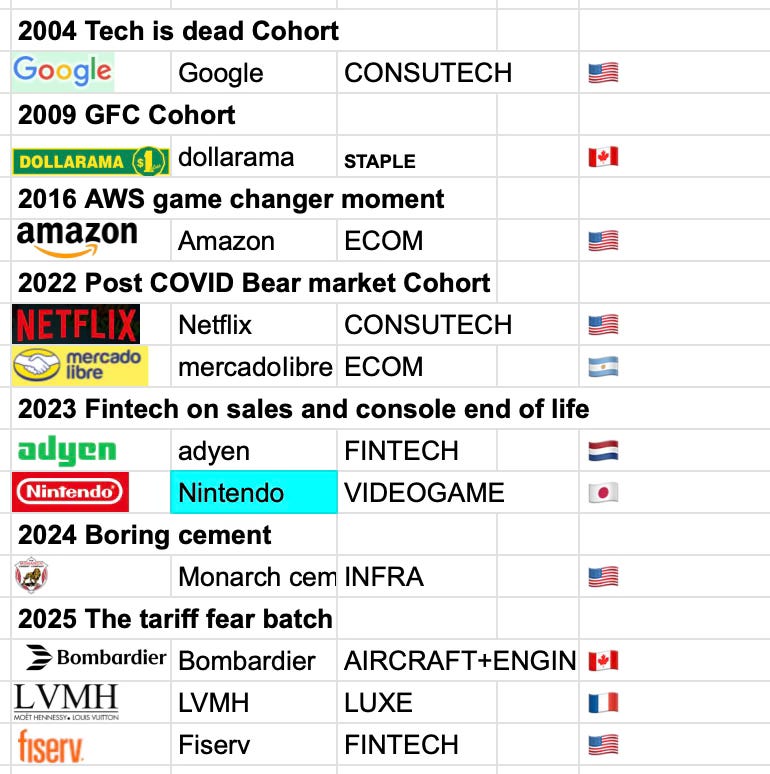

Every year as an investor I build a significant position in one or 3 stocks. But conditions are not always good to find a true compounder at a discount price. Sometimes a very depressed name or an industry does not turnaround and the discounted price stays discounted. But with a bit of luck and a good judgment, one can catch a falling knife and make a good deal of money. There are also very good time to invest in particular industry. 2004 was a great year to invest in Tech stocks - probably not so in banks or small cap or oil. 2007 was a very loosy time to buy any stocks. Your odds of winning in the short term in 2021 was really slim. Jury is still out to figure out of what will happen to 2025.

Turnover should also be kept to a minimum. Each time you sell a stock to buy a new name you are opening up to a new risk - you are the newbie even how smart you may think you are! Its like visiting a new country.. For the "wannabe a global investor out there” this is even worse… investing in a new stock in a new country should be viewed more as an educational experiment.

In 2025 YTD, my best investments are stocks I purchased in 2022 (Mercado Libre and Netflix) and 2023 Nintendo. It shows 2 things: 1) Some cohorts are better than others and will likely dominate the portfolio over the years - namely 2022, like 2004 and 2009, and 2) you should let you winners run even if they look a bit overpriced.

Having said that… in 2025, I did cut or exit some very old positions that were WAY OVERVALUED (2018 cohort Tradedesk at 120x real earnings, 2009 cohort Intuitive surgical at 120x earnings, 2020 Celsius, a very large portion of Amazon. In summary, we need to be patient and every year a new batch should be purchased so that in 3 years for now those stocks will turbo charge your portfolio.

The 3 new names

I have written extensively about Bombardier in Notes or in one post. I think all the fear about tariff is overblown for Bombardier and this industry is so intertwined (canada, USA) that the USMCA tariff free deal will remain in place for this industry. Bombardier is one of the most exceptional turnaround story in recent years in my opinion and will be deleveraging at a rapid pace over the next 3 years. Also it trades in Canadian dollar but all numbers are in US dollar so it doesn’t screen well.

