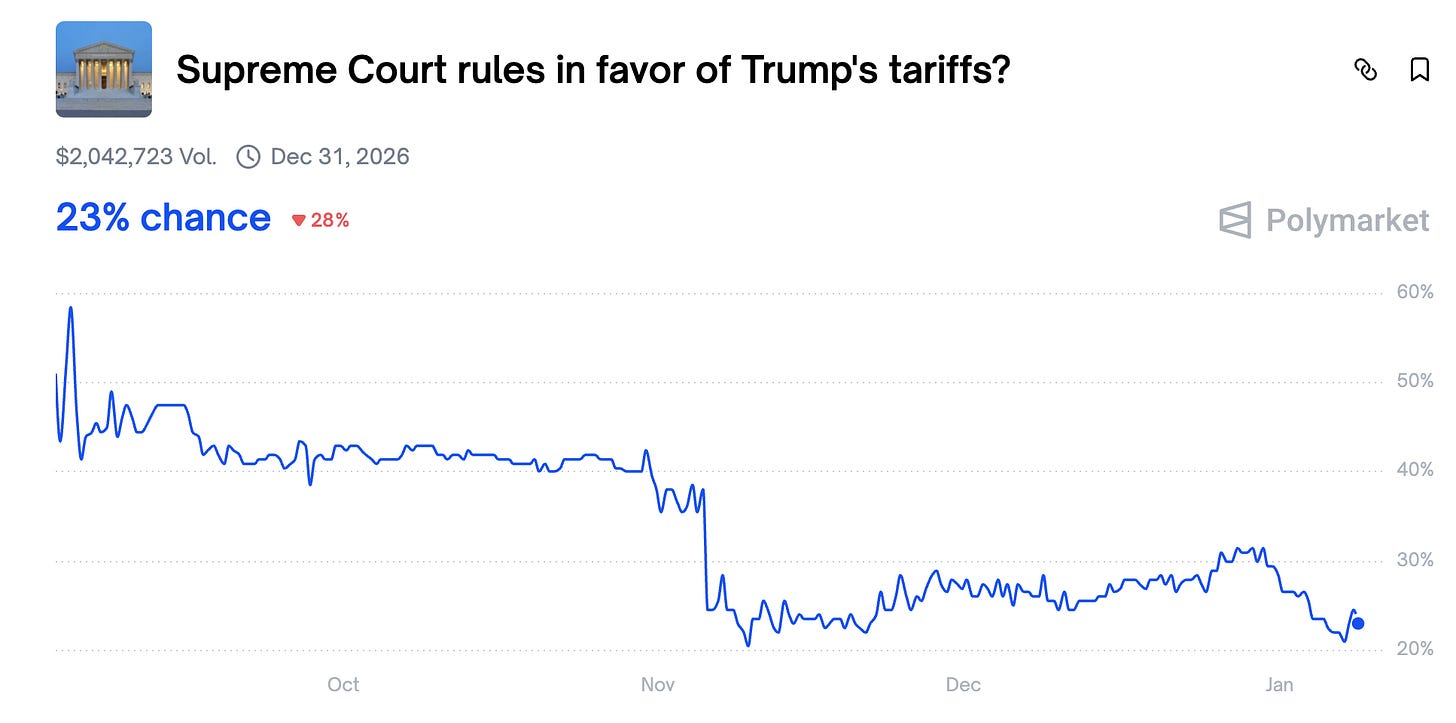

Flash update : 77% chance Supreme court will rule against Trump's tariff tomorrow!

Be prepared when the news will come out 10am Friday

UPDATES: (Jan10th 2026) : The Supreme Court has not yet made a decision on whether the tariff imposed by Trump on individual countries exceeded the President’s authority under the International Emergency Economic Powers Act (IEEPA) - This delay has not change the probability. If I speculate I would say that the additional delay may be due to disagreement and complexities related to the refunding of the tariff imposed. Polymarket still see a 74% change of revoking the executives decisions. For me, I like these odds and this give me more time to implement this trade. I also like to bet against the Crony in Chief Trump.

Based on polymarket, there is a 77% chance that the Supreme Court will rule against Trump tariff. I recommend you do a quick pass on all your goods exporters to USA and understand the implication. The decision will likely be made public at 10am tomorrow (Jan 9 2025) so you still have some time tonight (Japan) and early tomorrow morning (europe) to bet more on your exporters.

The article constitutes my personal views and is for entertainment purposes only. The main goal of this article is to log my personal views. Nothing in this article or these posts in this blog should constitute an investment advice. The projections and estimates provided here should be considered as purely speculative. Do your own model and projections. Please refer to the disclaimer at the end of this article for more details.

