Dollarama - 1 year later

A year ago I posted on a rarely mentioned compounder story - outside of the Canadian circle : Dollarama. Dollarama is hitting on all cylinders and expanding in Central America and soon Australia!

Before you continue glancing into the latest post, I would strongly encourage you to first review my analysis publish last year in June on this amazing dollar store company based in Canada :

The article constitutes my personal views and is for entertainment purposes only. The main goal of this article is to log my personal views. Nothing in this article or these posts in this blog should constitute an investment advice. The projections and estimates provided here should be considered as purely speculative. Do your own model and projections. Please refer to the disclaimer at the end of this article for more details.

In a nutshell, Dollarama operates very efficient dollar stores across Canada with a dominant market share of around 65% to 75% (based on my own analysis) of the dollar stores segment.

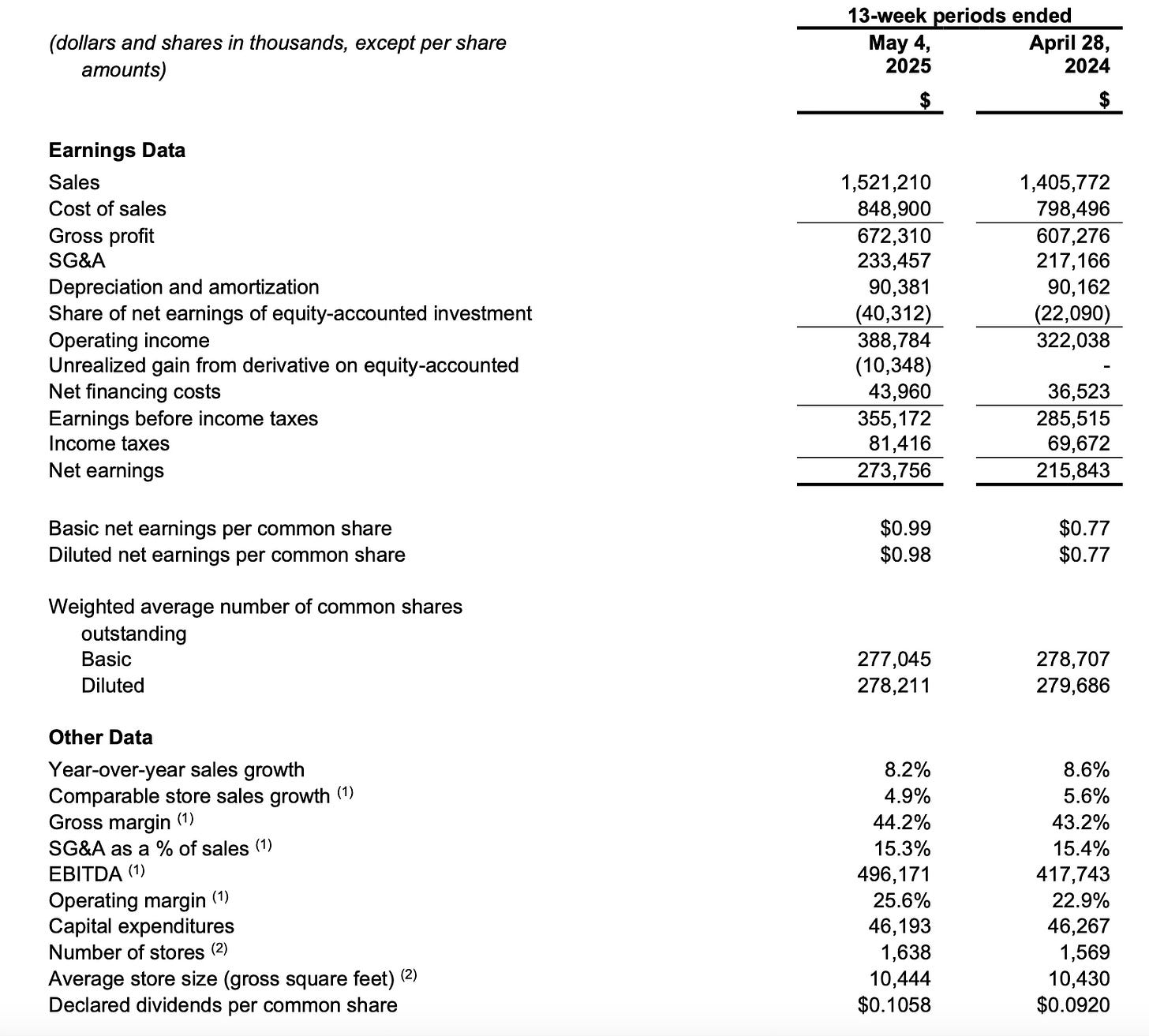

Today (June 11th. 2025), Dollarama released some very strong results as shown below for the last quarter:

EPS is up 28% on sales up by 8.2%.

