Insights on Logistec from Annual Meeting

On May 3rd, I attended Logistec's annual meeting in Old Montreal and I am now even more positive about the company and its 2023 prospects and beyond

The following are my takeaways from Logistec’s annual meeting that was held a couple weeks ago. The meetings was attended by a good crowd, a mix of individual shareholders, employees and possibly a few professional fund managers. Based on the information received during the annual meeting and also discussions I had with executives of the Company, I am feeling even more positive about the prospects of the Company in 2023 and beyond.

This following is an article on Logistec. The article constitutes the authors’ personal views and is for entertainment purposes only. Please refer to the disclaimer at the end of this article for more details.

Very positive outlook in environmental segment

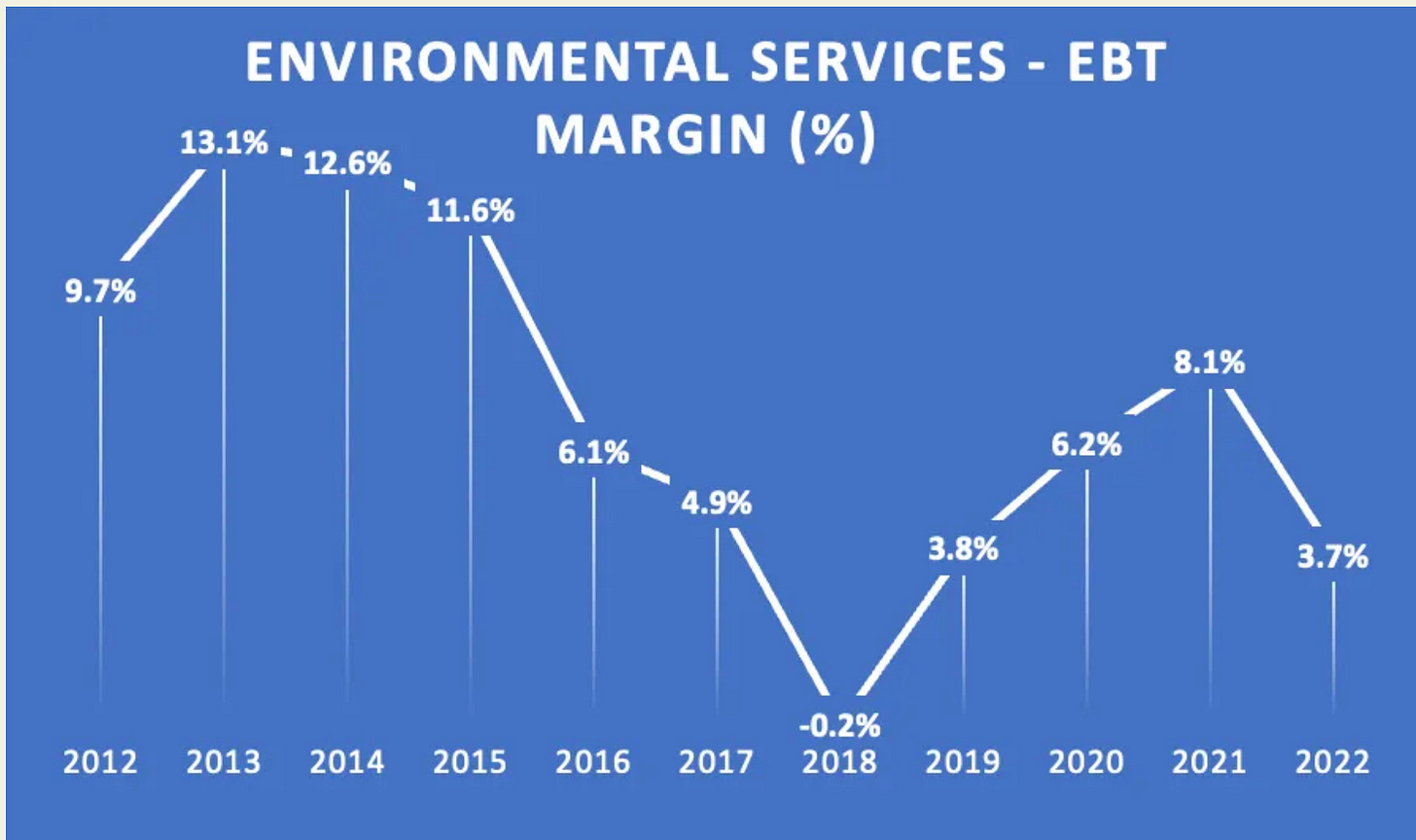

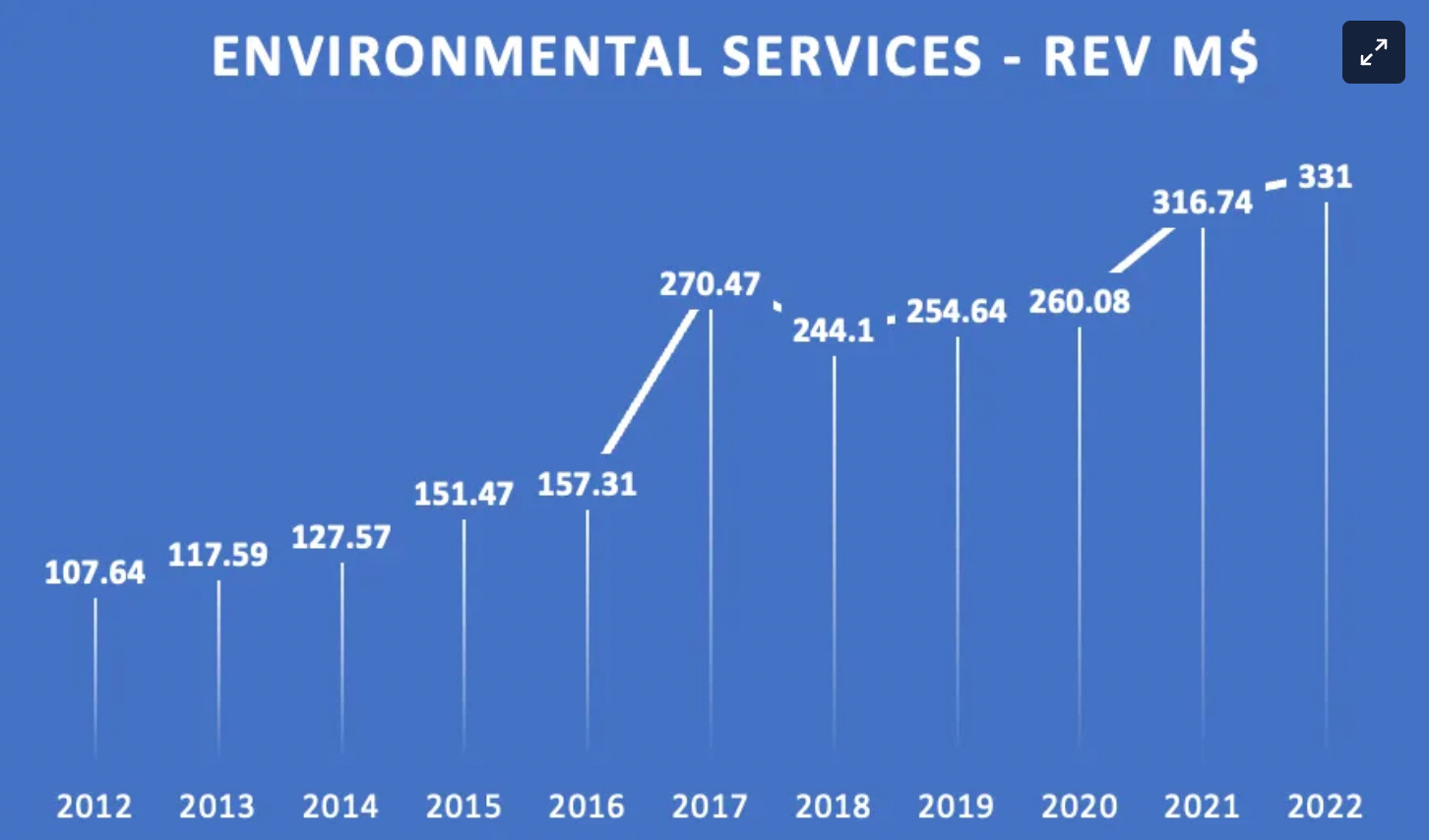

As you know, one concern I had about the company recently was about the profitability of the environmental segment in the recent years as seen below:

So one of my main goal was to assess whether margins will raise in this segment in the short term and also what should be the expected long term margins of this business.

One element of the information was given during the annual meeting. Jean-Francois Bolduc, who joined the Company as president of Logistec Environmental Services in January 2022, gave a presentation where he mentioned that in late last year - November 2022, they have streamlined the internal structure notably in the sales team. They did some cost optimization which should translate in savings this year (2023). Also, the environmental backlog has never been that high both in terms of site remediation and water rehabilitation. So management is confident that EBT margin could reach the 8-10% and possibly higher in the long term. Another factor that explains the low margins over the last few years was the accelerated amortization (goodwills, customer list, intangibles) of the FER PAL and the APC acquisitions. These amortizations should be less and EBT should resume at a much higher range. As such, management is confident that a 8-10% EBT margin is very achievable.

