$LGT Strategic Review Process

Sumanic, the controlling family holding co, is considering selling its shares and asked Logistec to start a strategic review process including a potential sale transaction.

All figures in this article are in canadian dollars

The article constitutes my personal views and is for entertainment purposes only. This is not an investment advice. Please refer to the disclaimer at the end of this article for more details.

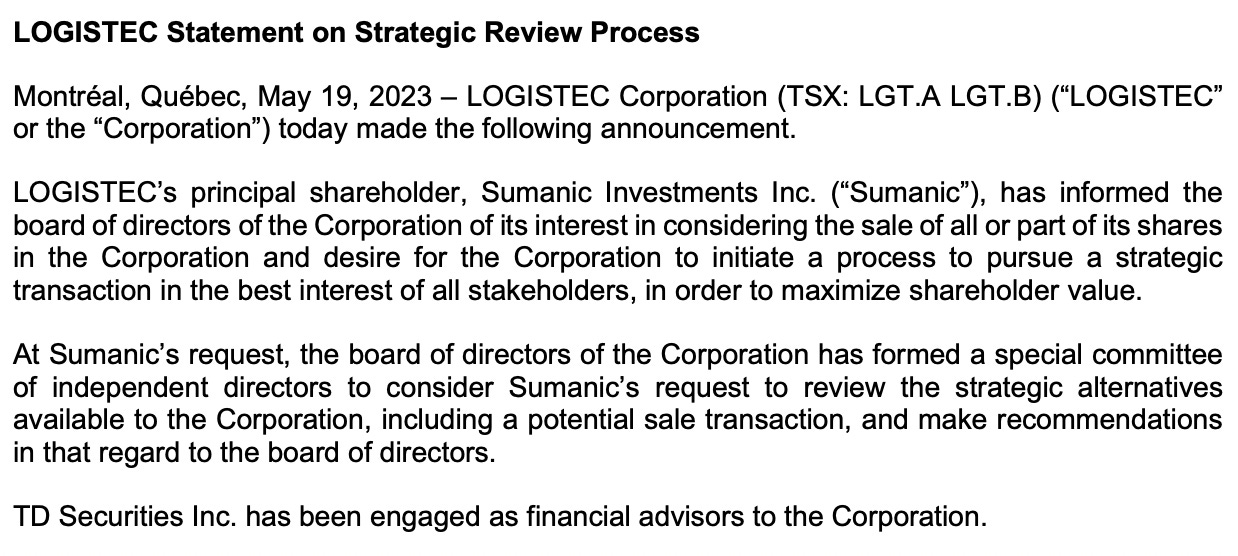

Last Friday, after the close of the market, Logistec sent a brief press release about initiating a Strategic Review Process. The French and English version is included here in case something was lost in the translation.

Sumanic, the controlling family holding co, has 45% of the total shares (A and B class) and 76% of the votes.

The main piece of news here is that the family is officially willing to sell its shares and any large entity can buy Logistec at the right price.

Logistec is currently trading at a historically low in terms of PE - PE of 11 and EV/EBITDA. Most acquisitions of infrastructure assets are priced using EV/EBITDA benchmarks.

Warning: This is just my initial thoughts, based on some reflexions during this week-end… Trading this stocks based on the probability that a deal goes through is actually very speculative at this early stage. Due your own due diligence. This is not a recommendation to buy or sell this stock.

Calculating current EV / EBITDA

What is the correct EV/EBITDA?

The sites like Koyfin, Tikr are all over the place in terms of EV/EBITDA.

