Dollarama - The Dominant Dollar Store in Canada

Republishing this post which was originally part of a year end portfolio review

Originally published in January 2024

Dollarama is the dominant dollar store in Canada. It currently operates 1541 stores in Canada which is pretty well distributed across Canada. It is still in store expansion mode, having established 21, 18 and 16 stores in the latest 3 quarters (Q1, Q2, Q3 respectively) and having opened 65 stores in 2022.

The article constitutes my personal views and is for entertainment purposes only. The main goal of this article is to log my personal views. Nothing in this article or these posts in this blog should constitute an investment advice. The projections and estimates provided here should be considered as purely speculative. Do your own model and projections. Please refer to the disclaimer at the end of this article for more details.

In contrast to US where you have multiple players in the dollar store segment, notably Dollar Tree and Dollar General, Dollarama rules this segment. Dollarama mentions that the top 4 competitors owns in aggregation 550 stores, so Dollarama has 3 times more stores than the next 4 competitors.

A brief history

Dollar Stores were founded by the Rossy family in the 90s. But I suspect this became the very efficient machine under Bain Capital guidance. By the time it became public in 2009 it was running on all cyclinders and expanding quickly across Canada. It had 550 stores at IPO. Bain Capital sold basically all shares in 2011 - big mistake for them. Today it has 1540 stores and a controlling stake in Dollarcity operating in Central America and Peru with over 550 stores.

Unique lucrative growth story

There is no equivalent in the Canadian market - of a fast growing retailer like Dollarama. All the growth is organic, just plain new stores and better merchandising and better operating margin along the way. In 12 years, Dollarama was able to decuple (10x) the EPS from 0.31 $ to 3.32 $

This rapid increase of the EPS came from

Revenue growth by almost 4x (3.6x to be exact)

A share reduction which increase EPS by 58%

Operating margin increasing by more than 60%

The 10x gains resulted partly by sales increasing by almost 4x (3.6x). This growth should continue fueled by same stores sales and store count.

Same store sales seems abnormally high in the 2023. A 5% to 7% range should be more probable over the next few years.

Store count: 550 stores in 2009, 850 in 2013, 1550 oct 2023. Increasing by 60-70 stores per year in recent years.

Operating margin increasing by more than 60% from 14.76 to 23.68%. That growth has stalled since 2018.

The company is buying back shares aggressively over the last few years. Also smartly - not buying as much shares when the price has run-up. Share count have produced an increase of 58% on the EPS since 2011.

Extract for annual report. The company is proud of purchasing shares regularly.

