$ADYEN's free fall - PART1

$ADYEN is a new position that I added early this year when the stock tumbled - tales of a high growth high risk holding!

This article is Part1 of a multi-part series of articles on Adyen that will be published over the next few days. The main customer is myself to put on paper facts and thoughts regarding this current holding. Part 1 provides an overview of the company, the historical results and KPIs. Part 2 will cover the most recent results including the latest 1H 2023 and trying to pinpoint some of the cause of the top line slowdown. Part2 of adyen free fall

Part3 will look at competitors more closely and valuation comparison.

The article constitutes my personal views and is for entertainment purposes only. This is not an investment advice. Please refer to the disclaimer at the end of this article for more details.

Background

Early this year (February 8), a high growth great culture company in a secular high growth industry on my watchlist tumbled towards 1280 euros from a high of 1650. I build a good position since top line story was intact (40% YoY growth) and as the key reason for the stock crash was that management was ramping up on hiring thus putting pressure on an overall margin (EBITDA/Net Revenue). For 2022, the EBITDA margin was a high 55%. But the company was warning that margin would go in the 45% level in 2023 and then it would level up slowly in 2024 to get back to a long term goal of 65%. This warning that EBITDA margin would be pressured in 2023 was acceptable for me and a short term pain on margin was fine if I could buy the stock at a lower price.

After the sharp drop in February, the stock rebounded and raised up to 1600 level again until the last shoe (hopefully) dropped on Thursday where the company high growth came to a halt and the top line net revenue grew only 21% (from historical 40-50% range) for the first half. This stock went into free fall and still is in free fall.

Adyen is a high tech full stack payment processor and acquirer.

The following describes Adyen’s business, the competitive landscape according to the IPO prospectus.

Adyen’s business

Extract from the IPO prospectus in 2018:

Adyen is a technology company redefining payments for merchants globally. It has built an efficient single platform that enables the acceptance and processing of cards and local payments globally across its merchants’ online, mobile and point of sale (“POS”) channels. Adyen’s global platform has integrated and simplified the payments value chain, enabling it to partner with large merchants to rapidly scale their businesses both locally and globally, without the varied inefficiencies inherent in traditional payment platforms. Adyen’s technology removes friction for both shoppers and merchants and allows for an improved shopper experience while simplifying the global management of payments across sales channels and geographies for merchants…

Adyen’s ever-evolving platform encompasses the entire payments value chain as it relates to merchants, from checkout to payment settlement. This single integrated platform provides a merchant-friendly alternative to the numerous legacy providers that merchants previously had to rely on for their payments processing. The Adyen platform combines global reach with local capabilities, directly connecting merchants to Visa, Mastercard and many other payment methods and supporting numerous transaction currencies across six continents. Adyen’s platform supports “unified commerce” for merchants across online, mobile and POS channels, which are connected to the same Adyen back-end infrastructure for processing and settling payments and offers feature-rich application programming interfaces (“APIs”)…

Adyen primarily targets large, global companies as well as, increasingly, domestic/mid-market merchants, which the Company views as the next adjacent segment to enterprise merchants. In 2017, Adyen processed transactions for several thousand merchants across the globe and across a wide number of industries, including retail, travel, digital services, hospitality and marketplaces. Adyen’s merchant portfolio includes Uber, Netflix, Facebook, Spotify, Etsy, Vodafone, Sephora, Tory Burch, L’Oréal and booking.com.

Competition

Extract from the IPO prospectus

Adyen's competitors also include incumbent payment service providers and banks and their joint ventures, and on a world-wide basis include PayPal, Bank of America Merchant Services, Worldpay, First Data Corporations, Chase Paymentech Solutions, Barclaycard, Global Payments, Cielo, Elavon, Ingenico, Wirecard, Worldline and potentially the card networks, for example Visa and Mastercard, who increasingly are offering new products and services. Adyen is facing new competitive pressure from non-traditional payments processors and other parties entering the digital payments industry, such as Stripe, Klarna, Square and Braintree (part of PayPal), which may compete in one or more of the functions performed in processing merchant transactions. These companies have significant financial resources and robust networks and are highly regarded by shoppers and merchants. If these companies gain a greater share of total digital payments transactions or if Adyen is unable to successfully react to changes in the industry spurred by the entry of these new market participants, it could have a material adverse effect on Adyen's business, financial condition and results of operations.

Historical key financials and KPIs

The most important KPI for a payment processor is the processed volume. Adyen growth is spectacular, meteoric. It went from processing 33 Billion of Euros in 2015 to a staggering 767 Billion Euros. This is a CAGR of 57%. The company must be doing something right.