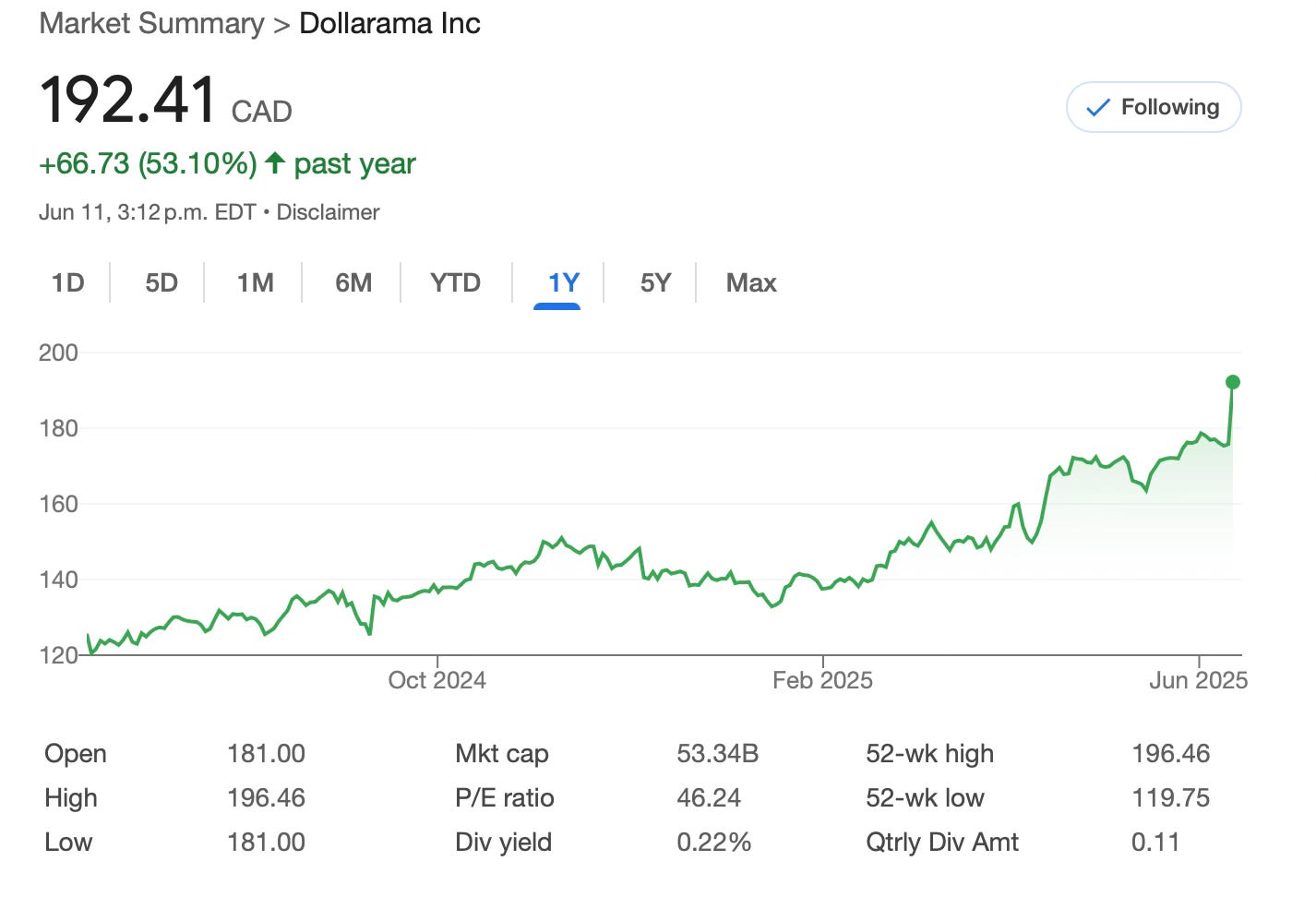

The stock reacted quite favourably on these strong results and the stock is up 53% since I last published on the company a year ago. I hope some of you