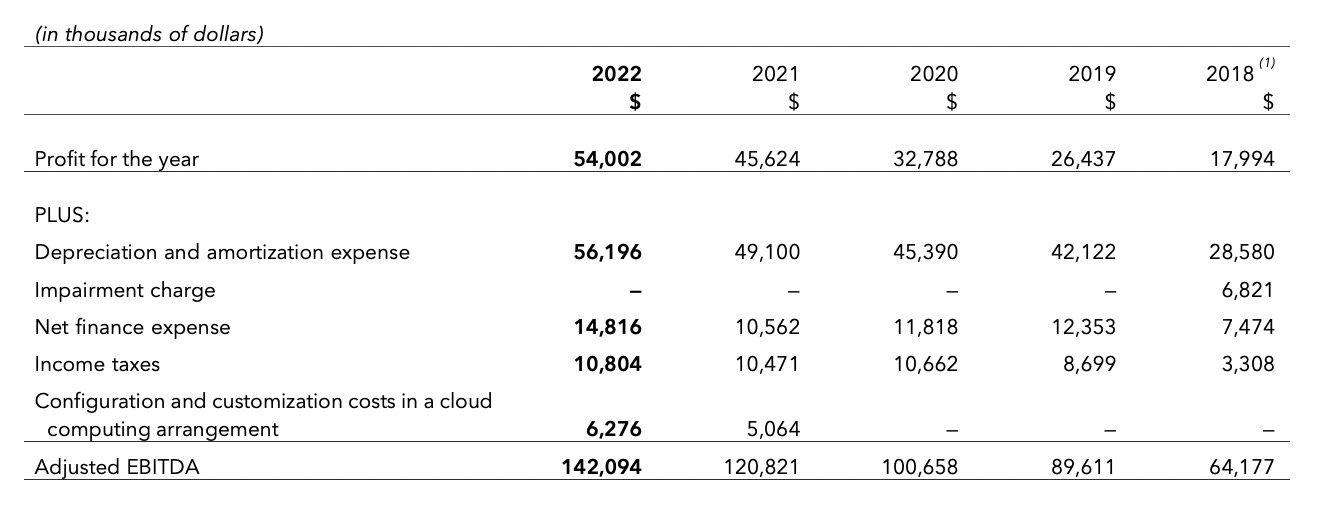

Based on the 2022 annual report, here is the company adjusted EBITDA:

My view is for the real EBITDA, I would simply removed the configuration and customization in a cloud computing arrangement. So,

EBITDA = $135.8 million.

There are 12.8m shares in circulation. At 43.8$, the market cap is $561 million.

The long term debt is $235 million if you include the current portion. I do not believe that lease liabilities should be included in the EV or total debt as it is part of the normal operating expense of a maritime terminal to pay leases. Contract assets and contract liabilities are about the same so we should also exclude. The same with trade and other receivables ($198 million) versus trade and other payable ($128 million). Cash of $36 million should be included in the EV calculation.

EV = market cap + LT debt (including current portion) - cash.

EV = $760 million.

So Logistec is currently trading at 5.6 EV/EBITDA.

Why Sell Now?

As such, Logistec has rarely traded that low in terms of EV/EBITDA. I am also expecting that in 2023, we will see a major expansion of EBITDA due to strong numbers from the environment segment (last year was a underperforming year). We will probably get to the $155 million range of EBITDA. I am excluding Fednav from the 2023 calculation. I think Fednav will be neutral or slightly dilutive in terms of EV/EBITDA ratio. Logistec likely paid more than 5.6 times EBITDA!

I am surprised that the family has decided to sell now at a historical low in terms of valuation. I would have rather be more patient, grow the earnings again in 2023 as expected, probably get the EPS is the 5$ or 5.50 range, showing the market that Logistec is a steady compounder and get the market to value the stock as is. In other words, by showing steady performance, get the stock to trade on its own in the PE of 15 or 8-10 EV/EBITDA then put the company on sale.

As you see, Logistec as steadily increase the EPS since 2018 low point. I estime we could get in the 5$ EPS range in 2023.

But, I am not the one deciding the timing here… Last year, Logistec started to do quarterly calls - a first. It probably means that the intention to sell was in the works already last year. Now, it is hiring TD Securities for a strategic review. Clearly, the family wants to sell. It may have gotten some informal offer. It may not have.

I am a long term holder. I have owned Logistec since early 2013. I think Logistec is worth at least 8-10 EV/EBITDA. I believe the family also think the same. They have been doing acquisition at these levels on the market.

