Bombardier - What a ride!

On March 8th 2025, Bombardier trading at 78CAD on threat of a 25% tariff from Trump. I put 10% of portfolio on this stock on the belief that tightly interconnected aerospace is protected from tariff

I am writing this down on a quiet Saturday night while getting over a cold for too many days that I got from running too often in the wet snow… But the latest result from Bombardier, the latest SCOTUS decision on IEEPA followed by the section 122 tariff counterattack was too good to pass. I am writing this in one shot without thinking too much solely based on my recollection, no fact checked take this with a grain of salt and enjoy my rumblings...

Legal Disclaimer: All content published on Wintergems is intended for informational and entertainment purposes only. It is not intended to serve as a recommendation to buy or sell any security. The views expressed are my own and are subject to change without notice. The information provied here is proprietary. I make no representations or warranties as to the accuracy or completeness of the information provided and will not be liable for any losses, injuries, or damages from the display or use of this information. Readers are solely responsible for their own investment decisions.

The Global 8000 was certified in December by FAA - The fastest and arguably the best private jet in the world

Tariff and the particular case of Aerospace

On March 4th 2025, Bombardier had a major drawdown (starting a few weeks before) and was trading at 78CAD on the threat of a 25% tariff from Trump to be imposed to Canada under the now illegal IEEPA tariff due to the fentanyl crisis!

USA is by far the largest market of private jets in the world and as such those now illegal tariff would have significantly impacted the Company - thus the drawdown.

That day and a few days afterwards, I put 10% of my portfolio on this stock on the belief that the tightly interconnected and critical aerospace industry will be eventually protected from these tariffs ! I actually swap Amazon for Bombardier on March 4th… got to sell something… Amazon did nothing since then so at least no regret.

The rationale behind my thinking that aerospace would be protected is still valid and you can have a look on the March4th 2025 post:

One area which I did not see coming is that under section 232, a 50% tariff will be imposed on Aluminum. I thought that Aluminum being so critical for USA manufacturers that this commodity would be preserved from section 232 tariff. This is plain stupid from the USA executives branch. Since the USA has limited domestic Aluminum producing capacity, USA manufacturers must pay their Aluminum 50% higher than the rest of the World - one of key reason that manufacturing jobs have actually decline in USA since the tariff war in my opinion. Quebec still provides the majority of the Aluminum to the USA and the tariff is just passed along to the consumers. This means that Gulfstream and Boeing need to pay up for that critical material while Bombardier or Airbus can avoid the 50% tariff for delivery outside the USA. For USA, my understanding it that the value in Aluminum on the plane must be tariffed by 50% since August 2025. This enhances Bombardier position relative to Gulfstream for sales in RoW.

