$ADYEN Strikes Back Part IV

$ADYEN gave a Q3 business update yesterday with top line growth at 22% in line with Wintergems' top line projection (+21%)

The Company Update

$ADYEN gave a Q3 business update yesterday with top line growth at 22% which was in line with Wintergems' top line projection (+21%). Here is the business update provided by the Company:

The article constitutes my personal views and is for entertainment purposes only. This is not an investment advice. The projections and estimates provided here should be considered as purely speculative. Do your own model and projections. Please refer to the disclaimer at the end of this article for more details.

WinterGems Top Line Projection

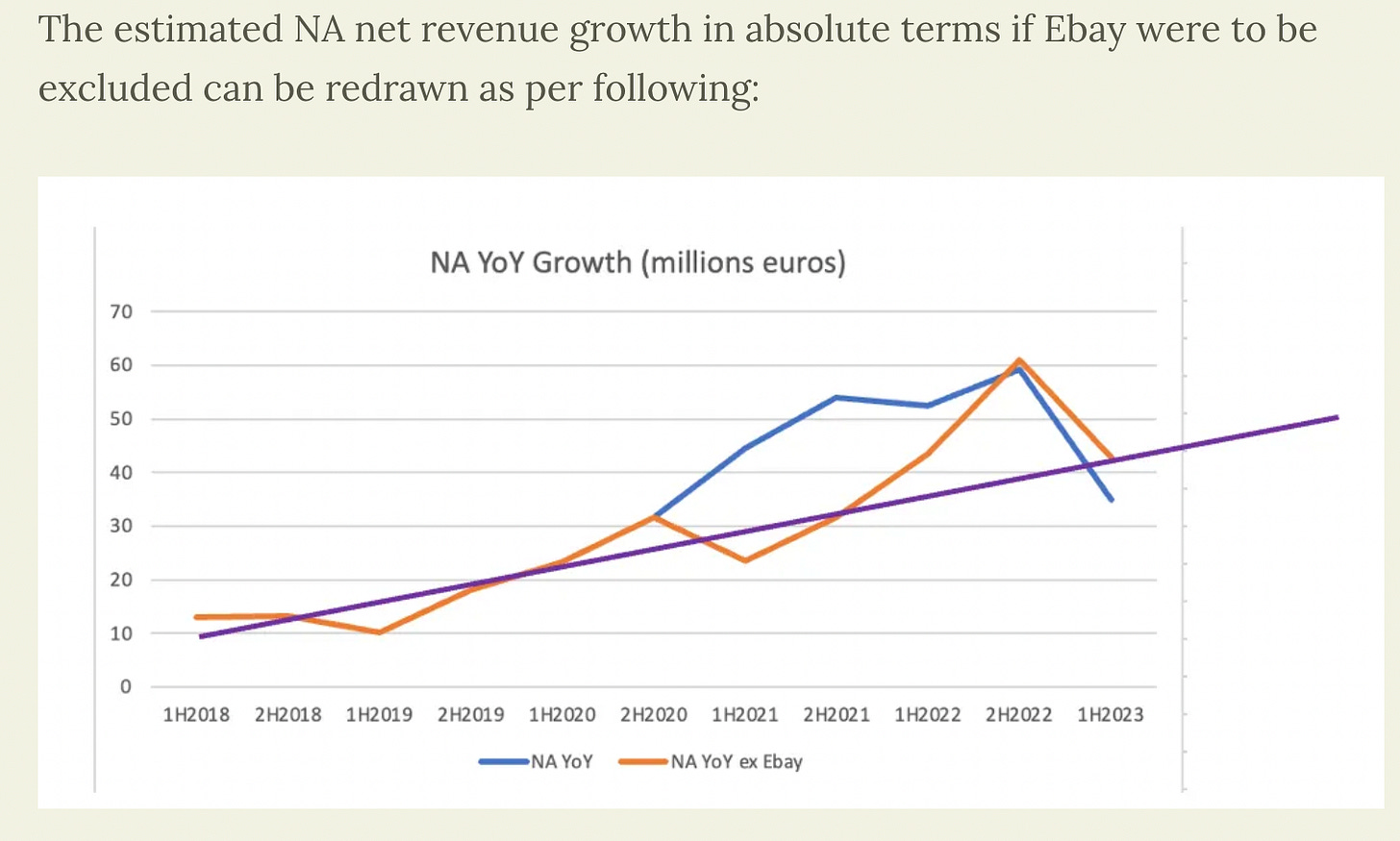

Just to recap, in our second piece Adyen free fall - Part2, I have modeled Adyen’s top line growth using the YoY absolute growth in net revenue for each geographical area. For North America, I modeled the growth excluding the Ebay revenue to better modelized the NA growth.

