The Danger Zone

A Lollapalooza post covering 15 stocks! Yearly I review the danger zone, stocks that trades at EV/EBIT at over Thirty - ejecting some! to make sure that they do not become 2026 loosers.

Last year’s Danger Zone

Revvin’ up your engine

Listen to her howlin’ roar

Metal under tension

Beggin’ you to touch and go

Highway to the danger zone

Ride into the danger zone

The article constitutes my personal views and is for entertainment purposes only. The main goal of this article is to log my personal views. Nothing in this article or these posts in this blog should constitute an investment advice. The projections and estimates provided here should be considered as purely speculative. Do your own model and projections. Please refer to the disclaimer at the end of this article for more details.

Although some traders might like the adrenaline rush of investing in the danger zone, an investor tend to focus on staying out of the danger zone and avoid loosers. Often times, high growth and compounders get assigned a risen and risen valuation until some hiccups. Once they hit a hiccup, that valuation premium goes into reverse creating a sharp drawdown. A large portion of the outperformance is generated by reducing the number of loosers, not just picking the best winners. Great offense will lead you to the playoff but great defense will get you the Superbowl. Like a lucky pilot ejecting before the explosion, identifying which stocks are in the danger zone and which one belongs to that high valuation zone, is critical.

Every year, I do this exercise:

Identify the stocks in the danger zone

Carefully reviewing them and verify if expected forward earnings justifies the premium and if the state of the underlying industry.

Identify unfavorable industry forces and get out of the way

Last year, 3 stocks that were trading far into the danger zone were sold:

Trade desk was trading at a unbelievably high EV/EBIT of 200 and I sold all on January 2, 2025. I bought trade desk at a PE of 40 in 2018. The stock became a runaway 10 bagger. This year, the stock is down -67%. Tradedesk hit a big hiccup as it became clear that Amazon Prime is consolidating the streaming ads market place. It won a large share of Netflix ads in 2025. I do not pretend to have foreseen this. But what I could see is that there was a clear divergence between valuation and growth in recent years.

Intuitive surgical was trading in the top of the danger zone at a EV/EBIT of 80 and I sold all on January 2, 2025. I bought Intuitive in 2009 at 25 times earnings. This year the stock is up 9%, below market average and much below my average performance. So, considering all the capital gain cost, this might not have been the best move. However, I was able to reallocate the money in much better opportunities.

Amazon was trading at the middle of the range of the danger zone at a EV/EBIT of 35. The expected EBIT growth was around 15% so it was trading at a PEG of higher than 2, so I decided to cut down my holding by 90% in January and February 2025. I bought Amazon in 2016 and Amazon was my largest holding at the end of 2024 and could not risk to hold this large position at this valuation. There was fundamental reasons as well as I published earlier this year. This year the stock is up 5%, well below market average and much below my average performance. Most of the proceeds went to Bombardier and Google, so this was a great move. I will discuss Amazon hereafter.

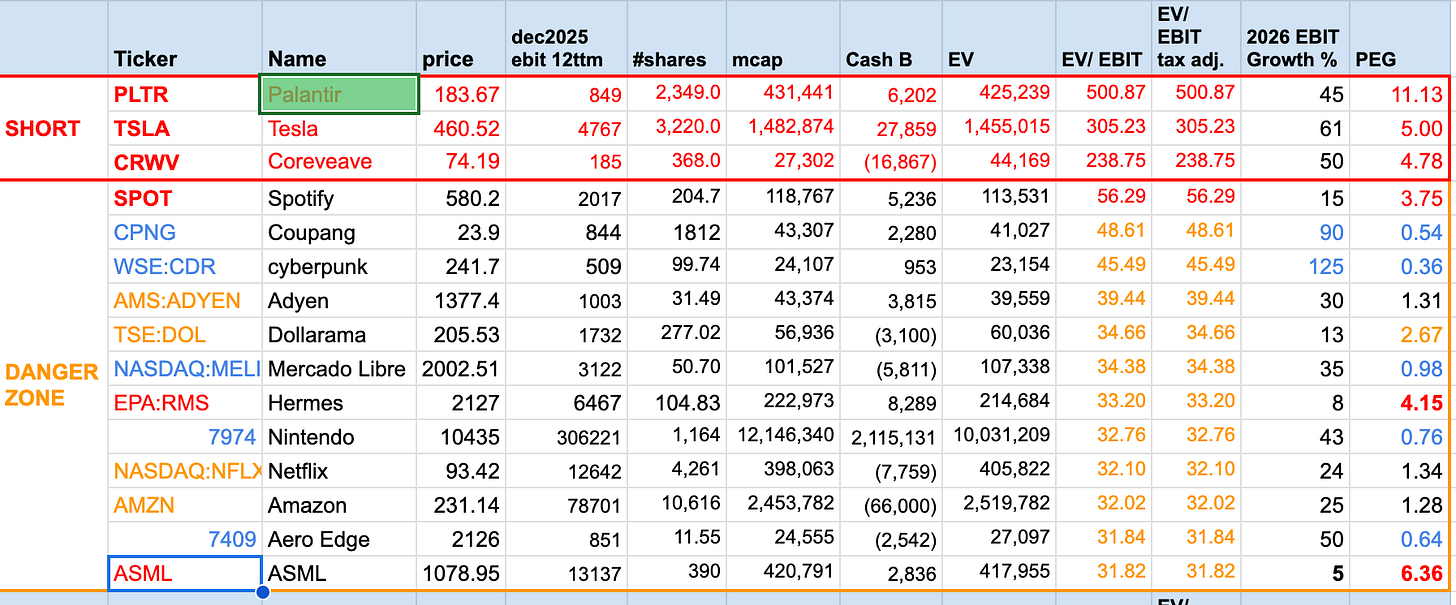

The danger zone table

The following table shows my current holdings that are trading over a EV/EBIT of 30.

The EBIT number is based on the trailing 12 months. So for stocks reporting only twice a year - like Adyen, Hermes and ASML, this means from July 2024 to June 2025. I included the basic number of shares (not diluted), the implied market cap and the net cash level after subtracting the debt.