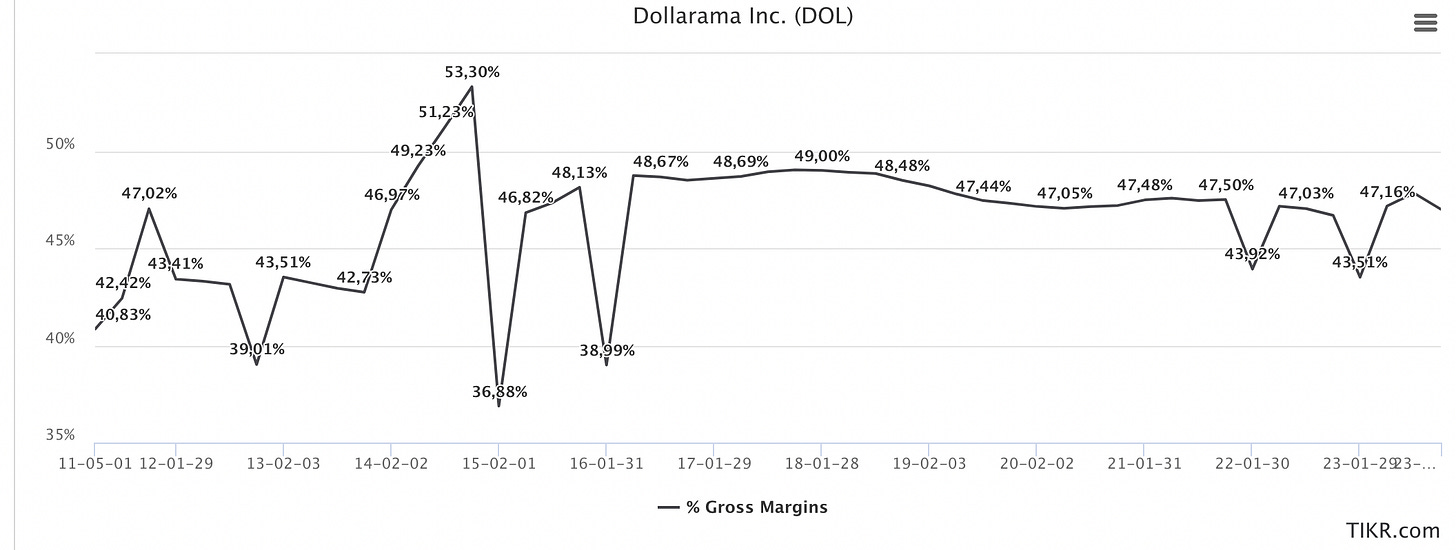

Along the way, the gross margin have been stable, so the customer gets the same value.

Market share gain

Dollarama has been gaining share over other retailers like Canadian Tire, Pharmacy, hardware stores, grocery, corner stores (like couche tard) in my opinion as the density of Dollarama has increased. If I take my personal situation, 10 years ago there was no Dollarama in my town (suburban town) and now one mom and pop dollar stores were converted to a Dollarama at 2.5km North West from my house 6-7 years ago and a new Dollarama was established in a new strip mall at 1.5km South East (next to a Jean Coutu - and a Super C for Metro shareholders!). This store has become almost a proximity store for me where I can find almost all household items you need at a cheap price. This is more a hardware store than a food store in contrast to some US dollar stores.

Info on Debt

Debt of 2.2B $ is reasonable considering the high cash flow entering every year.

E-commerce Threat

All retailer should be analysed from the secular trend of the fact that a larger share of sales will be done online. In the context of Dollarama, considering these are all low cost items, the economic is not there to have a small item being ship to your home considering the cost of delivery. Dollarama is also offering a online delivery, but I suspect there is not much success about it.

In general because of online threat, I do not invest in retails with the following expection:

Goods are low cost or need to be fresh (food) so delivery to home is cost prohibitive

Goods are exclusively private label (e.g. Lululemon, Uniclo, etc) so there is no competition from major e-commerce cos.

Historically High Price Market Evaluation

Dollarama has been trading at high PE ranging at around 30x since 2015, peaking often at around 35x. It is currently a little below 30x so fairly valued for a fantastic company. You could have bought DOL 0.00%↑ at 20x PE in March 2020 and end of 2018.

I am seeing at least a 10% increase in sales over the next 5 years a combination of 5-7% same store sales and 4% new stores and 3%-4% share reduction per year. There is also Dollarcity - a central america dollar stores owned by Dollarama at 51%, which I havent discuss which gives some additional growth potential. As such, we are close to growing EPS at 15% per year ( a doubling in EPS in 5 years). This very predictable and non cyclical growth is worth north of 25x times based on my experience.

I am happy to hold this stock as my #6 position and would add on weakness around 25x PE.

Disclaimer: The above article constitutes my or the authors’ personal views and is for entertainment purposes only. It is not to be construed as financial advice in any shape or form. Please do your own research and seek your own advice from a qualified financial advisor. I / The authors may from time to time hold positions in the aforementioned stocks consistent with the views and opinions expressed in this article. The information provided in this article is not making promises, or guarantees regarding the accuracy of information supplied, nor that you guarantee for the completeness of the information here. The information in this article is opinion-based and that these opinions do not reflect the ideas, ideologies, or points of view of any organization the authors may be potentially affiliated with. The authors reserve the right to change the content of this blog or the above article. The performance represented is historical" and that "past performance is not a reliable indicator of future results and investors may not recover the full amount invested.