Bolloré Africa Port terminal acquisition - Peer evaluation

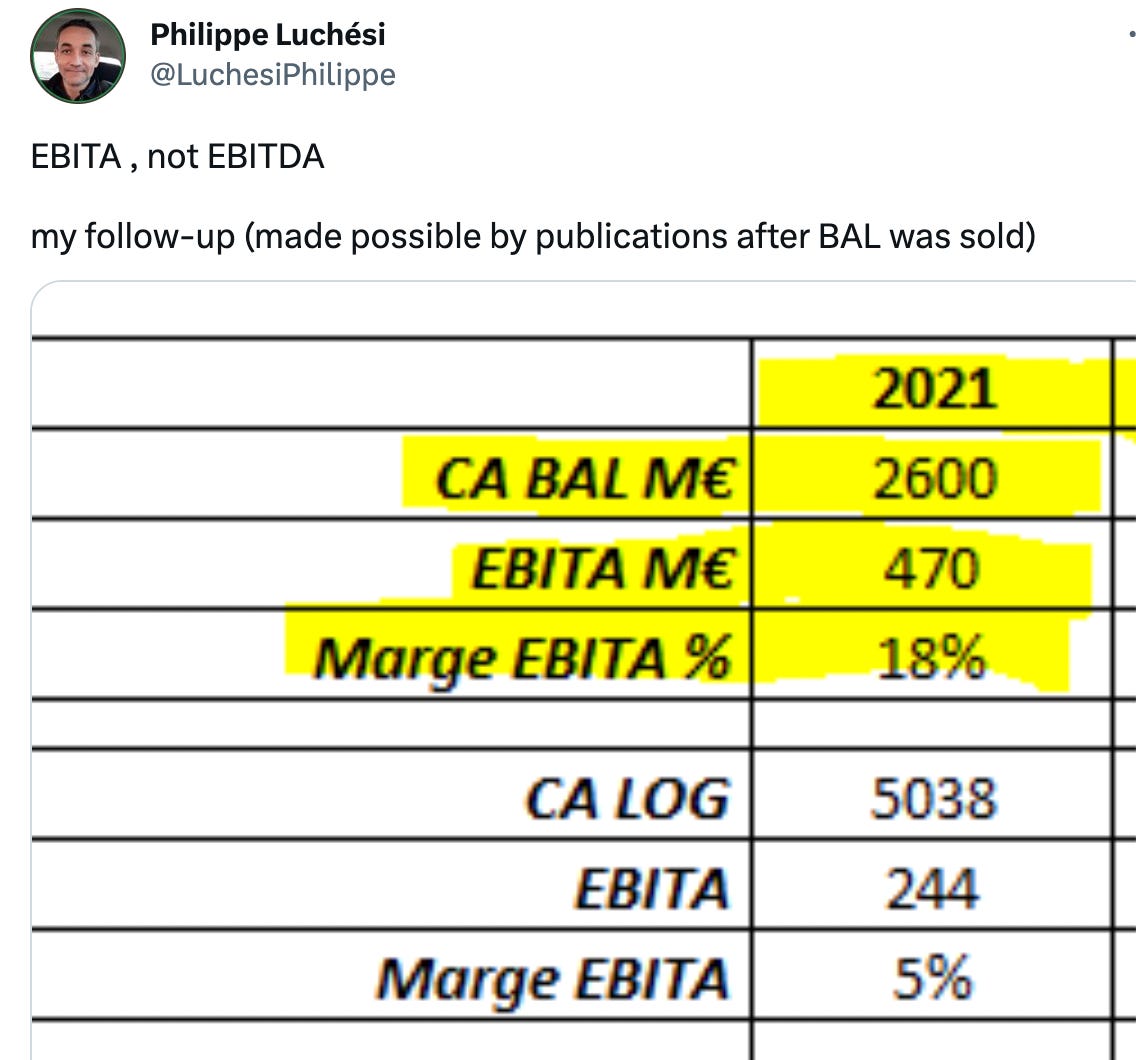

MSC Mediterranean Shipping Co. a close partner of Logistec, agreed to buy the African transport and logistics business of Bollore SA for 5.7 billion euros. The transaction was closed recently, so the pricing is not to off from current market pricing which is influenced downward by the higher interest rate. It is also very relevant, as Bolloré has built a network of terminals in Africa over several decades, and as such a network of terminals as a much higher value than a simple terminal, both in terms of scale and diversity. It is also very relevant since MSC could be a potential buyer.

According to Philippe Luchési, who is following Bolloré very closely, the priced paid was 12.4x EBITA. So depreciation was excluded from the ratio. Amortization was $7 million in 2022 for Logistec. Since D&A was $56 million in 2022, depreciation is estimated to be $49 million which is actually aligned with the capex expense in 2022 (i.e. $49 million). As such, Logistec earned $95 million of adjusted EBITA. At 12.4x EBITA (based on the same pricing that MSC offered Bolloré), you get an EV of $1178 million. This is equivalent to 8.7 x EBITDA in the context of Logistec.