I have ranked all the stocks based on EV/EBIT. I used tax adjusted EV/EBIT to consider special cases like Bombardier or D-BOX who dont need to pay corporate taxes as they have accumulated a very large amount of tax loss over the years.

I then use the projected EBIT growth for next year based on official estimates if available to get the PEG. Analysts are quite good at estimating earnings in the short term. I do not trust long term guidance. A Price to EBIT to Growth ratio below 2 is fine. Below 1 is a good deal. Higher than 2 is risky.

AI Boom: The Unsustainibility and Unpredictability Factors

Numbers are not the only consideration. Some years I get to identify unfavorable industry forces and try to get out of the way. In my opinion, the current AI boom is unsustainable as the revenue and lack of profits generated by the largest consumers of GPUs (Open AI, Gemini, Anthropic) is an order of magnitude lower (revenue wise) than what is spent in Capex. Current AI funding is provided mostly by non AI earnings (Google search, Microsoft SAAS, Meta ads), debts (Amazon, Meta, Oracle), venture capital (OpenAI, Anthropic) and vendor financing (Nvidia, GPU leases back). I could be wrong and AI revenue might grow 10x again in the next year or 2, but this is not what I am seeing or project right now. Consumers are using chatbot less than 10min per day and only a few % are willing to pay for a subscription. On the business side, AI software coding generation has grown very fast and we have seen rapid wide adoption and but the type of growth seen in 2025 will likely decelerate. Software developers are quick adopters. Once all the excitement subsides, the industry will be faced with the reality of maintaining, adding and optimizing the software automatically generated by AI. This might be terrible. In this business, debugging or adding software that is not developed internally by the team is always a risky and time consuming endeavour. The gain from the code generation may all be lost in software maintenance. Also it is not the first time that SW generation was accelerated. Think of going from punch card to keyboards in the seventies. That move did not replace human programmers. I view this acceleration in coding generation similarly.

Secondly, chips made for LLM AI training and inference are evolving quickly and may not be compliant to future AI algorithms. We are seeing a rapid evolution in both hardware and software algorithm. A few years back all the focus was on LLM training. Now that LLM pre-training is saturated, chain-of-thoughts mimicking reasoning is increasing inference needs. Live search to complement training results is becoming essential. What come next is unpredictable. As such, it is misleading to pretend that chips that were purchase today will have a useful life of 5 years. In contrast, a CPU made in the 2010s is still useful. Both the algorithms and hardware did not evolve that quickly. This is the reason I believe that current depreciation expenses related to GPU are likely under-estimated and thus the AI cost structure is even higher. So both frontier model labs and AI infrastructure company have a much higher cost than reported.

My opinion could be wrong, and the AI industry might be rosier, but one thing for sure, our visibility into the future for this industry is not good.

As an investment theme entering towards 2026, I want to decouple as much as possible from the AI CAPEX boom for these unsustainability and unpredictability factor.

I will go over all 12 names one by one. Please go ahead and comment below if you have a question or a different view on one of those 12 names.

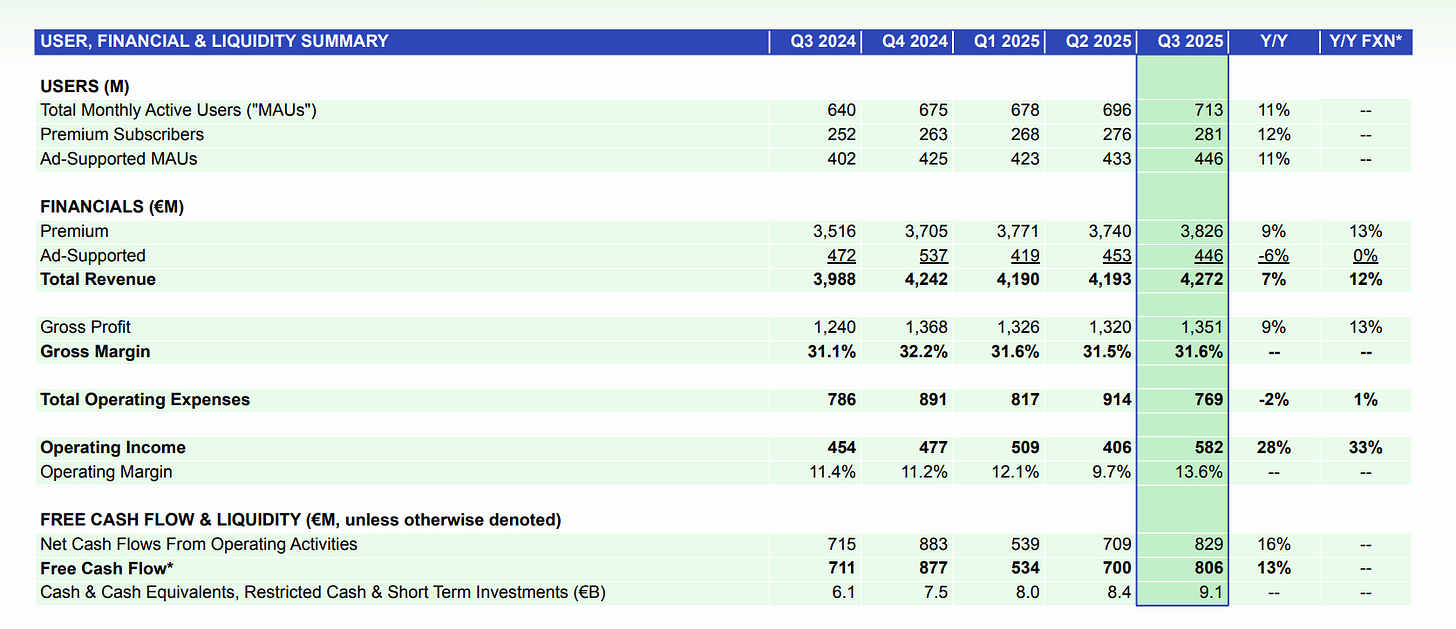

Spotify

Spotify is trading at a very high EV/EBIT of 56. Everything over 50 makes my blood froze.

