Japanese Stocks Series Part II - AIT Corp $9381 and other Attractive Logistics Companies operating in Japan

Since both Clasquin and Bolloré Logistics are being taken out by MSC and Hitachi Transport Systems by KKR in Japan this year, buying attractively priced Logistics stocks could be opportunistic

Background - Japanese Stock Series Part II

Strategy: The Japanese stock market have been a fertile ground to find attractively priced stocks of good business with cash rich balance sheet.

The article constitutes my personal views and is for entertainment purposes only. This is not an investment advice. The projections and estimates provided here should be considered as purely speculative. Do your own model and projections. Please refer to the disclaimer at the end of this article for more details.

This analysis will go through Logistics companies trading in the Japanese stock market. I will use the same criteria as stated in PART 1 :

1) Bullet proof balance sheet with net cash>25% of market cap and little debt

2) Robust and good business

3) Attractive operating income yield compare to peers

4) Lt Rev and EPS growth

5) >10B yen cap

Screening the Air Freight and Logistics Industry

The following is a list of the Air Freight and Logistics stocks trading in japan with positive revenue growth over the last 10 years. This list is not exhaustive, as other Logistics companies might be under another industry name but it is a good start for a foreign investor. I used koyfin screener to generate the following:

Twelve companies in the industry were identified with positive revenue growth over the last 10 years. Key ratios were captured such last 12 mo PE ratio, Revenue CAGR over the last 10Y, Net income CAGR over the last 10 years, Current EV/EBITDA ratio, the Cash and Short term investment securities (cash equivalent) in million USD, Net debt and the Long term Debt.

In the last column, we have calculated the ratio of cash equivalent minus long term debt over the market cap. As a necessary criteria for Japanese stock selection, we want to have a bullet proof balance sheet with net cash of over 25%.

As such, only 5 stocks out of 12 have met this stringent criteria:

AIT Corporation $9381

The Keihin Co $9312

Tonami Holding $9070

Hamakyorex Co $9037

Chuo Warehouse $9319

All these companies belongs to the small cap or the micro cap segment.

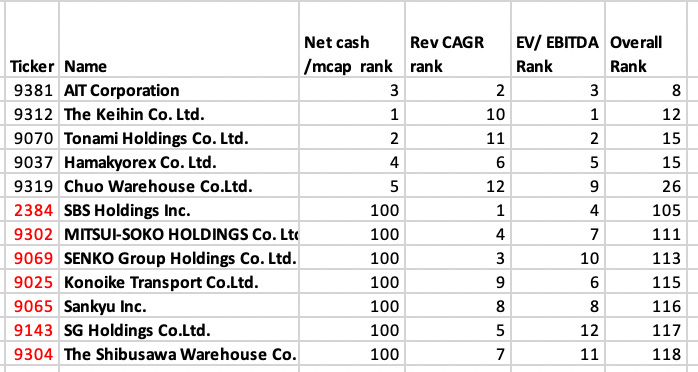

We then ranked each companies based on 3 criteria:

Cash Rich: Ratio of Net cash over the market cap

Revenue Growth: CAGR of Revenue over 10 years

Operating income yield: We have chosen the EV/EBITDA

We have ranked each companies based on these 3 criteria :

The overall rank is the sum of the ranking, the lowest the better. For companies not meeting the cash rich criteria, we have assigned a very large number (i.e. 100) to discard the company from the overall ranking. We have lowered our minimum level of cash rich ratio to 0.2 in this instance to include Hamakyorex and Chuo Warehouse in our analysis.

Over the next few weeks, I will go over those 5 companies, looking closely at qualitative aspects of the companies in terms

Cyclicality of revenue and earnings

Quality of the business in terms of margins, RoIC (excluding cash) as well as whether the company is operating in asset light business or asset heavy.

Shareholder composition and payout ratio

AIT Corporation $9381

This week, I will concentrate on the highest rank Logistic company based on my core criteria. AIT Corp scored very high on the 3 core criteria as shown below:

Cash rich (Net cash / market cap) : 40%

Revenue growth (10 Years CAGR) : 12.8%

Operating income yield (EV/EBITDA): 4.5

AIT Corporation is an asset lite freight forwarder very similar to Clasquin. The majority of the volume is centered around the logistics of shipping goods from China to Japan mostly sea freight. The following maps shows the number of offices in each country or region. Ocean freight forwarding on China routes to Japan accounts for the largest share of the AIT Group’s cargo volume. China is the largest trading partner of Japan with around 24% of commercial imports and exports. AIT has concentrated since the beginning of establishing trading bases along the coast of China.