Who could be the buyers?

The major Canadian pension funds have been buying port infrastructures all over the world. Here are the major players:

Caisse de Dépot et Placement du Québec (CDPQ)

The CDPQ has been very active in buying port infrastructure. This is an attractive asset for pension fund. It is a close partner of DP World. Here are some of the deals:

June 2022: CDPQ will invest US$2.5 billion in the Jebel Ali Port, the Jebel Ali Free Zone and the National Industries Park through a new joint venture in which it will hold a stake of approximately 22%2, with the remainder of the transaction being financed by debt.

CDPQ partnered with DP World to create a US$3.7-billion platform to invest in ports and terminals globally. DP World holds 55% of the platform and CDPQ holds the remaining 45%. The investment vehicle will be seeded with two of DP World’s Canadian container terminals, located on the Pacific Coast in Vancouver and Prince Rupert, with CDPQ acquiring a 45% stake of the combined assets for CA$ 865 million (US$ 640 million).

CDPQ already owns 13% of Logistec. So they will be involved in whatever deals occur as a seller or as buyer. It is possible that CDPQ purchase Logistec via the DP World / CDPQ partnership.

Canadian Pension Plan Investment Board (CPPIB)

The CPPIB has an impressive array of infrastucture assets, as one can see in the link https://www.cppinvestments.com/the-fund/our-investments/investment-real-assets/

They own several highways but also two large port infrastructure:

Ports America (investment estimated at $3 billion USD)

Associated British Port ($1.6 billion)

Ontario’s Teachers Pension Plan

Ontario’s Teacher has been early in the game of purchasing port infrastructure. It bought in 2006 four North American container terminals from Orient Overseas for $2.35 billion to tap rising sea cargo demand. The pension fund bought terminals in New York and New Jersey, as well as two in Vancouver. They paid a very high price of estimated to be 22 times EBITDA. These 4 terminals are now part of GCT.

Ontario Teachers' still holds 37.5% of GCT, Headquartered in Vancouver, GCT operates four Green Marine certified terminals in two principal North American ports. Through GCT USA on the East Coast, the company operates two award-winning facilities: GCT New York on Staten Island, NY and GCT Bayonne in Bayonne, NJ. On the West Coast, GCT Canada operates two gateway terminals: GCT Vanterm and GCT Deltaport in Vancouver and Delta, BC.

The pension fund could decide to merge Logistec’s 90 port terminals network into GCT.

Other potential buyers:

The large container shippers (MSC, Happag-Lloyd, CMA) have been diversifying by buying port terminals. Logistec has a very close relationship with MSC, the current partner in Termont Montréal, so that could be a potential buyer.

What if Logistec gets an offer at the 8-10 EV/EBITDA range?

Based on Bolloré Africa pricing and other equivalent purchase, a 9 times EV/EBITDA should be a fair market price for Logistec. At this price this represents an EV of $1181 million based on trailing 2022 numbers. This excludes Fednav. I would treat Fednav as neutral (non accreditive), since Fednav was probably acquired at around the same ratio. So I decided to exclude both the debt and the value of Fednav. An EV of 1181 million, assuming a net debt of $199 million (LT debt+current portion-cash), we get a stock price offer of 76$.

Now, if the strategic review drags on and 2023 numbers need to be considered, the better performing results from the environment business which is expected in 2023, should bring the EBITDA to $155 million according to my estimate, so we could get an even better offer.

What are the strategic options

The special committee could one of these scenarios - the first 2 options more likely and in this order of priority:

Scenario 1: Selling the whole company at an attractive price in the 9-10 EV/EBITDA range in the $1200 million range ($1350 million with Fednav)., which would represent an almost double in stock price (see spreadsheet in the previous section).

Scenario 2: Sell the environmental segment for a good price at around 7-10 EV / EBIT. 2023 EBT is projected to be in the $30 million in 2023. This could bring $250 - $300 million. The PFAS solution that Sanexen has developed might attract large players in the environmental field. With the proceeds, payback some of the debt (or not) and make a tender offer (like Dutch auctioning) for a large portion of the shares (e.g. 30%+). This will allow Sumanic to sell 30%+ (e.g. 3.5m shares at 60$ equals $210 million ) of their shares at a good premium from today price. A 55-60$ Dutch auction offering for example.