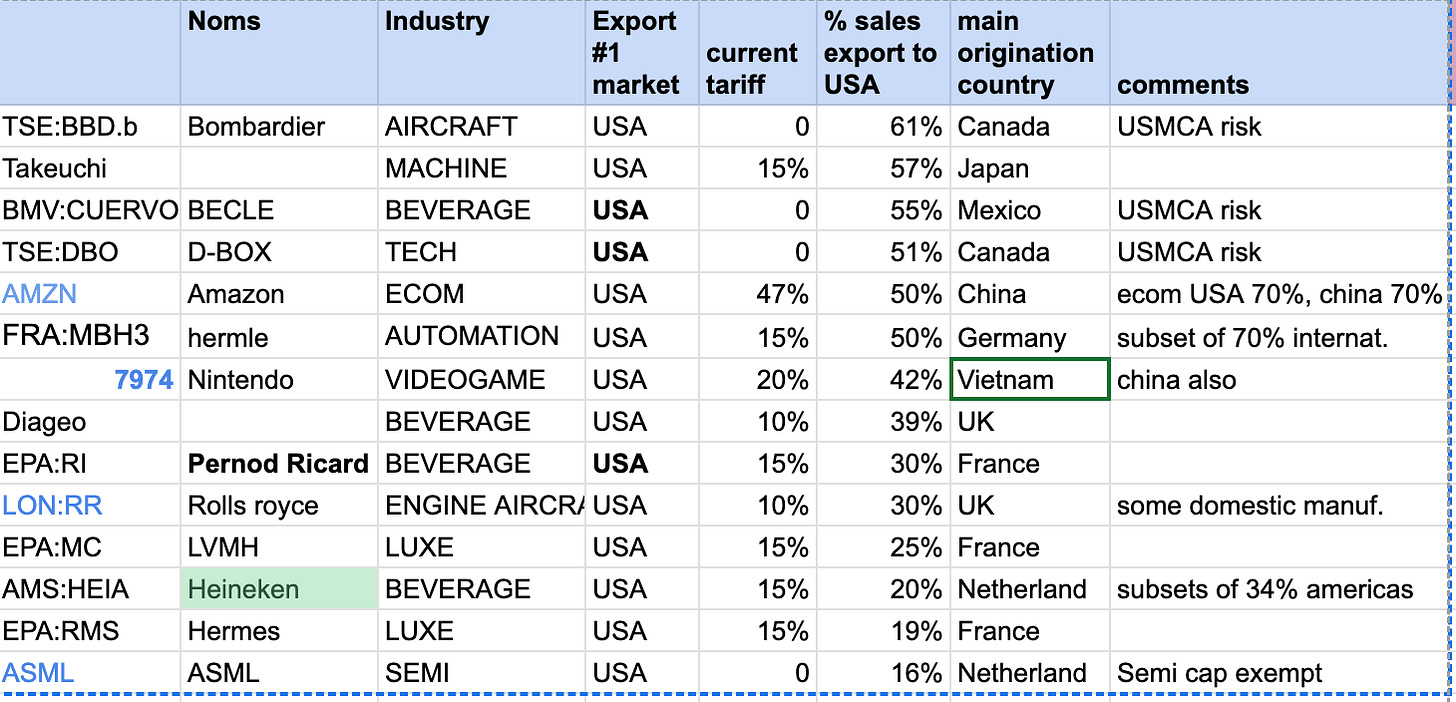

I did a quick pass today and ranked my holding based on the % of goods sold to USA. I excluded companies sellling mostly digital goods or USA domestic companies or companies which are mostly operating for their domestic market (Okano Valve) or which USA is marginal market.

Bombardier: 61% of Bombardier sales goes to USA! Some of these sales are services related so not impacted by potential tariff but still. Due to USMCA, Bombardier is not paying tariff, but as USMCA is due for renewal on July 2026, if Trump keeps its power to impose tariff on a country basis, then it will create a lot more uncertainties as we get closer to July 2026. If Supreme Court revokes Trump’s capacity to impose country specific tariff, only the Congress will have the authority remove the USA from the USMCA as it should be based on the constitution. This would need to be voted most likely after the midterms. The probability of removing USA from the USMCA should be very small. Very positive long term.

Takeuchi: Takeuchi will immediately see a decrease of 15% on more than 57% of sales. Takeuchi operating margin will immediately benefit from this decision if the Supreme Court is revoking the tariff. Very positive short term.

Cuervo: Similar to Bombardier, revoking Trump’s tariff will remove a lot of uncertainties as Cuervo sales to USA represents 57%. Very positive long term.

DBO: Similar to Bombardier, revoking Trump’s tariff will remove a lot of uncertainties as D-Box sales to USA represents 51%. Positive long term.

Amazon: 70% of sales of Amazon e-commerce is originated from China. E-commerce USA represents 70% of sales. Thus around 50% of sales overall is impacted by China tariff which are 47%. Positive for Amazon in the short term, but all retailers also get the same benefits so I am not sure that Amazon operating margin will expand due to this decision. Neutral.

Hermle: Hermle does not split sales to USA, but 70% of sales is international and USA should represents a large percentage. Hermle must pay 15% of tariff to USA export. Positive short term.

Nintendo: 42% of sales are going to USA and most of the hardware is coming from Vietnam with 20% tariff. 2026 is a big year in terms of Switch2 sales ramp-up and so to get a reduction of 20% is very positive. Very positive short term.

Diageo: USA is Diageo largest market. Johnnie Walker and Guiness are the 2 most important product and are made in UK which is currently subject to a 10% tariff. Diageo needs all the positive news it can get in this though market. Very positive short term.

Pernod Ricard: USA is Pernod Ricard largest market. As mentioned in my previous post, the 5 top brands in terms of growth and importance the 5 are Jameson, Ballantine Absolut, Beefeater and Glenlivet and are all coming from UK or Sweden and thus are subject to a 10% and 15% tariff respectively. Pernod Ricard needs all the positive news it can get in this though market. Very positive short term.

Rolls Royce, LVMH, Heineken, Hermes should get a positive impact to a less degree. ASML is not subject to tariff.

Cheers!

Disclaimer: The above article constitutes my or the authors’ personal views and is for entertainment purposes only. It is not to be construed as financial advice in any shape or form. Please do your own research and seek your own advice from a qualified financial advisor. I / The authors may from time to time hold positions in the aforementioned stocks consistent with the views and opinions expressed in this article. The information provided in this article is not making promises, or guarantees regarding the accuracy of information supplied, nor that you guarantee for the completeness of the information here. The information in this article is opinion-based and that these opinions do not reflect the ideas, ideologies, or points of view of any organization the authors may be potentially affiliated with. The authors reserve the right to change the content of this blog or the above article. The performance represented is historical” and that “past performance is not a reliable indicator of future results and investors may not recover the full amount invested.