AIT focused on sales activities that leverage the Group’s ability to provide integrated services extending from international freight forwarding and customs clearance to delivery. AIT is working closely with overseas group business sites to provide customers with useful information about logistics.

In 2023, the number of containers handled in the sea freight sector decreased 9.3% from one year earlier to 242,407 TEU for imports and the total for imports and exports decreased 7.9% to 258,302 TEU. Customs clearance orders were lower than one year earlier, decreasing 7.4% to 135,176 because of lower ocean freight volume. However, operating income has raised in 2023 from the previous due to healthy margin and reduction in operating expenses.

Cyclicality of revenue

Lets look at how revenue increased since 2005:

Revenue did increase steadily at a CAGR of 16% since 2005. Surprisingly, revenue does not seem to be very cyclical. There is an acceleration of revenue growth since 2020. There are 2 factors in play here:

AIT Corporation acquired Nishin Transport in 2019 from Hitachi Transport System in exchange of 20% of shares. Then, KKR bought Hitachi Transport System, thus this explains why KKR owns 20% of AIT Corporation. More on Nishin Transport later.

The COVID period created significant logistic challenges which have allowed freight forwarder to increase their commissions on shipping rate. Although freight cost has returned to normal, the commissions pricing earned by freight forwarder has remained strong and have not return to pre-COVID level.

Here is the LTM quarterly revenue line since 2011. Quarter over quarter sales is very smooth except the last few quarters. This is impacted by freight rate as freight rate is included in the gross revenue.

More significant is the gross income, which includes only the commissions that AIT charges to the customers. Annual gross income since 2005. Very smooth.

LTM Quarterly revenue line since 2011:

Very smooth growth with a bit of weakness in the last few quarters due to a return to normal after the COVID era.

Cyclicality of Income

The following is the operating income since 2011. We can observe that margin was relatively stable at a range of 6.5% to 8% between 2011 and 2016 and recently since 2022. So current margins are consistent with the 2011-2016 period.

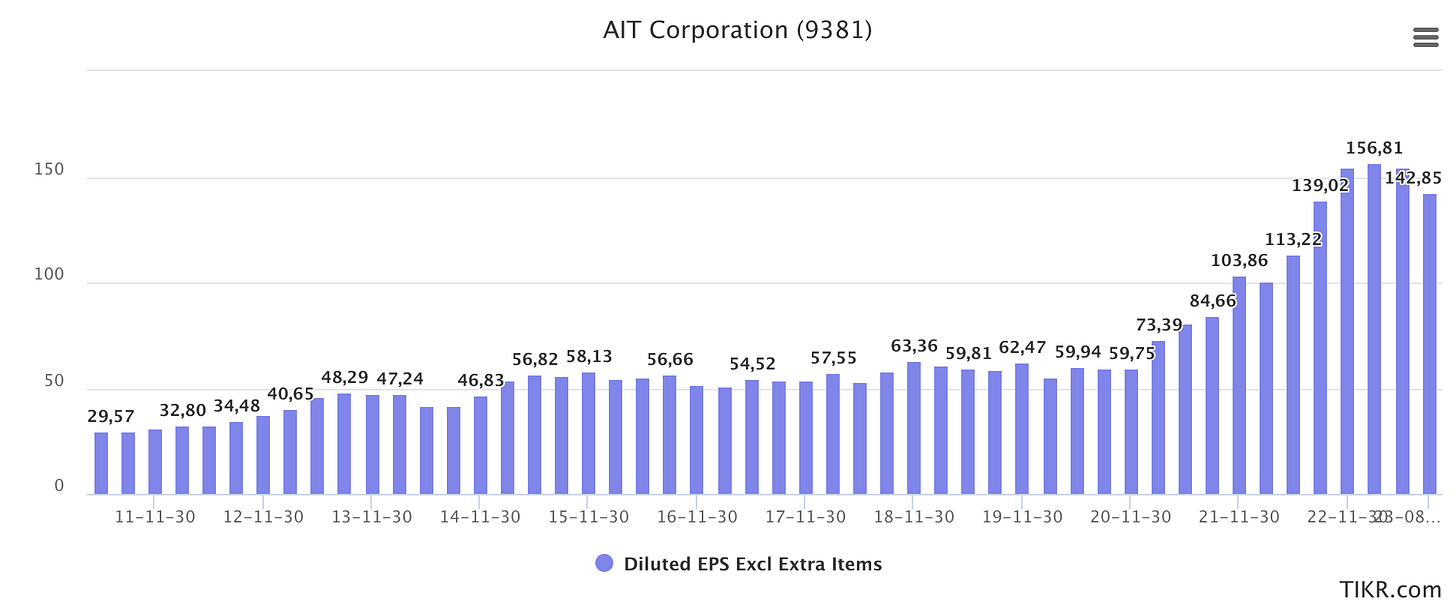

If we look at net income and EPS, we can observe that EPS has been consistently growing since 2006.

