The State of Moat: starting with Adyen

My personal views on their respective moat using 21 homegrown criteria- will start with Adyen for this multi-part series.

The State of Moat

In this regard, one of the most important question and the most difficult to answer in my opinion: DOES the COMPANY MOAT HAS EXPANDED OR CONTRACTED THIS YEAR or IN THE RECENT YEARS?

An economic moat is a distinct advantage a company has over its competitors that allows it to protect its market share and profitability. A wide economic moat is difficult to mimic or duplicate and creates an effective barrier against competition from other firms.

In this post, I am proposing 21 questions to ask ourselves when evaluating a Company’s Moat. Those are questions that I feel important to answer based on my experience. Feel free to complement this post by providing more questions that could be pertinent to MOAT evaluation in the comments below.

So, in this very long post, I will

First, describe those questions in details.

Two, present my top 20 positions from A to Z,

Three, address those questions for Adyen, the first of the list.

In subsequent posts I will go through the other 19 holdings. This will be a long adventure!

The article constitutes my personal views and is for entertainment purposes only. The main goal of this article is to log my personal views. Nothing in this article or these posts in this blog should constitute an investment advice. The projections and estimates provided here should be considered as purely speculative. Do your own model and projections. Please refer to the disclaimer at the end of this article for more details.

To answer this complex topic, they are a few questions one can ask both quantitative and qualitative:

Some quantitative indicators of the strength of the moat can be

Is the operating margin relatively high compared to another business or other companies operating in the industry. A Company should not be penalized if it is operating in a great industry with wide margin. But it becomes even better if it beats its competition on this aspect. Have operating margin been stable or expanding over the recent years?

Is the gross margin stable or expanding and are healthy compared to other companies operating in the industry?

Is the Return on Invested Capital or ROE good?

Has the Company increased market share over the recent years. What is the company market share versus the companies operating in the industry?

In contrast what is NOT MOAT:

Is the Company benefiting from a cyclical tailwind in demand in the industry? This actually might be temporary and might lead to new entrants.

Is the operating margin increase due to an increase in industry wide scarcity of the product sold?

The Company is making acquisitions outside its market. Horizontal broadening?

More qualitative aspects of MOAT are:

Is the management concerned more about the long term of the business and is capable of suffering in the short term? Is management incentivize to perform over the long term or the short term.

Is the Company enriching its offering by offering add-on to strengthen its relationship with customers? Broadening offering.

Is the Company passing some of the savings to its customers?

Are the products continuously improving and innovating? How is this improvement compared to the competition?

Is the Company reducing its dependency on suppliers through vertical integration?

Is the Company making acquisition to reduce competition by consolidating companies operating in the same segments?

According to Pat Dorsey’s book the Little Book that Builds Wealth, there are 5 additional categories that are indicative that a company has moat:

Is the product protected by Intangibles (brands, patents, regulatory capture)? Is this widening?

Is there a HIGH Switching cost for a customer to switch from the Company‘s product to another competitive product? Is this widening?

Is there a Network effect, meaning that the more the product is attracting buyers the more the product has value. Marketplace like ebay is a good example. Is this widening?

Is the Process to fabricate and provide the product benefits from a scaling factor as low cost producer?

Is the Company operating in a Niche - too small for big player to enter and with a significant market share in the niche?

The following can also be red flags of LOSS of Moat

Are we seeing a lot of new entrants in the industry?

Is there a product disrupter (innovator dilemma) in the horizon offering a simplified (incomplete) product but priced at a lower price level?

Is there a Company offering a replacement product with a different product positioning?

I will start analyzing Adyen today :