If you look at the last few quarters, premium subscribers are growing at 11% and related revenue 13%. Ads growth is endemic. The recent stock run-up was a story of margin expansion. I think that story has run its course. Gross margin and operating margin are pretty stable now, so the expected EBIT growth for 2026 should not be higher than 15%. The PEG is getting at a very uncomfortable level of 3.75.

I will thus reduce my holding of Spotify significantly. I believe Universal Music Group and possibly Sony, trading both at roughly 20x EV/EBIT and benefiting from the same industry trend are a better investment. I will therefore use the proceeds from Shopify to buy UMG. Reducing.

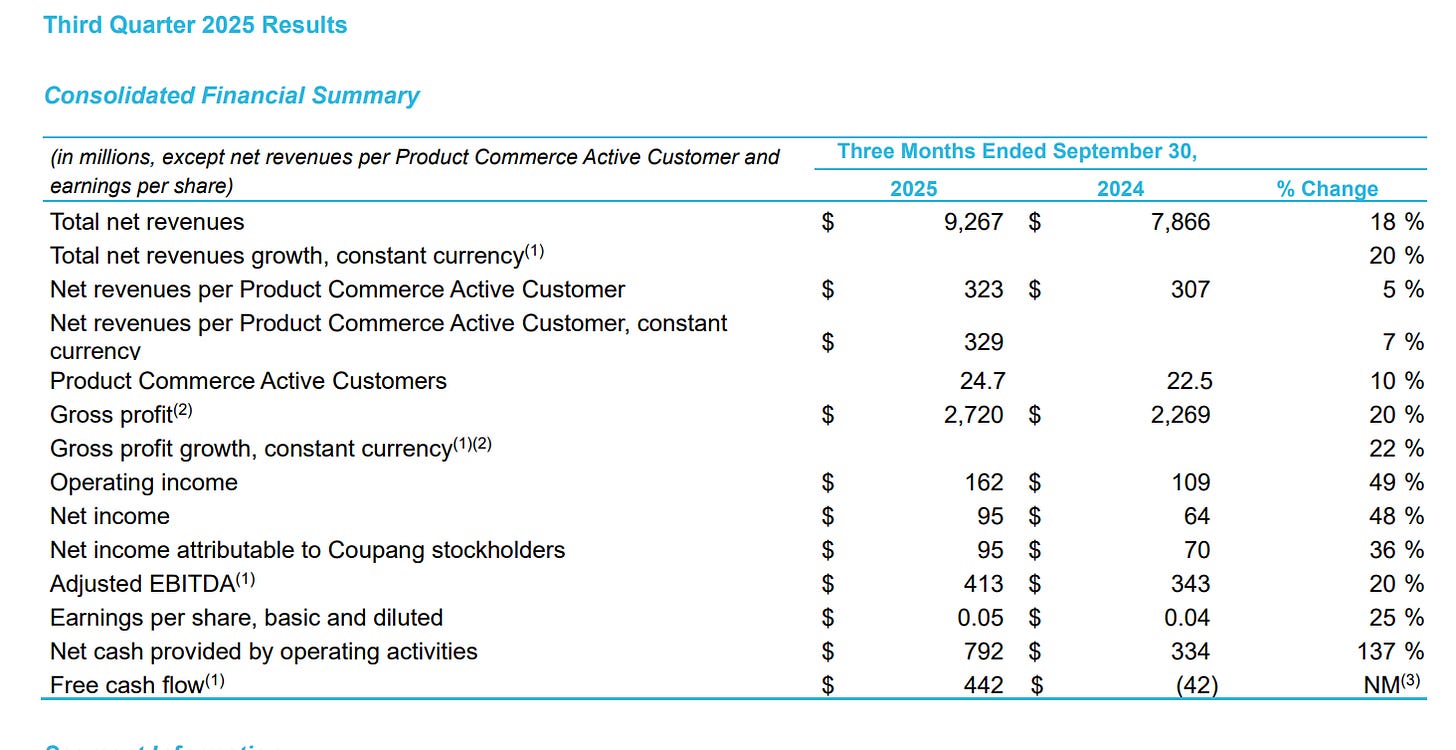

Coupang

Coupang is trading at a very high EV/EBIT of 48. Coupang is the leading e-commerce platform in South Korea and have expanded operating in Taiwan in 2021 and bought the Farfetch platform. Similar to Spotify, Coupang should see some margin expansion over the next few years, as both traditional and developing platform should exhibit better margin. This has been felt in the last quarter where operating income has improved by 50%. Analysts are expecting operating income to improve by 90%. I think by using a more conservative number of 50% based on the latest quarter, we still get a PEG of below 1.

Coupang stock price has come down due to a serious data breach in the last weeks.

As such, I have decided to increase my position at below 24$. Adding.

CD Projekt

CD Projekt is a major video game developer who has created in the last 10 years two exceptional franchises: Witcher 3 which has sold 60 millions copies ranking number 8th of the best selling video games and Cyberpunk2077 , which sold 35million copies. The company is in transition developing the next iterations of its 2 franchises but still able to make a profit using catalog sales. This year, the company sold around 5 million copies of cyberpunk 2077 in the last 12 months. In late 2027, the new iteration of Witcher 3 should come out and should drive more than 500m to 750m operating income per year in 2028, 2029 followed by the sequel of Cyberpunk2077 in late 2029-2030 also generating similar operating income in 2030, 2031. The company is currently valued at 6.5B USD.

If you look at TakeTwo, once Grand theft auto 6 will come out, the company should generate 2 billion USD of operating income per year for the next 3 years trading at little bit higher than 20x-25x operating income of 2026-2028 yearly operating income. My investment thesis is that once the new iteration of Witcher comes out, the company should also get valued at 20x or 25x yearly operating income achieved in 2028-2031. Adding.

Adyen

I have written extensively about Adyen. Current PEG is reasonable at 1.31. Holding.

Dollarama

Dollarama had a great run in the last few years, being up 3x since 2022.

Currently trading at a ratio of 34 EV/EBIT, the stock is trading at its high historical range with a PEG of 2.36. Purchase in 2009, Dollarama is a 50 bagger+ and thus I need to sell a small amount every year. Reducing.

Mercado Libre

Mercado Libre is one of the steadiest growth story in the stock market. MELI has grown 30% yearly in the past 22 years. The best growth story.