joined the rank of shareholders at that time.

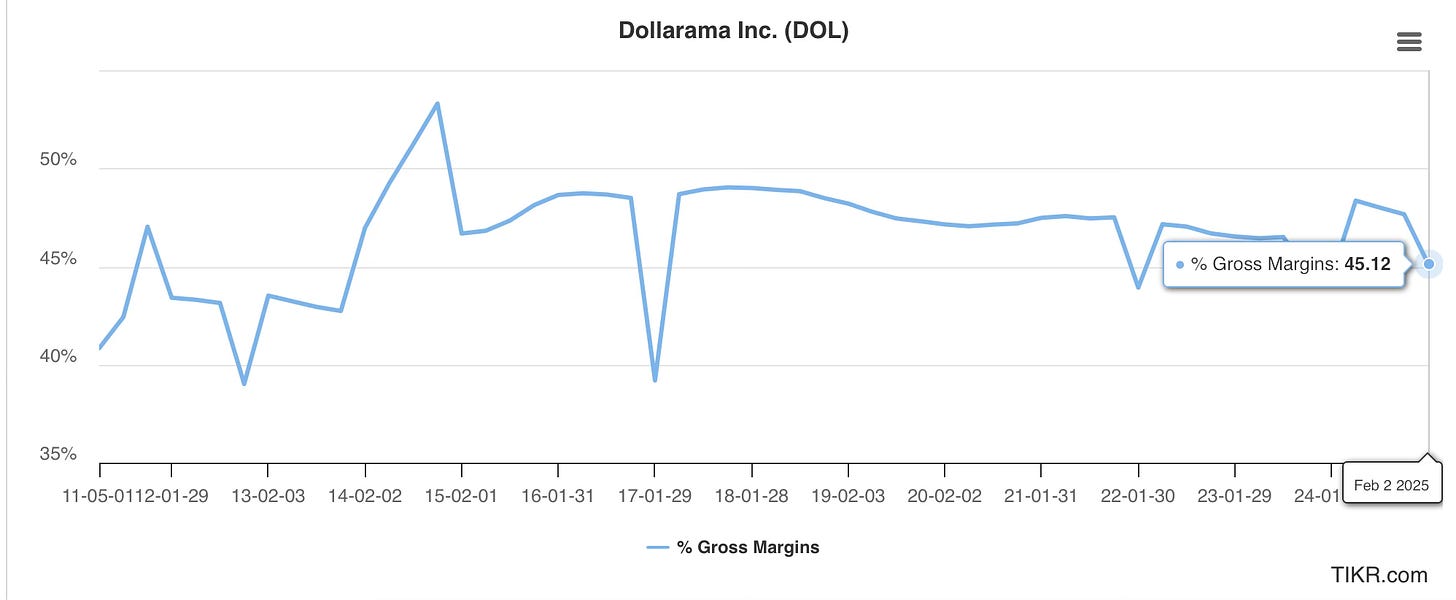

Comps sales is at a healthy and sustainable 4.9%. GM is within long term range at 44.2% (as shown below),