As such, with a record backlog, we can assume a good increase of sales and a EBT margin of 8-10% range for this segment. Therefore, say $350 million with a margin of 10%, could result in a EBT of $35 million versus $12.2 million last year. Assuming a 20% income tax, that would mean $18 million more of net income or 1.40 EPS.

I also questioned about the state of FER-PAL. FER-PAL’s trouble are behind. FER-PAL is mostly operating in the Toronto area. Things are going well there, and FER-PAL is now contributing significantly to the bottom line. One important competitor in the trenchless water rehabilitation in Toronto closed business during the COVID and so Logistec is dominant in that region. In Montreal, it is a more competitive landscape. But the Company offers a superior product. The Company also competes with the traditional dig-and-replace method. The advantage of the trenchless approach is actually greater in the north (like in Canada, or Northern part of USA) as water pipe must be installed much deeper in the ground to protect from freezing water in the winter.

Marine Segment and the Fednav acquisition

The marine segment will remain strong this year. The marine segment is a very diverse entity now, both in terms of the cargo types and geographical being spread over 90 terminals now. There was a bit of softness in the container space, but it is getting stronger or at least stabilizing for the rest of the year. The container sub-segment is mainly impacting Termont in Montreal. Montreal is supply constraint so I am not expecting a big drop in volume, Madeleine Paquin did mentioned that ancillary sales related to the storing of containers (due to less storing overflow) will be below last year.

The comments from management indicates that oil and gaz is strong still but probably stable versus last year, and windmills which was slower last couple of years is picking up. I would guess based on Q1 that revenue is slightly up with possibly some margin compression. Q1 was up 8.7% versus last year. Bulk is probably still strong.

One think to consider is the impact of Fednav. According to management, the acceleration of the intangibles due to the acquisition should impact the EBT margin. As such, I think a better valuation measure would be EV/EBITDA.

I will address this in the next section.

Outlook for EBITDA

In 2022, the EBITDA was $135.8 million - I removed $6.2 million (configuration and customization of cloud) from the adjusted EBITDA number.

So based on a EV at currently of $900 million and 2022 EBITDA of $135.8, the trailing EV/EBITDA is 6.7 based on 2022 numbers.

I believe, the significant margin improvement from the environmental segment should increase the EBITDA by $20 million - I am assuming a drop of $3 million of intangibles from last year. Assuming a flat EBITDA versus last year from the maritime segment (increase in sales but lower margin), we are looking at a EBITDA of $155.8 million.

Now, we need to add the Fednav acquisition. Based on management feedback, Fednav is operating at a similar EBT margin than Logistec, so about 9-10% EBT margin. As such, with a revenue of $117 million, EBT should be $12 million. I would be assuming that 11 terminals would have at least $5-8 million of depreciation. So EBITDA is probably around $17 million to $20 million. I believe Fednav was bought in the high single digits of EV/EBITDA. Logistec is trading at 6.7x EV/EBITDA. At $18 million over a purchase of $140 million, Logistec paid 8x EV/EBITDA.

So EBITDA in 2023 with Fednav is estimated to be $173 million. EV with FedNav is $1040 million. As such, if stock price stays the same, the Company is currently trading at EV/EBITDA of 6 of projected numbers for 2023.

Assuming that Logistec stays at a 6.7 EV/EBITDA, the new EV should be $1160 million. Removing net debt ($370+$140 million) = $510 million, the market cap should be $650 million.

To get there, stock would be valued at 50$ even at a depressed EV/EBITDA of 6.7 by the end of the year, a nice 20% increase in stock price. I believe, Logistec deserves a much higher EV/EBITDA than 6.7, probably 10 to be honest. At a EV/EBITDA of 10, Logistec’ EV is worth $1700 million based on my projected 2023 numbers.

Disclaimer: The above article constitutes my or the authors’ personal views and is for entertainment purposes only. It is not to be construed as financial advice in any shape or form. Please do your own research and seek your own advice from a qualified financial advisor. I / The authors may from time to time hold positions in the aforementioned stocks consistent with the views and opinions expressed in this article. The information provided in this article is not making promises, or guarantees regarding the accuracy of information supplied, nor that you guarantee for the completeness of the information here. The information in this article is opinion-based and that these opinions do not reflect the ideas, ideologies, or points of view of any organization the authors may be potentially affiliated with. The authors reserve the right to change the content of this blog or the above article. The performance represented is historical" and that "past performance is not a reliable indicator of future results and investors may not recover the full amount invested