Here were the linear interpolation I traced for NA - extract from PartII:

I used a 40m increase YoY in PartII to be more conservative although my model is indicating an increase of 48m . I later corrected this and used 48m in PartIII - Follow the model and see what happens!

For Europe:

This resulted in a growth of 80m YoY.

I did the same for the other 2 regions to get the following estimates:

Extract of PartII top line estimates.

I later used 48m of revenue growth in NA as per the model to get to the 880m revenue estimates used in Part III.

Sequential Growth from Q3 to Q4

For the first time Adyen is providing quarter revenue for Q3 2022 and Q3 2023 as shown below

As such, we can used 2022 number to estimate the seasonality and the sequential growth from one quarter to another. Q4 2022 (382m) was 12.6% higher than Q3 2022 (339m). As such, we can extrapolate and use the same sequential growth for 2023 as another estimate. Assuming the same sequential growth is to be repeated, Q4 2023 revenue would be 465m resulting in a total net revenue of 879m. Very close to the 880m we got using our YoY absolute growth methodology. As such, the Q3 business update confirms that 880m is a likely outcome.

Updating Net Income Calculation for 2H2023

Although top line is unchanged (at 880m) from our projection, Adyen has cut back on the number of hires to 175FTEs (from expected 275 FTEs) and will do the same in Q4. As such, I am revising upward my net income calculation. For explanation on the expenses side please refer to PartIII Adyen Free Fall - Part III.

Thias result in EPS of 21.83 for the year 2023 and 12.77 for the second half alone. For the second half 2023, this would represent a YoY growth of EPS of 40%. So after the hiccup in earnings growth in the first half of 2023, the high EPS growth will resume based on my model.

Undeserved Pessimism views and top line estimates

After the surprised deceleration of top line revenue in 1H2023, analysts had lowered way too much their estimates. For example, Barclays had estimated a top line revenue for 2H2023 of 810m. This is very pessimism compared to my own projection and was not deserved based on the company recent business update. The high level of pessimism remind me the level of pessimism that I saw in mid 2022, when Netflix user growth stalled for 2 quarters. Media and Wall Street analysts were all claiming that Netflix was overwhelmed by competition, that streaming golden year were gone and so on. This was the time to buy. Now fast forward, Netflix subscriber growth has resumed and free cash flow and margin are sky rocketing.

Very high quality companies sometimes fumbles. In the case of Netflix it was the post COVID aftermath with maybe some competition pressure - which were unsustainable - the other competitors are incumbents and are loosing revenue from cord cutting and are loaded of debt (e.g. WBD and Disney). So they must cut back on content and must resume selling content to their arch-rival Netflix. But high quality company very often rebounds. You have a management team and a organization that has overachieved, won market share and grow every year at an incredible rate, and suddenly after one or 2 challenges they will transform into an ordinary company? I dont believe so. Overachievers mean revert to outperformance after a bad year. This is my experience. I saw that with Couche Tard, Monster Energy, Apple, Netflix, Amazon, Google, Nvidia, MercadoLibre and I am now seeing this with Adyen. These companies were tested by fire several times and rebounded to excellence.

For Adyen, it was the Ebay effect and the post COVID effect - Ebay effect: an unsustainable growth during the 2021-2022 years as Ebay was transfering all TPV from Paypal to Adyen and then in 2023, Ebay started to internalized some of the payments which lead to a rapid drop in volume from Ebay in 2023. Ebay decided to process some payment types internally. There was also a Post COVID effect, as Adyen’s main volume is still non POS and so online did suffer from the end of the COVID era as people resumed their old behavior of shopping in traditional on premises stores. There is also the simple fact that a company cannot grow at 50% for too long and looking at the growth is absolute terms, one can better estimate by how much revenue it will grow instead of simply using a percentage growth.