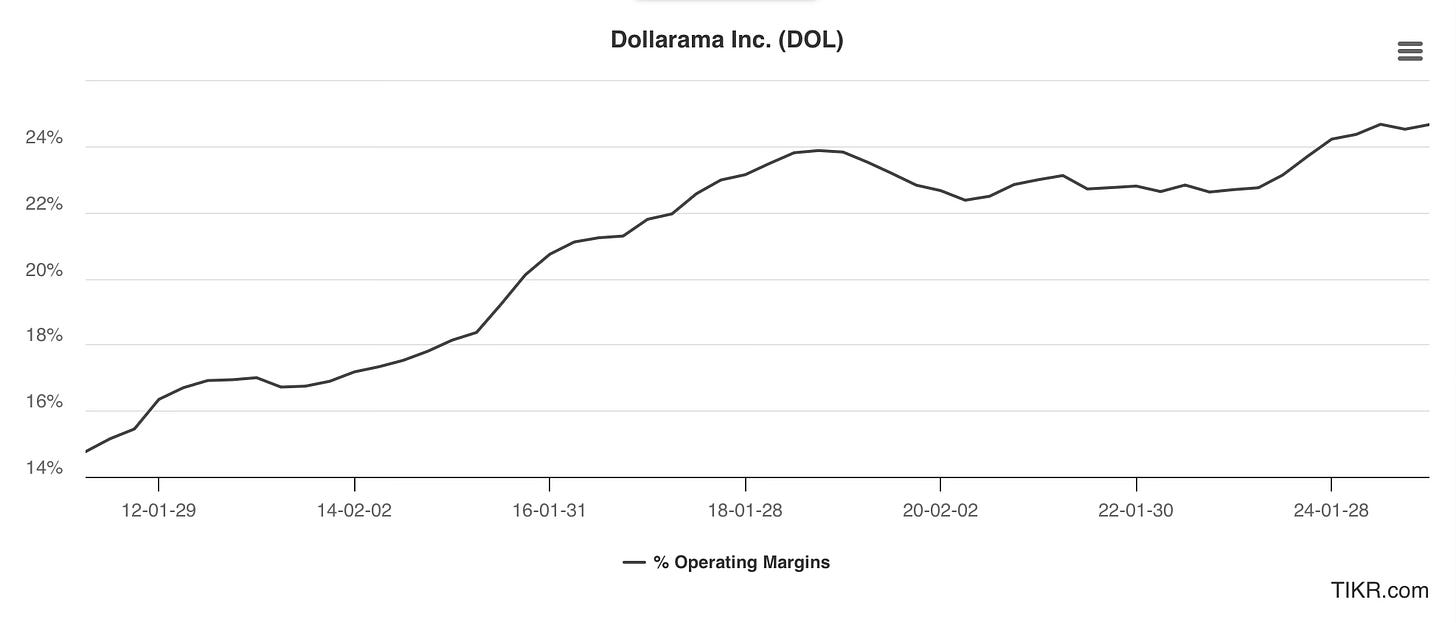

and operating margin has kept improving over the recent years now at 25.6% (historical. chart below) which is almost 3% higher than last year.

As I disclosure, Dollarama is part of my 2009 cohort- found this stock “a la” Peter Lynch, realizing that new Dollarama stores were popping up left and right in my area, replacing mom and pop dollar stores and started to investigate.

Now in recent years, there are 2 development that gets me excited for future growth: Dollarcity and international expansion via acquisition.

Dollarcity

Dollarcity had a total of 644 stores, with 377 locations in Colombia, 109 in Guatemala, 77 in El Salvador and 81 in Peru. This compares to 632 stores as at December 31, 2024. Dollarcity stores are very similar to Dollarama stores in Canada and there is strong synergies in terms of type of goods sold and operational systems. In June last year, Dollarama has increased its stake in Dollarcity to 60.1% (by about 10%) and has the option to further increase its stake to 70%. As of March 31, 2025, sales were up by 12.6% YoY.