The stock has come down recently:

At a EV/EBIT of 34 and a PEG of 0.98, this stock is currently cheaper than historical range. The stock typically trades at 50x range. Adding.

Hermes

Dont have much to say here except that it trades at too high a premium for the kind of high single digit growth. This is a small position that I will remove first thing on January. Reducing.

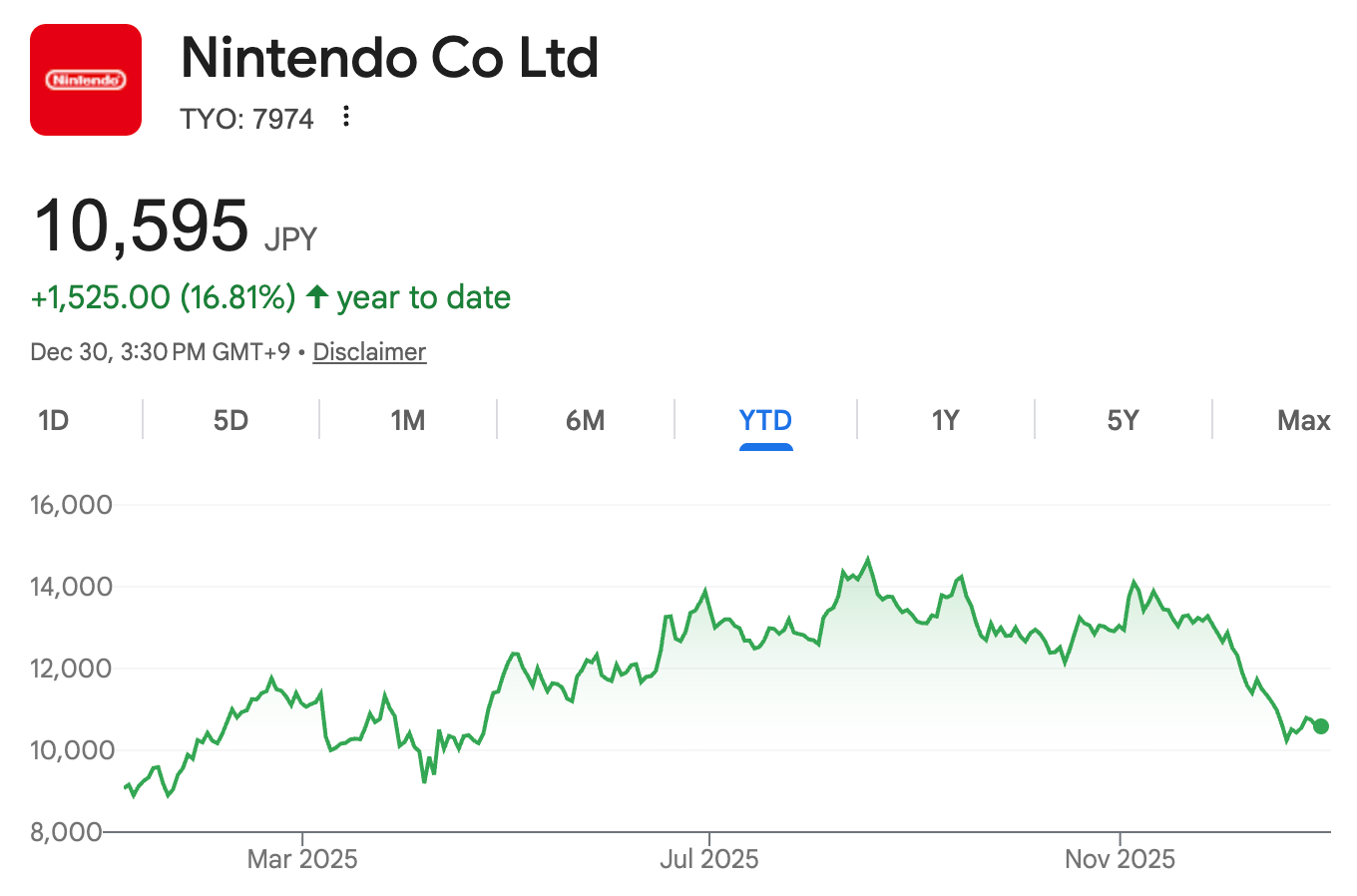

Nintendo

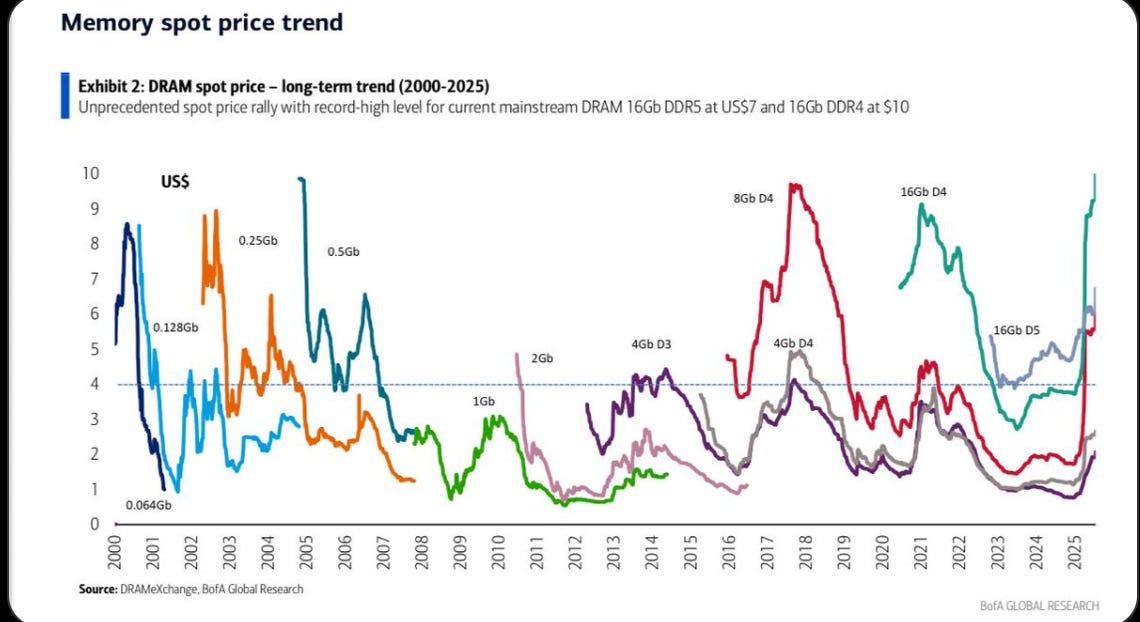

Nintendo should reap the benefit of a full year of the new platform rollout in 2026. Analyst estimates that EBIT should raise by 40%. This should get us to a EV/EBIT based on forward 2026 (ending March 2027) to 23. We have a good visibility of earnings growth for the next half of cycle (2026-2030) on the Switch2. Stocks went down due to memory elevated pricing and impact on the switch 2.