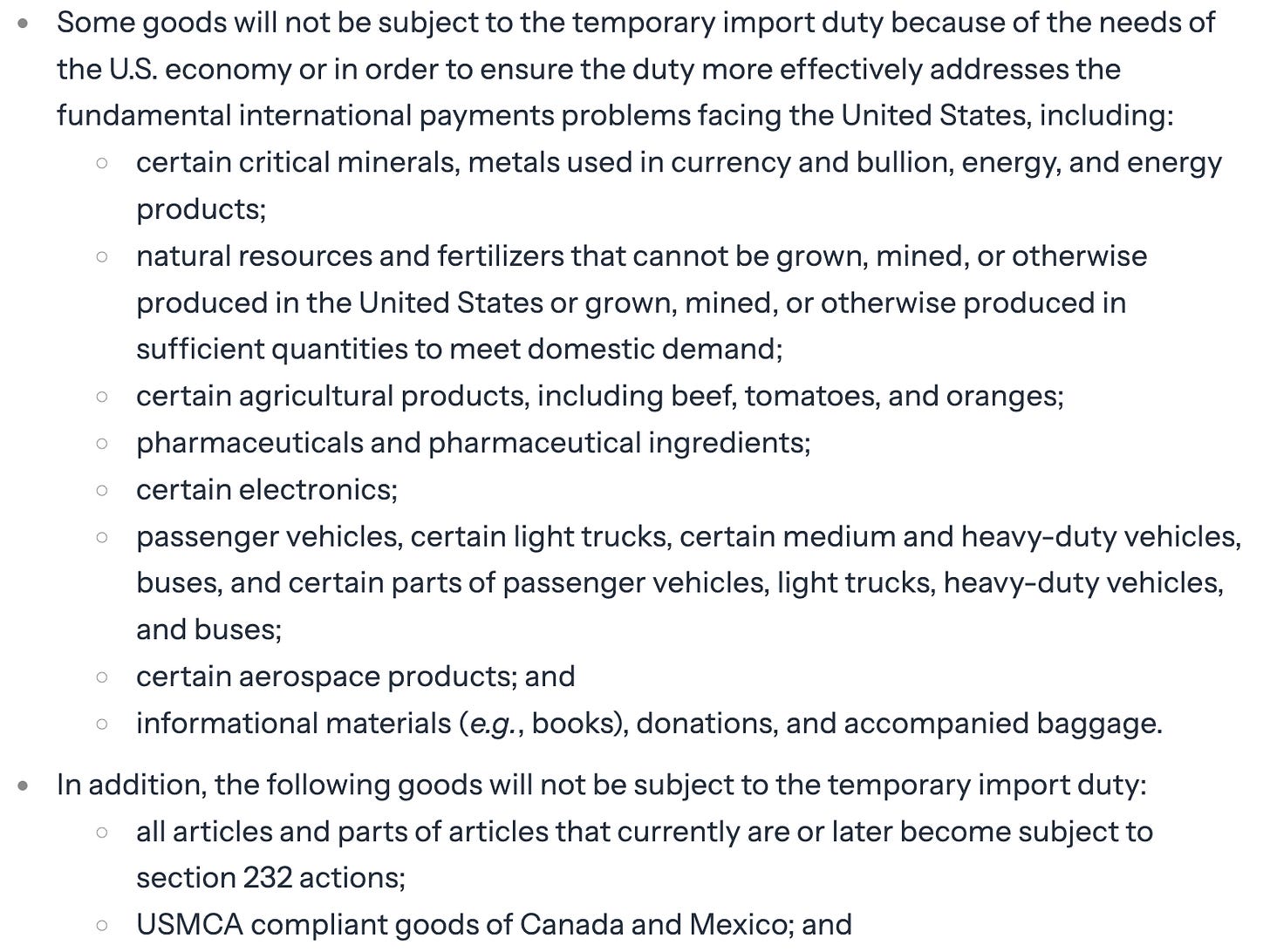

I was right however that all aerospace components and planes build in Canada or Mexico would eventually be tariff free - except for the Aluminum content. Now that the IEEPA tariff is deem illegal by the Supreme Court, we need to turn to the brand new section 122 global tariff. You have to give credit to Trump’s minions… they do come up with creative - often on shaky ground - mechanism to come up with new tariff. Since section 122 was created to mitigate a situation of fundamental international payments problems which is likely not applicable to our current situation but hey ! This tariff will be dead in 150 days and congress nor the Senate will vote to renew it so who cares.

In any case, the brand new 15% global tariff under section 122 do contain a special protection related to the aerospace industry which are exempted and confirm my case that aerospace will be exempted from a tariff war in general. It also confirms that goods under USMCA are also exempted. So Bombardier is dual protected here for now…

As a sidenote, Canada is also the largest exporter to USA of energy products, fertilizer and gold bullions, so with aerospace, even if USMCA was not renewed, a very large portion of Canadian goods would be exempted anyway. Note that beef is also exempted, Trump was complaining that Canada is not selling enough beef to them… In fact, my gut feeling is the list of goods provided here is a wish list of product that the current administration wants in priority to be tariff exempt whatever happen to USMCA. Now it does say certain aerospace product, so there is a risk that private jets are not covered here. But again the administration wants to make sure no tariff war on aerospace happen so that aircraft engine from GE, P&W, aircraft and copters from Boeing and Textron enjoy a free trade. Textron makes most of the civil helicopter in Montreal.