The Corporation’s 60.1% share of Dollarcity’s net earnings for the period from January 1, 2025 to March 31, 2025 amounted to $40.3 million, compared to $22.1 million for the Corporation’s 50.1% share during the same period last year. This represents a 82.4% increase. As such, the net income of Dollarcity represents already a bit more than 10% of the overall operating income of the Company.

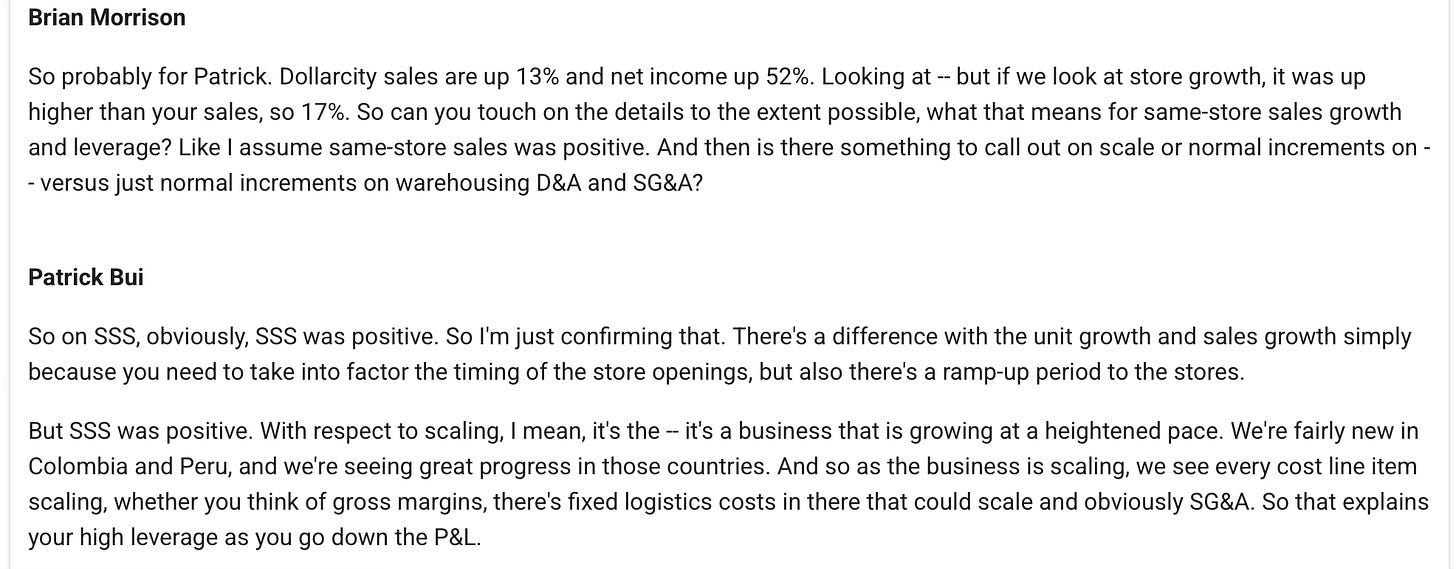

Some colours on how Dollarcity is performing: ie. operating margin gain, SSS positive, still quite new in Columbia and Peru. So Guatemala and El Salvador are the orignal countries.