If there is one product that is cyclical is memory. Not this time is not different. h/t @jukan05

So have been adding on weakness with a PEG at 0.75. Adding.

Netflix

Netflix has come down recently. So EV/EBIT is at a more reasonable 32.

Netflix is the dominant streamer. If the Warner Bros goes through, its game over. The HBO and Warner Bros library will be monetize like there is no tomorrow. Youtube is used as a decoy to allow Netflix to claim no domination. If the deal goes through, costly original content will be reduced significantly on a relative basis (subscribers unit cost). This acquisition makes perfect sense. Can’t wait to see it happen. Holding.

Amazon

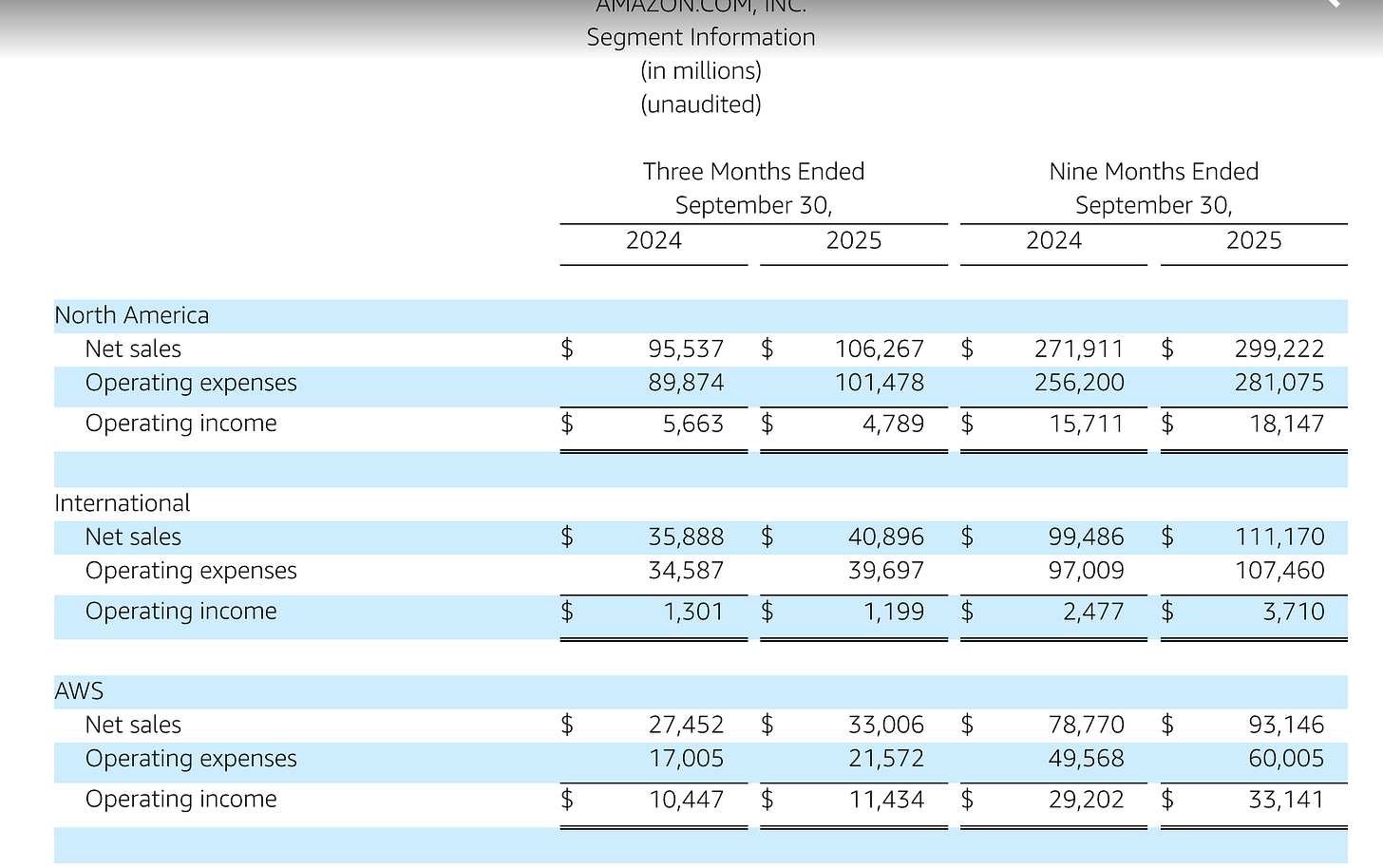

Amazon is trading at a high 32x EV/EBIT. The market is expecting a 2026 YoY growth of 25%, so at first glance this looks okay. However, much of this growth is due to the re-acceleration of Amazon’s AWS business due to the AI buildout.

I believe there is a moderate to large probability that AWS should see eventually a sharp reduction of growth at some point in 2026-2028 timeframe as explained in the previous section. I also think they will return to a shorter depreciation duration as GPU specific hardware becomes a larger and larger portion of the cloud infrastructure leading to a compression in margins. AWS represents more than 66% of operating income and as such Amazon is particularly vulnerable to a AI bust.

As mention previously at the beginning of the post, as an investment theme entering towards 2026, I want to decouple as much as possible from the AI CAPEX boom due to the unsustainability and unpredictability factors.

As such: REDUCING significantly.