Now the narratives were all over the board in Twitter, traditional media and so on for Adyen. Adyen has lost their competitive edge. Paypal was using Braintree has a loss leader. On this, Paypal has been using the same approach - using Braintree as a loss leader for years - and there was no significant change in the competitive landscape. Also Braintree is playing catch-up with Adyen as Paypal has under-invested in Braintree since the acquisition in 2013. So Braintree has to win accounts by lowering price. I even heard some talking head in the famous ALL IN podcast .. ahum Chamath- stating that payment processor in general were a commoditized business and a lousy business with no moat. One a side note, payment processor is one of the best business out there, simply look at the stock chart of one of the leader of in this space - Fiserv. These business are amazing compounders.

The Ebay effect was never talked about - except in Wintergems PartII and PartIII to my knowledge - until Adyen’s management provided more insights during the GS conference call in early September. But this never got any attention. The Post COVID effect was never mentioned neither by media.

Extreme Pessimism and Falling Knife Opportunity

The extreme pessimism has pushed this exceptional company to a fall from an average price of 1500 euros before the 1H2023 announcement, to a low of 630 euros - down almost 60%. Personally, I was able to average down my initial position and buy a very large position from 850 euros to 640 euros. I was buying shares at every 5% drop. Writing this blog, modeling the top line and bottom line for weeks, understanding the competitive landscape, doing some SWOT analysis, just enhanced my confidence level to purchase more.

With the jump of more than 42% in price in the last 5 days after the business update, Adyen is now a #4 position in my portfolio and I intend to keep it this way.

The Ebay Effect on hypergrowth Platform

Platform volume increased 15% YoY versus 3% YoY in the last semester. So we are seeing a re-acceleration of the platform growth. However, based on my model, Ebay has continued to move traffic from the Adyen platform to its own internalize payment processing capability. I am estimating that 66% of Ebay GMV is now routed to Adyen, down from 78% sequentially in the 1H2023. The Ebay effect is still impacting Adyen results. Now the excellent news is that non Ebay platform revenue is re-accelarating from 80% up YoY in 1H2023 to 120% YoY in Q32023.

Now non EBay platform revenue represents 62% of the platform revenue according to my estimates - please note that Adyen does not disclose this information, and I had to indirectly derive these numbers based on the overall platform revenue and the growth rate of Ebay and non Ebay TPV over several semesters.

Just to illustrate the drastic change over 1 year, non Ebay platform TPV went from 16B to 36B while Ebay TPV went from 35B to 22B.

At the September call, Adyen mentioned that Ebay was moving some of the payment types from Adyen to some internalize payment processing capability. I believe there are limits to how much Ebay can do this under their contractual agreement signed in 2018. Management mentioned that the internal transfer has stabilized as of early September 2023.