The USMCA negotiation and aerospace product

USMCA is due for renewal on July 2026. The statu quo is not acceptable for Canada. For sure, Canada will request that Aluminum, copper, Steel, Lumber, cars will be covered by USMCA and thus exempt from any section 232 tariff. What is the point of signing a free trade agreement if those key products are outside of the USMCA. But Trump is obsessed with making steel and trucks domestically. A deal is very unlikely in the short term and negotiation will stall in my opinion. So there are 3 scenarios for USMCA in front of us:

Negotiation breaks down and Trump makes a big show and decides to officially retire from the USMCA. Congress will have to ratify this like they did on December 2019. After some time Congress decides not to ratify the retirement from the USMCA and the current USMCA remains in place with all the section 232 tariff. Bombardier is protected.

Negotiation breaks down and Trump makes a big show and decides to retire from the USMCA. Congress ratifies this - very unlikely - tariff on Canada is very unpopular. Maybe a lame duck Congress in December after mid terms would go for that. So we fall back to the section 122 exemptions including aerospace exemptions and all the products that USA really wants from Canada (energy, gold bullion, fertilizers, beef! ). There is a risk that private jets are not covered by this exemptions. Will know more about that over the next few weeks, when private jets or commercial plane from Airbus from France or Brazil will be delivered soon under the section 122.

Canada and USA agrees on a new USMCA whatever it is but for sure aerospace is included here. Bombardier is protected.

In conclusion, we have 12 months of tariff free in front of us and some risk if private jets is not covered by the aerospace exemption of section 122, for the very unlikely scenario that Congress ratifies Trump decision to retire from the USMCA. There is currently a 85% chance that after midterms the democrats take controls of Congress so even scenario 2 might be reversed or USMCA gets approved after midterms or even better that the president get impeached. The senate does not need to be controlled by the democrats to be trade friendly or tariff adverse.

Bombardier stock price action

Since the big March 4th drawdown, Bombardier had a hell of a run - a 3 bagger in 11 month.

Bombardier kept hitting on all cylinders - record booking, paying down debt, Global 8000 certified on time, record free cash flow of more than $1 billion, and adjusted EPS up 50%. Executive Management has executed perfectly on this turnaround all hands on deck. At the same time the tariff risk became non existent as the (now illegal!) 25% IEEPA tariff impacted only marginally Canadian exports - as only goods not compliant to USMCA were subjected to the 25% tariff.

I still own the vast majority of the shares I bought at the time, and I feel perfectly comfortable to own that level of concentration even though Bombardier now represents 27% of my portfolio. Trade carefully this is not a recommendation do your own research…

2025 Results

I read very carefully the latest annual report and I wanted to share a few aspects that I think is worth discussing.

“The results of our historical 5-year turnaround have drawn global attention and external recognition. I’m proud to note that our story is now the focus of two major case studies, at Harvard Business School and Columbia University.”