Adyen

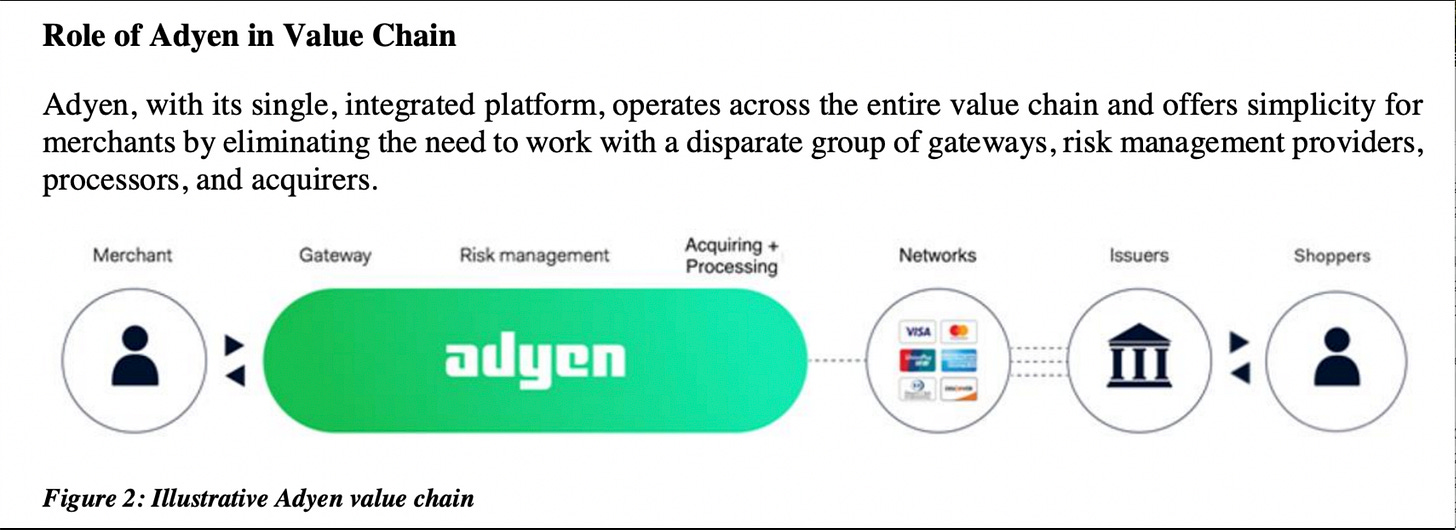

Adyen is a full stack payment processor and as such typically plays the role of both the gateway (or POS service) and the acquirer processor. Their customers are the merchants (a retailer like Urban Outfitter, a brand like Nike, a product like Spotify).

Recent reports have been strong as shown below. For more about the companies you can check my Fintech tab, where I posted 4 times on the company.

Quantitative indicators

Is the operating margin relatively high compared to another business or other companies operating in the industry?

The following is the operating income for every semester since 2017. The recent semester 1H2024 was 41.74%. Having operating margin higher than 40% consistently is truly exceptional.

How is this compared to peers. I put together a list of peers - no perfect comparison but it can be a good indication.

Paypal: enables digital payments on behalf of merchants and consumers. It has branded product like Paypal and Venmo and unbranded payment processor Braintree. The Braintree segment is the closest equivalent to Adyen but smaller.

Fiserv: It includes a Merchant Acceptance segment provides merchant acquiring and digital commerce services; mobile payment services; security and fraud protection products; Clover, a cloud based POS and integrated commerce operating system for small and mid-sized businesses and independent software vendors; and Carat, an integrated operating system for large businesses. Fiserv is larger than Adyen. Clover is equivalent to Adyen POS segment. Fiserv is a merchant payment processor very similar than Adyen.

FIS: provides core processing and ancillary applications; mobile and online banking; fraud, risk management, and compliance; card and retail payment; electronic funds transfer and network; wealth and retirement; and item processing and output solutions

Block: operates through two segments, Square and Cash App. The Square segment offers commerce products for restaurants, appointments, retail, point of sale, online, online checkout and payment. Cash App segment offers financial tools within the mobile Cash App, including peer-to-peer payments, bitcoin, and stock investment brokerage; Cash App Card, a debit card; The Square segment competes with Adyen in the payment processing market. Adyen is a customer of Adyen as Adyen processes a large portion of transactions done through Cash app.

Toast: operates a cloud-based digital technology platform for the restaurant industry in the United States, Ireland, and India. The company offers software products for restaurant operations and point of sale, such as Toast POS, Toast now, multi-location management, kitchen display system, Toast mobile order and pay. Toast POS business competes with Adyen POS business.

Adyen is ranked #1 in terms of operating margin with above 40% margin. Then Fiserv with margin at 25%, FIS at 24%, then Block at 5% and Toast at 0%. Fiserv and FIS are incumbent large merchant processors. From this point of view, Adyen could be considered with wide moat as it can dictate higher profit margin than peers.