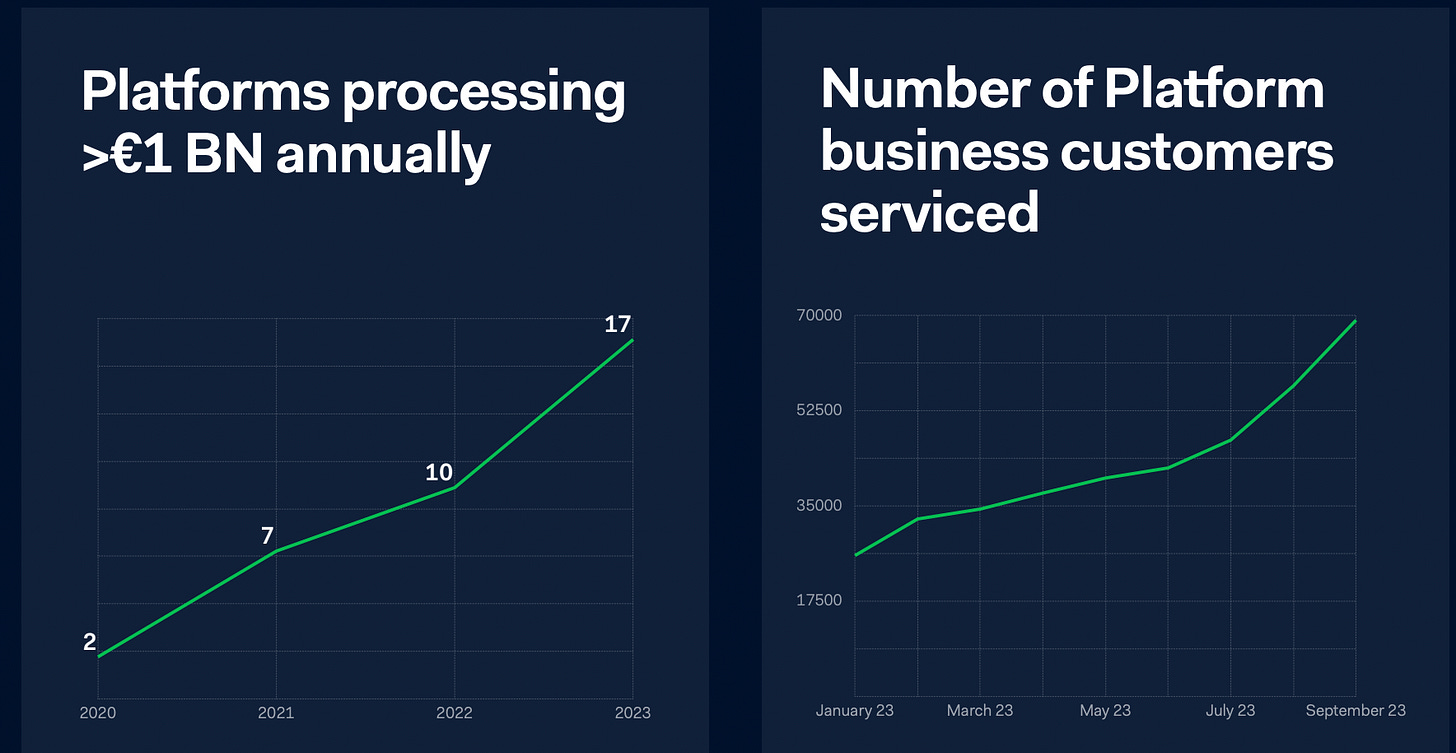

During the investor day, a large portion of the presentation was on platform. I think as I said before, that the majority of Adyen’s development effort is on platform and recent trends (July to September 2023) confirms that platform (non EBay revenue) is skyrocking. The number of business customers serviced went from around 47k to almost 70k in just 2 months. The number of platform customers processing more than 1B in revenue went from 10 to 17 in 1 year. I am estimating that in 2H2023, 36B in TPV will go through non Ebay platform from 16B last year. Based on the acceleration of growth I am seeing from July to August, this trend could accelerate even more.

Platform services are much more complex and differentiate significantly Adyen from their competitors. Probably only Stripe can compete with them in terms of this offering and Stripe does not have the same unified POS integration.

Platform represents only 29.5B of TPV in the latest quarter out of 243B in total TPV, but I forecast that this will become a much larger component in the next 2-3 years.

To put things into perspective, the platform TPV increased by 13x in less than 3 years and a half. If you exclude Ebay, TPV increased by 14x or a CAGR of 110%.

If this continue to trend this way for the next 2 years, platform revenue might become the largest component in 5 years.

Conclusion

The Q3 update confirms that the Wintergems model of top line growth is aligned.

We haven’t got any net income results, so we will have to wait at the 2H2023 before we get confirmation, but I am seeing a re-acceleration of EPS growth towards 40% in 2H2023. This will then level down to long term (2026) EPS growth of 25% after 1H2024 - 1H2024 will also see a jump in YoY EPS growth towards 40%. The projection for 2024 I published in Free Fall PartIII are looking more probable.

Non Ebay platform revenue is accelerating at a hyper growth rate (120%) and will represent a significant part of Adyen revenue in 3-5 years from now with very strong moat due to the broad services it must provide. The recent hiring spree we saw was likely to accelerate the development and support of this product line. This was a great decision from management even if margin was compressed.

I am keeping my shares and will look at buying more on weakness or cumulate but this is not an investment advice do your own due diligence. The shares are highly volatile.

Disclosure: Adyen is my #4 position, so I am obviously positively bias.

Disclaimer: The above article constitutes my or the authors’ personal views and is for entertainment purposes only. It is not to be construed as financial advice in any shape or form. Please do your own research and seek your own advice from a qualified financial advisor. I / The authors may from time to time hold positions in the aforementioned stocks consistent with the views and opinions expressed in this article. The information provided in this article is not making promises, or guarantees regarding the accuracy of information supplied, nor that you guarantee for the completeness of the information here. The information in this article is opinion-based and that these opinions do not reflect the ideas, ideologies, or points of view of any organization the authors may be potentially affiliated with. The authors reserve the right to change the content of this blog or the above article. The performance represented is historical" and that "past performance is not a reliable indicator of future results and investors may not recover the full amount invested

As a Star Wars fan and Adyen holder, this was a great update. Thank you for these insights!