.

Chinese mobile games are the best in the world. Japan had a head start but they are at best third place now, with Korean mobile games routinely being more impressive. China is so far ahead on mobile that they've left the Japanese companies in the dust. Existing games will continue to cash flow but new Japanese hits will be very tough.

Fortunately Nintendo and Capcom don't compete much in this space. But Chinese developers are investing massive amounts into PC / Consoles. A knockoff monster hunter style game from a well funded Chinese studio is inevitable. Marvel Rivals basically copied Blizzards Overwarch and did it so well that their numbers surpassed Overwatch!

I'm a longtime gamer and have a soft spot for gaming companies as potential investments, but currently only own some niche tiny net net like names in the space.

Capcom is one of the strongest players in the space so you are betting on a historical winner and super competent development team. But you pay up for it with the ev/ebit multiple.

Minimal industry growth going forward ex China + meaningful Chinese competition will lead to much slower growth imo. Existing top tier franchises like resident evil will continue to do well and of course there's room to improve monetization too.

Then there's AI risk which is largely overblown for gaming I think. Seems like developers will be the ones to benefit from AI. But if AI lowers the barrier to making games so much, it could devalue premium games. Anyway, just rambling now. Good luck!

Nice one!