AeroEdge

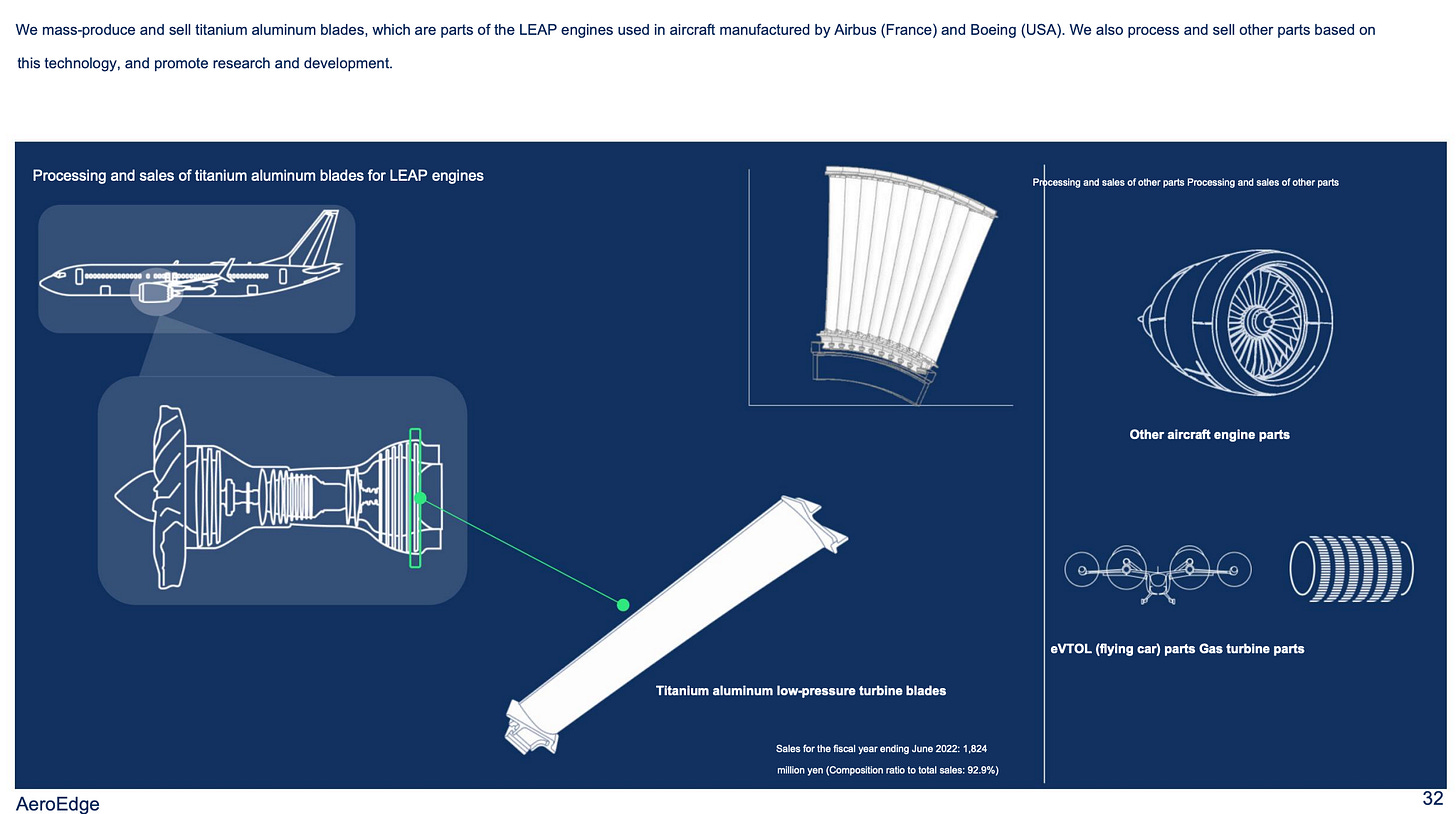

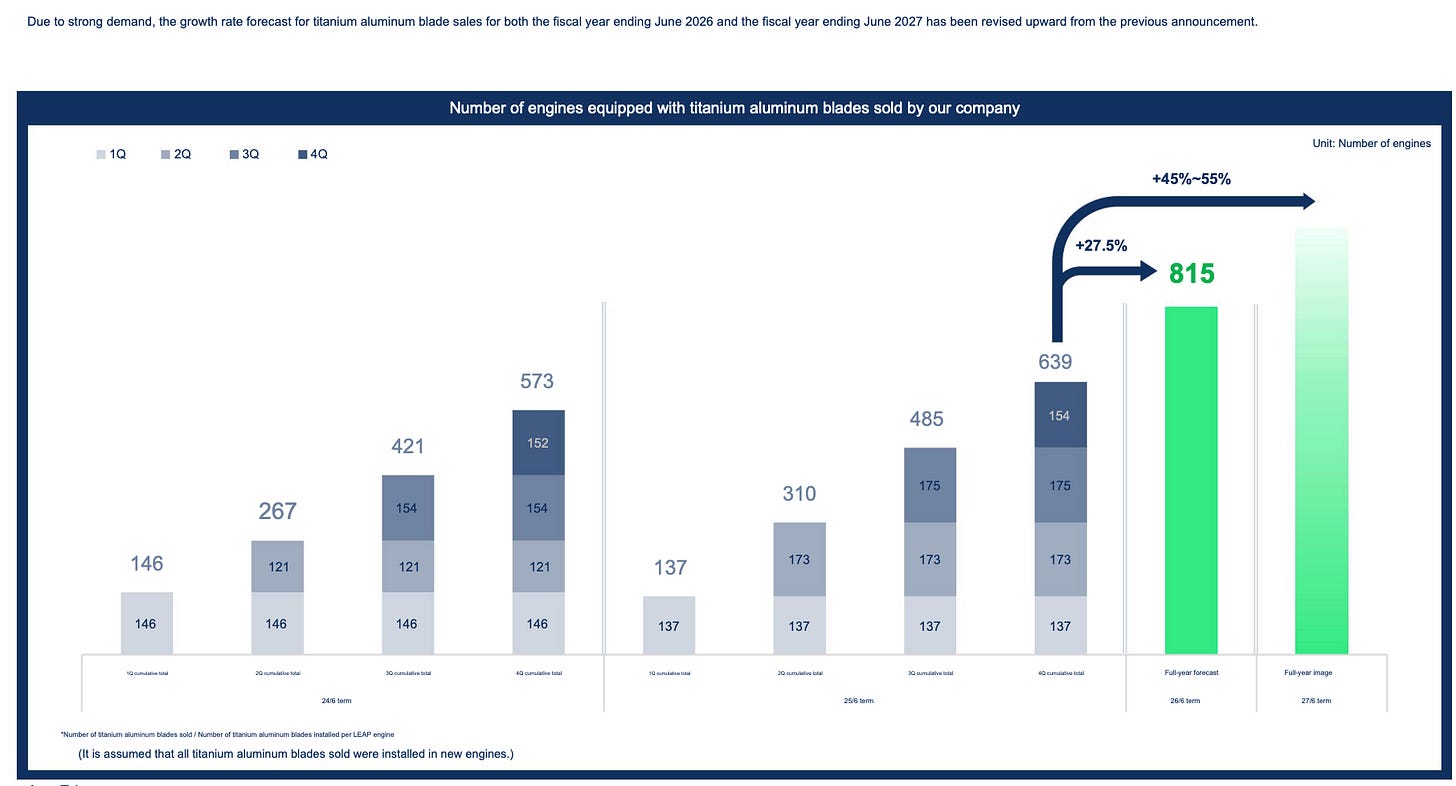

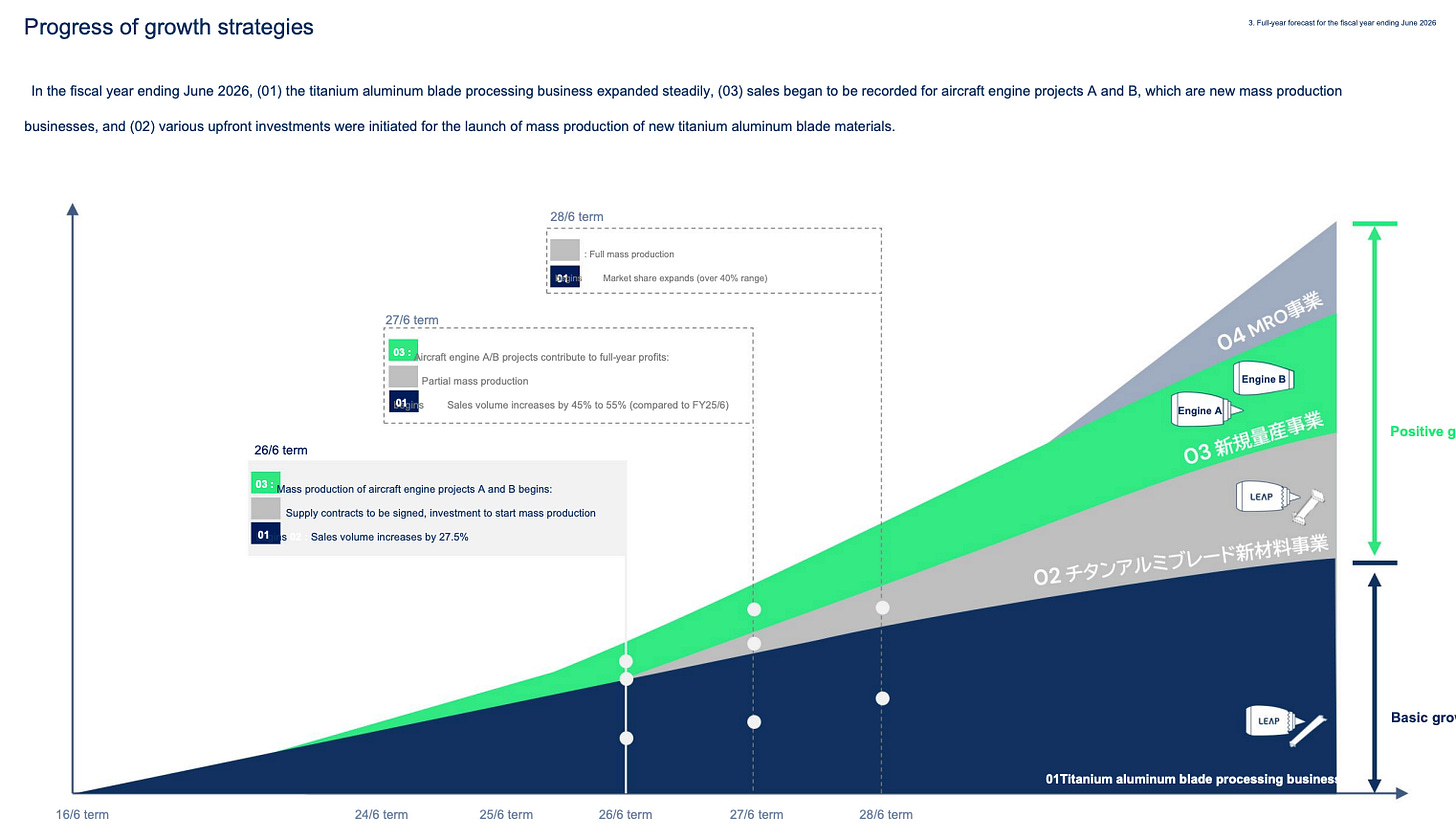

Aeroedge makes titanium aluminide blades for the LEAP aircraft engine, the Low Pressure blades at the rear of the engine as shown below. The exhaust gas, after passing through the high-pressure turbine, still has significant energy. The LPT blades spin as this gas flows over them, converting that thermal energy into mechanical energy. These blades made of titanium aluminide are very complex to manufacture, but are 50% lighter than traditional blades used (made of Nickel). Only 2 manufacturers in the world makes those: Aero Edge and a subsidiary of GE. AeroEdge fullfils 40% of the LP blades market.