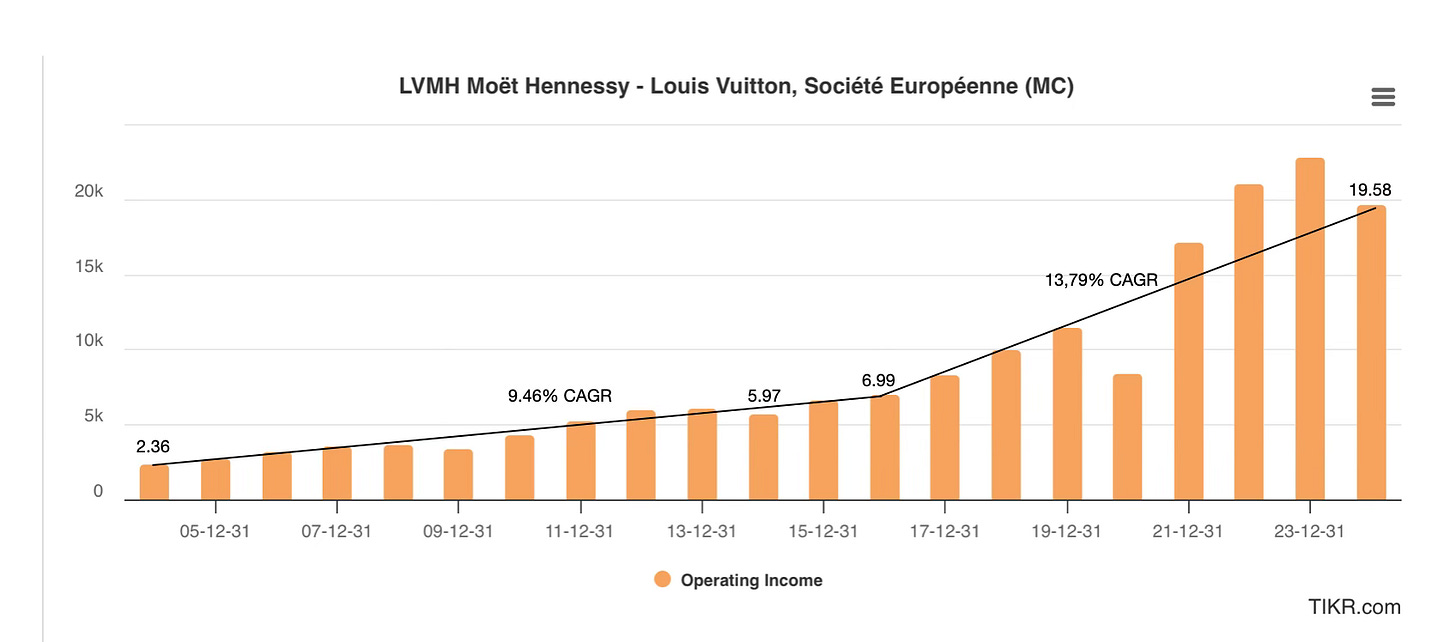

LVMH have grown its operating income at a rapid pace of 13.4% since 2016. It is currently priced at 14x EV/EBIT a 25%-30% discount from historical valuation as if the company’s future growth prospects are gone. I do not believe so. LVMH has compounded operating income at close to 10% from 2004 to 2016 and then at 13% from 2016 to 2024.

Fiserv is a mega consolidator of the merchant payment and banking services. Its clover cloud POS is gaining market share over Square and other fintech and is #1 in NA. It is also a cannibal using its growing 5.5B free cash flow to purchase a lot of stocks. It has come down significantly from the peak and was a good entry for me.

What happened to your TFF position? Did you sell?

Hi,

I love the vinatge year approach. I guess I will do a similar exercise as it offers a very different perspective.

Thanks for sharing !!!