In recent years, we have seen a compression from 50% level to 41%, this was mostly explained by a surge in expenses in 2022 and 2023 for hiring new engineers and sales rep at a higher rate than previously done. At the same time, the growth rate of revenue have slow down from higher level during COVID. The slowdown in revenue was partially explained by the Ebay effect. More on the Ebay effect are well explained in :

$ADYEN's free fall - PART2

This article is Part2 of a multi-part series of articles on Adyen covering Adyen's recent results including the latest 1H 2023 and trying to pinpoint some of the cause of the top line slowdown. Based on the most recent slowdown, I am also revising top line figures for 2023-2025. This is a difficult exercise do you own due diligence. As I disclosure,

2. Is the gross margin stable or expanding and are healthy compared to other companies operating in the industry?

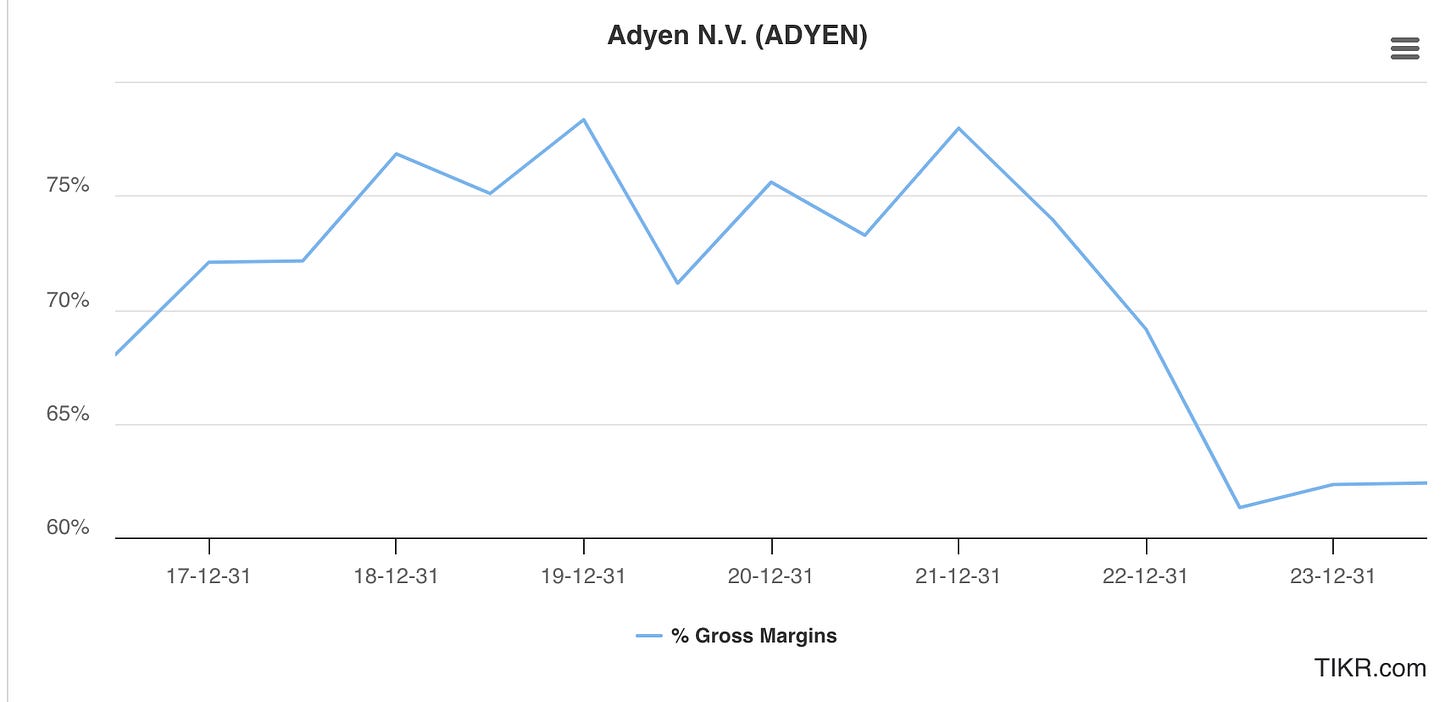

The following shows the gross margin which have been above 60% in recent years.