Processed Volume:

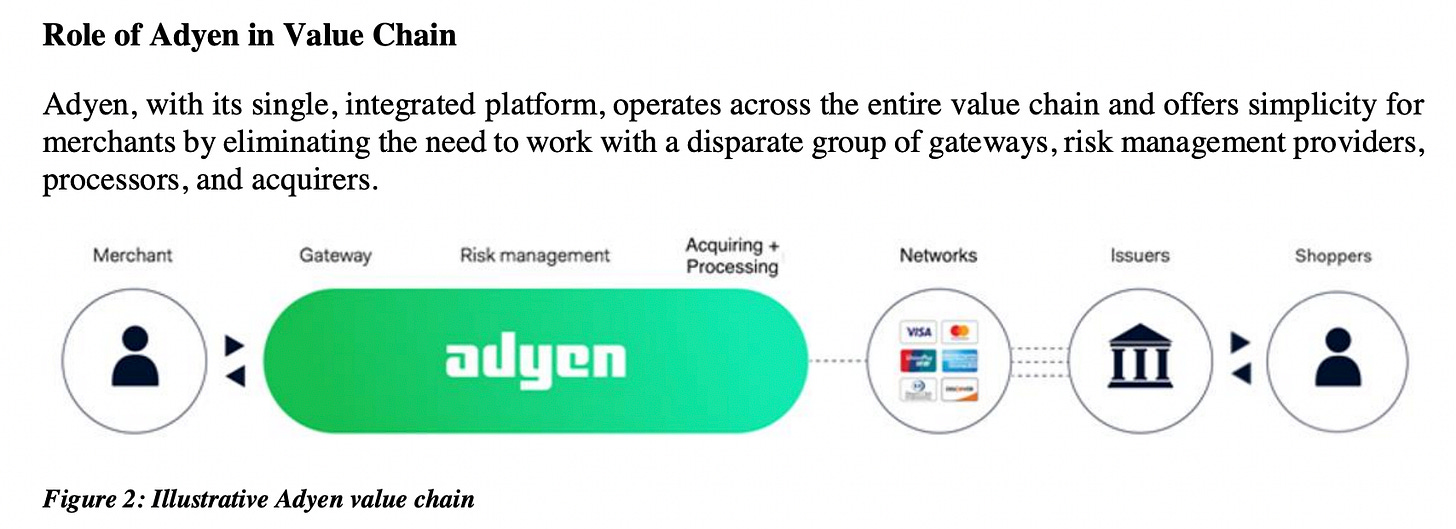

Adyen is a full stack payment processor and as such typically plays the role of both the gateway (or POS service) and the acquirer processor.

As such, Adyen keeps the processing fee and the acquiring markup. The sum of it constitutes the net revenue. All pass through fees like the interexchange fees and the car network fee are not considered in the net revenue.

Take Rate:

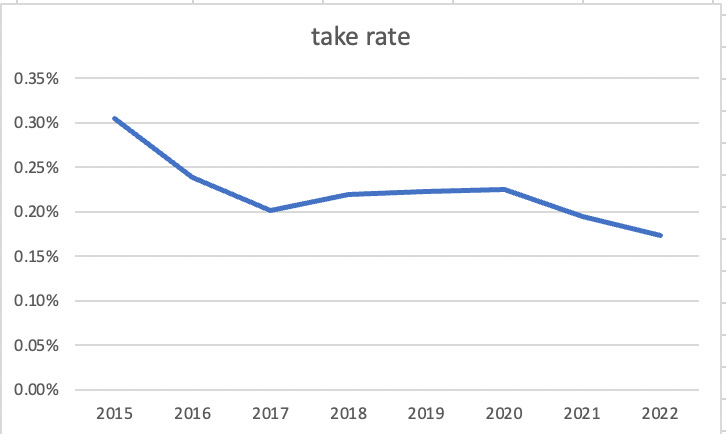

The take rate of the processed volume is very small. Currently 0.17% of the processed volume is kept by Adyen and thus is considered Net Revenue.

Here is the historical take rate is the following:

As you can see, Adyen charges less over the years. The downtrend is due to the fact that Adyen has a progressive discount pricing based on volume. So the more a merchant or a customer funnels processed volume towards Adyen, the lower the take rate Adyen charges. As a given customer sends more and more volume to Adyen, Adyen reduces its price. Contrary to some comments, Adyen pricing is competitive and take rate is low. A company like Nike might have multiple payment processors. So a progressive discount based on volume incentivized Nike to send more volume to Adyen to lower the take rate.