Mexico expansion of Dollarcity

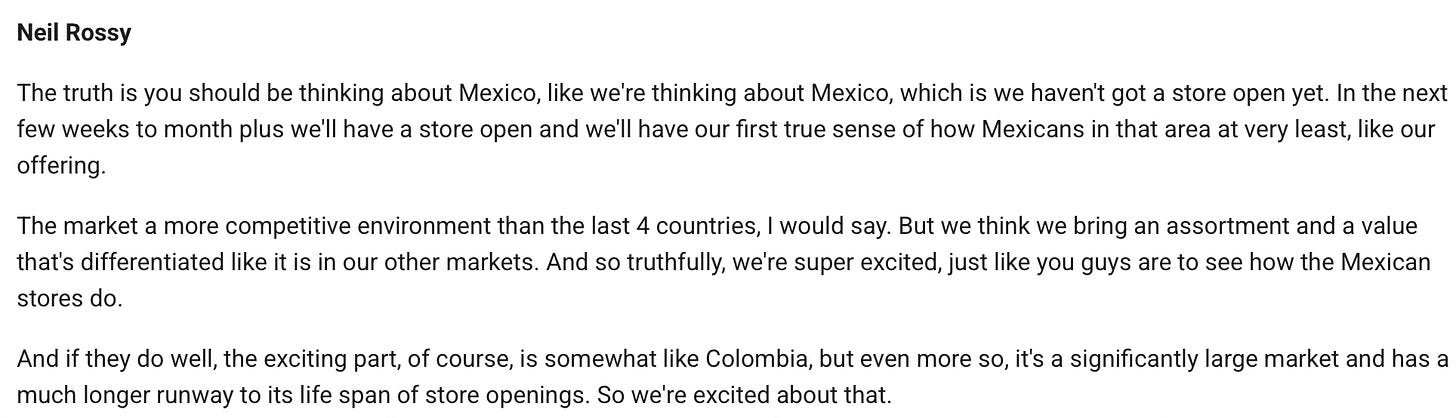

Dollarama and the Dollarcity founding stockholders have also agreed on governance terms providing for the future expansion of the business to a new country, Mexico. Dollarama and the Dollarcity founding stockholders will indirectly have an 80.05% and 19.95% equity interest, respectively, in the Mexico portion of the business. Based on comments yesterday from the CEO, Neil Rossy, a first pilot store in Mexico will open this Summer.

The merchandise should be very similar than the one you can find in other Latin America countries:

Australia expansion

Dollarama in March 2025, has reached a definitive agreement to buy the Reject Shop. Headquartered in Melbourne, The Reject Shop is Australia's largest discount retailer with a store network of more than 390 locations across the country. Its offering includes private-label and national brand products. The Reject Shop generated consolidated sales of A$866 million (C$779 million1) for the last twelve-month period ended December 29, 2024, and employs over 5,000 people.

Once the acquisition is consumed, this will represent an increase of almost C$800m in sales, adding close to 12.5% of sales. It will allow Dollarama to apply its operational knowhow to the Australian market. There are a lot of synergies between Dollarama and The Reject Shop in terms of merchandising. The Australian company should also benefit from the buying power of Dollarama since Dollarama has 8x more volume. It will be quite interesting to analyse the operating margin evolution of the Australian operation over the years.

The acquisition need to be accepted by shareholders this month. I will keep you posted.

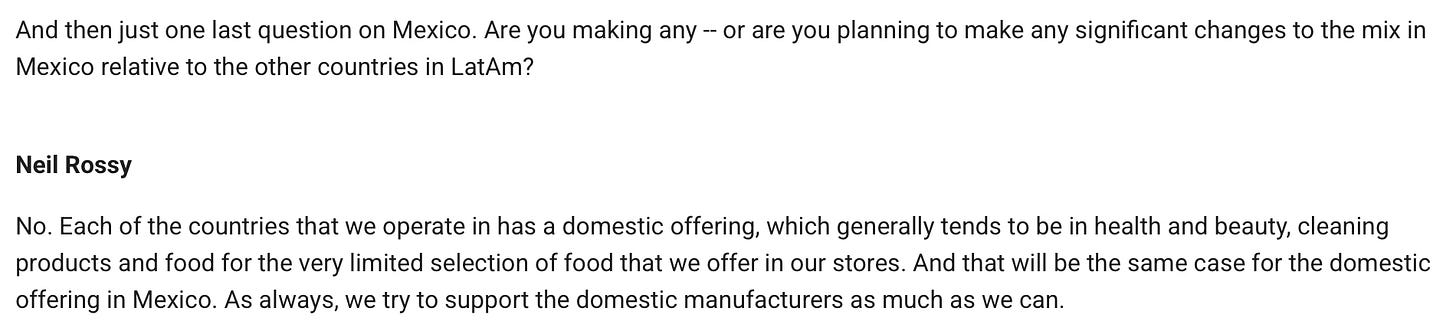

Free cash Flow machine

Another aspect I like is that although Dollarama is expanding in Canada at a rapid pace, it is able to generate a very healthy free cash flow, matching almost the net income. This allows the company to make buyback when the stock is undervalued. I mentioned in more detail that aspect in my previous post.