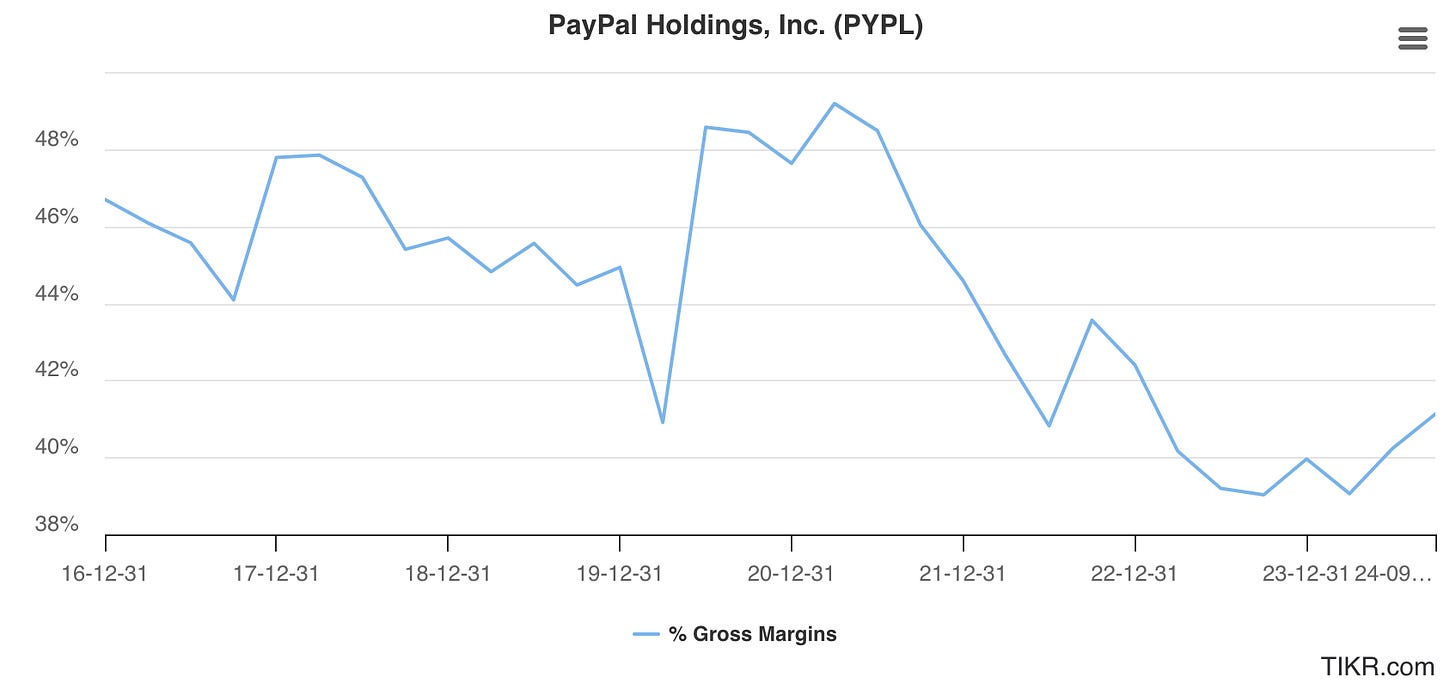

I have captured the gross margin for two important fintech company Paypal and Square and one incumbent payment processor Fiserv.

Again, Adyen achieves the best gross margin, followed by Fiserv, Paypal and Block. Again, Adyen has come down on 1H2023 and stabilize at around 63-63% for the same reasons as explained above.