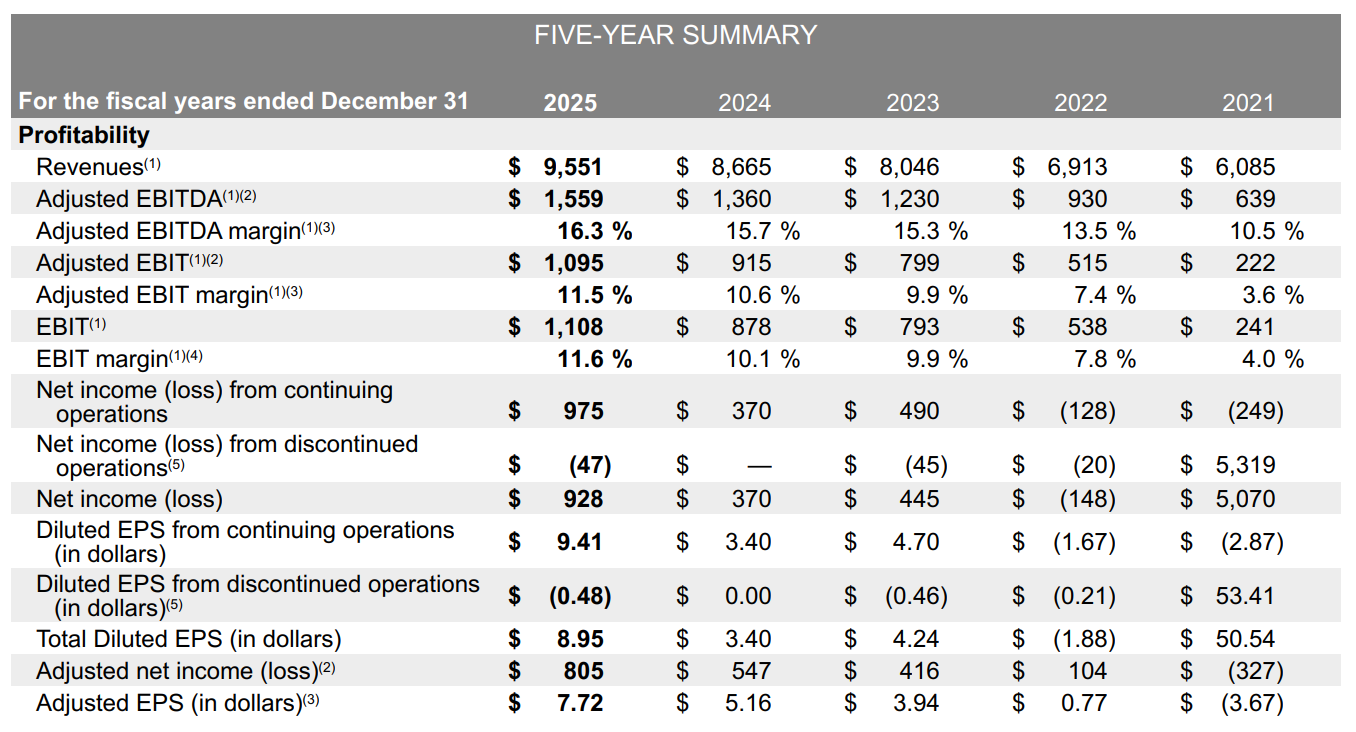

The following five-year summary demonstrates the radical turnaround that occurred in 5 years. If you look at the top line, since 2021, the CAGR was 12%. However adjusted EBIT margin went from a very low 3.6% and has climbed steadily to 11.5%.

I prefer to use adjusted EBIT or adjusted net income, since net income includes gains or loss related to derivatives related to call options on long-term debt or losses related to the partial repayment of certain Senior Note.