Net Revenue:

The combination of a reduced take rate and a meteoric rise of the processed volume still result in a mind boggling net revenue growth, growing at a rate of 45% going from 98 million Euros in 2015 to 1330 million Euros in 2022.

In contrast to other high growth high flyer companies growing in the 50% per year, Adyen is fueling this growth while making a ton of money and very little share dilution. This is a truly disciplined management and exceptional company operating in a exceptional industry. All this growth is fueled internally without the need of any acquisition. Actually the management believes that acquisition would be counterproductive and create more harms than good as this would create software integration issue. Being a software engineer in a previous life and can truly rely on this - this will haunt companies like Constellation software in my opinion someday!

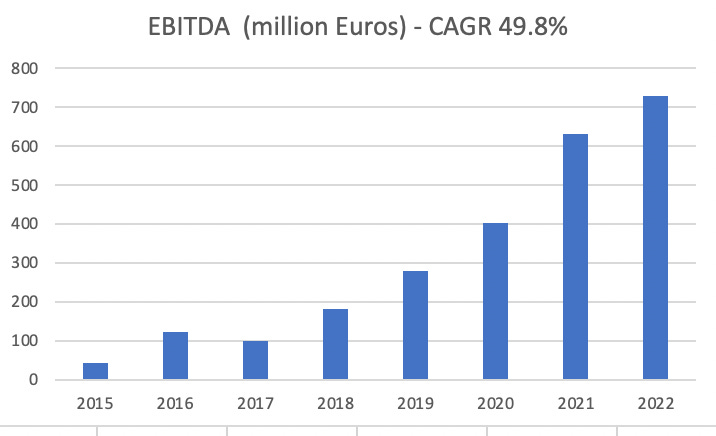

EBITDA growing at a CAGR of 50%.

EBITDA margin constantly hovering around 50-60%

and EPS growing at a CAGR of 49.4% with very little dilution.

Adyen - a cash machine

Because Adyen has a banking license in most of the countries it operates (it plays the role of the merchant acquirer bank) to streamline the processing transaction, it retains a portion of the processed volume over a few days. As such, the payable line has increased significantly over the years proportional of the volume processed.

Currently, as of June 30th 2023, Adyen has 6.4 billion euros in cash or equivalent. With the current interest rate, it earned 90 million euros in the last half. This cash balance will only grow with growing processed volume and free cash flow. Adyen converts the majority of the EBITDA in free cash flow.

I could foresee a time not too far in the future when Adyen retains more than 10B euros in cash on the balance sheet earning a sizable interest income. There is a lot to like in this business.

So what went wrong last week?

Last week, Adyen created a real surprise by publishing a 1H2023 result with top line growth well below expectation (21% growth versus expectation of around 30-35% growth). It also warned of increased pricing competition in North America. Stock is in free fall and is currently trading at 817 euros almost half recent high. Part 2 will cover more recent results including the latest 1H 2023 and trying to pinpoint some of the cause of the top line slowdown. Part2 was released

Part3 will look at competitors more closely - Braintree, FirstData, Stripe.

Disclaimer: The above article constitutes my or the authors’ personal views and is for entertainment purposes only. It is not to be construed as financial advice in any shape or form. Please do your own research and seek your own advice from a qualified financial advisor. I / The authors may from time to time hold positions in the aforementioned stocks consistent with the views and opinions expressed in this article. The information provided in this article is not making promises, or guarantees regarding the accuracy of information supplied, nor that you guarantee for the completeness of the information here. The information in this article is opinion-based and that these opinions do not reflect the ideas, ideologies, or points of view of any organization the authors may be potentially affiliated with. The authors reserve the right to change the content of this blog or the above article. The performance represented is historical" and that "past performance is not a reliable indicator of future results and investors may not recover the full amount invested.

Totally ! The recent drop is due competitive pressure and fear that adyen has lost some volume to competitors due to an aggressive pricing tactic. Just a precision It has no lost customer -churn is below 1% - but a portion of volume from these customers . Large Digital (Uber, eBay, wix, Spotify, Netflix) players have multiple payment processors in general. I actually found one particular customer that has moved out some of the volume .. I will discuss this in part2

My understanding is that the stock not just tanked because of the additional FTEs but also because it lost some clients to cheaper competitors which surprised market participants as they assumed higher switching barriers / lock-in effects for the clients