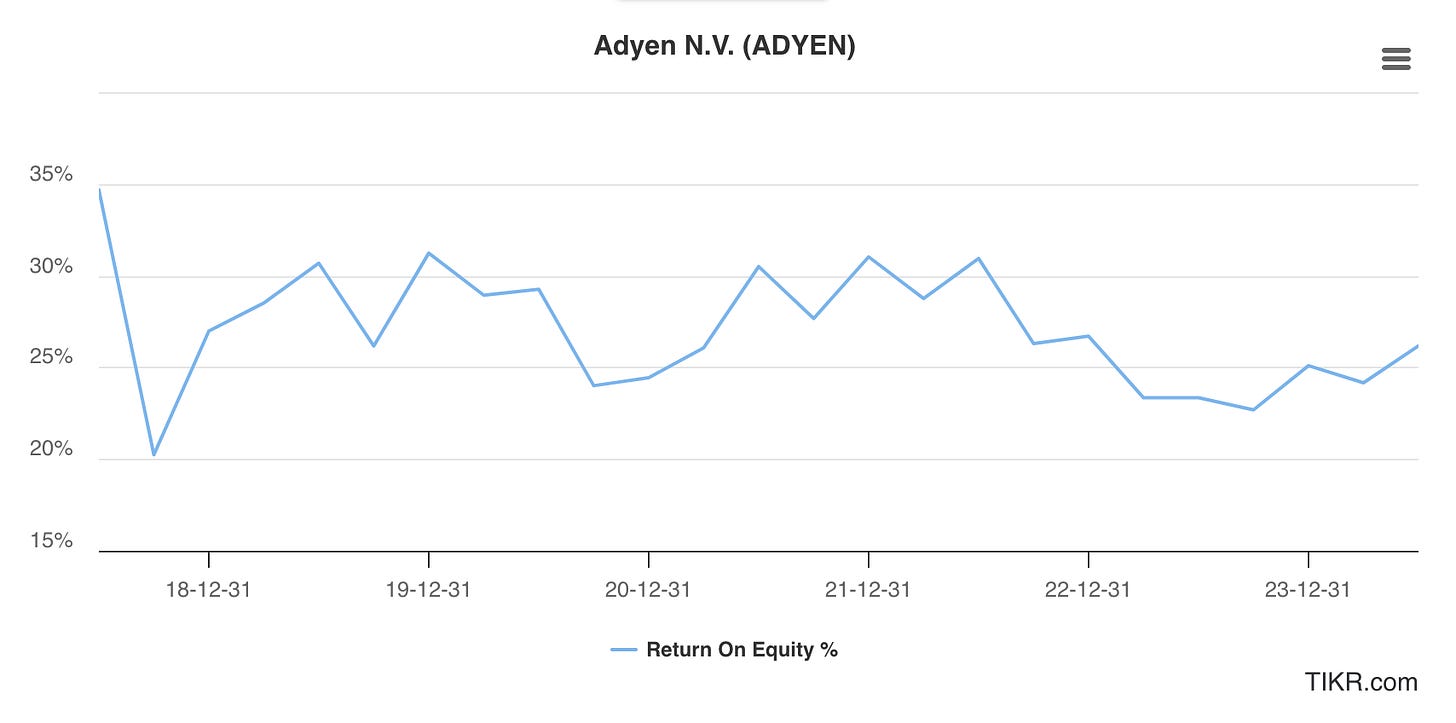

Is the Return on Invested Capital or Return on equity good?

The return on equity has been constantly excellent above 23%. The return on Equity is penalized by the high amount of cash owned by the company which is about 2.7B Euros.

Has the Company increased market share over the recent years. What is the company market share versus the companies operating in the industry?

There are 3 top dogs payment processor in the world:

Adyen, Stripe and Braintree (division of Paypal). Stripe being private does not disclose much information publicly. Still each year, some people are keeping track of Stripe TPV (Total Processed Volume).

The following shows the TPV of Stripe and Adyen over the last 4 years. So Adyen is performing a little better than Stripe in terms of growth. Adyen’s volume has roughly tripled in 4 years or a CAGR of 44%. Please note that Stripe is valued at 70B USD based on latest round, while Adyen has a market cap value of 50B USD. It is known that Stripe has a very low operating margin.

Thanks for @drapersgulld (X handle) for putting this chart together.

As for Braintree, it had TPV of 505B USD in 2023 and 408B USD in 2022. A strong increase but still smaller than Adyen by half and not growing as fast.

Large incumbents like Fiserv, WorldPay and FIS are processing much more volume than Adyen. WorldPay has a TPV of 2.2 trillion USD or about twice the volume of Adyen and FISERV is around 1.7 trillion USD. Large incumbents and small are loosing market share steadily from the 3 aforementioned fintech top dogs.

One interesting chart that I found on X a few weeks back was comparing the POS sales of Adyen, and other peers. Adyen had not been present in the POS market until recently. Adyen initial focus was on pure online e-commerce. This information was gathered by from Jevgenijs Kazanins. Jevguejs Kazanins has a very interesting substack on Fintech:

You can see that Adyen has gained market share on POS volume significantly from fintech players. Adyen is still a relatively small player compared to the incumbent payment processor like Worldpay, Fiserv and so on.

In contrast what is NOT MOAT:

Is the Company benefiting from a cyclical tailwind in demand in the industry? This actually might be temporary and might lead to new entrants and may bias high operating margin.