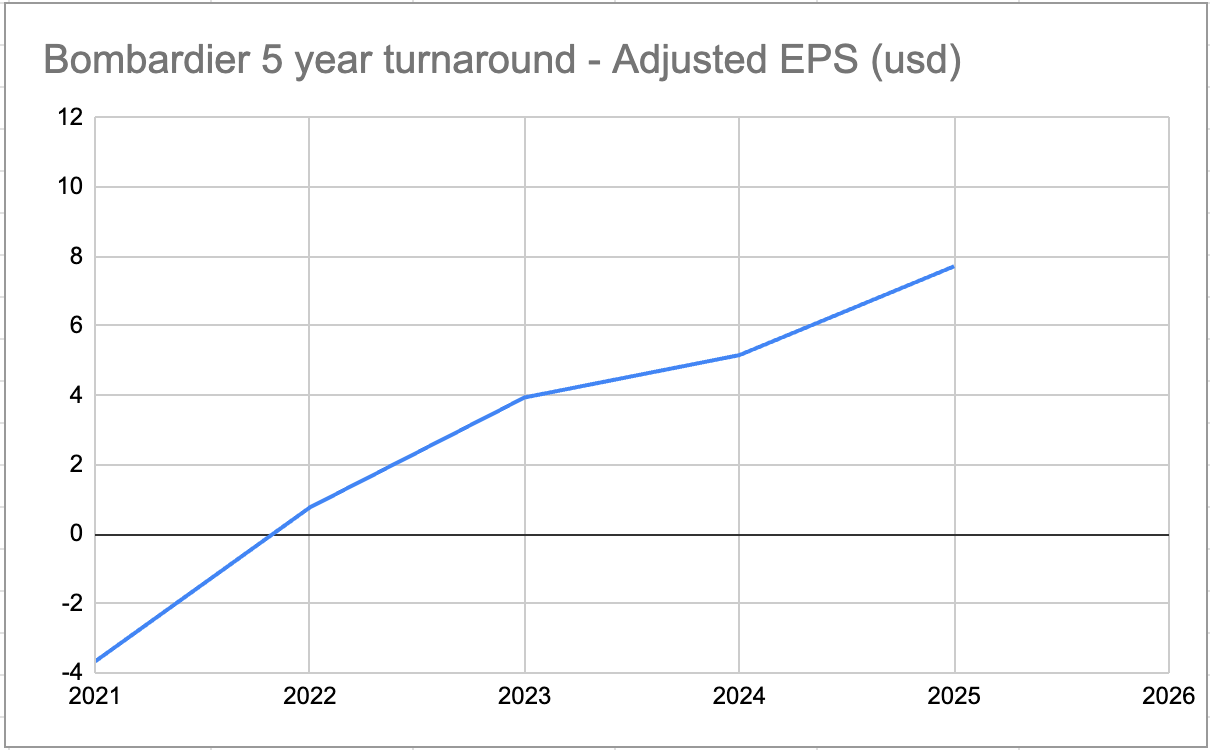

Charting the adjusted EPS for the last 5 years, you can visualize how steep and steady the EPS has improved. If we simply follow the trend, an EPS ranging from 10 to 11 USD should be probable for 2026. Those figures are in USD while Bombardier is trading in Canadian dollar. At 276 CAD, you can convert Bombardier price to 200 USD. So Bombardier is trading at 20x forward earnings based on the current trend.

Services revenue was a record of $2.3 billion for the year, which represents a growth of 13% compared to 2024. Service revenue has better margin than the private jets sales. Services revenue was only $1.2 billion in 2021, so it almost doubled in 4 years.