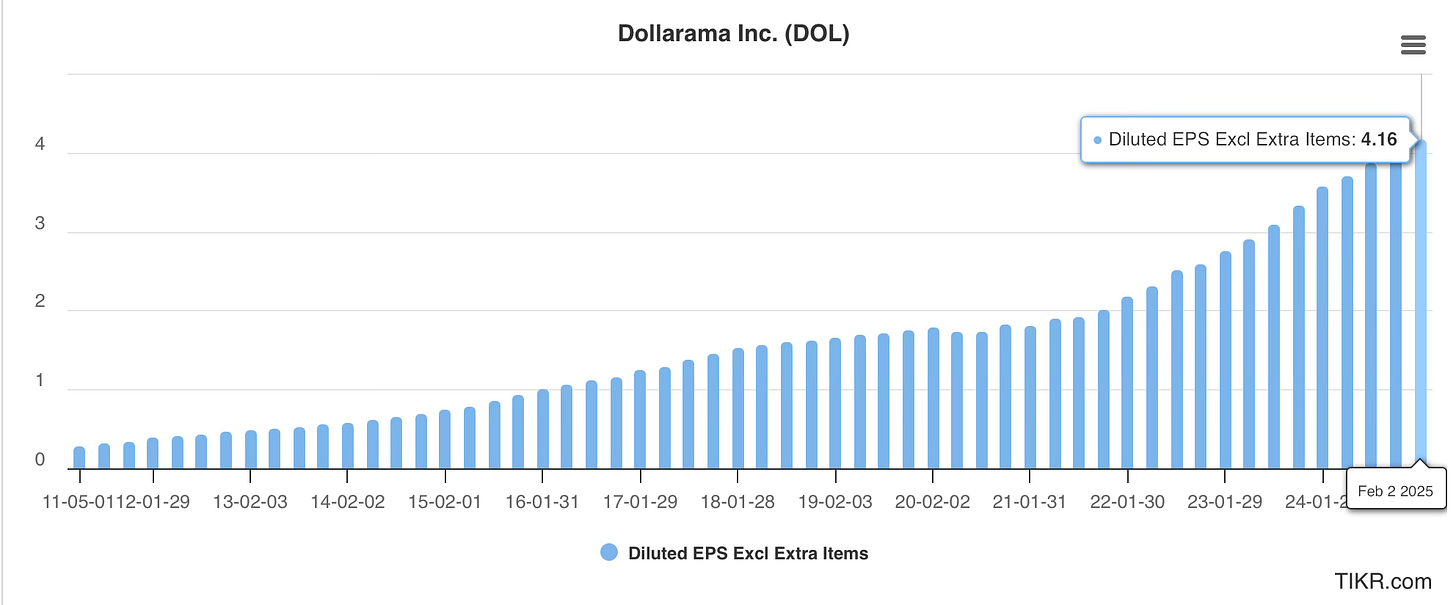

To summarize, Dollarama is a beast in the retailer space, compounding at an impressive level with no down year since it became public in 2009 as shown below. It is not well known, but I am surprised that it has not yet achieved a cult status in the stock market. If you include today’s result, which is not shown in TIKR yet, the 12 mo EPS is now 4.39$.

The valuation is quite high at 43x trailing earnings, but put it in your watchlist, and next time Mr Mussolini south of the border derails the stock market, you may get a chance to get a few shares. Dollarama is totally immune to the tariff shitshow in my opinion.

Leave a comment - doubts and questions are welcome