This will result in a pure port infrastucture play with a much reduced number of shares. Should be accreditive to EPS since this unlocks the value of the environmental business. Management may want to crank up the dividends to 4-5% to make it as a public infrastructure play like $BIP Brookfields Infrastructure Partners. BIP 0.00%↑ trades at a EV/EBITDA of 12. So Sumanic could sale slowly their shares at a even higher premium. And existing shareholders who are patient like me will continue to enjoy the long term value creation of this business while cashing a 4% dividends.

Scenario 3: Logistec is not able to sell the port maritime nor the environmental business at a fair price. It takes some debt to do a dutch offering to take out 25% of the shares at a premium - 55$. This is totally justified since Logistec is so undervalued. Allows Sumanic to sell a portion of the shares. This will be accreditive in terms of EPS. It could evaluate options like spining off the environmental segment with some of the debts. Then become a pure play port infrastructure and follow the playbook of BIP 0.00%↑ as explained in scenario 2 to enjoy a higher valuation.

Conclusion

The Family holding a majority of the votes wants to sell

Logistec is very undervalued

There are some interested buyers (Canadian pension funds)

Would buyers agreed to pay a big premium from current price? This is what I am the most worried - Buyers are anchored by the current price.

Sellers on the contrary probably wants a fair price (9-10 x EV/ EBITDA) so will not agree to a low ball offer with a classic 30-40% premium from current price.

Other strategic options like selling part of the business like the environmental business may create even more values to the shareholder.

Due to 4 and 5, I think that the probability that a deal goes through at a fair price might not be very high…… dont rush to buy the stock at high risen price …a lot of strategic reviews end up in a statu quo… The probability that a deals go through should be factored in any purchase. The probability that a deal happens is very uncertain at this early stage . I suspect a very wide gap in terms of sellers fair price and buyers willingness to pay the fair price so from that point of view a deal might not happen at all.

The family should consider other alternatives where they will get even more values out of their shares it they are more patient or if they sell the environmental business and do a dutch auction as explained before (scenario 2)

This is just my thought fresh from some reflexions during one week-end… This post may not aged well… Take these conclusions with a grain of salt! Do your own due diligence, do not rush into this.

Your thoughts or comments are welcome … My dream would be that shareholders like me would start a long thread into this blog to discuss the merits and the probability that a deal goes through and what form it will take!

Let me know if you liked this post as well..

Disclaimer: The above article constitutes my or the authors’ personal views and is for entertainment purposes only. It is not to be construed as financial advice in any shape or form. Please do your own research and seek your own advice from a qualified financial advisor. The authors may from time to time hold positions in the aforementioned stocks consistent with the views and opinions expressed in this article. The information provided in this article is not making promises, or guarantees regarding the accuracy of information supplied, nor that you guarantee for the completeness of the information here. The information in this article is opinion-based and that these opinions do not reflect the ideas, ideologies, or points of view of any organization the authors may be potentially affiliated with. The authors reserve the right to change the content of this blog or the above article. The performance represented is historical" and that "past performance is not a reliable indicator of future results and investors may not recover the full amount invested

Fantastic post (as always). I also worry most about the timing. Right now is not the optimal time to sell the asset. Infrastructure assets right now are clearly under some stress due to rising interest rates.

As a relatively new investor, I hoped that the CEO would have a couple of more years in the tank to realize the full value.

I really need to rethink my investment case here.

Thanks for starting this thread. Like you, I have been a shareholder for 10 years and I saw LGT as a perfect pillar in my portfolio (safe, well managed and an asset light token-taker model that handles inflation well).

I have to admit I am not very happy with the timing of this strategic review. I have been burned in the past with a company with similar characteristics being put on sale at a low valuation low and I really felt like I lost a great company for too low a price.

I like your 3 scenarios but I am quite worried that strategic review triggers bids with a 40% premium which brings us at a poor ~7 EV/EBITDA which is inferior to large periods where the stocks has been in the last 10 years. Loosing Logistec to a paltry one time 40% jump would be a sad outcome from my perspective. Cross my fingers.