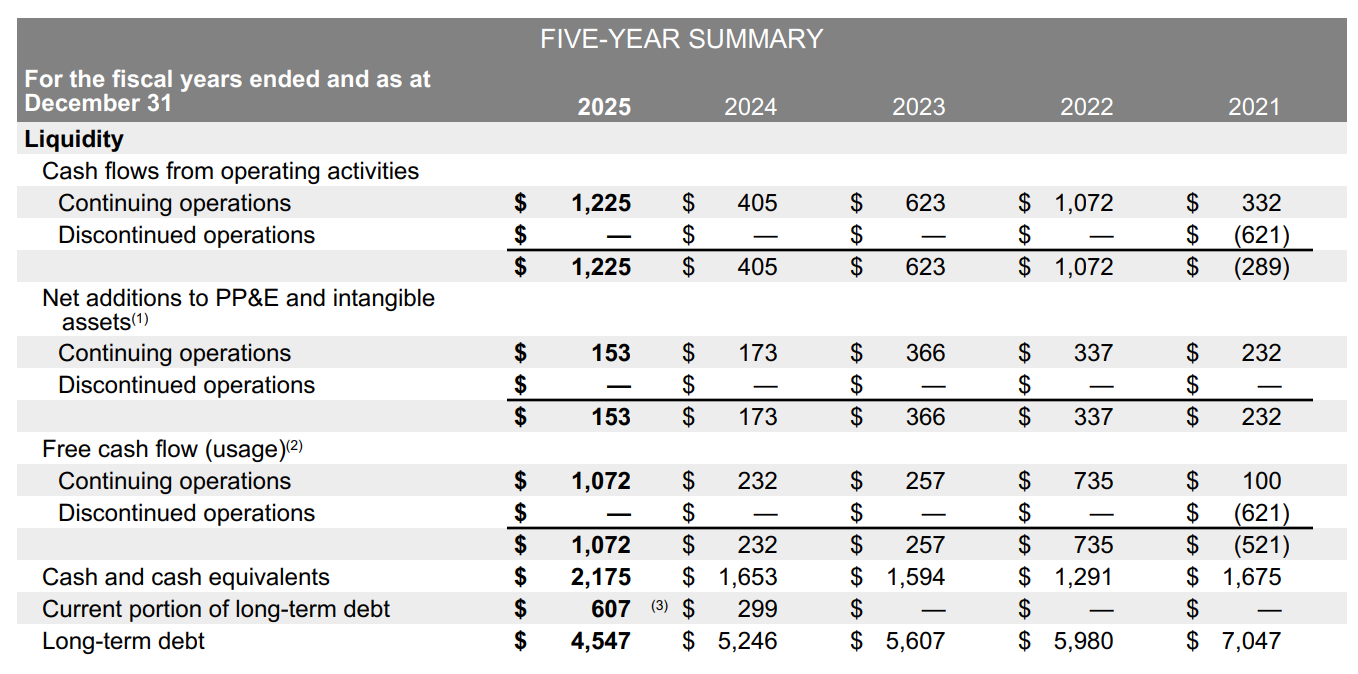

The following 5 year liquidity table is impressive. In 2021, Cash flow was negative 289m (including discontinued operation) and became 1225m in positive cash flow in 2025. Free cash flow was 1072m. Long term debt was reduced by 2.5B while net cash subtracting the current portion of long term debt was stable.

Aircraft deliveries is up sharply in 2025 from 146 to 157 aircrafts. In 2021, Bombardier had delivered only 120 aircraft. The order backlog is up also significantly by $3.1 billion.

This table shows the sales split by countries or continent.

On the plus side, the largest increases were in Canada, Turkey, Singapore, Africa, South America, Sweden (likely Globaleye related) and Central America.

USA did go down, as well as Germany, UK, Switzerland and Portugal. Interesting that Bombardier has no sales in France, probably due to French domestic competition from Dassault.

Canada’s Defence Industrial Strategy

Canada has published this week the Defence Industrial Strategy. The strategy has identified key sovereign capabilities. The following is an initial list of the sovereign capabilities for which the new DIA will be prioritizing build-in-Canada. Going forward, the Government’s designation of sovereign capabilities will not be static; it will evolve with the threat landscape, capability needs, technological change, and domestic industrial capacity.

Bombardier, as the leading (and only aircraft manufacturer in Canada) with leading edge design aerospace knowhow - they make the best wings in the industry - will play a central role in building in Canada a military aerospace platform (item 1) and likely - an uncrewed and Autonomous aerial systems (item 10). Bombardier will play a critical role in the domestic military development in Canada. I suspect Bombarder and SAAB will coordinate closely in making in Canada a substantial fleet of Gripen and possibly collaborate on a uncrewed and autonomous Aerial System. The modification of the Global 6500 to the Globaleye might also be done in collaboration.

There is a lot of upside here.