Yes, the e-commerce online business have seen an industry wide growth of about 8-10% per year worldwide in recent years but this is not cyclical. So this is prone to allow new entrants to come in with a different offering. The growth in online e-commerce is actually helping Adyen to enter new market with a multi-channel approach to acquire merchants that had a only on premises payment that wants to add a online component. I do not believe current tailwind is temporary. I would say this factor is neutral in terms of moat impact. Operating margin is not impacted by this factor.

Is the operating margin increase due to an increase in industry wide scarcity of the product sold?

No, there is no scarcity of competitions or product in online payment processor. This is not a factor.

The Company is making acquisitions outside its market. Horizontal broadening?

No, the company has not done any acquisition - as it is religious about making sure that all Software is developed internally.

More qualitative aspects of MOAT are:

Is the management concerned more about the long term of the business and is capable of suffering in the short term? Is management incentivize to perform over the long term or the short term.

The management displayed in the Summer of 2023 a strong will and capability of suffering in the short term. In 2022, they took the opportunity of the high tech downturn of 2022 (VCs was cutting funds or asking startup and unicorns to reduce their spending) and the sudden availability of excellent candidats to basically increase by 50% the headcount (2200 employers at the end of 2021) by adding 1100 employees in 2022. When they published the results of 2H2022, EBITDA margin was down to 45% due to this surge in hiring. So the stock plunged from 1800 to 1300 euros. Then, in 2023, although revenue growth was falling from 40% to 20%, they decided to keep the same pace of hiring. This take a lot of courage. The hiring was viewed critical to expand on their product offering especially the platform business and the sales force in USA.

Here is what they had to say in August 2023 after publishing bad results:

Another reasons that the management is focused on long term, is the fact that they do not do any acquisition to make sure all codes is internally developed. A unified code base is viewed by management as a technology hedge. A few acquisitions here and their would have allowed to broaden their porduct offering or increase sales reach, providing a short term boost on their revenue.

Is the Company enriching its offering by offering add-on to strengthen its relationship with customers?

Adyen is always looking on integrating new ways for end customers to make payments and in most of the case the first to do so. They have an impressive list of innovative ways to pay for goods. They supported Affirm way back in 2020, Cash App in 2022, and so. on If you select USA on their website, you can find not only the support of all major and minor credit cards, but other alternative payments such as Affirm, Cash App, Paypal, Afterpay and Klarna.

Adyen has also broaden its offering under the platform segment which includes new features like User onboarding: Easily onboard and verify new users or sellers on your platform.Payouts: Efficiently manage and automate payouts to your platform users. Risk management: Protect your platform from fraud and other risks with Adyen's advanced risk management tools. Reporting and reconciliation: Gain insights into your platform's performance with detailed reporting and reconciliation tools. Financial products: Offer your users additional financial services, such as business accounts and debit cards. These are all new features they had to develop in recent years to compete in the platform space.

Incumbent payment processors don’t support those services. Stripe does. One open question is whether Stripe is innovating more or Adyen is. I believe Stripe as started with small merchants and so on so onboarding and ancillary services like reporting and financial products was part of the product offering much before. In contrast, Adyen originally aimed very large customers (Netflix, Microsoft, Nike, Spotify), which already had their own internal reporting and onboarding tools. Adyen had to catch up in recent years to fill this gap. I believe the fact that the platform related revenue is following an incredible growth (55% in last semester and 90% if excluding Ebay - Ebay was their lead customer on the platform in 2018. In contrast, Stripe was not present in large account (except Shopify - Shopify owns some equity in Stripe in return) but is making breakthrough in large accounts in recent years (Amazon, Uber). Stripe had to optimize its code base significantly to make it scalable for large account. This was their own challenge. The fact that they were able to enter into those large accounts is also a testament that they can improve quickly. I think both are formidable companies.

Is the Company passing some of the savings to its customers?

The best example for this is Costco. Costco has kept a gross margin at 14% since the beginning and is passing all savings relating to the economy of scale and purchasing power to the customers. Adyen in contrast has a very high profit margin so it is not doing that. Adyen is pricing on volume discount. The more a merchant is processing through Adyen system, the lower the take rate Adyen charges. Also, Adyen’s pricing from what I heard is on the high side as they have the best authorization rates, the lowest latency and so on. In this regard, I would say that Adyen’s pricing is on the high side and is vulnerable from competition with a lower priced lower quality product.