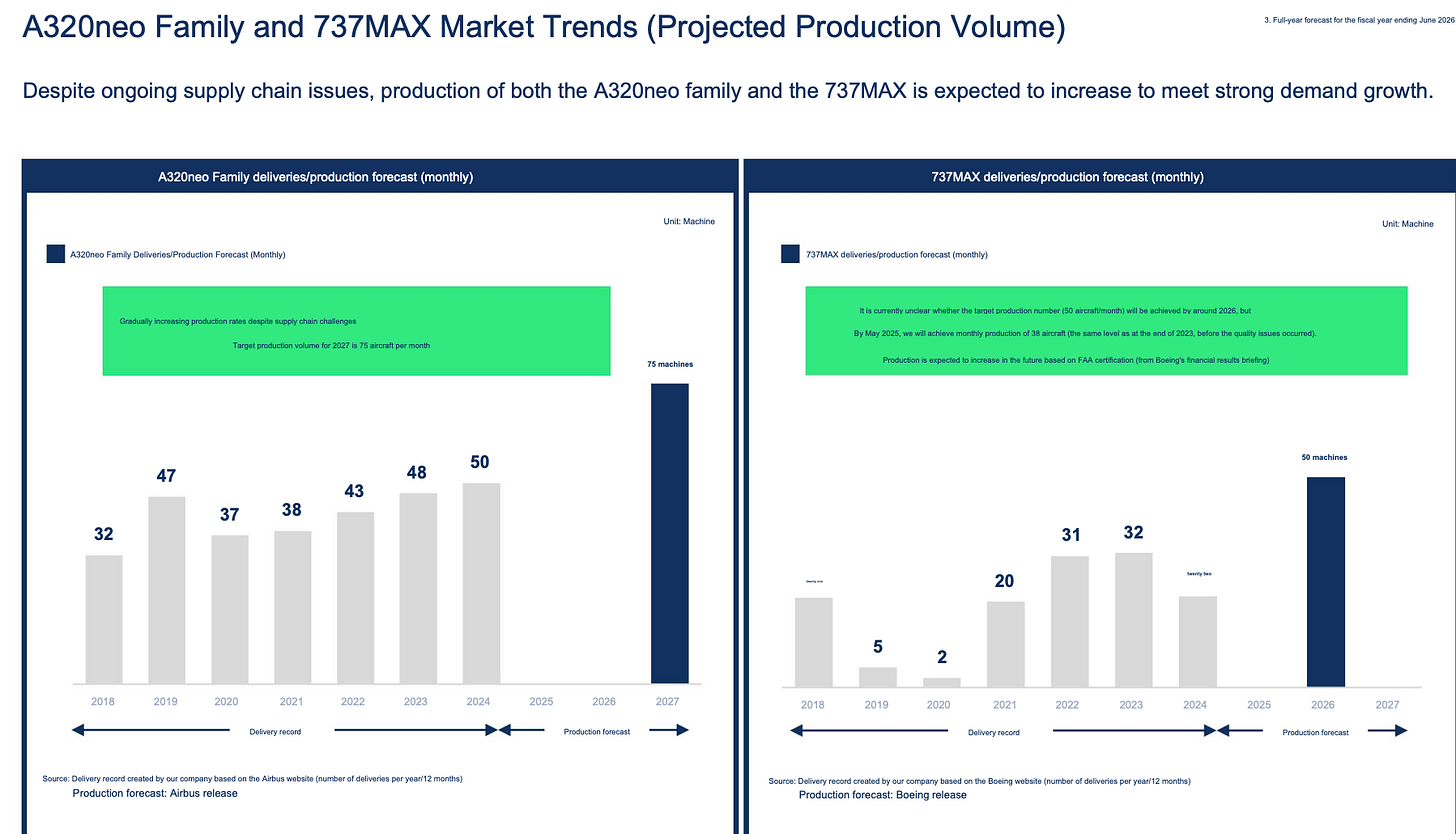

The LEAP engine populates 60% of the Airbus 320Neo and 100% of the Boeing 737Max. These 2 planes represent the vast majority (80% in the case of Airbus) of the total commercial airplane deliveries of Airbus and Boeing. The LEAP engine are manufactured by a joint venture of Safran and GE called CFM International (50% split).

Both the Airbus 320Neo and Boeing 737Max is extremely popular with backlog of more than 12 years ahead. However, both Airbus and Boeing are struggling to increase delivery rates. Boeing is also facing some serious reliability issues so FAA is limiting the number of delivery per month. The increase in rate for Airbus has been slow but more progressive. It should get to 75 monthly planes in 2027. Boeing should reach 430 planes in 2025 (36 planes per month) and 50 planes in 2026. The impact of Boeing production ramp-up is more significative for the LEAP engine since 100% of the aircraft use the LEAP engine.

The company is forecasting a sharp increase of the blades to be delivered in 2026 (+27%) and 2027 (+45 to +55%). This is explained not only by the increase number of aircraft deliveries towards 2027, but also by a new agreement with Safran to increase its share of the LP blade market from 40% to high 40%. This is likely capped to the 50% limit, which is the share of Safran in the CFM International joint venture. GE makes its own blades.

Furthermore, the company has signed a contract with a major engine maker to supply a key component. It could by Pratt and Whitney which also uses titanium aluminide blades for its PW1100g engine used in the Airbus 320Neo. Just speculating. The production of this new contract will start in 2026.

Finally, AeroEdge has internalize the production of the Titanium Aluminide raw material and will start using this raw material instead of relying on Safran.

So we have strong visibility for future profitable growth and as such the current EV/EBIT of 31 is justified and with a PEG of less than 1, we will slowly increasing on weakness. Adding.

ASML

ASML has a monopoly EUV lithography. We all know about the unique position of the company in semi cap. Current projection of growth next year is mid single digit. The fact that ASML cannot deliver to China is a pain point. Anyway, ASML is also quite dependent on the current AI CAPEX boom. As such, since it is trading a a PEG of 6 and as an investment theme entering towards 2026, I want to decouple as much as possible from the AI CAPEX boom due to the unsustainability and unpredictability factors. I will reduce significantly. Reducing Significantly.

Thanks for the write-up.

Very interesting read! Looking at the valuation of my AeroEdge position, I recently asked myself: what would Mr. Long Term Hold do? Guess I have the (somewhat surprising) answer now. So, thanks for that!