EPS growth

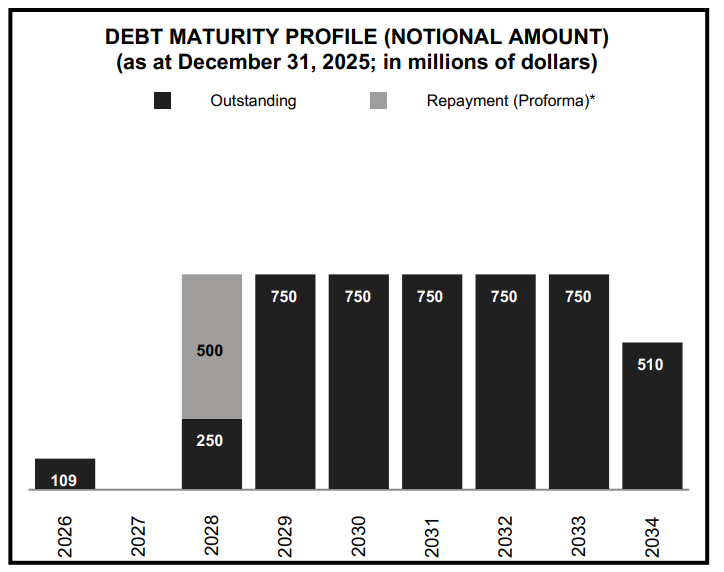

Bombardier is on a mission to reduce LT debt - after announcing to have paid back on Feb17th 500 000 000 USD on the 2028 Bond, they have announced 2 days later to that they will pay next month 250 000 000 USD to repay totally the 2028 BOND.

Here is the debt maturity of the Company Bonds. The last tranche of 2028 Bond will be paid next month. There is thus no bond due until 2029.

This should be acreditive to the net income for 45m annually or about 0.45USD on earnings in 2026… roughly. If Bombardier would repay its debt completely over the next 5 years as it could, they will save roughly 400m USD in interest of 4USD in EPS. This is a possible scenario in a low double digit growth scenario. Bombardier dont pay tax due to large accumulated loss.. 4USD is 5.50 CAD at current rate so Bombardier adjusted EPS would go from 10.57CAD today to 16CAD or 52% higher just by repaying debt.

I am modelling at least 10% sales growth and operating margin expansion on the business jet. This justified the current 25x PE of this duopoly or 20x PE on forward earnings in 2026. More on this later. In my opinion, adjusted PE (removing financing charge or gain from hedging, derivatives etc..) is the best metric to evaluate the company. Free cash flow is misleading since it depends or fluctuates based on orders - advanced payment.

Another scenario, is that the defence business accelerate, and Bombardier invest more of its cash flow into strategic defence opportunity or bolt-on defense acquisition with a steeper growth. In that scenario, debt is repaid more slowly, interest rate does not go down as quickly but the Defence business brings more growth and more organic earnings.

In the conservative scenario - limited growth in Defense, starting from a 10.50 CAD EPS

+50% due to sales growth or +5.25 CAD. So 15.75 CAD EPS in Year 5 due to sales growth.

Maintaining a +0.8% EBIT margin improvement per year or 400BP in Year 5. (based on historical trend of 2023 to 2025) so an improvement of 37% from current 11.5%. This would bring EPS to 20 CAD EPS.

+5.50 due interest expense reduction. Lets round this down to 25 CAD EPS. At 20x earnings we could get to 500 CAD or higher.

In the fast Defence expansion scenario, the interest expense reduction would be tone down to maybe 2$ EPS - less than half of debt repaid - as 3 billions would be invested in Defence investment. But after 5 years, these Defence investment will bring its share of profits. The strategic defence investment might bring some valuation premium - SAAB is trading at 50x earnings. So in this scenario, Bombardier might trade even higher than in the conservative scenario.

In any case it will be fun to watch..

Trade carefully and do your own due diligence

Legal Disclaimer: All content published on Wintergems is intended for informational and entertainment purposes only. It is not intended to serve as a recommendation to buy or sell any security. The views expressed are my own and are subject to change without notice. The information provied here is proprietary. I make no representations or warranties as to the accuracy or completeness of the information provided and will not be liable for any losses, injuries, or damages from the display or use of this information. Readers are solely responsible for their own investment decisions.

What do you think? Did you find this post fun to read

Legal Disclaimer: All content published on Wintergems is intended for informational and entertainment purposes only. It is not intended to serve as a recommendation to buy or sell any security. The views expressed are my own and are subject to change without notice. The information provied here is proprietary. I make no representations or warranties as to the accuracy or completeness of the information provided and will not be liable for any losses, injuries, or damages from the display or use of this information. Readers are solely responsible for their own investment decisions.