The LTM quarterly EPS is also non cyclical and smooth. It has raised 5x since 2011.

Please note that even if 12mo trailing have come down a bit in recent quarters, the company is still guiding for an EPS of 157yen for fiscal 2024. So AIT is trading at a PE of 10.6 on expected EPS. If we remove the cash 663yen per share from current price, this result in an adjusted price of 1015yen and an adjusted PE of 6.4.

Historical valuation

AIT group has historically been trading at a PE of at least 15x earnings. So at a PE of 10-11, AIT group is trading at a large discount to historical average.

Very strong RoIC

AIT group being a pure play freight forwarder with no hard assets, the RoIc should be expected to be high.

In 2023, the operating income minus tax = 3467 million yen

Total assets minus cash = 9242 million yen

As such RoIC = 37.5%

RoE = 22.5%. A very large portion of the equity is cash equivalent.

Comparison with Clasquin

Clasquin is currently trading at 123 euro per share. Based on the 325m euro EV takeover price from MSC, Clasquin’s shareholder should get around 136 euro per share.

I would like to do a quick comparison of AIT Corp with Clasquin. I will use Clasquin current price to make thing easier. I converted all numbers in euro. Clasquin proposed buyout price from MSC is a fair market value based on large peers comparable. So it is a good comparison of market value.

You can see that AIT gross income is 58% of the gross income generated by Clasquin. However, AIT Corp has a better cost structure with EBITDA a bit larger than Clasquin (35m euros versus 33m euros) even with a lower gross income. In terms of EV/EBITDA there is no question that AIT is much cheaper than Clasquin (4.7 versus 8.4) representing a 44% discount to Clasquin.

If you consider the projected EPS of 2024 (ending in February 2024 for AIT and December 2023 for Clasquin) of AIT Corp versus Clasquin, the comparison is even better. AIT Corp Management sees EPS being stable for 2024 versus 2023, where analysts are expecting Clasquin to have a sharply reduced EPS - estimates of 5.87. On projected EPS, AIT Corp is trading at a 49% discount.

In summary, AIT Corp is of smaller size than Clasquin (in terms of volume), but it capable of earnings more and is trading at almost half the value to Clasquin in terms of projected PE and EV/EBITDA. You basically paying for Clasquin at an equivalent price of when Clasquin was trading at 60 euro range and you have a bullet proof balance sheet.

AIT - Shareholders

The largest shareholder is the president of the company with 32.7% of the company. KKR also owns 20% of the company. These shares were acquired when KKR purchased Hitachi Transport System. KKR could be a potential buyer of the company which would allow to merge AIT and Hitachi Transport System now called Logisteed. We have skin in the game, with both KKR and the CEO being the largest shareholder.

AIT did do some buybacks in 2020 and 2021. It is sitting on a large cash balance sheet representing more than 40% of the market cap. As such, it could decide to make further buybacks.

AIT is generous with its dividends, paying more than 50% of its net income in dividends (80yen versus 156yen EPS) but it could do more. I am sure that KKR is putting pressure on the boards to increase the payout ratio.

I think we have a good company here… I hope this analysis was useful but please do your own analysis, this is not investment advise. This is a foreign country for most of the readers including the author which leads to additional risks. We don’t have boots on the ground.

The Risks: AIT Corp might see its operating margin fallen again to 5-6% like in circa 2017-2019. As such, this could explain why the company is trading at historical low PE (10x) versus 15x historical PE. Another risk is that AIT is mostly focus on the China - Japan trade, the largest Japan trade partner. So military or economical tensions could be very detrimental to the company.

Please leave a comment..

Disclaimer: The above article constitutes my or the authors’ personal views and is for entertainment purposes only. It is not to be construed as financial advice in any shape or form. Please do your own research and seek your own advice from a qualified financial advisor. I / The authors may from time to time hold positions in the aforementioned stocks consistent with the views and opinions expressed in this article. The information provided in this article is not making promises, or guarantees regarding the accuracy of information supplied, nor that you guarantee for the completeness of the information here. The information in this article is opinion-based and that these opinions do not reflect the ideas, ideologies, or points of view of any organization the authors may be potentially affiliated with. The authors reserve the right to change the content of this blog or the above article. The performance represented is historical" and that "past performance is not a reliable indicator of future results and investors may not recover the full amount invested

Great article. Just wondering about the growth. Is that not something that came from the historical growth of the Chinese economy. Growth going forward might be a lot lower than historically.

on which broker do you trade stock like these?