Are the products continuously improving and innovating? How is this improvement compared to the competition?

Adyen is continuously improving its product offering in terms of authentication rates, latency and so on.

For authentication rates, they were the first to use Network Token Optimization with Microsoft in 2020. This method greatly enhances the authorization rates. Network token was later adopted by the industry in 2022. But it gave Adyen a major boost in authorization rates for a few years to gain additional market share. Adyen have been iterating on this feature several times while the competition is catching up, and its proprietary network token database and methods still exhibit higher yield.

A feature within the Adyen payment platform that uses machine learning to decide whether to use a network token (a secure, non-sensitive identifier) or a cardholder's primary account number (PAN) for a transaction, aiming to maximize authorization rates by selecting the most likely approved option based on the issuing bank's preferences and real-time data analysis; essentially, it optimizes the use of network tokens to improve payment success rates for businesses using Adyen.

The same open question whether Stripe or Adyen are innovating and improving more. But definitely, I believe Adyen is better than Stripe in terms of performance including authentication rates and latency.

Is the Company reducing its dependency on suppliers through vertical integration?

In order to reduce its dependency on banks, provide better control over its operations and reduce costs, Adyen currently holds banking licenses in:

The European Union: This license was obtained in 2017 and allows Adyen to operate as a bank throughout the EU.

The United Kingdom: Adyen also has a banking license in the UK, obtained after Brexit.

The United States: As we discussed earlier, Adyen received a Federal Foreign Branch license from the OCC in 2021.

This enables them to Process payments directly: They don't need to rely on partner banks for payment processing, giving them more control and potentially lower costs.

Offer more financial products: This license allows Adyen to expand its offerings beyond payments, potentially including services like business accounts and lending.

Increase trust and reliability: Having a banking license strengthens Adyen's position as a reliable and trustworthy financial institution in the US market.

In contrast, Stripe, Fiserv and Braintree do not have a banking license.

Another vertical integration is that Adyen has its own cloud infrastructure which gives them: Full Control: Adyen owns and operates its entire infrastructure, including servers and data centers. This gives them complete control over their systems and data, unlike many competitors who rely on third-party cloud providers. No Reliance on Public Cloud: Adyen specifically states that they don't use public cloud services for payment processing. This provides them with greater security and control over their sensitive data. Maximum Redundancy: Their infrastructure is designed with multiple layers of redundancy, including dual internet uplinks, redundant switches, and dual power feeds. This ensures high availability and minimizes downtime.

Another key independence aspect is that Adyen relies mostly on Open Source Software for their own SW development: Adyen utilizes mostly open-source software, giving them flexibility and independence from third-party vendors.

Is the Company making acquisition to reduce competition by consolidating companies operating in the same segments?

Nope. Adyen has not done any acquisition. Although acquisition would have help in the short term to reduce competition, the preservation of a genuinely internally developed code base is more critical. This is a trade-off.

Pat Dorsey’s categories

Is the product protected by Intangibles (brands, patents, regulatory capture)? Is this widening?

Adyen has build a very strong brand among merchants of very high quality product. This is only a narrow moat. It is not ingrained in end user consumers. This is a B2B market so brand is less important.

Is there a HIGH Switching cost for a customer to switch from the Company‘s product to another competitive product? Is this widening?

I would say that there is only a small switching cost especially for large digital players in US. Uber and Netflix have build their own infrastructure that allowed them to funnel more or less transactions over multiple payment processors. This is especially true for US. For non US countries, the switching cost can be higher more complex. Adding complementary services especially for the platform segment should increase the switching cost.

Is there a Network effect, meaning that the more the product is attracting buyers the more the product has value. Marketplace like ebay is a good example. Is this widening?

Somewhat, as the more merchants Adyen processes, the more Adyen have a better view of the end user credentials which could be useful for authentication rates and fraud detection.

Is the Process to fabricate and provide the product benefits from a scaling factor as low cost producer?

Adyen uses a single code base, so if the same software code base development costs is shared among a very large numbers of merchants, this gives them a lower cost. The same can be true to a certain degree to their competitors although, historically the incumbent payment processors has done numerous acquisitions and do not have a uniform code base.

Is the Company operating in a Niche - too small for big player to enter and with a significant market share in the niche?

Red flags

The following can also be red flags of LOSS of Moat

Are we seeing a lot of new entrants in the industry?

