A Net Cash - Kikukawa Enterprise 2025 year end results

Kikukawa Enterprise 6346 is the oldest and a leading sawmilling and woodworking machine manufacturer in Japan - microcap priced below cash level & PE 8.6 - WARNING no event trigger besides cheapness

Kikukawa is a leading maker of sawmilling and woodworking in Japan - it is also the oldest company in Japan in this industry, being founded in 1897. Their product lineup includes sawmilling machinery, plywood finishing machines, machine tools for applications in automotive, aircraft, and railway vehicle construction, as well as wide belt sanders and moisture meters.

The article constitutes my personal views and is for entertainment purposes only. The main goal of this article is to log my personal views. Nothing in this article or these posts in this blog should constitute an investment advice. The projections and estimates provided here should be considered as purely speculative. Do your own model and projections. Please refer to the disclaimer at the end of this article for more details.

The company is operating in a niche market. I am using May 17th quote of 5340 yen per share for this analysis. The company is a small (only 40m USD in sales) and is thus a micro-cap with market cap of 6.4B Yen (44mUSD) and a NEGATIVE enterprise value of 1.6B yen. If you add the 1.5B yen in investment securities, you get a negative 3.1B yen of enterprise value. In other words, if you buy for 1$ of shares of Kikukawa you get close 1.5$ of net cash and securities and the cash keeps rising:

WARNING: Kikukawa is not doing anything with the extra cash (i.e. not buying back shares) besides returning 180yen in dividends in 2025 - or only 29% of its EPS of 613 yen per share. At 5300 yen (current price), the stock trades at 8.6PE.

This is a net net that I have been following for a long time, so my interest here is to update my views based on 2025 results. This is also a small position since management is ultra conservative in how to manage cash level. The only hope is that having this high cash level and a price to book of 0.5 are not aligned with the new Tokyo stock exchange policies:

2025 Results ( in Yen)

Sales : 5.5 B (+1%)

Operating Income: 1.024 B (+33%)

Operating margin: 18.6%

Net income: 0.743 B (+20%)

EPS: 613

PE: 8.6

Market Cap: 6.4B

Cash: 7.95B

Securities: 1.5B

EV : -3.1B

P/B: 0.5

EV/EBIT: negative!

Prospects

Although Kikukawa enterprise operates in a small niche industry, it it providing tools that helps companies automate their woodworking activities. So this is a positive long term trend. It can be viewed as a niche automation play. So a not so uninteresting industry in my opinion. Sales are growing slowly, a bit cyclical.

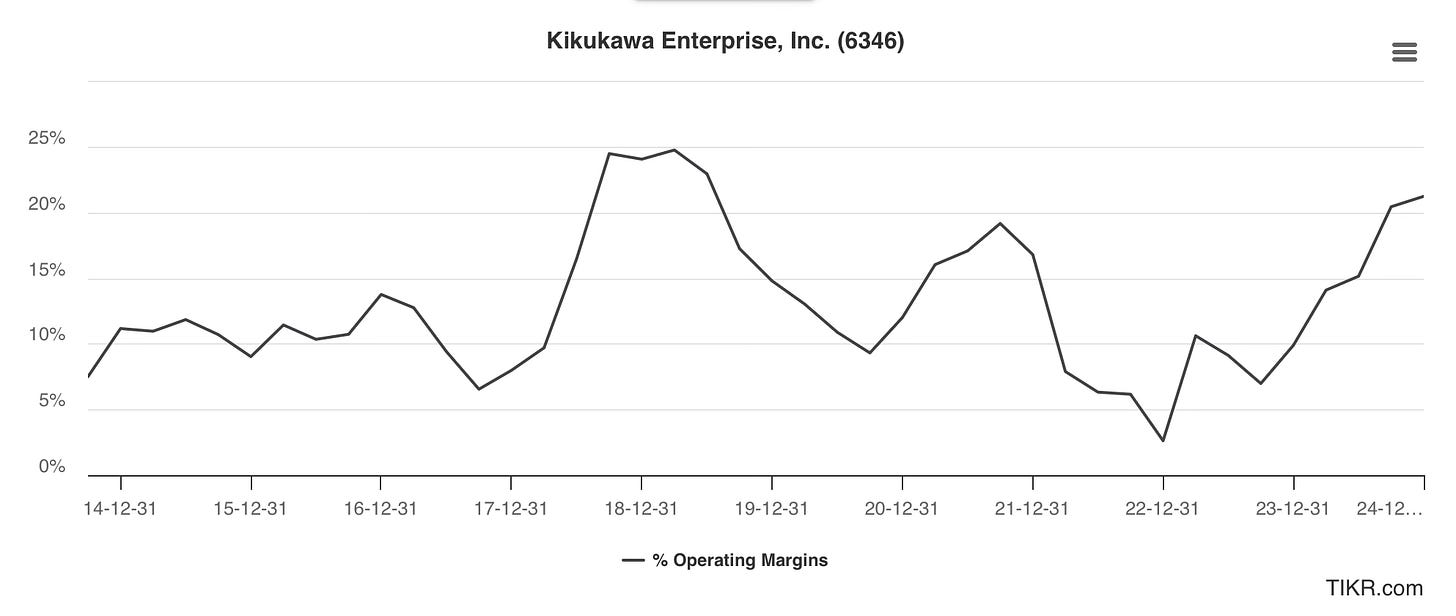

Margins is cyclical but always positive, ranging from 5% to 25% since 2014:

As such, there is no reason to keep this level of cash. The company is holding the equivalent of 2 years of low cycle sales in cash. The company could buffer the equivalent of a 2 years economical nuclear winter while still producing a low amount of tools with no sales. Time to buy back some stocks Mr. Kikukawa!!

In good company

As a shareholder, you are in good company with famous value investor Yasumitsu Shigeta (Hikari Tsushin) controlling 10% of the stocks. The CEO owns 5% so a bit of skin in the game but no controlling stake.

The 20% buyback scenario

Share buybacks announced by Japanese companies in April nearly tripled on the previous year as boards opted for placating investors over holding dry powder for tariff uncertainties. Of those, a few cash rich companies have announced 20% buyback plan. Although unlikely, I think a 20% buyback plan at a 20% premium could be quite achievable for Kikukawa.

The company could announce a 20% buyback at 20% of current price (current 5350 yen as of yesterday) thus at 6400 yen. This would increase operating income yields per share by 20%.

The 20 % buyback at 6400yen scenario:

20% buyback : 242k shares

#shares after: 0.968

Cost: 1.548B yen

Cash balance after buyback: 6.45B

Cash balance per share: 6600 yen per share.

The stock would likely be priced much higher than current price after the buyback, since management is signalling a much friendlier capital allocation, and operating income per share is 20% higher. The stock would be trading at a P/B closer to 1. Even after a 20% buyback, the company would still have plenty of cash in the balance sheet and would likely be still a Net cash stocks.

I hope you enjoy this foray in a net cash Japanese stock. We have wasted way too much time in economic and tariff related news - time to get into business of analyzing individual stocks!

Peter Lynch: If you spend more than 13 minutes analyzing economic and market forecasts, you've wasted 10 minutes.

Cheers

Thanks for the nice feedback. On kikukawa contrary to many net cash this is a legitimate business with good RoIC almost century old managed by the kikukawa family.. so long tradition. Just too conservative in terms of cash management. It is also a automation play. This is not a part of a basket of net net it is actually a good business i am happy to own. Not a cigare butt. I dont do cigar butt. Another automation play I would say hermle is not great in cash management - although more generous in terms dividend but it is still a good investment. I will look at stalproduct. Thanks again for the feedback.

Hi there, I found your blog just recently, very well written. Kikukawa: Finally - what to do with it? I've been searching for companies like these, and there's no question, that it is cheap. But, if they just keep so money or sometime start to do something stupid with it...besides a small position, would you really go for companies like these? Stalprodukt S.A. from Poland might also interest you. Maybe not that dirt cheap, but somewhat, and they are doing tenders. Nevertheless...I somewhat lost faith in making money with these companies without getting influence on the management's capital allocation. Best regards, Ole