Yes there is a good number of new entrants in the fintech payment processor business. Check-out and Rapyd are gaining market share.

Check-out is believed to a have a simpler way to on-board new business or merchants than Adyen. They don’t have however the same level of product service offering. For less sophisticated and smaller merchants, this could be a simpler and better solution.

Rapyd is very strong in cross-border payment and emerging markets. It supports 170 countries.

Is there a product disrupter (innovator dilemma) in the horizon offering a simplified (incomplete) product but priced at a lower price level?

I would say that check-out could be viewed as lower price for smaller merchants with a simplified product offering. I do not believe it is a true product disruptor, just a different pricing strategy.

Braintree also is pricing its product at a lower take rate, as it is using Braintree favorable pricing as an incentives for a merchant to start accepting paypal checkout services.

The issue with this pricing approach is that although take rate might be lower, the total cost of transaction including lower authentication rates, higher latency and higher frauds might actually lead to a higher total cost even if take rate is lower.

Is there a Company offering a replacement product with a different product positioning?

I do not believe so. One long term threat could be a company like Visa or Apple Pay who decide to go after merchants directly, bypassing the payment processors for certain functionalities like fraud prevention and so on making the payment processing part more commoditized.

Summary

If we put all moat criteria together and rank them based on widest=3 (of its industry)=3, wide moat=2, narrow moat =1, and no moat=0, in a table we get this:

Strengths:

Operating margin

Management focus on Long term

Product innovation and improvement

Reducing dependencies

Scaling factor with a unified code base

Weakness

Passing savings to customers

Very large market highly competitive

Disclaimer: The above article constitutes my or the authors’ personal views and is for entertainment purposes only. It is not to be construed as financial advice in any shape or form. Please do your own research and seek your own advice from a qualified financial advisor. I / The authors may from time to time hold positions in the aforementioned stocks consistent with the views and opinions expressed in this article. The information provided in this article is not making promises, or guarantees regarding the accuracy of information supplied, nor that you guarantee for the completeness of the information here. The information in this article is opinion-based and that these opinions do not reflect the ideas, ideologies, or points of view of any organization the authors may be potentially affiliated with. The authors reserve the right to change the content of this blog or the above article. The performance represented is historical" and that "past performance is not a reliable indicator of future results and investors may not recover the full amount invested.

Great work thanks! Some stuff that came to mind while reading:

- Braintree is raising it's price, the market for large merchant might become less competitive

- I think the zero for number 10 passing savings might be a 2: Tobias Lutke/SHOP CEO in an all-in podcast, and other sources, explain how they shift from saving money (lower prices) to creating revenues with the higher authorization rate in their client negociation. If you create revenues.. you pass savings allowing a higher total fee IMHO. I also think they did not flex their pricing, so did not demonstrate a moat on how much they could charge.. yet.

- Owning bank charters allows Adyen to give the money faster to its client, enabling more savings and cashflow.

- Large multi-national market is not the same as smaller merchants market. I think we mix both market in our analysis, mixing two moat measure.

I used ChatGPT to summarize morningstar article on Adyen's moat:

• Adyen’s full-stack platform directly connects merchants to issuers, reducing intermediaries and enabling higher authorization rates.

• Its growing transaction volume continuously improves fraud detection and acceptance optimization, strengthening its intangible asset advantage.

• A single, global platform covering multiple payment methods and channels gives merchants a seamless solution with one contract.

• Local acquiring licenses and a European banking license make Adyen independent of legacy banking infrastructure.

• Authorization rate improvements shift the focus from cost savings to revenue growth, supporting premium pricing.

• Knowledge gained from each merchant transaction benefits all merchants on the platform, creating a network effect.

• Adyen repeatedly gains wallet share from existing large, global merchants as they observe higher success rates.

• Consolidation of fraud tools and best practices for multiple countries and payment methods protects merchants more effectively.

Great article!

I also think Adyen is a great opportunity.

But I think you're missing a major risk in the disruption category = stablecoin payments.

It's coming faster than we expect.

Paypal has launched their pyUSD, Stripe just made a >1bn acquisition very recently.

As this guy puts it:

"Traditional payments: 6 intermediaries, 2% fees, 6-day delays

Stablecoin payments: 2 steps, 0.2% fees, instant settlement"

https://x.com/eco/status/1870847013723505151